Ablation Technology Market – Global Forecasts to 2023

- May, 2017

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Overview:

Ablation refers to the surgical removal of a body tissue in the form of transferring heat to the target tissue. The process is used to remove a tiny or large quantity of tissue. There are many types of ablations and have multiple techniques, which are used to perform the removal of tissue, depending on the type of tissue.

A specially equipped needle is inserted near the site with image-guided modalities such as computed tomography (CT), ultrasonography, and magnetic resonance imaging (MRI). The needle is subjected to various form of electrical tests depending on the type of technology used. The techniques such as radiofrequency with radio waves, cryoablation by liquid nitrogen, and laser ablation by laser beam have proven to be beneficial for individuals who have critical medical conditions such as cardiac arrhythmias, prostate tissue, corneal surface laser ablation, tumors, and chronic pain. Based on the type, the products are classified into different categories such as radiofrequency, ultrasound, electrical, cryoablation, hydrothermal ablation, microwave ablation, and laser.

The rise in awareness about minimally invasive surgeries or procedures has created high adoption as it is less painful, performed as an outpatient procedure, and unlike traditional open surgeries, they require less cost. Minimally invasive surgeries are emerging as potential replacements for conventional therapeutic cancer surgeries for the treatment of various tumors of prostate gland, lungs, and liver. Further, robotic navigation technologies that perform ablation procedures more accurately are being incorporated to increase the popularity of these surgeries. The cost of tissue ablation treatment is directly proportional to the size of the tissue/tumor and the number of probes required for the surgery..

Market Analysis:

The “Global Ablation Devices Market” is estimated to witness a CAGR of 10.61% during the forecast period 2017–2023. The market is analyzed based on three segments – product type, end-users, and regions.

The market is dominated by Medtronic, St. Jude Medical (now Abbott Laboratories), Boston Scientific, Johnson & Johnson, and AngioDynamics which has more than 75% market share in the Global Ablation Devices market. The market is highly fragmented with the presence of many global and local players. The factors such as increased prevalence of chronic disorders, growing popularity about minimally invasive surgeries, focus on early prevention, and increase in disposable income are driving the market growth.

Regional Analysis:

The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (ROW). The Americas is set to be the leading region for the ablation devices market growth followed by Europe. Asia Pacific and ROW are set to be the emerging regions. Brazil is set to be the most attractive destination, and in Latin America, the popularity and the usage of ablation procedures are expected to increase in the coming years.

Product Analysis:

Consumables are the fastest growing segment and dominates the global ablation market with 47% of the total market. Cardiac arrhythmias are the most popular ablation treatment followed by cancer ablation methods in all ablation types. Increase in the prevalence of chronic disorders and growing number of ablation procedures are expected to drive the consumable market during the forecast period. The ablation catheters segment is growing at a steady rate and stands second in the global ablation market. The generator/electrosurgical unit segment is growing at a moderate growth rate and is expected to see a significant growth in the emerging markets.

The major products in the market include:

- Endostat III Bipolar/Monopolar Electrosurgical Generator

- MAESTRO 4000 Cardiac Ablation System

- Cool-tip RF Ablation System E Series

- Barrx Radiofrequency Ablation System

- Cardioblate iRF Irrigated Radiofrequency Surgical Ablation System

- Cardioblate 68000 Surgical Ablation System Generator

- CARTO 3 System

- Ethicon Endo-Surgery Generator

- GYNECARE THERMACHOICE III Uterine Balloon Therapy System

- VAPR VUE Radiofrequency System – Johnson & Johnson

- AtriCure Ablation Sensing Unit (ASU)

- BLAZER PRIME Temperature Ablation Catheter

- INTELLANAV XP & INTELLANAV MIFI XP Temperature Ablation Catheter Family

- Cardioblate MAPS Device

- Cardioblate CryoFlex Surgical Ablation Probes

- THERMOCOOL Bi-Directional Catheter

- TactiCath Quartz Contact Force Ablation Catheter

- FlexAbility Irrigated Ablation Catheter

- ViewFlex Xtra Intracardiac Echocardiography Catheter

- Monopolar Sealers PlasmaBlade Soft Tissue Dissection Devices

Key Players:

Abbott Laboratories, Boston Scientific, AngioDynamics, Johnson & Johnson, Medtronic, and other predominate & niche players.

Competitive Analysis:

The Global Ablation Devices market is highly fragmented and has immense growth opportunities for vendors, especially in the developed regions. The presence of large, small, and local vendors in the market possess high competition. The vendors have a strong focus on acquiring smaller companies and expanding their business operations by leveraging their products portfolio across the globe. The competitive environment in the market will intensify further with an increase in product/service extensions, product innovations, and M&As. They form strategic alliances for the marketing or manufacturing of ablation devices products.

Benefits:

The report provides complete details about the usage and adoption rate of ablation devices for the treatment of various chronic disorders. With that, key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, government initiatives towards the ablation devices adoption in the upcoming years along with the details of pureplay companies entering the market. Moreover, the report provides details about the major challenges that are going to impact on the market growth. Additionally, the report gives complete detail on the key business opportunities to key stakeholders to expand their business and capture the revenue in the specific verticals to analyze before investing or expanding the business in this market.

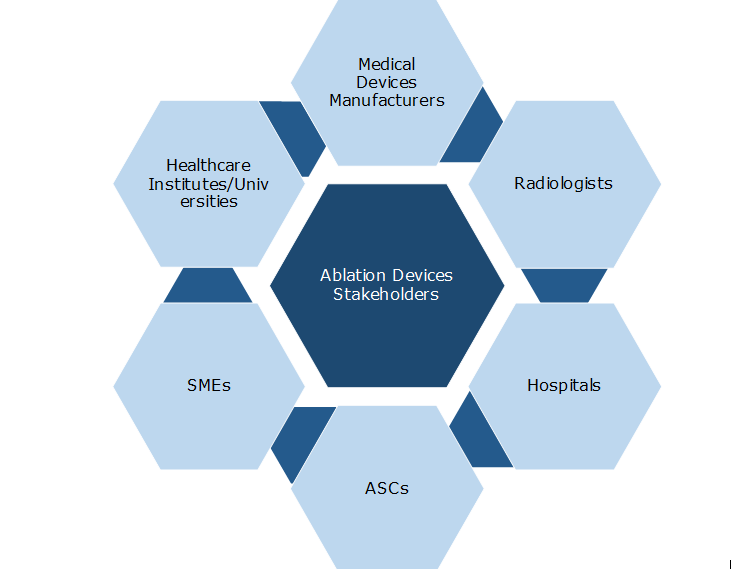

Key Stakeholders:

1 Industry Outlook

1.1 Industry Overview

1.1.1 Generators/Electrosurgical Unit

1.1.2 Ablation Catheters

1.1.3 Consumables

1.2 Major Diseases Covered

1.2.1 Cancer

1.2.2 Cardiac Arrhythmias

1.3 Industry Trends

1.4 PEST Analysis

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Total Addressable Market (TAM)

3.2 Segmented Addressable Market (SAM)

3.3 Related Markets

3.3.1 Surgical Devices Market

3.3.2 Radiofrequency Ablation Devices Market

3.3.3 Ablation Catheters Market

3.3.4 Cardiac Ablation Market

4 Market Outlook

4.1 Overview

4.2 Importance of Ablation Devices

4.3 Porter 5(Five) Forces

4.4 Market Dynamics

4.4.1 Drivers

4.4.1.1 Rise in the prevalence of chronic disorders

4.4.1.2 Increasing popularity of MI surgeries

4.4.1.3 Increase in the number of outpatient procedures

4.4.1.4 Increasing market awareness and campaigns

4.4.1.5 Rise in elderly population

4.4.1.6 Increase in disposable income

4.4.2 Opportunities

4.4.2.1 Technological advancements

4.4.2.2 High demand for lasers in ablation techniques

4.4.2.3 Increasing healthcare spending

4.4.2.4 Shift towards minimal and non-invasive procedures

4.4.3 Restraints

4.4.3.1 Complications and risk associated with ablation procedures

4.4.3.2 High cost of ablation procedures

4.4.3.3 Stringent regulatory approval process

4.4.3.4 Lack of skilled electrophysiologists

4.5 DRO – Impact Analysis

4.6 Key Stakeholders

5 Product Type: Market Size and Analysis

5.1 Overview

5.2 Generators/Electrosurgical Units

5.2.1 Overview

5.2.2 Featured Products: Generators/Electrosurgical Units

5.3 Ablation Catheters

5.3.1 Overview

5.3.2 Featured Products: Ablation Catheters

5.4 Consumables

5.4.1 Overview

5.4.2 Featured Products: Consumables

6 Technology: Percentage Split

6.1 EBRT

6.2 Radiofrequency Ablation

6.3 Ultrasound Ablation

6.4 Laser-Based Ablation

6.5 Cryoablation

6.6 Hydrothermal Ablation

6.7 Microwave Ablation

7 Application

7.1 Oncology

7.2 Cardiovascular

7.3 Orthopedic

7.4 Urology

7.5 Gynecology

7.6 Others

8 End-Users

8.1 Overview

8.2 Hospitals

8.3 Ambulatory Care

8.3.1 ASCs in the Americas

8.3.1.1 US

8.3.1.2 Canada

8.3.1.3 Mexico

8.3.1.4 Cuba

8.3.2 ASCs in the EMEA Region

8.3.2.1 UK

8.3.2.2 Germany

8.3.2.1 France

8.3.2.2 Israel

8.3.2.3 Africa

8.3.3 ASCs in the APAC Region

8.3.3.1 Australia

8.3.3.2 Japan

8.3.3.3 India

8.3.3.4 China

8.4 Physician’s Office

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.2.1 Market Overview

9.3 Europe

9.3.1 Market Overview

9.4 APAC

9.4.1 Market Overview

9.5 Rest of the World

9.5.1 Market Overview

10 Competitive Landscape

10.1 Overview

11 Vendor Profiles

11.1 Abbott Laboratories

11.1.1 Overview

11.1.2 Key Highlights (St. Jude Medical)

11.1.3 Business Strategies (St. Jude Medical)

11.1.4 Business Units

11.1.5 Geographic Presence

11.1.6 Business Focus

11.1.7 SWOT Analysis

11.1.8 Business Strategy

11.2 AngioDynamics, Inc.

11.2.1 Overview

11.2.2 Business Units

11.2.3 Geographic Presence

11.2.4 Business Focus

11.2.5 SWOT Analysis

11.2.6 Business Strategy

11.3 Boston Scientific Corp.

11.3.1 Overview

11.3.2 Business Units

11.3.3 Geographic Presence

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategy

11.4 Johnson & Johnson

11.4.1 Overview

11.4.2 Business Units

11.4.3 Geographic Presence

11.4.4 Business Focus

11.4.5 SWOT Analysis

11.4.6 Business Strategy

11.5 Medtronic PLC

11.5.1 Overview

11.5.2 Business Units

11.5.3 Geographic Presence

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategy

12 Companies to Watch For

12.1 Stryker Corp.

12.1.1 Overview

12.1.2 Key Highlights

12.1.3 Business Strategies

12.2 AtriCure, Inc.

12.2.1 Overview

12.2.2 Key Highlights

12.2.3 Business Strategies

12.3 Smith & Nephew plc

12.3.1 Overview

12.3.2 Key Highlights

12.3.3 Business Strategies

12.4 Galil Medical Inc.

12.4.1 Overview

12.4.2 Key Highlights

12.4.3 Business Strategies

12.5 CONMED Corp.

12.5.1 Overview

12.5.2 Key Highlights

12.5.3 Business Strategies

12.6 Olympus Corp.

12.6.1 Overview

12.6.2 Key Highlights

12.6.3 Business Strategies

12.7 MedWaves, Inc.

12.7.1 Overview

12.7.2 Key Highlights

12.7.3 Business Strategies

Annexure

Abbreviations

TABLE 1 GLOBAL ABLATION DEVICES MARKET BY TYPES, 2016–2023 ($MILLION)

TABLE 2 GLOBAL ABLATION DEVICES MARKET BY END-USERS

TABLE 3 GLOBAL ABLATION DEVICES MARKET REVENUE BY REGIONS, 2016–2023 ($MILLION)

TABLE 4 DRO (NORTH AMERICA)

TABLE 5 DRO (EUROPE)

TABLE 6 DRO (APAC)

TABLE 7 DRO (REST OF THE WORLD)

TABLE 8 GLOBAL ABLATION DEVICES MARKET BY VENDOR RANKING, 2016

TABLE 9 ABBOTT LABORATORIES: PRODUCT OFFERINGS

TABLE 10 ABBOTT LABORATORIES: RECENT DEVELOPMENTS

TABLE 11 ANGIODYNAMICS, INC.: PRODUCT OFFERINGS

TABLE 12 ANGIODYNAMICS, INC.: RECENT DEVELOPMENTS

TABLE 13 BOSTON SCIENTIFIC CORP.: PRODUCT OFFERINGS

TABLE 14 BOSTON SCIENTIFIC CORP.: RECENT DEVELOPMENTS

TABLE 15 JOHNSON & JOHNSON: PRODUCT OFFERINGS

TABLE 16 JOHNSON & JOHNSON: RECENT DEVELOPMENTS

TABLE 17 MEDTRONIC PLC: PRODUCT OFFERINGS

TABLE 18 MEDTRONIC PLC: RECENT DEVELOPMENTS

TABLE 19 STRYKER CORP.: SNAPSHOT

TABLE 20 STRYKER CORP.: RECENT DEVELOPMENTS

TABLE 21 ATRICURE, INC.: SNAPSHOT

TABLE 22 ATRICURE, INC.: RECENT DEVELOPMENTS

TABLE 23 SMITH & NEPHEW PLC: SNAPSHOT

TABLE 24 SMITH & NEPHEW PLC: RECENT DEVELOPMENTS

TABLE 25 GALIL MEDICAL INC.: SNAPSHOT

TABLE 26 CONMED CORP.: SNAPSHOT

TABLE 27 OLYMPUS CORP.: SNAPSHOT

TABLE 28 OLYMPUS CORP.: RECENT DEVELOPMENTS

TABLE 29 MEDWAVES, INC.: SNAPSHOT

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.