Global Prosthetic Heart Valve Market 2018-2024

- January, 2018

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Overview: Prosthetic heart valve, also known as an artificial heart valve, is implanted in the heart of an individual with cardiac vascular disease (valvular heart disease). The prosthetic valve is made of strong material such as carbon or titanium. There are three types of prosthetic heart valves: mechanical heart valve, transcatheter heart valve, and tissue or bio-prosthetic heart valve. The individuals have the choice of selecting prosthesis depending on their health condition and surgeon’s recommendation. The heart valve replacement procedure helps to remove the diseased valve and replace with an artificial valve. The recommendation of the prosthetic valve is based on two considerations: high likelihood of failure of tissue prosthesis within a short period of time and high probability of the need for long-term anticoagulation in an individual with severe mitral stenosis due to atrial fibrillation. However, individuals aged below 60 will benefit from the prosthetic mechanical valve and individuals aged above 70 would benefit from a bio-prosthetic valve.

Heart valves are essential for proper flow of the blood in the right direction. If the heart valves do not work properly, blood disruption occurs causing a condition called stenosis. This condition restricts the amount of blood that can flow and lead to various heart conditions such as coronary artery disease, congenital heart defects, degenerative valve disease, rheumatic fever, and bacterial endocarditis (infections).

The market is growing at a faster pace and is expected to proliferate in the emerging countries. Factors such as increasing lifestyle diseases, smoking population, growing aging population, favorable reimbursement, and technological advancements in products are driving the growth of the market. However, lack of awareness about the disease, stringent regulatory approval procedures, and risk associated with the procedure are hampering the growth of the market.

The market is dominated by Abbott Laboratories, Boston Scientific Corp., Medtronic plc, Edwards Lifesciences Corp., and LivoNova, PLC (Sorin Group) with maximum revenue generation in the global prosthetic valves market.

Market Analysis: The global prosthetic valves market is estimated to witness a CAGR of 13.7% during the forecast period 2018–2024. The market is analyzed based on three segments, namely product type, end-users, and regions.

Regional Analysis: The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (ROW). North America is set to be the leading region for the prosthetic valves market growth followed by Europe. Asia Pacific and ROW are set to be the emerging regions. The emerging markets have a high potential to grow due to increase in the patient population and focus on healthcare infrastructure. The market has the lowest penetration in the emerging regions, and most of the vendors are targeting to penetrate in countries such as India, China, Thailand, Vietnam, etc. However, the risk associated with the prosthetic valve, stringent regulations for approval, lack of skilled surgeons, and paucity lack of awareness about advanced diagnostic tools in the developing countries have a significant impact on the overall market growth.

Product Analysis: The transcatheter heart valve market is growing faster and dominates the global prosthetic valve market with more than 62% of the share. The increasing aging population, the rise in the prevalence of CVD, and growing adoption of transcatheter aortic valve replacement procedures (TAVR) are driving the market growth. Multi-modality cardiac imaging tools such as MRI, CT scan, and ultrasound are highly adopted to diagnose various valvular diseases. The advancements in heart valve technologies, i.e., 100% sutureless solution aortic valve replacement by LivaNova (Sorin Group), have revolutionized the valvular replacement procedures. Further, the use of biodegradable and synthetic polymeric scaffolds for exogenous stimulation of tissue growth with extracellular matrix has created tremendous opportunities for tissue engineering.

Key Players: Abbott Laboratories, Boston Scientific Corp., Medtronic plc, Edwards Lifesciences Corp., LivoNova, PLC (Sorin Group), and other predominate & niche players.

Competitive Analysis: The global prosthetic valves market is highly fragmented and has immense growth opportunities for vendors, especially in the developing regions. The market has the presence of many global, regional, and local players with intense competition among themselves to acquire the largest share. Abbott Laboratories, Boston Scientific Corp., Edwards Lifesciences, and Medtronic acquire small players to increase their market share. The vendors have a strong focus on acquiring smaller companies and expanding their business operations by leveraging their products portfolio across the globe. The competitive environment in the market will intensify further with an increase in product/service extensions, product innovations, and M&A. They form strategic alliances for the marketing or manufacturing of prosthetic valve devices.

Benefits: The report provides complete details about the usage and adoption rate of prosthetic valves for the treatment of various valvular-related disorders. Thus, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives in the upcoming years along with details of the pureplay companies entering the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to key stakeholders to expand their business and capture the revenue in specific verticals, and to analyze before investing or expanding the business in this market.

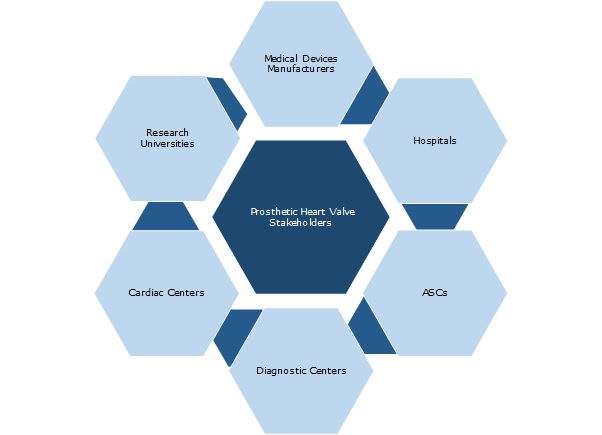

Key Stakeholders:

1. Industry Outlook

1.1 Industry Overview

1.2 Patient demographics

1.3 Healthcare Spending in the US

1.4 Definition: Prosthetic Valve

1.5 Why prosthetic valve?

1.6 Selection criteria for prosthetic heart valve

1.7 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Total Addressable Market (TAM)

3.2 Segmented Addressable Market (SAM)

3.3 Porter 5 (Five) Forces

4 Market Dynamics

4.1.1 Drivers

4.1.1.1 Increasing prevalence of cardiovascular diseases

4.1.1.2 Increasing geriatric population

4.1.1.1 Increase in healthcare spending

4.1.1.2 Increasing number of insurance providers

4.1.2 Restraints

4.1.2.1 Risk associated with prosthetic valves

4.1.2.2 Stringent regulations for approval

4.1.2.3 Intense competition among vendors

4.1.2.4 Lack of awareness

4.1.3 Opportunities

4.1.3.1 Technological advancement

4.1.3.2 Increase demand or minimally invasive procedures

4.1.3.3 Increase in demand for cardiac diagnostic imaging

4.1.3.4 5.2.1.2 Increase in the number of outpatient procedures

4.1.3.5 Growth opportunities in emerging nations

4.1.4 DRO – Impact Analysis

4.1.5 Key Stakeholders

5 Product Types: Market Size & Analysis

5.1 Overview

5.2 Transcatheter heart valve

5.2.1 Overview

5.3 Mechanical Heart Valve

5.3.1 Overview

5.4 Tissue or Bio-prosthetic heart valve

5.4.1 Overview

6 End-user: Market Size and Analysis

6.1 Overview

6.2 Hospitals

6.3 Ambulatory Surgical Center

6.3.1 ASCs in the Americas

6.3.1.1 US

6.3.1.2 Canada

6.3.1.3 Mexico

6.3.2 ASCs in the EMEA Region

6.3.2.1 France

6.3.2.2 UK

6.3.2.3 Israel

6.3.2.4 Africa

6.3.3 ASCs in the APAC Region

6.3.3.1 Australia

6.3.3.2 India

6.3.3.3 China

6.4 Cardiac Centers

7 Regions: Market Size & Analysis

7.1 Overview

7.2 North America

7.2.1 Market Overview

7.3 Europe

7.3.1 Market Overview

7.4 APAC

7.4.1 Market Overview

7.4.2 Japan

7.4.3 China

7.4.4 India

7.5 Rest of the World

7.5.1 Market Overview

8 Competitive Landscape

8.1 Competitor Comparison Analysis

9 Vendor Profiles

9.1 Abbott Laboratories

9.1.1.1 Overview

9.1.2 Overview

9.1.3 Business Unit

9.1.4 Geographic Presence

9.1.5 Business Focus

9.1.6 SWOT Analysis

9.1.7 Business Strategy

9.2 Boston Scientific Corp

9.2.1 Overview

9.2.2 Business Units

9.2.3 Geographic Presence

9.2.4 Business Focus

9.2.5 SWOT Analysis

9.2.6 Business Strategy

9.3 Medtronic Plc

9.3.1 Overview

9.3.2 Business Units

9.3.3 Geographic Presence

9.3.4 Business Focus

9.3.5 SWOT Analysis

9.3.6 Business Strategies

9.4 Edward Lifesciences Corp

9.4.1.1 Overview

9.4.1.2 Business unit

9.4.1.3 Business focus

9.4.1.4 SWOT analysis

9.4.1.5 Business strategies

9.5 LivaNova, PLC (Sorin Group)

9.5.1 Overview

9.5.2 Business Units

9.5.3 Geographic Presence

9.5.4 Business Focus

9.5.5 SWOT Analysis

9.5.6 Business Strategy

10 Companies to watch for

10.1 Cryolife, Inc.

10.1.1 Overview

10.1.2 Key Highlights

10.1.3 Business Strategies

10.2 Lepu Medical Technology Co., Ltd.

10.2.1 Overview

10.2.2 Key Highlights

10.2.3 Business Strategies

10.3 Colibri Heart Valve LLC

10.3.1 Key Highlights

10.3.2 Business Strategies

10.4 JenaValve Technology GmbH

10.5 TTK Healthcare Ltd

10.5.1 Overview

10.6 ValveXchange Inc.

10.6.1 Overview

Annexure

Acronyms

TABLE 1 TOP ACQUISITIONS IN CARDIOVASCULAR INDUSTRY 20

TABLE 2 GLOBAL PROSTHETIC VALVE MARKET BY TYPES, 2017–2024 ($MILLION) 34

TABLE 3 GLOBAL PROSTHETIC VALVES MARKET BY END-USERS 43

TABLE 4 GLOBAL PROSTHETIC VALVES MARKET REVENUE BY REGIONS FORECAST, 2018–2024 ($MILLION) 46

TABLE 5 DRO (NORTH AMERICA) 47

TABLE 6 DRO (EUROPE) 48

TABLE 7 DRO (APAC) 51

TABLE 8 DRO (REST OF THE WORLD) 53

TABLE 9 ABBOTT LABORATORIES: PRODUCT OFFERINGS 56

TABLE 10 ABBOTT LABORATORIES: RECENT DEVELOPMENTS 56

TABLE 1 BOSTON SCIENTIFIC CORP: OFFERINGS 62

TABLE 2 BOSTON SCIENTIFIC CORP: RECENT DEVELOPMENTS 62

TABLE 3 MEDTRONIC PLC: OFFERINGS 68

TABLE 4 MEDTRONIC PLC: RECENT DEVELOPMENTS 68

TABLE 11 PHILIPS HEALTHCARE: PRODUCT OFFERINGS 79

TABLE 12 EDWARD LIFESCIENCES CORP: RECENT DEVELOPMENTS 79

TABLE 13 LIVANOVA, PLC: RECENT DEVELOPMENTS 85

TABLE 14 LIVANOVA, PLC: RECENT DEVELOPMENTS 85

TABLE 15 CRYOLIFE, INC: SNAPSHOT 90

TABLE 16 CRYOLIFE, INC: RECENT DEVELOPMENTS 90

TABLE 17 LEPU MEDICAL TECHNOLOGY CO., LTD.: SNAPSHOT 91

TABLE 18 LEPU MEDICAL TECHNOLOGY CO., LTD.: RECENT DEVELOPMENTS 92

TABLE 19 COLIBRI HEART VALVE LLC: SNAPSHOT 93

TABLE 20 COLIBRI HEART VALVE LLC: RECENT DEVELOPMENTS 93

TABLE 21 JENAVALVE TECHNOLOGY GMBH: SNAPSHOT 94

TABLE 22 JENAVALVE TECHNOLOGY: RECENT DEVELOPMENTS 94

TABLE 23 TTK HEALTHCARE LTD.: SNAPSHOT 95

TABLE 24 VALVEXCHANGE INC.: SNAPSHOT 95

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.