Video Surveillance and VSaaS Market based on Product (Analog and IP-based), Component (Hardware, Software, and Services), Application (Commercial, Infrastructure, Residential, Military and defense, Institutional and Industrial), and Geography – Global Forecast up to 2027

- July, 2021

- Domain: ICT - Security

- Get Free 10% Customization in this Report

Video surveillance is the visual observation of the site without being directly on site. Surveillance is based on a real-time basis, and information will be recorded and stored in a storage device for later viewing. This technique will also be used to regulate and control, which includes quality affirmation, production control, and traffic regulation. It is also leveraged for other purposes such as minimizing accidents, observing open air grounds, tracing culprits, and preventing sabotage and security-related events. The adoption of video surveillance in business is increasing significantly due to the increasing requirement of physical security. The advent of new IP-based digital technologies to detect and avoid unwanted behaviors, such as vandalism, shoplifting, thefts, and terror attacks, is projected to fuel the video surveillance and VSaaS market growth. But, the privacy and security concerns about data usage may limit the video surveillance and VSaaS market. The Video Surveillance and VSaaS Market is projected to grow at 16.1% CAGR by 2027.

Research Methodology:

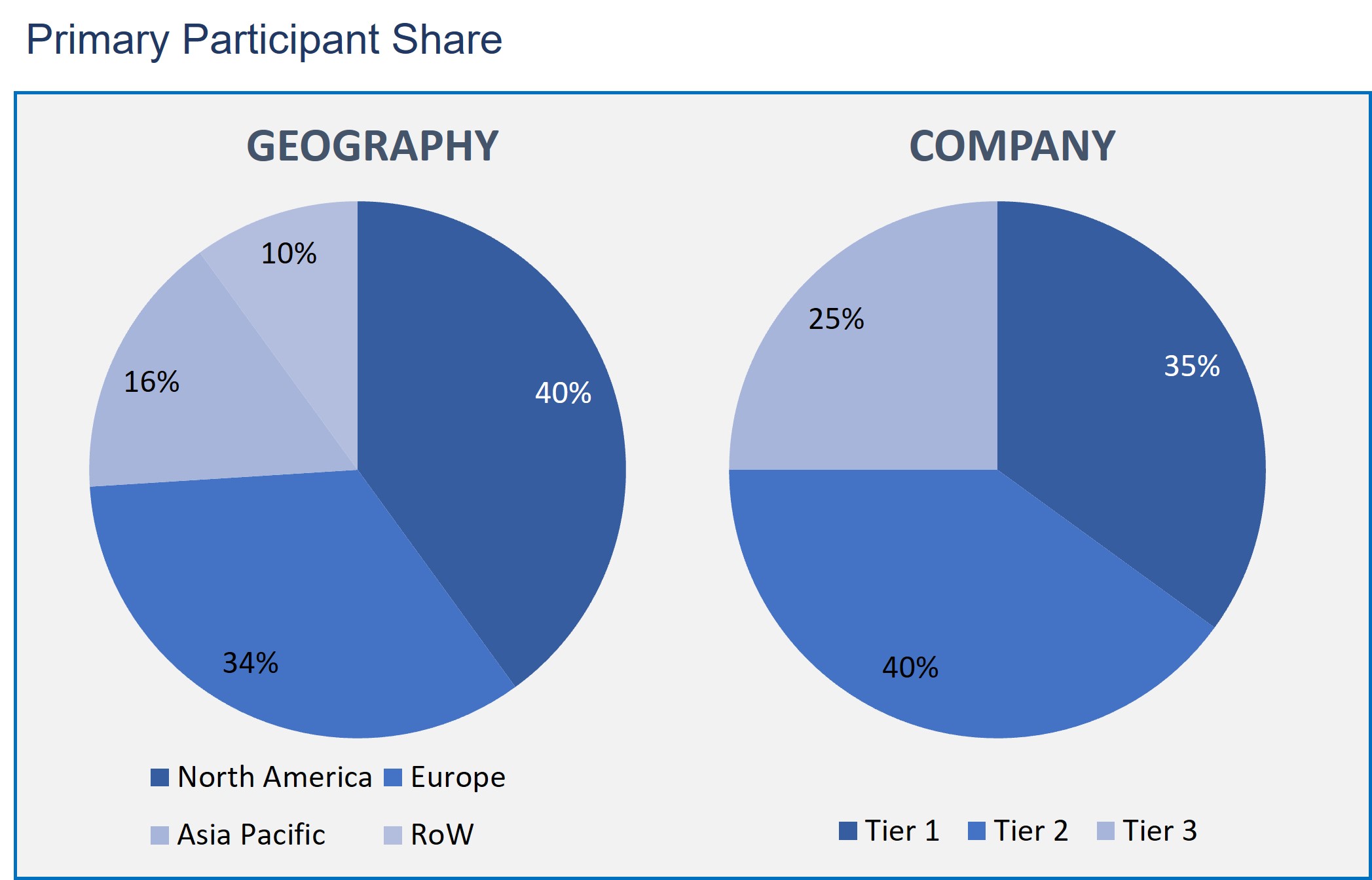

The Video Surveillance and VSaaS Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Video Surveillance and VSaaS Market based on the Product

- Analog

- IP-based

Video Surveillance and VSaaS Market based on the Component

- Hardware

- Software

- Services

Video Surveillance and VSaaS Market based on the Application

- Commercial

- Infrastructure

- Residential

- Military and defense

- Institutional

- Industrial

Video Surveillance and VSaaS Market based on the Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

The IP-based surveillance segment is anticipated to witness substantial growth based on the product segmentation over the coming years. This can be ascribed to the high scalability and flexibility characteristics provided as compared to the usual analog surveillance. In addition, the proliferation of internet protocol in surveillance and rising installations of IP cameras with improved video quality has created significant potential for IP-based systems.

The hardware segment has a major share in the video surveillance and VSaaS market based on component segmentation which includes monitors, recorders, encoders, and cameras. The surveillance cameras as hardware are estimated to exhibit high growth, which can be accredited to increasing sales of IP cameras with integrated recorders.

Further on the video surveillance and VSaaS market basis of application, the commercial segment is expected to be the major market in the forecast period. This is primarily due to the rising demand for cloud services and rising awareness regarding video surveillance application management in commercial sector, and the technological advancements in high-resolution video and imaging analytics estimated to drive video surveillance and VSaaS in the segment.

The North American region has acquired a substantial share in the video surveillance and VSaaS market. This is due to the technological advancements in security services in several countries and the adoption of new and emerging technologies at a very early stage. Apart from this, the region dominated technological adoption, compared to other geographical regions, and increasing demand for a hybrid system, megapixel camera, and analytics is high in this region which has also fostered the market growth.

Video surveillance has application in the security industry to avoid terrorist and criminal attacks. As a result, governments worldwide are majorly investing in developing the most advanced surveillance networks and increasing their utilization to encounter street crimes and counterterrorism operations. Globally, a key driver is taking place to bring most of the crucial infrastructure under video surveillance, including installations funded by government around public infrastructure, roads, airports, and maritime and defense, which eventually increase the demand for video surveillance.

The key vendors operating in the video surveillance and VSaaS market are Hikvision Digital Technology Co., Ltd., Axis Communications AB, Bosch Security Systems Inc., Zhejiang Dahua Technology Co. Ltd., Honeywell Security Group, Agent Video Intelligence, Panasonic System Networks Co. Ltd., Canary Connect, Inc., FLIR Systems, Inc. and D-Link Systems, Inc.

Henceforth, in the scenario of increasing vandalism and shoplifting, video surveillance plays a key role in commercial purposes and residential and commercial buildings where it was confined to the military and defense applications.

- This report describes the market fostering factors and also factors limiting the video surveillance and VSaaS market growth.

- The study represents the future and present predictions of the video surveillance and VSaaS market size and its contribution to the parent market.

- This report also gives accurate predictions of the prevailing trends and needs of the end-users.

- This report further gives an overview of the competitive landscape and the profiles of the major market players regarding their strategies and SWOT analysis.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Product: Market Size & Analysis

- Overview

- Analog

- IP-based

- Component: Market Size & Analysis

- Overview

- Hardware

- Software

- Services

- Application: Market Size & Analysis

- Overview

- Commercial

- Infrastructure

- Residential

- Military and defense

- Institutional

- Industrial

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Hikvision Digital Technology Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Axis Communications AB

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Bosch Security Systems Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Zhejiang Dahua Technology Co. Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Honeywell Security Group

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Agent Video Intelligence

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Panasonic System Networks Co. Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Canary Connect, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- FLIR Systems, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- D-Link Systems, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Hikvision Digital Technology Co., Ltd.

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 2. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR ANALOG, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 3. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR IP-BASED, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 4. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 5. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR HARDWARE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 6. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR SOFTWARE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 7. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR SERVICES, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 8. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 9. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR COMMERCIAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 10. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR INFRASTRUCTURE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 11. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR RESIDENTIAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 12. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR MILITARY AND DEFENSE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 13. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR INSTITUTIONAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 14. GLOBAL VIDEO SURVEILLANCE AND VSAAS MARKET VALUE FOR INDUSTRIAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 15. NORTH AMERICA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 16. NORTH AMERICA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 17. NORTH AMERICA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 18. NORTH AMERICA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 19. U.S VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 20. U.S VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 21. U.S VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 22. CANADA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 23. CANADA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 24. CANADA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 25. EUROPE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 26. EUROPE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 27. EUROPE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 28. EUROPE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, APPLICATION, 2021-2027 (USD BILLION)

TABLE 29. GERMANY VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 30. GERMANY VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 31. GERMANY VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 32. U.K VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 33. U.K VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 34. U.K VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 35. FRANCE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 36. FRANCE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 37. FRANCE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 38. ITALY VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 39. ITALY VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 40. ITALY VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 41. SPAIN VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 42. SPAIN VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 43. SPAIN VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 44. ROE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 45. ROE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 46. ROE VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 47. ASIA PACIFIC VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 48. ASIA PACIFIC VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 49. ASIA PACIFIC VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 50. ASIA PACIFIC VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 51. CHINA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 52. CHINA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 53. CHINA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 54. INDIA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 55. INDIA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 56. INDIA VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 57. JAPAN VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 58. JAPAN VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 59. JAPAN VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 60. REST OF APAC VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 61. REST OF APAC VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 62. REST OF APAC VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 63. REST OF WORLD VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 64. REST OF WORLD VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY COMPONENT, 2021-2027 (USD BILLION)

TABLE 65. REST OF WORLD VIDEO SURVEILLANCE AND VSAAS MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 66. HIKVISION DIGITAL TECHNOLOGY CO., LTD: FINANCIALS

TABLE 67. HIKVISION DIGITAL TECHNOLOGY CO., LTD: PRODUCTS & SERVICES

TABLE 68. HIKVISION DIGITAL TECHNOLOGY CO., LTD: RECENT DEVELOPMENTS

TABLE 69. AXIS COMMUNICATIONS AB: FINANCIALS

TABLE 70. AXIS COMMUNICATIONS AB: PRODUCTS & SERVICES

TABLE 71. AXIS COMMUNICATIONS AB: RECENT DEVELOPMENTS

TABLE 72. BOSCH SECURITY SYSTEMS INC: FINANCIALS

TABLE 73. BOSCH SECURITY SYSTEMS INC: PRODUCTS & SERVICES

TABLE 74. BOSCH SECURITY SYSTEMS INC: RECENT DEVELOPMENTS

TABLE 75. ZHEJIANG DAHUA TECHNOLOGY CO. LTD: FINANCIALS

TABLE 76. ZHEJIANG DAHUA TECHNOLOGY CO. LTD: PRODUCTS & SERVICES

TABLE 77. ZHEJIANG DAHUA TECHNOLOGY CO. LTD: RECENT DEVELOPMENTS

TABLE 78. HONEYWELL SECURITY GROUP: FINANCIALS

TABLE 79. HONEYWELL SECURITY GROUP: PRODUCTS & SERVICES

TABLE 80. HONEYWELL SECURITY GROUP: RECENT DEVELOPMENTS

TABLE 81. AGENT VIDEO INTELLIGENCE: FINANCIALS

TABLE 82. AGENT VIDEO INTELLIGENCE: PRODUCTS & SERVICES

TABLE 83. AGENT VIDEO INTELLIGENCE: RECENT DEVELOPMENTS

TABLE 84. PANASONIC SYSTEM NETWORKS CO. LTD: FINANCIALS

TABLE 85. PANASONIC SYSTEM NETWORKS CO. LTD: PRODUCTS & SERVICES

TABLE 86. PANASONIC SYSTEM NETWORKS CO. LTD: RECENT DEVELOPMENTS

TABLE 87. CANARY CONNECT, INC: FINANCIALS

TABLE 88. CANARY CONNECT, INC: PRODUCTS & SERVICES

TABLE 89. CANARY CONNECT, INC: RECENT DEVELOPMENTS

TABLE 90. FLIR SYSTEMS, INC: FINANCIALS

TABLE 91. FLIR SYSTEMS, INC: PRODUCTS & SERVICES

TABLE 92. FLIR SYSTEMS, INC: RECENT DEVELOPMENTS

TABLE 93. D-LINK SYSTEMS, INC: FINANCIALS

TABLE 94. D-LINK SYSTEMS, INC: PRODUCTS & SERVICES

TABLE 95. D-LINK SYSTEMS, INC: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.