Crypto Asset Management Market by Solution (Custodian Solution and Wallet Management), Deployment Mode (Cloud, On-Premises and Software as a Service (SaaS)), Application (Banking, Financial Services, and Insurance (BFSI), Information Technology (IT) and Telecom, Healthcare and Education, Manufacturing and Transportation, Travel and Tourism, Construction and Retail and Others (Food & Beverages, Oil & Gas, Real Estate)) and Geography (North America, Europe, APAC and RoW) - Global Forecast to 2026

- November, 2020

- Domain: ICT - digital technologies

- Get Free 10% Customization in this Report

Crypto asset management is the process of managing the digital assets to render efficient service by piling and maintaining distributed electronic ledger by means of a network. It involves cryptocurrency funds, cryptocurrencies (including bitcoins), blockchain companies, and initial coin offerings. The Crypto asset management deployment model includes on-premise and cloud. The crypto asset management market end-users include financial institutions. The enlarging cryptocurrency market accompanying with increasing dependency on crypto-currency is propelling the market growth. Drastically growing blockchain technology is another factor accelerating market growth. Apart from that, the dearth of stringent rules may hinder the market growth. The Crypto Asset Management Market is anticipated to grow at a rate of 23.9% CAGR by 2026.

Research Methodology:

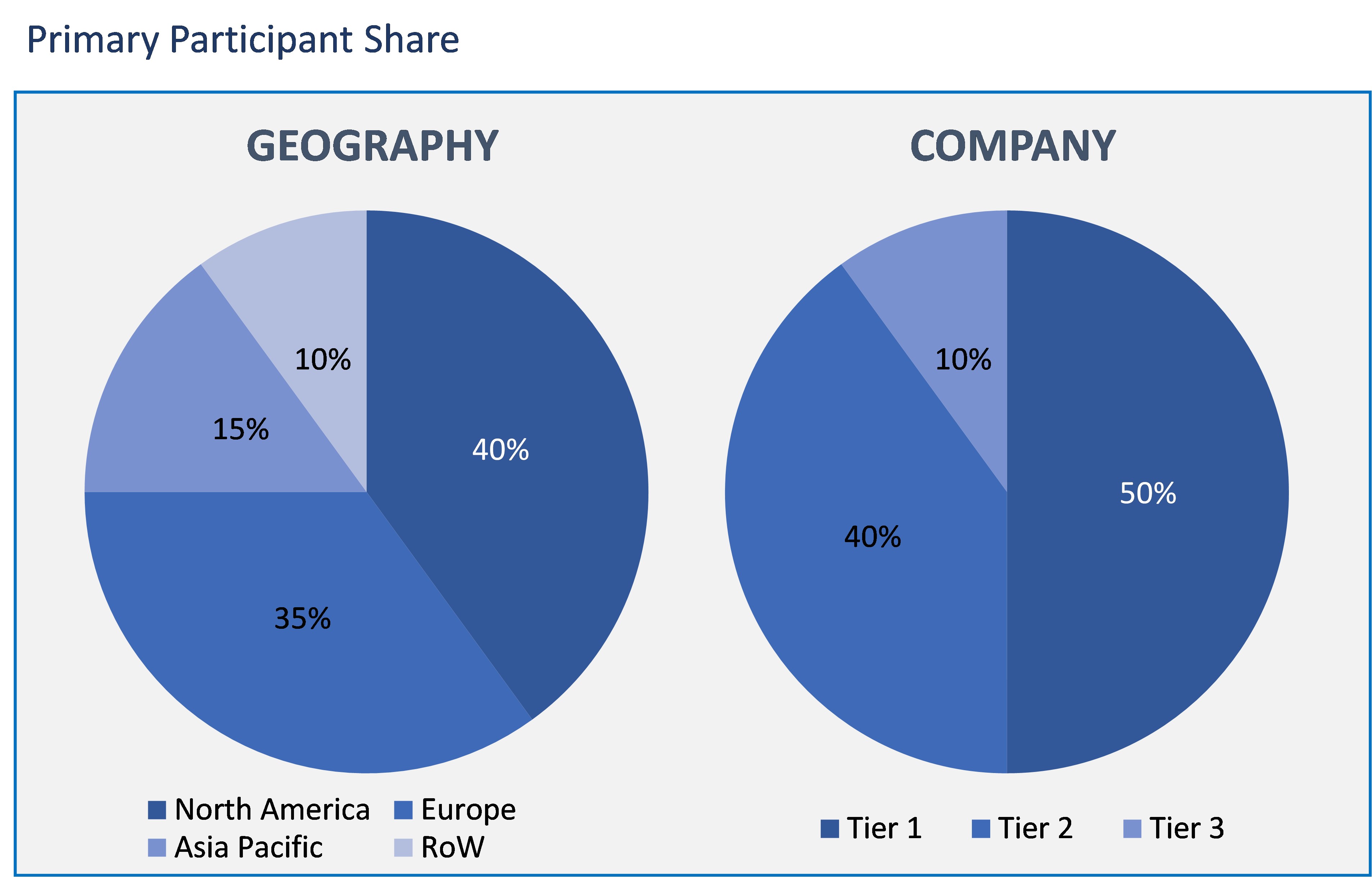

The crypto asset management market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

Crypto Asset Management market segmentation, by Solution

- Custodian Solution

- Wallet Management

Crypto Asset Management market segmentation, by Deployment Mode:

- Cloud

- On-Premises

Crypto Asset Management market segmentation, by Application:

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Healthcare and Education

- Manufacturing and Transportation

- Travel and Tourism

- Construction and Retail

- Others (Food & Beverages, Oil & Gas, Real Estate)

Crypto Asset Management market segmentation, by Geography:

- North America

- Europe

- Asia Pacific

- Rest of the World

In terms of solution, the crypto asset management market is divided into custodian solution and wallet management solution. The wallet management solution is having the major share as it lets businesses to secure digital assets and efficient business operations. Furthermore, asset managers and small financial institutions commonly adopt a wallet management solution. The deployment of cryptocurrency is increasing among large and small financial institutions. Since the wallet management segment registers the largest market share.

The on-premises segment is projected to acquire a maximum crypto asset management market share on the basis of the deployment model. Owing to its high demand in large organizations, easy deployment, low cost, and an enhanced internal connection.

The growing deployment of blockchain or distributed ledger technologies in this domain is predicted to surge the cryptocurrency investment in the banking, financial, services, and insurance industry. The BFSI segment is leading the crypto asset management market based on application as blockchain can improve the efficiency of the banking and lending services, minimize third party risks, and enable reliable documentation.

Majorly, the crypto asset management market as per the regional market is segregated into North America, Europe, Asia Pacific, and the Rest of the World. North America is the major region to hold a significant share in the market due to the high adoption of bitcoin and cryptocurrencies. Also, this region is an early adopter of digitization as well the other latest technologies, which is one of the major factors to boost the market growth in North America.

The influx of various cryptocurrencies and tokens in recent times is one of the key factors enhancing the global crypto asset management market's growth. Moreover, the existence of multiple numbers of corporate entities contributing a mark of credibility to crypto transactions has also played a vital role in the surge of the global market for crypto asset management. The uninterrupted security rendered by cryptocurrencies is exceptional, and this has become a core factor for growth in the global crypto asset management market.

The report consists of the list of the vendor's profile of the crypto asset management market Coinbase, Gemini, Crypto Finance, Vo1t, Bakkt, BitGo, Ledger, Metaco SA, ICONOMI, Xapo, itBit, Koine Finance, Amberdata, Gem, Tradeium, Blox, Opus labs, Binance, Kryptographe, Koinly, Altpocket, Mintfort, Coinstats, Anchorage and CoinTracker.

Hence, the demand for crypto asset management is anticipated to obtain traction as various developing countries such as China and Japan are investing their capital in establishing advanced crypto networks. Additionally, the frauds and scams are increasing while the transaction of non-digital currencies has brought digital currencies under the spotlight of attention.

- This report implies the arising opportunities, competitive landscape, and revenue share of major manufacturers.

- This study describes the Crypto Asset Management Market scope, which provides a concise outline of the major market regions also about their major countries is detailed

- This study also provides vendor profiles, product portfolio, dynamic strategies, emerging market segments.

- Further exclusive insights of crypto asset management market challenges for the new players and new players' survival.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Total Addressable Market

- Segment Addressable Market

- PEST Analysis

- Porter Five Forces

- Related Markets

- Ecosystem

- Market Overview

- Overview

- Market Evolution

- Market Trends and Impact

- Pricing Analysis

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Overview

- Solution: Market Size & Analysis

- Overview

- Custodian Solution

- Wallet Management

- Deployment mode: Market Size & Analysis

- Overview

- Cloud

- On-Premises

- Application: Market Size & Analysis

- Overview

- Banking, Financial Services, and Insurance (BFSI)

- Information Technology (IT) and Telecom

- Healthcare and Education

- Manufacturing and Transportation

- Travel and Tourism

- Construction and Retail

- Others (Food & Beverages, Oil & Gas, Real Estate)

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Coinbase

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Gemini

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Crypto Finance

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Vo1t

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Bakkt

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- BitGo

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Ledger

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Metaco SA

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- ICONOMI

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Xapo

- Overview

- Financials

- Products & Services

- Recent Developments

- Business Strategy

- Coinbase

- Companies to Watch

- itBit

- Overview

- Products & Services

- Business Strategy

- Koine Finance

- Overview

- Products & Services

- Business Strategy

- Amberdata

- Overview

- Products & Services

- Business Strategy

- Gem

- Overview

- Products & Services

- Business Strategy

- Tradeium

- Overview

- Products & Services

- Business Strategy

- Blox

- Overview

- Products & Services

- Business Strategy

- Opus labs

- Overview

- Products & Services

- Business Strategy

- Binance

- Overview

- Products & Services

- Business Strategy

- Kryptographe

- Overview

- Products & Services

- Business Strategy

- Koinly

- Overview

- Products & Services

- Business Strategy

- Altpocket

- Overview

- Products & Services

- Business Strategy

- Mintfort

- Overview

- Products & Services

- Business Strategy

- Coinstats

- Overview

- Products & Services

- Business Strategy

- Anchorage

- Overview

- Products & Services

- Business Strategy

- CoinTracker

- Overview

- Products & Services

- Business Strategy

- itBit

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.