Software-Defined Networking Market by Solution (Physical Network Infrastructure, Virtualization/Control Software, SDN Applications, and Professional Services), End-User (Cloud Service Providers (CSPs), Technology Service Providers (TSPs) and Enterprises), Vertical (Banking, Financial Services, and Insurance, Telecom & Information Technology, Consumer Goods & Retail, Manufacturing, Government & Defense, Academia & Research and Others) and Geography – Global Forecast up to 2027

- May, 2021

- Domain: ICT - Infrastructure Networking & Data centres (IND)

- Get Free 10% Customization in this Report

Software-Defined Networking is a networking structure where the network management is decoupled from forwarding and provides a programmatically effective network configuration to improve network performance. It focuses on delivering an open interface that helps develop the software to regulate data traffic flow among the network resources. The increasing trend of network infrastructure automation and the extensive adoption of cloud-computing services and big data analytics among various industries are the major factors compelling the market's growth. There is an elevating demand for efficient networking solutions, including software-defined networking for data center consolidation, server virtualization, and enhancing enterprise potency. In addition to this, with the rising adoption of Bring-Your-Own-Devices (BYOD), organizations are vastly using software-defined networking solutions to customize and control the data accessed by employees and minimize the mobile workforce. Apart from this, the SDN controller is the perfect attack platform offering total hacker control of the network, which is a critical factor in limiting the market growth. The Software-Defined Networking Market is expected to grow at the rate of 13.8% CAGR by 2027.

Research Methodology:

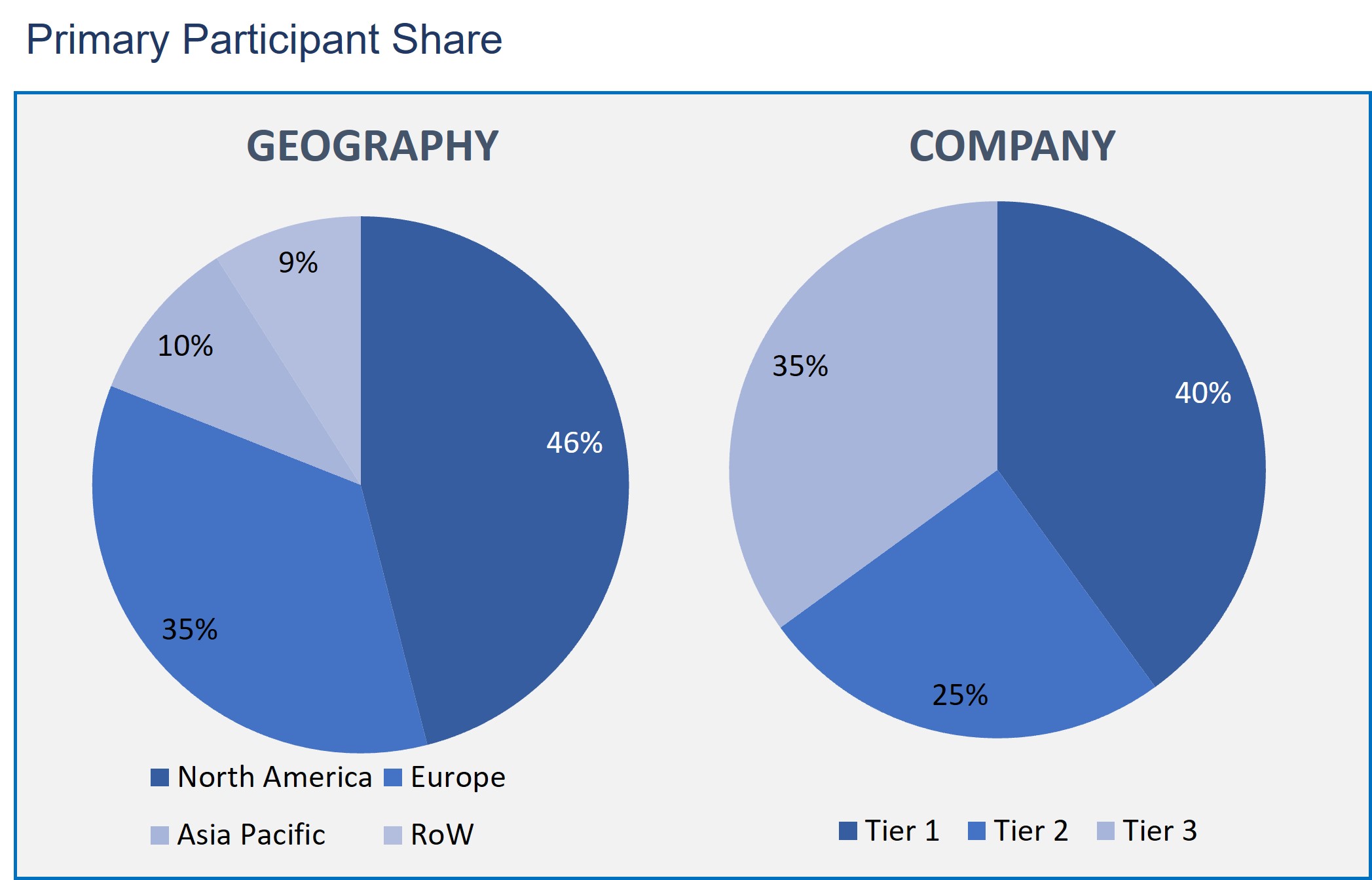

The Software-Defined Networking Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Software-Defined Networking by Solution

- Physical Network Infrastructure

- Virtualization/Control Software

- SDN Applications

- Professional Services

Software-Defined Networking by End User

- Cloud Service Providers (CSPs)

- Technology Service Providers (TSPs)

- Enterprises

Software-Defined Networking by Vertical

- Banking, Financial Services, and Insurance

- Telecom & Information Technology

- Consumer Goods & Retail

- Manufacturing

- Government & Defense

- Academia & Research

- Others

Software-Defined Networking by Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

The physical network infrastructure is projected to have the highest share in the software-defined networking market growth based on the solution segment. The software-defined networking majorly spreads in the industry and handles the flow control among the network devices and the application.

On the basis of end-user, the enterprise segment is expected to be the leading segment in the software-defined networking market. The key factors fostering the SDN adoption in the enterprise space include improved infrastructure flexibility and the requirement to minimize the time-to-market of several applications and services. For SDN to be employed across the enterprise, it is essential to ensure the complete knowledge of the implementation.

The telecom and IT vertical is projected to hold a significant share in the software-defined networking market as per the vertical segmentation. This is due to an increasing number of telecom and IT companies moving towards web-based applications and services. Less operational costs, holistic infrastructure management, abstraction, and integration with the cloud are the few major factors contributing to the rising adoption of software-defined networking in the telecom and IT vertical.

As per the geographical analysis, North America has a major position in the market share. This is ascribed to the early and rapid adoption of technologies, such as cloud computing, mobility services, network functions virtualization, Bring Your Own Device (BYOD), and high industrialization in the region.

The exponential development in the size and complexity of network infrastructures in the past few years has created a requirement for solutions to simplify and effectively manage the whole network. SDN solutions directly handle these problems by offering more flexibility in traffic management to the operator to enhance the network's efficiency. Hence, most Communication Service Providers (CSPs) worldwide are investing in software-defined networking for end-to-end network, service management, and control, stimulating the software-defined networking market growth.

Leading competitors operating in the software-defined networking market are Arista Networks Inc., International Business Machines Corporation, Cisco Systems Inc., Citrix Systems Inc., Hewlett-Packard Enterprise Company, Cloudgenix Inc., Extreme Networks Inc., Cumulus Networks Inc., Dell Technologies Inc., and Juniper Networks Inc.

Henceforth, software-defined networking transforms the conventional way of networking. The objective of the approach is to avoid the physical infrastructure limitations of the network. It offers a cost-effective, application-centric networking approach and allows network functions to be virtualized with the implementation of NFV.

- This study helps in understanding the analysis of the market size based on quantitative and qualitative.

- This report provides complete information about the key factors fostering or restricting the market's growth, such as opportunities, drivers, industry-specific challenges, and risks.

- This report majorly highlights significant players' profiles to describe the market competition outlook, SWOT analysis, and development strategies in the coming years.

- This report also covers the geographical analysis of the market as per the market share and the future prospective.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Solution: Market Size & Analysis

- Overview

- Physical Network Infrastructure

- Virtualization/Control Software

- SDN Applications

- Professional Services

- End User: Market Size & Analysis

- Overview

- Cloud Service Providers (CSPs)

- Technology Service Providers (TSPs)

- Enterprises

- Vertical: Market Size & Analysis

- Overview

- Banking, Financial Services and Insurance

- Telecom & Information Technology

- Consumer Goods & Retail

- Manufacturing

- Government & Defense

- Academia & Research

- Others

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Arista Networks Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- International Business Machines Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Cisco Systems Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Citrix Systems Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Hewlett-Packard Enterprise Company

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Cloudgenix Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Extreme Networks Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Cumulus Networks Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Dell Technologies Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Juniper Networks Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Arista Networks Inc.

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.