Global Dental Implants Market 2017-2023

- December, 2017

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Overview: A dental implant is a tooth like structure made of hybrid material such as titanium or zirconium. Such an implant is also known as frames or metal posts. These implants are surgically implanted/positioned into the jawbone beneath the gum line. This helps dentists to restore any missing tooth and provide support to the gum in that area. Dental implant benefits oral health and restores the mouth’s ability to chew, talk, bite into food. These implants provide adequate bone support and commit the implanted structures for long-term functionality. Owing to its growing popularity, especially among the elderly population worldwide, the dental implant market is on a rapid upward climb globally. The rise in awareness about safe and effective dental retstoration procedures has has led to an increased number of people opening up to dental implants. It is seems attractive because it is a relatively hassle-free medical process and is performed as an outpatient procedure.

The dental implant market is growing at a steady pace and is expected to grow at a rapid rate in the emerging economies. There are more than 35 million Americans who are fully edentulous, and this is expected to increase as the aging population grows. Most of the older population is demanding tooth replacement, especially is they are fully edentulous. However, even partially edentulous people, young and old are viewing dental implant as a viable option.. According to the American College of Prosthodontists, it estimated that by 2030 there will be more than 200 million partially edentulous patients.

The major products in the dental implant market include:

- 3M ESPE MDI Hybrid Lab Analog

- OSSEOTITE Implants

- SeissPlus Implants

- Ankylos

- Astra Tech Implant System EV

- InterActive, RePlant

- NobelParallel Conical Connection

- Straumann Tissue Level Implant

- Bone Level Implant Line

The top players in this market are Straumann, Danaher Corp, Zimmer Biomet, Dentsply Sirona, and 3M. These companies hold more than 70% to 75% of the global market share . Factors such as the increased prevalence of oral diseases, growing popularity of mini-dental implants, and the introduction of new technologies, are driving the market growth.

Market Analysis: The Global Dental Implant Market is estimated to witness a CAGR of 6.01% during the forecast period 2017–2023. The market is analyzed based on three segments, namely product type, end-users, and regions.

Regional Analysis: The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (ROW). Europe is set to be the leading region for the dental implant market growth followed by the Americas. Asia Pacific and ROW are set to be the emerging regions. The emerging markets have a high potential to grow owing to an increase in the patient population and their focus toward healthcare infrastructure. The dental market has the lowest penetration in the emerging market and most of the vendors are targeting to penetrate in countries such as India. China, Thailand, and Vietnam. Further, medical tourism has become a new trend in the emerging markets as most of the people from developed countries are travelling to the APAC region, especially India, for dental implant procedures. However, the high cost of implants and the expensive procedural cost in the US, lack of skilled surgeonsand proper reimbursement policies across some of the developed countries, and lack of awareness about advanced implants in the developing countries have a significant impact on the overall market growth.

Product Analysis: Titanium is the fastest growing segment and dominates the global dental implant market with more than 93% of the total market share. Factors, such as the increasing elderly population, the rise in prevalence of oral diseases, and growing adoption of knowledge-based dentistry, are driving the market growth. Titanium is the most common metal used in dental implants because of its inherent qualities. It is safe and stable and is used in various dentistry procedures such as dental implants, abutments, crowns and bridges, and in various other dental fixtures. These implants are usually made of titanium alloy (a combination of a different metals such as aluminum, vanadium and nickel). The advantage of using titanium is its long-term success rate of about 95%. It means that the implant fixtures, if maintained properly, will last for ten years or longer. Zirconium, the second leading material in dental implant, is an alternative to Titanium and is growing at a slow pace presently. Though slow, this metal is emerging steadily and is expected to replace the gold standard methods of dental implantology. The material is suitable for procedures such as osseointegration and aesthetic dental treatment with high biocompatibility. However, the research studies on zirconium dental implantology are short-term and there is a need for more long-term clinical trials to prove zirconium is worth replacing titanium as a biomaterial. Further, hybrid implants, comprising both titanium and zirconium will also generate revenue in the market because of their cost effectiveness and performance

Key Players: Straumann Group, Danaher Corp, Zimmer Biomet, Dentsply Sirona, and 3M are the predominant players in the current dental implant market

Competitive Analysis: The global dental implant market is highly fragmented and has immense growth opportunities for vendors, especially in the developing regions. The market enjoys the participation of many global, regional, and local players who are competing fiercely to gain a strong foothold as top vendor. Big players, such as Danaher, Dentsply Sirona, Zimmer Biomet, Straumann, and 3M often acquire small yet promising companies to increase their market share. Most giant companies are using acquisition strategies to expand their business operations by leveraging their products portfolio across the globe. The competitive environment in the market will intensify further with an increase in product/service extensions, product innovations, and M&A. Strategic alliances are being formed to manufacture and market dental implants more vigorously and efficiently

Benefits: The report provides complete details about the usage and adoption rate of dental implants for the treatment of various oral issues. Thus, the key stakeholders can know in detail about the latest trends, drivers, investments, vertical players’ initiatives, and government initiatives toward the dentistry industry in the upcoming years. The report also provides details of the pure play companies entering the market. Moreover, the report highlights the major challenges that are going to impact the market growth. Additionally, it brings forth the key business opportunities to key stakeholders to aid them in expanding their business and capture the revenue in specific verticals. It also aims to help stakeholders analyze the pros and cons of this market before investing or expanding the business in this arena.

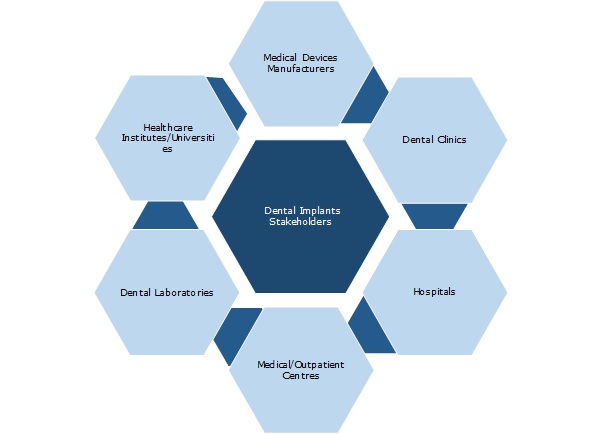

Key Stakeholders:

1 Industry Outlook

1.1 Industry Overview

1.2 Patient demographics

1.3 Healthcare Spending in the US

1.4 Definition: Dental Implants

1.5 Why Dental Implants?

1.6 Industry Trends

1.7 Reimbursement Scenario

1.8 Emerging Global Markets

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Total Addressable Market (TAM)

3.2 Segmented Addressable Market (SAM)

3.3 Porter 5 (Five) Forces

3.4 Market Dynamics

3.4.1 Drivers

3.4.1.1 Increase incidence of oral diseases

3.4.1.2 Growing adoption of knowledge-based dentistry

3.4.1.3 Increasing geriatric population

3.4.1.4 Increase spending for oral health

3.4.2 Restraints

3.4.2.1 High cost of dental implants

3.4.2.1 Low penetration rate in emerging countries

3.4.2.2 Intense competition among vendors

3.4.2.3 Lack of reimbursement

3.4.2.4 Paucity of skilled dental specialities

3.4.3 Opportunities

3.4.3.1 Medical tourism

3.4.3.2 Emergence of mini dental implants

3.4.3.3 Growing popularity of cosmetic dentistry

3.4.3.4 Technological advancement

3.4.4 DRO – Impact Analysis

3.4.5 Key Stakeholders

4 Product Types: Market Size & Analysis

4.1 Overview

4.2 Titanium Dental Implants

4.2.1 Overview

4.3 Zirconium Dental Implants

4.3.1 Overview

5 End-user: Market Size and Analysis

5.1 Overview

5.2 Hospitals

5.3 Dental Clinics

6 Regions: Market Size & Analysis

6.1 Overview

6.2 North America

6.2.1 Market Overview

6.3 Europe

6.3.1 Market Overview

6.4 APAC

6.4.1 Market Overview

6.5 Rest of the World

6.5.1 Market Overview

7 Competitive Landscape

7.1 Competitor Comparison Analysis

8 Vendor Profiles

8.1 3M

8.1.1 Business Unit

8.1.2 Geographic Presence

8.1.3 Business Focus

8.1.4 SWOT Analysis

8.1.5 Business Strategy

8.2 Zimmer Biomet Holdings, Inc

8.2.1 Overview

8.2.2 Business Unit

8.2.3 Geographic Revenue

8.2.4 Business Focus

8.2.5 SWOT Analysis

8.2.6 Business Strategy

8.3 Dentsply Sirona Inc

8.3.1 Business Unit

8.3.1.1 Business focus

8.3.1.2 SWOT analysis

8.3.1.3 Business strategies

8.4 Danaher Corp

8.4.1.1 Overview

8.4.1.2 Business focus

8.4.1.3 SWOT analysis

8.4.1.4 Business strategies

8.5 Straumann Group

8.5.1.1 Overview

8.5.1.2 Geographical Revenue

8.5.1.3 Business focus

8.5.1.4 SWOT analysis

8.5.1.5 Business strategies

9 Companies to watch for

9.1 Henry Schein

9.1.1 Overview

9.1.2 Key Highlights

9.1.3 Business Strategies

9.2 Carestream

9.2.1 Overview

9.2.2 Key Highlights

9.2.3 Business Strategies

9.3 Biotech Dental

9.3.1 Overview

9.3.2 Key Highlights

9.3.3 Business Strategies

9.4 CAMLOG Biotechnologies AG

9.4.1 Overview

9.4.2 Key Highlights

9.4.3 Business Strategies

9.5 BioHorizons

9.5.1 Overview

9.5.2 Key Highlights

9.5.3 Business Strategies

9.6 OSSTEM IMPLANT Co., Ltd

9.6.1 Overview

9.6.2 Key Highlights

9.6.3 Business Strategies

Annexure

Acronyms

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.