Molecular Diagnostics Market (US-specific Market Assessment) - Global Forecast up to 2024

- May, 2018

- Domain: Healthcare - Diagnostics

- Get Free 10% Customization in this Report

Molecular Diagnostics is the branch of clinical pathology or laboratory medicine that utilizes various molecular biology techniques to diagnose diseases, predict disease course, select treatments, and monitor the effectiveness of therapies. These tests are performed mainly to examine the existence of the disease in blood, tissue, or even in bones. The importance of nucleic acids and other cellular biomarkers in defining the vital cellular process has facilitated medical advancements in the diagnosis of various diseases. Early diagnosis of the disease is one of the key advantages of this technology. The capacity of molecular diagnostics to systematize molecular reactions for the enhancement of the clinical diagnosis has put healthcare in the front line. According to the estimation of the American Cancer Society, around 1,688,780 new cancer cases were diagnosed, and 600,920 people died due to cancer in 2017. According to the study by World Health Organization (WHO), approximately 14 million new cancer cases were diagnosed in 2017 and is expected to grow by about 70% over the next 2 decades. The outbreak of swine flu in Myanmar and India, in 2017, increased the demand for diagnosis in the Asia Pacific region. It is noticed that there is a considerable rise in the number of cases reported in 2017 when compared to 2016.

The market for molecular diagnostics is driven by increasing prevalence of infectious and other lifestyle diseases, increasing demand for non-invasive biomarker-based tests, growing adoption of point-of-care testing, and high growth of the market in emerging countries. Increasing number of mergers & acquisitions and growing significance of companion diagnostics are providing opportunities for the market growth. Low awareness about standardization, stringent regulatory approval process, and lack of skilled labors are hampering the market growth.

Market Analysis: The global molecular diagnostics market is estimated to witness a CAGR of 8.7% during the forecast period 2018–2024. The US occupied a dominant market share, i.e., 32% in 2017, and is expected to grow at a CAGR of 8.4% during the forecast period 2018–2024. The market is analyzed based on four segments – applications, technologies, end-users, and regions.

Regional Analysis: The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (ROW). North America is the major shareholder, followed by Europe, in the global molecular diagnostics market with the US contributing to significant market revenue. Increasing incidences of disease and organ transplantation in the US along with increasing funding by government & private players and increased adoption of personalized medicine in clinical practices are few of the factors driving the US molecular diagnostics market growth. Various countries in the Americas region are taking initiatives for the elimination of viral hepatitis, but the major challenge remains in the diagnosis of the disease. This is providing an opportunity for manufacturers to enhance their market presence. The Asia Pacific region is expected to witness the fastest growth rate due to the large patient pool, increasing awareness, and rising healthcare expenditure.

Technology Analysis: PCR occupied significant share in the global molecular diagnostics market in 2017. PCR is a gold standard technique for DNA amplification and is the primary technique conducted prior to any molecular diagnostic examination. Next-generation sequencing and microarray are expected to grow at the fastest rate during the forecast period.

Application Analysis: Among various application areas, the infectious disease application occupied the largest share in 2017 and cancer application is expected to grow at the highest growth rate during the forecast period. A large number of patients suffering from hospital-associated infection, sexually transmitted infection (STI), hepatitis, respiratory infection, pathogen ID detection, and others is fostering the market growth. Increasing incidence of cancer globally makes it the fastest growing application segment during the forecast period.

Key Players: F. Hoffmann-La Roche, Hologic, Inc., Danaher Corporation, Abbott Laboratories, and Siemens Healthineers Inc. are the key players in the market. Becton Dickenson and Company, bioMerieux S.A., Bio-Rad Laboratories, Inc., Qiagen NV, Grifols, S.A, Thermo Fisher Scientific, Sysmex Corporation, and Myriad Genetics are few predominate & niche players.

Competitive Analysis: Polymerase Chain Reaction (PCR) occupied a significant share in the molecular diagnostics market. The emerging players are focusing on developing NGS and microarray technology to have the edge in the market. The increasing importance of molecular diagnostic tests has resulted in the launch of new tests and also increased acquisition, strategic partnership, and funding to develop new tests and technologies. For instance, in April 2018, NanoString Technologies, Inc. launched a Breast Cancer 360 (BC 360) research panel. In July 2017, MDxHealth SA announced the commercial launch of its AssureMDx for bladder cancer test in the US as a laboratory developed test. Illumina recently started a new company, named GRAIL, for liquid biopsy. It invested $100 million and raised another $900 million through public funding to develop new non-invasive tests for cancer diagnosis.

Benefits: The report provides complete details about the usage and adoption rate of molecular diagnostics in various therapeutic verticals and regions. With that, key stakeholders can know about the major trends, drivers, investments, and vertical player’s initiatives. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives the complete information about the key business opportunities to key stakeholders to analyze before investing or expanding the business in this market.

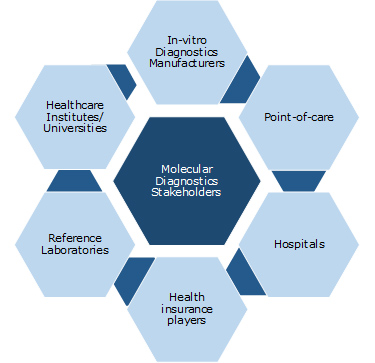

Key Stakeholders:

1 Industry Outlook

1.1 Industry Overview

1.2 Total Addressable Market

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Basic Steps of Molecular Diagnostics

3.3 Segmented Addressable Market

3.4 Major Trends in the Molecular Diagnostics Market

3.5 Related Markets

3.5.1 Liquid Biopsy

3.5.2 Point-of-care Diagnostics

3.5.3 Immunoassays

3.5.4 Clinical Chemistry

4 Market Outlook

4.1 Evolution of Molecular Diagnostics

4.2 Market Segmentation

4.3 PEST Analysis

4.4 Porter 5(Five) Forces

5 Market Characteristics

5.1 DRO – Market Dynamics

5.1.1 Drivers

5.1.1.1 Rising prevalence of infectious diseases

5.1.1.2 Growing adoption of point-of-care testing

5.1.1.3 Increasing demand for biomarker-based tests

5.1.1.4 High growth of the market in emerging countries

5.1.2 Opportunities

5.1.2.1 Growing significance of companion diagnostics

5.1.2.2 Increase in number of mergers & acquisitions

5.1.2.3 Increased adoption of DNA probe-based diagnostics

5.1.3 Restraints

5.1.3.1 Stringent regulatory approvals

5.1.3.2 Lack of skilled labors

5.2 DRO – Impact Analysis

5.3 Key Stakeholders

6 Technology: Market Size and Analysis

6.1 Overview

6.2 Polymerase Chain Reaction (PCR)

6.3 Isothermal Nucleic Acid Amplification Technology (INAAT)

6.4 Microarray

6.5 Hybridization

6.6 DNA Sequencing

6.7 Others

7 Applications: Market Size and Analysis

7.1 Overview

7.2 Oncology

7.2.1 Breast Cancer

7.2.2 Colorectal Cancer

7.2.3 Prostate Cancer

7.2.4 Other Cancers

7.3 Blood Testing

7.4 Infectious Disease

7.5 Genetic Testing

7.6 Tissue Typing

7.7 Others

8 End-users: Market Size and Analysis

8.1 Overview

8.2 Hospitals

8.3 Reference Laboratories

8.4 Others

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.3 Overview: US Molecular Diagnostics Market

9.4 Major Trends in the US Molecular Diagnostics Market

9.5 DRO – US Molecular Diagnostics Market Dynamics

9.6 Technology: US Molecular Diagnostics Market

9.7 Applications: US Molecular Diagnostics Market

9.8 Key Companies in the US Molecular Diagnostics Market

9.9 Europe

9.9.1 UK

9.9.2 Germany

9.10 Asia Pacific

9.10.1 India

9.10.2 China

9.10.3 Japan

9.11 Rest of the World

9.11.1 Brazil

9.11.2 Mexico

9.11.3 Africa

10 Competitive Landscape

10.1 Overview

11 Vendor Profiles

11.1 Danaher Corporation

11.1.1 Overview

11.1.2 Business Units

11.1.3 Geographic Revenue

11.1.4 Business Focus

11.1.5 SWOT Analysis

11.1.6 Business Strategies

11.2 F. Hoffmann-La Roche Ltd.

11.2.1 Overview

11.2.2 Business Units

11.2.3 Geographic Revenue

11.2.4 Business Focus

11.2.5 SWOT Analysis

11.2.6 Business Strategies

11.3 Abbott Laboratories

11.3.1 Overview

11.3.2 Business Units

11.3.3 Geographic Revenue

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategies

11.4 Hologic Inc.

11.4.1 Overview

11.4.2 Business Units

11.4.3 Geographic Revenue

11.4.4 Business Focus

11.4.5 SWOT Analysis

11.4.6 Business Strategies

11.5 Siemens Healthineers (Siemens AG)

11.5.1 Overview

11.5.2 Business Units

11.5.3 Geographic Revenue

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategies

12 Companies to Watch for

12.1 Qiagen N.V.

12.1.1 Overview

12.2 Bio-Rad Laboratories

12.2.1 Overview

12.3 Myriad Genetics Inc.

12.3.1 Overview

12.4 Thermo Fisher Scientific

12.4.1 Overview

12.5 bioMerieux S.A.

12.5.1 Overview

12.6 Beckton Dickinson and Company

12.6.1 Overview

12.7 Grifols S.A.

12.7.1 Overview

12.8 Sysmex Corporation

12.8.1 Overview

Annexure

Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.