Blood Glucose Monitoring Systems Market – Global Forecasts upto 2024

- June, 2018

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Overview: Blood glucose monitoring is an integral part of the standard diabetes care, and it is very helpful in controlling the glucose levels in individuals with diabetes and impaired glucose tolerance. The incidence of diabetes is increasing globally, and around 90% of the patients have type 2 diabetes mellitus with approximately one-fifth of the people undergoing insulin treatment. Self-monitoring blood glucose (SMBG) systems and continuous glucose monitoring (CGM) systems are two major types of blood glucose monitoring systems.

The market for blood glucose monitoring systems is driven by increasing incidence of diabetes across various geographies, huge surge in the aging population, and increasing product launch and approvals. Increasing collaboration and funding to develop innovative devices and raising awareness among the patients are providing an opportunity for the market growth. Product recalls and inadequate reimbursements are few of the factors that may hamper the market growth to an extent.

Market Analysis: The “Global Blood Glucose Monitoring Systems” market is estimated to witness a CAGR of 6.7% during the forecast period 2018–2024. The global market is analyzed based on four segments – products, applications, end-users, and regions.

Regional Analysis: The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (RoW). North America is the major shareholder in the global blood glucose monitoring systems market, followed by Europe. The Asia Pacific region is expected to grow at a high CAGR during the forecast period due to an upsurge in access to health care services, increasing patient pool, raising awareness among patients, and growing healthcare expenditure. According to the Asian Diabetes Prevention Initiative, nearly 60% of the total diabetic population resides in Asia. It also estimates that 65.1 million adults in India and 113.9 million adults in China have diabetes.

Product Analysis: The blood glucose monitoring systems market, by product, is segmented into self-monitoring blood glucose (SMBG) systems and continuous glucose monitoring (CGM) systems. SMBG systems occupied a significant market share in 2017, and CGM systems are expected to grow at a high CAGR during the forecast period. Increasing adoption of minimally invasive procedures makes it the fastest growing segment during the forecast period.

Application Analysis: The market, by applications, is segmented into type 1 diabetes, type 2 diabetes, and gestational diabetes. Type 2 diabetes occupied a significant market share in 2017 and is expected to remain the same for the next 5 years. This is due to growing patient base for type 2 diabetes and increasing launch of the advanced product in this segment.

End-users Analysis: The market, by end-users, is segmented into hospitals, homecare, private clinics, and others. Among various end-users, homecare occupied a significant market share and is expected to remain the same during the forecast period.

Key Players: Medtronic plc, Johnson and Johnson, Abbott Laboratories, F. Hoffmann-La Roche Ltd., PHC Holdings Corporation, Ypsomed Holding, Dexcom, Acon Laboratories, Trividia Health Inc., Arkray Inc., Sanofi S.A., Terumo Medical Corporation, Prodigy Diabetes Care LLC, and niche players.

Competitive Analysis: The market has a large number of medium and small players that offer innovative products and has immense growth opportunity, especially in the emerging countries. The key market players are taking advantage of product approvals and new product launches, making their strategies to increase the market share. For instance, in September 2017, the US FDA approved FreeStyle Libre Flash Glucose Monitoring System, the first continuous glucose monitoring system that can be used by adult patients to make diabetes treatment decisions without calibration using a blood sample from the fingertip. In February 2018, Roche Diabetes Care India announced the launch of its new glucometer Accu-Chek Instant S, which marks the entry of the organization into the mass market segment in diabetes self-monitoring.

Benefits: The report provides complete details about the usage and adoption rate of blood glucose monitoring systems in various therapeutic verticals and regions. With that, key stakeholders can know about the major trends, drivers, investments, and vertical player’s initiatives. Moreover, the report provides details about the major challenges that are going to impact on the market growth. Additionally, the report gives the complete details about the key business opportunities to key stakeholders to expand their business and capture the revenue in the specific verticals to analyze before investing or expanding the business in this market.

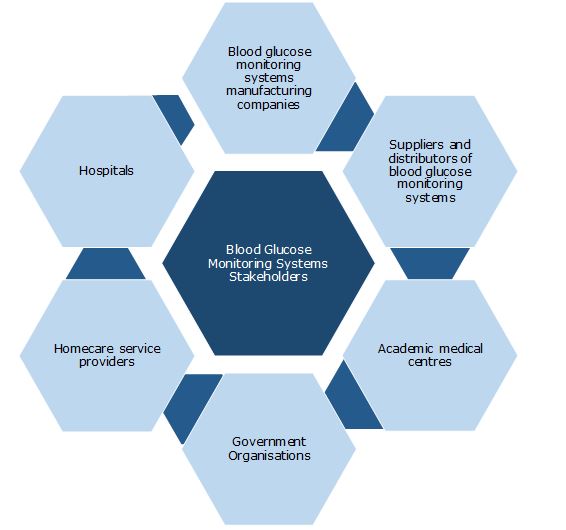

Key Stakeholders:

1 Industry Outlook

1.1 Market Overview

1.2 Total Addressable Market

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Advantages of Blood Glucose Monitoring Systems

3.3 Segmented Addressable Market (SAM)

3.4 Trends of the Blood Glucose Monitoring Systems Market

3.5 Related Markets

3.5.1 Insulin Pump

3.5.2 Smart Insulin Pen

3.5.3 Insulin Syringes

4 Market Outlook

4.1 Evolution of Blood Glucose Monitoring

4.2 Market Segmentation

4.3 PEST Analysis

4.4 Porter 5 (Five) Forces

5 Market Characteristics

5.1 DRO – Global Blood Glucose Monitoring Systems Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing incidence of diabetes across various geographies

5.1.1.2 Increasing number of product launch and approvals

5.1.1.3 Huge surge in the aging population

5.1.2 Opportunities

5.1.2.1 New collaboration and funding to develop new devices

5.1.2.2 Growing patient awareness

5.1.3 Restraints

5.1.3.1 High cost and inadequate reimbursement

5.1.3.2 Product recalls

5.2 DRO – Impact Analysis

5.3 Key Stakeholders

6 Products: Market Size & Analysis

6.1 Overview

6.2 Self-monitoring Blood Glucose Systems

6.3 Continuous Blood Glucose Monitoring Systems

7 Application: Market Size & Analysis

7.1 Overview

7.2 Type 1 Diabetes

7.3 Type 2 Diabetes

7.4 Gestational Diabetes

8 End-Users: Market Size and Analysis

8.1 Overview

8.2 Hospitals

8.3 Homecare

8.4 Private Clinics

8.5 Others

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.3 Europe

9.4 Asia Pacific

9.5 Rest of the World

10 Competitive Landscape

10.1 Overview

11 Vendor Profiles

11.1 Medtronic plc

11.1.1 Overview

11.1.2 Medtronic plc: Recent Developments

11.1.3 Business Units

11.1.4 Geographic Revenue

11.1.5 Business Focus

11.1.6 SWOT Analysis

11.1.7 Business Strategies

11.2 Abbott Laboratories

11.2.1 Overview

11.2.2 Abbott Laboratories: Recent Developments

11.2.3 Business Units

11.2.4 Geographic Revenue

11.2.5 Business Focus

11.2.6 SWOT Analysis

11.2.7 Business Strategies

11.3 Johnson and Johnson

11.3.1 Overview

11.3.2 Business Units

11.3.3 Geographic Revenue

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategies

11.4 F. Hoffmann-La Roche Ltd.

11.4.1 Overview

11.4.2 Business Units

11.4.3 Geographic Revenue

11.4.4 Business Focus

11.4.5 SWOT Analysis

11.4.6 Business Strategy

12 Companies to Watch for

12.1 Dexcom

12.1.1 Overview

12.2 PHC Holdings Corporation

12.2.1 Overview

12.3 Ypsomed Holding

12.3.1 Overview

12.4 B. Braun Melsungen AG

12.4.1 Overview

12.5 Trividia Health Inc.

12.5.1 Overview

12.6 Acon Laboratories

12.6.1 Overview

12.7 Sanofi S.A.

12.7.1 Overview

12.8 Arkray, Inc.

12.8.1 Overview

12.9 Nova Biomedical Corporation

12.9.1 Overview

12.10 Prodigy Diabetes Care, LLC

12.10.1 Overview

12.11 Terumo Medical Corporation

12.11.1 Overview

Annexure

Ø Abbreviations

TABLE 1 ESTIMATED PERCENTAGE INCREASE IN AGING POPULATION, 2015–2035 23

TABLE 2 GLOBAL BLOOD GLUCOSE MONITORING SYSTEMS REVENUE BY REGIONS, 2017–2024 ($MILLION) 38

TABLE 3 OTHER VENDORS OF BLOOD GLUCOSE MONITORING SYSTEMS MARKET 47

TABLE 4 MEDTRONIC PLC: OFFERINGS 48

TABLE 5 ABBOTT LABORATORIES: PRODUCT OFFERINGS 60

TABLE 6 JOHNSON AND JOHNSON: OFFERINGS 67

TABLE 7 JOHNSON AND JOHNSON: RECENT DEVELOPMENTS 68

TABLE 8 F. HOFFMANN-LA ROCHE LTD.: OFFERINGS 75

TABLE 9 F. HOFFMANN-LA ROCHE LTD.: RECENT DEVELOPMENTS 75

TABLE 10 DEXCOM, INC.: SNAPSHOT 81

TABLE 11 DEXCOM, INC.: RECENT DEVELOPMENTS 82

TABLE 12 PHC HOLDINGS CORPORATION: SNAPSHOT 83

TABLE 13 PHC HOLDINGS CORPORATION: RECENT DEVELOPMENTS 83

TABLE 14 YPSOMED HOLDINGS: SNAPSHOT 85

TABLE 15 YPSOMED HOLDING: RECENT DEVELOPMENTS 86

TABLE 16 B. BRAUN MELSUNGEN AG: SNAPSHOT 87

TABLE 17 B. BRAUN MELSUNGEN AG: RECENT DEVELOPMENTS 87

TABLE 18 TRIVIDIA HEALTH, INC.: SNAPSHOT 88

TABLE 19 TRIVIDIA HEALTH, INC.: RECENT DEVELOPMENTS 89

TABLE 20 ACON LABORATORIES: SNAPSHOT 89

TABLE 21 ACON LABORATORIES: RECENT DEVELOPMENTS 90

TABLE 22 SANOFI: SNAPSHOT 91

TABLE 23 SANOFI: RECENT DEVELOPMENTS 91

TABLE 24 ARKRAY, INC.: SNAPSHOT 93

TABLE 25 ARKRAY, INC.: RECENT DEVELOPMENTS 94

TABLE 26 NOVA BIOMEDICAL CORPORATION: SNAPSHOT 94

TABLE 27 NOVA BIOMEDICAL: RECENT DEVELOPMENTS 95

TABLE 28 PRODIGY DIABETES CARE: SNAPSHOT 96

TABLE 29 PRODIGY DIABETES CARE: RECENT DEVELOPMENTS 96

TABLE 30 TERUMO MEDICAL CORPORATION: SNAPSHOT 96

TABLE 31 TERUMO MEDICAL CORPORATION: RECENT DEVELOPMENTS 97

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.