Global Point-of-Care Diagnostics Market 2018-2024

- February, 2018

- Domain: Healthcare - Diagnostics

- Get Free 10% Customization in this Report

The point-of-care diagnostics market is booming due to several factors such as the growing patient base for lifestyle diseases globally, growing elderly population, increasing prevalence of infectious disease, technological innovations and increasing adoption of point-of-care diagnostics. Stringent approval processes, unfavorable reimbursement scenarios and product recalls are some of the factors hampering the market growth. The market in emerging countries is expected to grow at a rapid pace during the forecast period because of increasing healthcare awareness towards point-of-care diagnostics, increasing healthcare spending and growing patient pool.

Market Analysis: The “Global Point-of-Care Diagnostics Market” is estimated to witness a CAGR of 7.7% during the forecast period 2018–2024. The market is analyzed based on four segments –products, prescription mode, end-users and regions.

Regional Analysis: The regions covered in the report are North America, Europe, Asia Pacific, and the Rest of the World (RoW). North America is set to be the leading region for the Point-of-Care Diagnostics market growth followed by Europe, Asia Pacific and the rest of the world.

Product Analysis: The global Point-of-Care Diagnostics market by product is segmented into glucose monitoring kits, infectious diseases testing kits, pregnancy and fertility testing kits, hematology testing kits, cardiometabolic monitoring kits, urinalysis testing kits, coagulation monitoring kits, tumor/cancer markers, cholesterol test strips, drugs-of-abuse testing kits, and others. Glucose monitoring kits occupied the largest share in 2017 due to factors such as an increase in the prevalence of diabetes, change in lifestyle, growing elderly population and increasing demand for disease management.

Prescription Mode Analysis: The global point-of-care diagnostics market by prescription mode is segmented into Prescription-based POC diagnostics and OTC-based POC diagnostics. The latter has occupied a major market share since 2017 and is expected to retain its position during the forecasted period with the introduction of hand-held and portable devices and increased awareness of POC diagnostics.

End-Users Analysis: The global point-of-care diagnostics market by end-users is segmented into hospitals, clinics, home-care and others. Hospitals occupied the maximum market share in 2017 and is expected to be same for the next few years.

Key Players: Abbott Laboratories, F. Hoffmann-La Roche, Johnson & Johnson, Siemens AG, Danaher Corporation, Qiagen N.V., BioMerieux S.A., Nova Biomedical, Beckton Dickinson and Company, Trinity Biotech plc and other niche players.

Competitive Analysis: Currently, the glucose monitoring kits dominate the global point-of-care diagnostics market. A lot of new players are concentrating on this market to deliver advanced and innovative products. The key market players are acquiring other companies to enhance their product portfolio and strengthen their leadership position in the market. For instance, in October 2017, Abbott completed the acquisition of Alere for about $5.3 billion. In January 2017, Werfen acquired Accriva Diagnostics, a global leader in in vitro diagnostic (IVD) blood testing at the Point-of-Care (POC). The acquisition included Accriva’s flagship product portfolio spanning coagulation, platelet aggregation, CO-Oximetry and incision devices. Not only this but key players are also launching new products to have an edge in the market. For instance, in January 2018, Abbott Laboratories announced the launch of CE marked Alinity h-series integrated system for hematology testing.

Benefits: The report provides complete details about the usage and adoption rate of point-of-care diagnostics products in various regions. With the help of this report, key stakeholders will find extensive details about the major trends, drivers, investments and vertical players’ initiatives. It will also shed light on government initiatives toward the test adoption in the upcoming years along with the details of commercial tests available in the market. Moreover, the report provides details about the major challenges that are going to have an impact on the market growth. Additionally, the report gives in-depth information about the key business opportunities to key stakeholders so that they can expand their businesses and forecast the revenue in specific verticals before investing or expanding their businesses in this market.

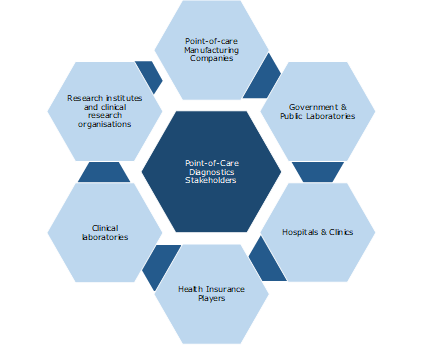

Key Stakeholders:

1.1 Industry overview

1.2 Total addressable market

1.3 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Advantages of Point-of-care testing

3.3 Disadvantages of Point-of-care testing

3.4 Segmented Addressable Market (SAM)

3.5 Trends of the point-of-Care diagnostics market

3.6 Related Markets

3.6.1 Molecular diagnostics

3.6.2 Infectious disease diagnostics

4 Market Outlook

4.1 Overview

4.2 Funding scenario

4.3 Market segmentation

4.4 PEST Analysis

4.5 Porter 5(Five) Forces

5 Market Characteristics

5.1 DRO – Global Point-of-care Diagnostics Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing prevalence of infectious disease

5.1.1.2 Growing incidence of life-style disease

5.1.1.3 Technological innovations

5.1.1.4 Increasing adoption of point-of-care diagnostics

5.1.2 Opportunities

5.1.2.1 Growth opportunities in emerging markets

5.1.2.2 Increasing awareness towards point-of-care diagnostics in developing countries

5.1.3 Restraints

5.1.3.1 Stringent approval process

5.1.3.2 Product recalls

5.1.3.3 Unfavorable reimbursement scenario

6 Product: Market Size and Analysis

6.1 Overview

6.2 Glucose monitoring kits

6.3 Infectious disease testing kits

6.4 Pregnancy and fertility testing kits

6.5 Hematology testing kits

6.6 Cardiometabolic monitoring kits

6.7 Urinalysis testing kits

6.8 Coagulation monitoring kits

6.9 Tumour or cancer marker testing kits

6.10 Cholesterol testing kits

6.11 Drugs of abuse testing kits

6.12 Others

7 Prescription mode: Market Size and Analysis

7.1 Overview

7.2 Prescription-based point-of-care diagnostics

7.3 Over the counter-based point-of-care diagnostics

8 End Users: Market Size and Analysis

8.1 Overview

8.2 Hospitals

8.3 Clinics

8.4 Home-care

8.5 Others

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.2.1 Overview

9.2.2 US

9.2.3 Canada

9.3 Europe

9.3.1 Overview

9.3.2 UK

9.3.3 Germany

9.3.4 France

9.3.5 Spain

9.4 APAC

9.4.1 Overview

9.4.2 India

9.4.3 China

9.5 Rest of the World

10 Competitive Landscape

10.1 Overview

11 Vendor Profiles

11.1 Abbott Laboratories

11.1.1 Overview

11.1.2 Business Unit

11.1.3 Geographic Presence

11.1.4 Business Focus

11.1.5 SWOT Analysis

11.1.6 Business Strategy

11.2 F.Hoffmann-La Roche Ltd

11.2.1 Overview

11.2.2 Business Unit

11.2.3 Geographic Presence

11.2.4 Business Focus

11.2.5 SWOT Analysis

11.2.6 Business Strategy

11.3 Johnson & Johnson

11.3.1 Overview

11.3.2 Business Units

11.3.3 Geographic Revenue

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategies

11.4 Danaher Corporation

11.4.1 Overview

11.4.2 Business Unit

11.4.3 Geographic Presence

11.4.4 Business Focus

11.4.5 SWOT Analysis

11.4.6 Business Strategy

11.5 Siemens Healthineers Inc. (Siemens AG)

11.5.1 Overview

11.5.2 Business Units

11.5.3 Geographic Presence

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategy

12 Companies to Watch For

12.1 Trinity Biotech plc

12.1.1 Overview

12.1.2 Trinity Biotech plc: Recent Developments

12.2 Qiagen N.V.

12.2.1 Overview

12.2.2 Qiagen N.V.: Recent Developments

12.3 BioMerieux S.A.

12.3.1 Overview

12.3.2 BioMerieux S.A.: Recent Developments

12.4 OraSure Technologies, Inc.

12.4.1 Overview

12.4.2 OraSure Technologies, Inc.: Recent Developments

12.5 Instrumentation Laboratory (a Werfen company)

12.5.1 Overview

12.5.2 Instrumentation Laboratory: Recent Developments

12.6 Becton Dickinson and Company

12.6.1 Overview

12.6.2 Becton dickenson and company: Recent Developments

12.7 Nova Biomedical

12.7.1 Overview

12.7.2 Nova Biomedical: Recent Developments

13 Annexure

13.1 Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.