North America In Vitro Diagnostics Market Forecast up to 2025

- March, 2019

- Domain: Healthcare - Diagnostics

- Get Free 10% Customization in this Report

[116 pages report] This market research report includes a detailed segmentation of the North America in vitro diagnostics market – By Technology Types (Clinical Chemistry, Molecular Diagnostics, Immunoassay, Clinical Microbiology, Coagulation, Hematology, and Others), By Applications (Oncology, Infectious Disease, Diabetes, Cardiology, Nephrology, Autoimmune Disease, and Others), By End-users (Hospitals, Laboratories, Home Care, Academic & Research Institutes, and Others), and By Country (US and Others).

Overview of the In Vitro Diagnostics Market Research

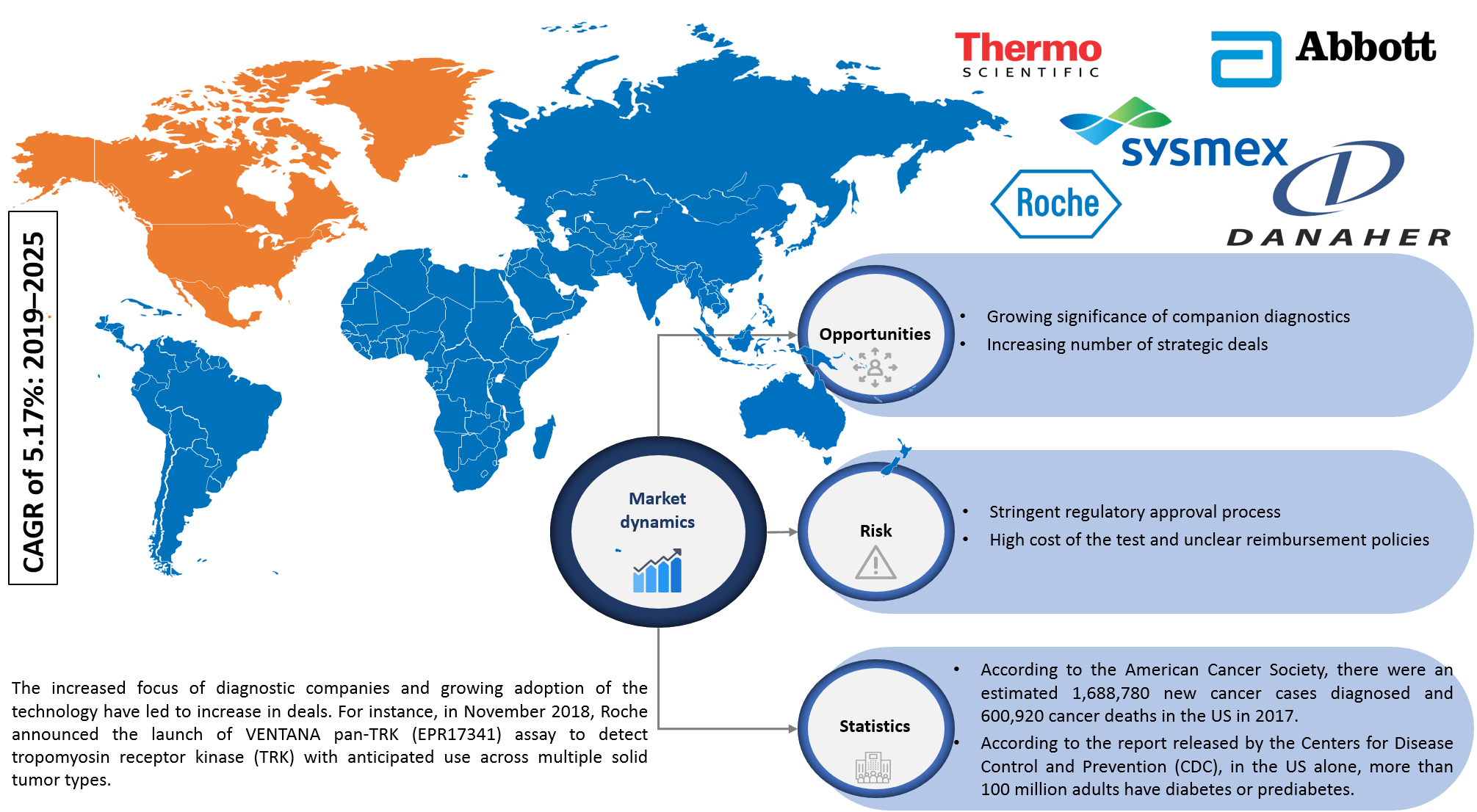

Infoholic’s market research report predicts that the North America In Vitro Diagnostics market will grow at a CAGR of 5.17% during the forecast period 2019–2025. The market has witnessed steady growth in the past few years, and the advancements in technology with the introduction of innovative products have increased the adoption of in vitro diagnostics products in the market. The market is fueled by the increasing incidence of lifestyle and chronic diseases, rising adoption of point-of-care testing (POCT), the upsurge in the biomarker-based tests, and growing significance of companion diagnostics.

The market continues to grow, and in vitro diagnostics is one of the most widely used techniques for screening, diagnosis, treatment, and monitoring purposes. The field is getting revolutionized with the advancement in technology. Vendors are focusing on new product launches, approvals, and targeting toward end-user’s perspective. The market generates revenue from the key players operating in this field, and few of them include Abbott Laboratories, F. Hoffmann-La Roche, Thermo Fisher Scientific, Danaher Corporation, and Sysmex Corporation.

According to Infoholic Research analysis, the US accounted for the largest share of the North America in vitro diagnostics market in 2018 and “others” segment is expected to grow a high CAGR during the forecast period. According to the estimation of the National Cancer Institute, in the US, around 1.6 million new cases of cancer were diagnosed, and 595,690 people have died due to cancer in 2016. In 2016, Canada had an estimated 202,400 new cases of cancer and nearly 78,000 deaths according to the Canadian Cancer Society. Lifestyle-related diseases such as diabetes and heart diseases are becoming a major threat to the population across the world with 425 million people suffering from diabetes. Cardiovascular disease (CVD) accounts for approximately 800,000 deaths in the US and on an average, one person dies from CVD every 40 seconds in the US. Favorable reimbursement policies, the presence of dominant market vendors in the country, increased awareness among patients, availability of government funds, and increasing adoption of molecular diagnostics make the US a dominant shareholder in the market.

In Vitro Diagnostics Market by Technology Types

- Clinical Chemistry

- Molecular Diagnostics

- Immunoassay

- Clinical Microbiology

- Coagulation

- Hematology

- Others

In 2018, the clinical chemistry segment occupied the largest share, and molecular diagnostics segment is expected to grow at a high CAGR during the forecast period. Clinical chemistry includes metabolic panel, electrolyte panel, liver panel, lipid profile, renal profile, thyroid function panel, and specialty chemistry tests. Increased technological advancements such as next-generation sequencing & polymerase chain reaction and growing number of strategic deals are likely to propel the molecular diagnostics segment during the forecast period.

North America In Vitro Diagnostics Market by Applications

- Oncology

- Infectious Disease

- Diabetes

- Cardiology

- Nephrology

- Autoimmune Disease

- Others

The infectious disease segment occupied a major market share in 2018, and the oncology segment is predicted to hold a significant share during the forecast period. Increase in the prevalence of the disease such as tuberculosis & pneumonia and growing healthcare awareness among the population make the segment a dominant shareholder.

North America In Vitro Diagnostics Market by End-users

- Hospitals

- Laboratories

- Home Care

- Academic & Research Institutes

- Others

Hospitals occupied a significant market share in 2018, and hospitals and laboratory segments are expected to dominate the market for the next few years.

In Vitro Diagnostics Market by Country

- US

- Others

The US occupied a significant market share in 2018, and the “others” segment is expected to grow at a high CAGR during the forecast period. The increased technological advancement and higher GDP of the nation make “others”, that includes Canada and Mexico, the fastest growing segment during the forecast period.

In Vitro Diagnostics Market Research Competitive Analysis – The in vitro diagnostics market has massive growth opportunities in the North American region. The advancements of technology will increase competition among vendors. The diagnostics and biotechnology continuously focus on the market due to an increase in lifestyle and chronic diseases. This has resulted in approvals and collaborations related to in-vitro diagnosis in recent years. For instance, Roche launched VENTANA pan-TRK (EPR17341) Assay to detect tropomyosin receptor kinase (TRK) to diagnose multiple solid tumor types at the end of 2018. FDA has approved F1CDx test to identify genetic alterations in tumors in December 2017. The genomic test can identify cancer-related alterations in 324 genes in any type of solid tumor. FDA approved Ortho Clinical Diagnostics VITROS Immunodiagnostic Products HIV Combo Reagent Pack and Calibrator for use on the VITROS 5600 Integrated System in 2018. This 4th generation test can detect both HIV-1 and HIV-2 antibodies as well as the p24 antigen, which provides a shorter diagnostic window compared to 3rd generation assays. In late 2018, Precision for Medicine acquired ApoCell, a next-generation lab specializing in the identification and analysis of biomarkers. In addition, other leading players are focusing on hugely investing in R&D activities to develop new products to attain the maximum share in the market.

Key Vendors

- Abbott Laboratories

- Hoffmann-La Roche (Roche)

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Sysmex Corporation

- bioMerieux S.A.

- Becton Dickinson and Company

- Bio-Rad Laboratories

- Qiagen N.V.

- Siemens Healthineers

- Ortho Clinical Diagnostics (Carlyle Group)

Key Competitive Facts

- The market is highly competitive with all the players competing to gain market shares. Intense competition, rapid advancements in technology, frequent changes in government policies, and the prices are key factors that confront the market.

- The requirement of high initial investment, implementation, and maintenance cost in the market are also limiting the entry of new players.

Benefits – The report provides complete details about the usage and adoption rate of in vitro diagnostic products. Thus, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives towards the tests in the upcoming years along with details of the pureplay companies entering the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to key stakeholders in order to expand their business and capture the revenue in specific verticals, and to analyze before investing or expanding the business in this market.

Key Takeaways

- Understanding the potential market opportunity with precise market size and forecast data.

- A detailed market analysis focusing on the growth of the in vitro diagnostics

- Factors influencing the growth of the in vitro diagnostics

- In-depth competitive analysis of dominant and pure-play vendors.

- Key insights related to major segments of the in vitro diagnostics

- Latest market trend analysis impacting the buying behavior of the consumers.

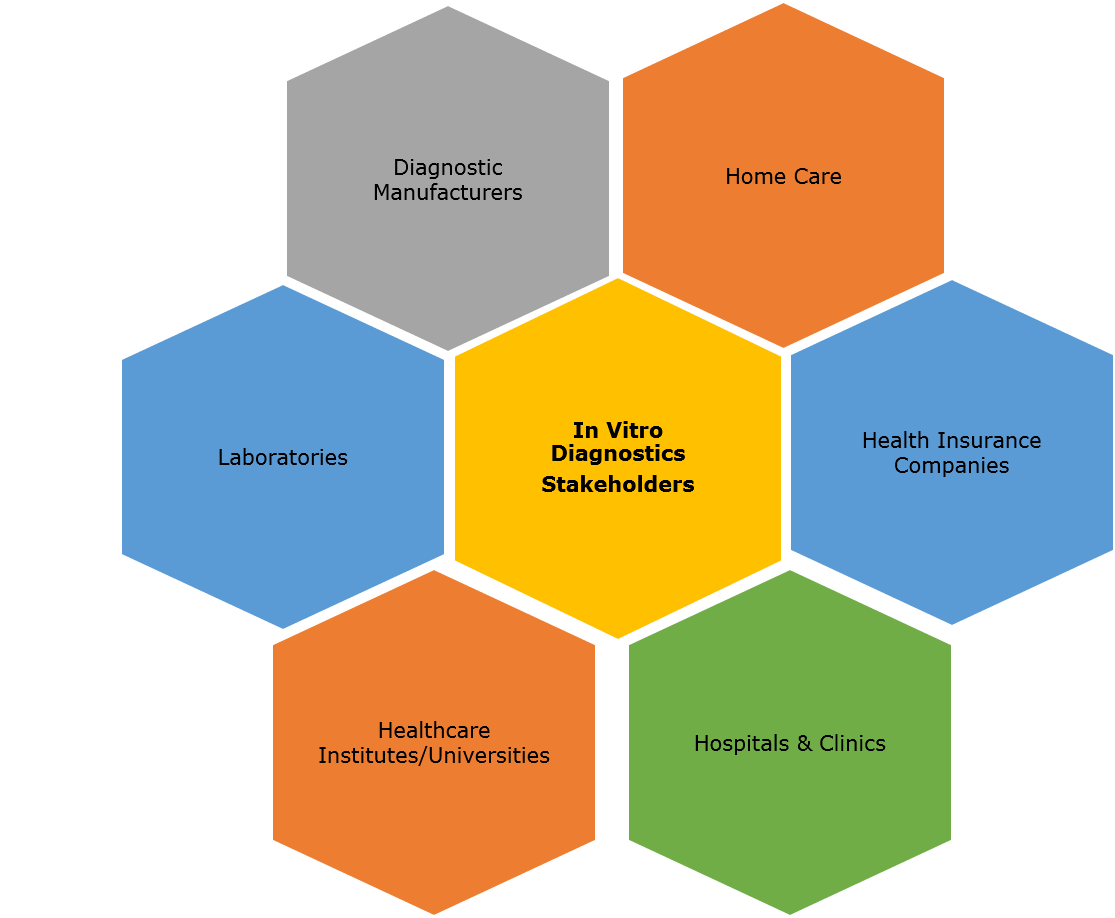

Key Stakeholders

1 Industry Outlook

1.1 Industry Overview

1.2 Total Addressable Market

1.3 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Advantages of IVD

3.3 Importance of IVD

3.4 Segmented Addressable Market

3.5 Trends in the North America In Vitro Diagnostics Market

3.6 Related Market

3.6.1 Medical Imaging

4 Market Outlook

4.1 Market Segmentation

4.2 PEST Analysis

4.3 Porter 5(Five) Forces

5 Market Characteristics

5.1 DRO – Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing incidence of lifestyle and chronic diseases

5.1.1.2 High adoption of POC testing

5.1.1.3 Growing demand for biomarker-based tests

5.1.2 Opportunities

5.1.2.1 Growing significance of companion diagnostics

5.1.2.2 Increasing number of strategic deals

5.1.3 Restraints

5.1.3.1 Stringent regulatory approval process

5.1.3.2 High cost of the test and unclear reimbursement policies

5.2 DRO – Impact Analysis

5.3 Key Stakeholders

6 Technology Types: Market Size and Analysis

6.1 Overview

6.2 Clinical Chemistry

6.3 Molecular Diagnostics

6.4 Immunoassay

6.5 Clinical Microbiology

6.6 Coagulation

6.7 Hematology

6.8 Others

7 Applications: Market Size and Analysis

7.1 Overview

7.2 Oncology

7.3 Infectious Disease

7.4 Diabetes

7.5 Cardiology

7.6 Nephrology

7.7 Autoimmune Disease

7.8 Others

8 End-users: Market Size and Analysis

8.1 Overview

8.2 Hospitals

8.3 Laboratories

8.4 Home Care

8.5 Academic and Research Institutes

8.6 Others

9 Country: Market Size and Analysis

9.1 Overview

9.2 US

9.3 Others

10 Competitive Landscape

10.1 Overview

11 Vendors Profile

11.1 F. Hoffmann-La Roche Ltd.

11.1.1 Overview

11.1.2 Business Units

11.1.3 Geographic Revenue

11.1.4 Business Focus

11.1.5 SWOT Analysis

11.1.6 Business Strategies

11.2 Thermo Fisher Scientific Inc.

11.2.1 Overview

11.2.2 Business Units

11.2.3 Geographic Revenue

11.2.4 Business Focus

11.2.5 SWOT Analysis

11.2.6 Business Strategies

11.3 Abbott Laboratories

11.3.1 Overview

11.3.2 Business Units

11.3.3 Geographic Revenue

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategies

11.4 Danaher Corporation

11.4.1 Overview

11.4.2 Business Units

11.4.3 Geographic Revenue

11.4.4 Business Focus

11.4.5 SWOT Analysis

11.4.6 Business Strategies

11.5 Sysmex Corporation

11.5.1 Overview

11.5.2 Business Units

11.5.3 Geographic Revenue

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategies

12 Companies to Watch For

12.1 bioMerieux S.A.

12.1.1 Overview

12.2 Beckton Dickinson and Company

12.2.1 Overview

12.3 Bio-Rad Laboratories

12.3.1 Overview

12.4 Qiagen N.V.

12.4.1 Overview

12.5 Siemens Healthineers

12.5.1 Overview

12.6 Ortho Clinical Diagnostics (Carlyle Group)

12.6.1 Overview

13 Annexure

13.1 Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.