Anti-obesity Drugs Market 2017–2023

- November, 2017

- Domain: Healthcare - Pharmaceuticals

- Get Free 10% Customization in this Report

Overview:

Globally, obesity has nearly tripled since 1975. In 2016, more than 1.9 billion adults, who were 18 years and older were overweight. Of these over 650 million were obese. An obese individual is at a higher risk of developing chronic diseases such as breast cancer, endometrial cancer, colon cancer, type 2 diabetes, cardiovascular diseases, and musculoskeletal disorders.

Anti-obesity drugs help in reducing body mass either by dipping the hunger or increasing the consumption of calories. The increasing prevalence of obesity globally is a major factor driving the market. It is principally because of wrong eating habits and swiftly varying regime of people. The increasing ingestion of unhealthy food along with the lack of exercises is intensifying the incidence rate of obesity globally.

Basic activities like reducing the intake of unhealthy diet and inculcating workout are not highly effective, and the medical devices like intragastric balloon and bariatric surgery are highly expensive and has high complications. This shows that there is a wide gap for the treatment of obesity. This unmet need is driving the market for anti-obesity drugs market.

Ill effects, such as the risk of mental illness, suicidal symptoms, stroke, are natively impacting the anti-obesity drugs market. Many drugs that were approved previously were withdrawn because of their side effects. Due to these factors healthcare specialists have an undesirable insight and do not recommend them to their clients.

Market Analysis:

The Global Anti-Obesity Drugs Market is estimated to witness a CAGR of 20.9% during the forecast period 2017–2023. The market is analyzed based on three segments, namely top FDA approved drugs, types of anti-obesity drugs, and regions.

Regional Analysis:

The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (RoW). North America is the leading region for the anti-obesity drugs market growth followed by Europe. Asia Pacific and RoW are set to be the emerging regions. India and China are set to be the most attractive destinations due to the large untapped market.

Types Analysis:

The top FDA approved anti-obesity drugs are Xenical, Saxenda, Contrave, Belviq, and Qsymia. Xenical was the largest selling drug in the market until 2012, but saw a dip in its revenue over the years. However, recently approved Saxenda by Novo Nordisk is gaining large interest among obese people and is growing at a fast growth rate.

Key Players: F. Hoffmann La Roche, GlaxoSmith Kline, Orexigen Therapeutics, Vivus Therapeutics, and Eisai Co, Ltd. are the key players in the market. Boehringer Ingelheim, Merck & Co, Nova Nordisk, Pfizer, Rhythm Pharmaceuticals, Zafgan, and Takeda Pharmaceuticals are the other prominent vendors.

Competitive Analysis:

Novo Nordisk, an innovator of drugs in the obesity market, launched Saxenda in all the major markets with a higher dose of glucagon-like peptide-1 (GLP-1) receptor agonist, liraglutide, which was first launched for type 2 diabetes as Victoza. Dual therapy for obesity and type 2 diabetes is the latest trend in the market. Therefore, big pharmaceutical companies, such as AstraZeneca, J&J, and Sanofi, are adopting low-risk strategy of using diabetes drugs to treat the obesity related problem. This helps the diabetes market players to enter the obesity market. J&J is intended to enter the market for prescription anti-oobesity drugs without further investing in the development of novel molecules.

Benefits:

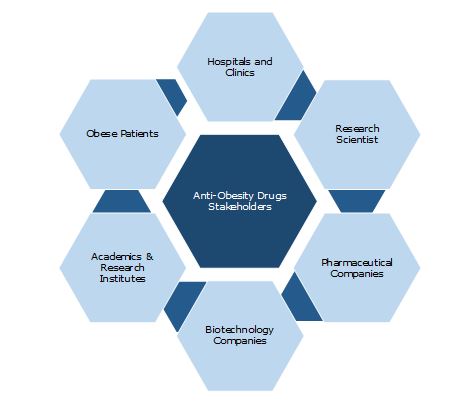

The report provides complete details about the usage and adoption rate of anti-obesity drugs during the forecast period and the various regions. With that, the key stakeholders can know about the major trends, drivers, and investments, along with the details of the commercial drugs available in the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to key stakeholders to expand their business and capture the revenue in specific verticals to analyze before investing or expanding business in this market.

Key Stakeholders:

1 Industry Outlook

1.1 Industry Overview

1.2 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Total Addressable Market

3.3 Segmented Addressable Market

3.4 Related Markets

3.4.1 Diabetes Drugs

3.4.2 Active Pharmaceutical Ingredients

3.4.3 Intragastric Balloon

3.4.4 Oncology (Cancer) Drugs

4 Market Outlook

4.1 Overview

4.2 Market Segmentation

4.3 Porter 5(Five) Forces

4.4 PEST Analysis

5 Market Characteristics

5.1 Market Evolution

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High prevalence of obesity

5.2.1.2 Unhealthy lifestyle

5.2.1.3 Chronic nature of obesity

5.2.2 Opportunities

5.2.2.1 Growing awareness of fitness

5.2.2.2 Large untapped market

5.2.3 Restraints

5.2.3.1 Side effects related to anti-obesity drugs

5.2.3.2 Availability of alternative treatment options

5.3 DRO – Impact Analysis

5.4 Key Stakeholders

6 Drug Details: Market Size and Analysis

6.1 Overview

6.2 Orlistat

6.3 Phentermine/Topiramate ER

6.4 Lorcaserin

6.5 Naltrexone SR/Bupropion SR

6.6 Liraglutide 3.0 mg

7 Types: Market Size and Analysis

7.1 Overview

7.2 Prescription Drugs (Rx)

7.3 OTC Drugs

8 Regions: Market Size and Analysis

8.1 Overview

8.2 North America

8.2.1 Overview

8.2.2 US

8.2.3 Canada

8.2.4 Mexico

8.3 Europe

8.3.1 Overview

8.3.2 UK

8.3.3 Germany

8.4 Asia Pacific

8.4.1 Overview

8.4.2 India

8.4.3 China

8.4.4 Australia

8.5 Rest of the World

8.5.1 Overview

8.5.2 Brazil

8.5.3 Africa

8.5.4 Middle East

9 Competitive Landscape

10 Vendors Profiles

10.1 F. Hoffmann-La Roche Ltd.

10.1.1 Overview

10.1.2 Business Units

10.1.3 Geographic Revenue

10.1.4 Business Focus

10.1.5 SWOT Analysis

10.1.6 Business Strategies

10.2 GlaxoSmithKline plc

10.2.1 Overview

10.2.2 Business Units

10.2.3 Geographic Revenue

10.2.4 Business Focus

10.2.5 SWOT Analysis

10.2.6 Business Strategies

10.3 Vivus, Inc.

10.3.1 Overview

10.3.2 Business Focus

10.3.3 SWOT Analysis

10.3.4 Business Strategies

10.4 Orexigen Therapeutics, Inc.

10.4.1 Overview

10.4.2 Business Focus

10.4.3 SWOT Analysis

10.4.4 Business Strategies

10.5 Eisai Co., Ltd.

10.5.1 Overview

10.5.2 Geographic Revenue

10.5.3 Business Focus

10.5.4 SWOT Analysis

10.5.5 Business Strategies

11 Companies to Watch for

11.1 Pfizer, Inc.

11.1.1 Overview

11.1.2 Highlights

11.2 Nova Nordisk A/S

11.2.1 Overview

11.2.2 Highlights

11.3 Boehringer Ingelheim GmbH

11.3.1 Overview

11.4 Rhythm Pharmaceuticals, Inc.

11.4.1 Overview

11.5 Zafgen, Inc.

11.5.1 Overview

11.6 Norgine B.V.

11.6.1 Overview

11.7 Merck & Co.

11.7.1 Overview

11.7.2 Highlights

11.8 Takeda Pharmaceutical Co., Ltd.

11.8.1 Overview

Annexure

Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.