Transfection Reagents and Equipment Market By Product (Reagent, and Instrument), By Method (Biochemical, Gene Expression Studies, Cancer Research, Transgenic Model, Physical, and Viral), By Application (Biomedical Research, Protein Production, and Therapeutic Delivery), By End-User and By Geography – Global Drivers, Restraints, Opportunities, Trends, and Forecast up to 2026

- September, 2020

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Transfection is a procedure of presenting hereditary material, for example, DNA or RNA, into eukaryotic cells to empower the creation or articulation of proteins utilizing the cell's own apparatus. An RNA transfection with two complementary strands is engaged to terminate the production of some proteins by restricting the conversion procedure. The procedure of transfection allows the study of gene functioning and expression, genetic mutations, and protein functioning.

Furthermore, in recent times, the biopharmaceutical industry has witnessed a significant patent cliff as several potential biologics are facing patent expiration. Consequently, several companies have shifted their investments in the production of biosimilar alternatives to off-patent biologics and to overcome the threat of revenue loss. Hence, this emerging patent cliff threat has significantly benefitted the market by the high adoption of transfection technology.

Research Methodology:

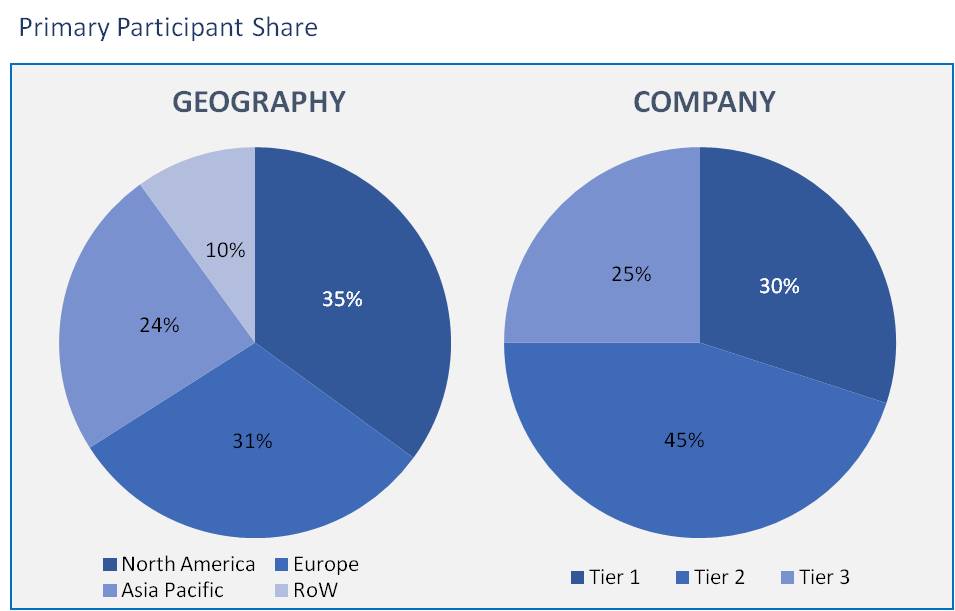

The transfection reagents and equipment market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

Technological advancements to introduce the enhanced techniques for stable and transient transfection with negligible off-target effects are projected to obtain high results in the market during the forecast period. For instance, Life Technologies has introduced Lipofectamine, a lipid-based formulation for nucleic acid delivery, which intensifies cells capable of survivability and reproducibility throughout the transfection process of hard to transfect cell lines by optimization in different steps of transfection.

The transfection reagents and equipment market was valued at $960.13 million in 2020, and is projected to reach $1,496.43 million by 2026, growing at a CAGR of 7.7% during the forecast period.

The scope of the Transfection Reagents and Equipment Market is defined in the market analysis as follows:

- Based on Product

- Reagents

- Instruments

- Based on Method

- Biochemical

-

- Calcium Phosphate

- Lipofection

- DEAE-dextran

- Dendrimers

-

- Physical

-

- Electroporation

- Nucleofection

- Others (Genegun, Sonoporation, Magnetofection, and Optoinjection)

-

- Viral

Based on the product, Reagents are used for transfection, which includes siRNA transfection kits, stem cell transfection kits, transfection optimization kits, and transfection buffers. Various methods of transfection involve the use of different reagents, thus generating substantial revenue in the segment. This segment is projected to gain significant share over the forecast period due to increasing commercial adoption rates of these reagents while reagents dominated the market in terms of revenue.

- Based on Appplication

- Biomedical Research

-

- Gene Expression Studies

- Cancer Research

- Transgenic Model

-

- Protein Production

- Therapeutic Delivery

In 2019, the biomedical research segment led the market in the application segment of the transfection reagent market. The biochemical method is further subdivided into lipofection, calcium phosphate, dendrimer, and DEAE-dextran. In 2019, the lipofection segment was predicted to share the largest market share.

- Based on End-User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

The end-user market is bifurcated into academic & research institutes and pharmaceutical & biotechnologies companies. In the year 2019, the academic & research institutes segment is projected to register for the largest share of the market. Moreover, the pharmaceutical & biotechnologies companies’ segment is also anticipated to rise at the highest CAGR in the forecast period of 2020 to 2026.

- Based on Geography:

- North America

- Europe

- Asia Pacific

- Rest of World

North America was the leading revenue contributor in the market in 2019 due to the presence of well-established genomic industries and biopharmaceuticals in the region. High utilization of transfection technologies is the evidence observed in genetic, oncology, and cytological research-based units. The existence of dominant companies that provides a wide variety of solutions to assist various end-users in this region is also responsible for the growth of the regional market.

Asia-Pacific is predicted to register the rapid growth in the forecast period. Significant factors driving the growth of the regional market are the growing number of biopharmaceutical & clinical R&D programs, increasing medical research expenditure, rising awareness regarding cytological and proteomic expressions.

The report also includes the analysis of major players in the Transfection Reagents and Equipment market. Some of the major players consist of Thermo Fisher Scientific Inc, PROMEGA CORPORATION, Lonza Group Ltd, Qiagen N.V, Bio–Rad Laboratories, Inc, Maxcyte, Inc, Merck KGaA, Polyplus-Transfection Sa, F. Hoffmann-La Roche Ltd, and Mirus Bio LLC.

The present trends of the market, dynamics of the market, and dynamic requirements of the end-users are provided in this study to assist the market vendor. The user experience is intensified by the Transfection Reagents and Equipment market report’s analysis based on qualitative and quantitative.

- The competitive analysis of the major players enables users to understand the dynamic strategies such as product innovation, partnerships, merger & acquisitions, and joint ventures of the key players

- This report also provides the portfolio analysis, capability analysis of the leading players

- Quantitative analysis of the market enables users to understand the facts of the market across four major regions

1. Executive Summary

2. METHOD Outlook

2.1. METHOD Overview

2.2. METHOD Trends

3. Market Snapshot

3.1. Total Adressable Market

3.2. Segment Addressable Market

3.2.1. PEST Analysis

3.2.2. Porter Five Forces

3.3. Related Markets

3.4. Ecosystem

4. Market Outlook

4.1. Overview

4.1.1. Market Evolution

4.2. Market Trends and Impact

4.3. Pricing Analysis

4.4. Market Segmentation

4.5. Market Dynamics

4.5.1. Drivers

4.5.2. Restraints

4.5.3. Opportunities

4.6. DRO - Impact Analysis

5. Product: Market Size & Analysis

5.1. Overview

5.2. Reagents

5.3. Instruments

6. Application: Market Size & Analysis

6.1. Overview

6.2. Biomedical Research

6.2.1. Gene Expression Studies

6.2.2. Cancer Research

6.2.3. Transgenic Model

6.3. Protein Production

6.4. Therapeutic Deli very

7. Method: Market Size & Analysis

7.1. Overview

7.2. Biochemical

7.2.1. Calcium Phosphate

7.2.2. Lipofection

7.2.3. DEAE-dextran

7.2.4. Dendrimers

7.3. Physical

7.3.1. Electroporation

7.3.2. Nucleofection

7.3.3. Others

7.4. Viral

8. End-User: Market Size & Analysis

8.1. Overview

8.2. Academic & Research Institutes

8.3. Pharmaceutical & Biotechnology Companies

9. Geography: Market Size & Analysis

9.1. Overview

9.2. North America

9.3. Europe

9.4. Asia Pacific

9.5. Rest of the World

10. Competitive Landscape

10.1. Competitor Comparison Analysis

10.2. Market Developments

10.2.1. Mergers and Acquisitions, Legal, Awards, Partnerships

10.2.2. Product Launches and execution

11. Vendor Profiles

11.1. Thermo Fisher Scientific Inc

11.1.1. Overview

11.1.2. Business Units

11.1.3. Geographic Revenue

11.1.4. Product Offerings

11.1.5. Developments

11.1.6. Business Strategy

11.2. Promega Corporation

11.2.1. Overview

11.2.2. Business Units

11.2.3. Geographic Revenue

11.2.4. Product Offerings

11.2.5. Developments

11.2.6. Business Strategy

11.3. Lonza Group Ltd

11.3.1. Overview

11.3.2. Business Units

11.3.3. Geographic Revenue

11.3.4. Product Offerings

11.3.5. Developments

11.3.6. Business Strategy

11.4. Qiagen N.V

11.4.1. Overview

11.4.2. Business Units

11.4.3. Geographic Revenue

11.4.4. Product Offerings

11.4.5. Developments

11.4.6. Business Strategy

11.5. Bio–Rad Laboratories, Inc

11.5.1. Overview

11.5.2. Business Units

11.5.3. Geographic Revenue

11.5.4. Product Offerings

11.5.5. Developments

11.5.6. Business Strategy

11.6. Maxcyte, Inc

11.6.1. Overview

11.6.2. Business Units

11.6.3. Geographic Revenue

11.6.4. Product Offerings

11.6.5. Developments

11.6.6. Business Strategy

11.7. Merck KGaA

11.7.1. Overview

11.7.2. Business Units

11.7.3. Geographic Revenue

11.7.4. Product Offerings

11.7.5. Developments

11.7.6. Business Strategy

11.8. Polyplus-Transfection Sa

11.8.1. Overview

11.8.2. Business Units

11.8.3. Geographic Revenue

11.8.4. Product Offerings

11.8.5. Developments

11.8.6. Business Strategy

11.9. F. Hoffmann-La Roche Ltd

11.9.1. Overview

11.9.2. Business Units

11.9.3. Geographic Revenue

11.9.4. Product Offerings

11.9.5. Developments

11.9.6. Business Strategy

11.10. Mirus Bio LLC.

11.10.1. Overview

11.10.2. Business Units

11.10.3. Geographic Revenue

11.10.4. Product Offerings

11.10.5. Developments

11.10.6. Business Strategy

11.10.7.

12. Analyst Opinion

13. Annexure

13.1. Report Scope

13.2. Market Definitions

13.3. Research Methodology

13.3.1. Data Collation and In-house Estimation

13.3.2. Market Triangulation

13.3.3. Forecasting

13.4. Report Assumptions

13.5. Declarations

13.6. Stakeholders

13.7. Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.