Feed Additives Market By Type (Amino acids, antibiotics, vitamins, enzymes and others) By Application (ruminants, poultry, swine, aquatic animals, and others) and By Geography – Global Driver, Restraints, Opportunities, Trends, and Forecast to 2023

- August, 2018

- Domain: Chemicals, Materials & Food - Specialty Chemicals

- Get Free 10% Customization in this Report

Rising consumer awareness toward protein- and nutrient-based food and increasing concerns about the health & safety of livestock are fostering the market of feed additives. Feed additives play an essential role in the overall health of livestock, i.e., help in digestion, prevention from diseases, conversion rate, and improve weight gain.

Research Methodology

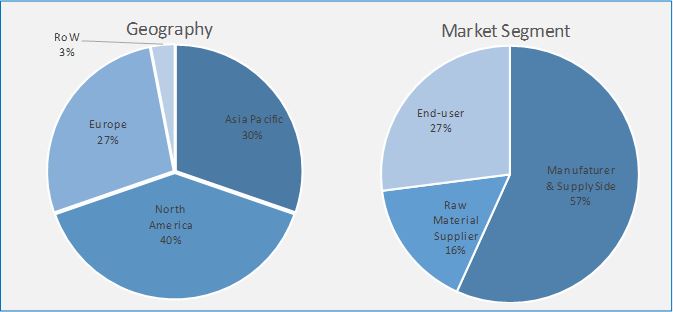

The feed additives market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

Primary Participant Share

Key Market Insights

Changing consumer preferences for better nutritional feed products are increasing the demand for feed additives. Further, the focus has shifted toward feed additive inclusive products to tackle the concern of nutritional loss such as unabsorbed fat and protein. The demand from consumers of ruminants and poultry industries is driving the feed additives market. Asia Pacific is currently the leading market for overall feed additives, whereas Europe is gaining popularity in terms of other feed additive chemicals such as amino acids, antibiotics, and feed enzymes. The rising consumer per capita income along with a shift in consumer food behavior toward a protein-rich diet is strengthening the industry growth in Asia Pacific.

Globally, Asia Pacific is the largest feed additives market, primarily due to the presence of export-oriented manufacturing capacities and intense domestic demand from various end-user industries. The increase in animal farmers is further driving the market growth in the region. The anticipated economic stability in Europe is expected to boost its manufacturing sector, complementing the growth of the feed additives market. North America is likely to remain the key region with a significant contribution from the US. Few of the prominent companies operating in the feed additives market are BASF SE, Cargill Inc., DowDuPont Inc., Novozymes, and Novus International Inc.

Types:

- Amino Acids

- Antibiotics

- Vitamins

- Enzymes

- Others

End-users:

- Ruminants

- Poultry

- Swine

- Aquatic Animals

- Others

Geography:

- Asia Pacific

- North America

- Europe

- Rest of the World

Table of Contents

1 Report Outline

1.1 Introduction

1.2 Report Scope

1.3 Market Definition

1.4 Research Methodology

1.4.1 Data Collation & In-house Estimation

1.4.2 Market Triangulation

1.4.3 Forecasting

1.5 Study Declaration

1.6 Report Assumptions

1.7 Stakeholders

2 Executive Summary

2.1 The market will be speeding up from developing countries

2.2 Poultry market is expected to ascend further

3 Market Positioning

3.1 Total Addressable Market (TAM): Specialty Ingredients Market

3.1.1 Market Overview

3.1.2 Major Trends

3.2 Segmented Addressable Market

3.3 Related Markets

4 Market Outlook

4.1 Overview

4.2 Value Chain Analysis

4.3 PESTLE

4.4 Porter 5 (Five) Forces

4.5 Patent Analysis

5 Market Characteristics

5.1 Market Segmentation

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing penetration of feed enzyme towards new markets

5.2.1.2 Growing demand of feed additives in sustainable farming

5.2.2 Restraints

5.2.2.1 High product prices and limited players

5.2.2.2 Changing geo-political structure

5.2.3 Opportunities

5.2.3.1 Growing innovation in feed additives

5.2.3.2 Large untapped market in developing and underdeveloped countries

5.2.4 DRO – Impact Analysis

6 By type: Market Size & Analysis

6.1 Overview

6.2 Amino Acids

6.3 Antibiotic

6.4 Vitamins

6.5 Enzymes

6.6 Vendor Profiles

6.6.1 Cargill Inc.

6.6.2 BASF SE

6.6.3 DowDuPont Inc

6.6.4 Novozymes

6.6.5 Novus International, Inc.

(Overview, business units, geographic revenues, product profile, recent developments, business focus, SWOT analysis, and business strategy have been covered for all the vendors)

7 End-user: Market Size & Analysis

7.1 Overview

7.2 Ruminants

7.3 Poultry

7.4 Swine

7.5 Aquatic Animals

7.6 Customers Profile

7.6.1 Tyson Food

7.6.2 Archer Daniel Midland Company

7.6.3 Land O’Lakes Inc

7.6.4 Nutrena

7.6.5 Provimi

(Overview, business units, geographic revenues, product profile, SWOT analysis, and business strategy have been covered for all the customers)

8 Regions: Market Size and Analysis

8.1 Overview

8.2 Asia Pacific

8.3 Europe

8.4 North America

8.5 Rest of the World

(Market segmentation for geography, material type, and end-user have been covered for all the regions)

9 Companies to Watch for

9.1 Archer Daniel Midland Company (ADM)

9.1.1.1 Overview

9.1.1.2 Archer Daniel Midland increases specialty feed ingredient portfolio targeting poultry & swine

9.2 Neovia Sarl

9.2.1.1 Overview

9.2.1.2 Neovia makes strategic entry in the Nigerian premix market

10 Competitive Landscape

10.1 Competitor Comparison Analysis

10.2 Market Landscape

10.2.1 Mergers, Acquisitions & Joint Ventures

10.2.2 Joint Venture

10.2.3 Divestiture & Divestment

10.2.4 Expansion

10.2.5 Product Launch

10.2.6 Product Recall

Annexure

Ø Acronyms

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.