3D Printing Metals Market By Material (Precious metals, commodities, alloys), By End-User (Aerospace & Defence, Automotive, Healthcare, Consumer Product and others) and By Geography – Global Driver, Restraints, Opportunities, Trends, and Forecast to 2022

- February, 2018

- Domain: Chemicals, Materials & Food - Paints & Coatings/Inks & Pigments

- Get Free 10% Customization in this Report

Discovered in the 1980s, the three-dimensional printing, commonly known as additive manufacturing, has drastically changed the perception of the manufacturing process. The 3D printing technology uses a printer and a digital file to produce objects. The digital file is technically known as computer-aided design and is made according to the print requirement, materials type, and printer used to manufacture the printed product. According to material type, the market is majorly divided into plastics, photopolymers, metals, ceramics, and others that include metal–plastic composites and carbon fibers. Further, the metal segment of the 3D printing metals market is divided into precious metals (titanium, gold, silver, platinum, etc.), commodity metals (aluminum, copper, stainless steel, etc.), and alloys. Rapid prototyping for increasing the design efficiency has attracted OEM manufacturers, design hobbyists, and industrialists to opt for the 3D printing technology. Thus, a fair amount of 3D printing metals is demanded from the automotive and aerospace application industries.

Research Methodology

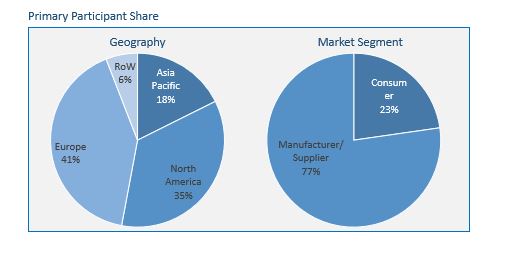

The 3D Printing metals has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology, wherein our industry experts and panel of primary participants helped in compiling the best quality with realistic parametric estimations. Further, the participation share of different categories of primary participants is given below:

The 3D printing technology has drastically reduced the material wastage, thereby adhering to save the environmental policy, which makes it a more viable option for the end-users. The main application areas of 3D printing metal materials are in aerospace & automotive, healthcare & medical, commercial/industrial equipment manufacturers, and consumer products/electronics among others.

Globally, the demand for 3D printing metal materials is high in economically developed countries, whereas the developing regions are catching up the pace. Extensive consumption of metal materials comes from aerospace and automotive domains due to changing product designs from time to time. Further, the light weight of OEM components for better fuel efficiency to reduce carbon footprint is an additional factor boosting the exponential growth for the 3D printing metals market in the next 5 years.

The regional demand for 3D printing metals is consistently growing, especially in the European and North American regions. This growth is supported by lucrative, fast-growing technological industries, and the growing manufacturing market in these regions. Currently, North America is the global leader in the 3D printing metals market from the demand side. North America has the highest adoption of 3D printing technology due to higher literacy rate and the availability of skilled labor. The US, which is the predominant region in North America, has the advantage of having most of the manufacturing and consumption markets, thus providing the maximum contribution to the 3D printing metals market in the region. Europe is not far behind North America in terms of 3D printing metal materials consumption value. From the supplier side, Europe followed by Asia Pacific are the market leaders in the 3D printing metals market. The European market is also witnessing a capital influx in 3D printing technology from Tier 1 companies, which is increasing the regional competition.

The study of the 3D printing metals market by Infoholic Research provides the market size information and market trends along with factors and parameters impacting it in both short- and long-term. The study ensures a 360° view, bringing out the complete key insights of the industry. These insights help the business decision-makers to make better business plans and informed decisions for the future business. In addition, the study helps venture capitalists in understanding the companies better and take informed decisions. Few of the key players in the 3D printing metals market are Stratasys, 3D Systems, SABIC, DOW, HP, Materialise, Sandvik Osprey, etc.

According to Infoholic Research, the global 3D printing metals market is expected to grow at a CAGR of 26.4% during the forecast period 2016–2022 to reach a value of $691.0 million by 2022. The Asia Pacific region has the fastest growth rate and is expected to move toward rapid adoption of 3D printing technology, which will directly boost the consumption by value, driven by Japan, China, and India. Asia Pacific is expected to contribute to the highest growth in the global 3D printing metals market.

Report Scope:

By Material Type

- Precious Metals

- Commodity Metals

- Alloys

- Others

By End-users

- Aerospace & Automotive

- Healthcare

- Construction & Architecture

- Commercial/Industrial

Regions

- Asia Pacific

- North America

- Europe

- Rest of the World

Industry outlook: Market trends, drivers, restraints, and opportunities

1 Report Outline

- 1.1 Introduction

- 1.2 Report Scope

- 1.3 Market Definition

- 1.4 Research Methodology

- 1.4.1 Data Collation & In-House Estimation

- 1.4.2 Market Triangulation

- 1.4.3 Forecasting

- 1.5 Study Declarations

- 1.6 Report Assumptions

- 1.7 Stakeholders

2 Executive Summary

-

- 2.1 Asia Pacific is Witnessing High Growth Rate in the 3D Printing Metals Market

2.2 End-user Moving from Testing Prototypes to Mass Production

3 Market Positioning

- 3.1 Total Addressable Market (TAM): 3D Printing Materials market

- 3.1.1 Market Overview

- 3.1.2 Major Trends

- 3.2 Segmented Addressable Market (SAM)

- 3.3 Related Markets

4 Market Outlook

- 4.1 Overview

- 4.2 Value Chain Analysis

- 4.3 PESTLE Analysis

- 4.4 Porter 5 (Five) Forces

- 4.5 Patent Analysis

5 Market Characteristics

- 5.1 Market Segmentation

- 5.2 Market Dynamics

- 5.2.1 Drivers

- 5.2.1.1 Increasing penetration of 3D printing technology

- 5.2.1.2 Expiring patents giving a way to new market entrants

- 5.2.1.3 Incresing competitiveness from logistics to reduce cost and time

- 5.2.2 Restraints

- 5.2.2.1 Fluctuations in raw material prices restrainating market growth

- 5.2.2.2 Changing geo-political structure across key markets affecting growth

- 5.2.3 Opportunities

- 5.2.3.1 Opportunities for better and cost effective 3D printing metal materials

- 5.2.3.2 Large untapped market in developing and underdeveloped countries

- 5.2.4 DRO – Impact Analysis

- 5.2.1 Drivers

6 By Type: Market Size And Analysis

-

- 6.1 Overview

- 6.2 Precious Metals

- 6.3 Commodity metals

- 6.4 Alloys

- 6.5 Vendor Profiles

- 6.5.1 Stratasys Inc

- 6.5.2 BASF SE

- 6.5.3 Dow Inc Chemicals

- 6.5.4 Saudi Basic Industries Corporation (SABIC)

- 6.5.5 3M Company

(Overview, business unit, geographic revenues, product profile, recent developments, buiness focus, swot analysis and business strategies have been covered for all vendors)

7 End-user: Market Size And Analysis

-

- 7.1 Overview

- 7.2 Aerospace & Defense

- 7.3 Automotive

- 7.4 Healthcare

- 7.5 Consumer products

- 7.6 Customer Profile

- 7.6.1 General Electric (GE)

- 7.6.2 Boeing Corporation

- 7.6.3 Toyota Motor Corporation

- 7.6.4 Siemens AG

- 7.6.5 Bechtel Corporation

(Overview, business unit, geographic revenues, product profile, recent developments, buiness focus, swot analysis and business strategies have been covered for all customers)

8 Regions: Market Size And Analysis

-

- 8.1 Overview

- 8.2 Asia Pacific

- 8.3 North America

- 8.4 Europe

- 8.5 Rest of the World

(Segmentation of by countries, by type and by end-user have been covered for all the geographic regions)

9 Companies to watch for

- 9.1 General Electric (GE)

- 9.2 Hewlett-Packard (HP)

10 Competitive Landscape

- 10.1 Competitor Comparison Analysis

- 10.2 Market Landscape

- 10.2.1 Mergers, Acquisitions & Joint Ventures

- 10.2.2 Divestiture & Divestment

11 Expert’s Views

Annexure

Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.