Textured vegetable protein market by Source (Soy, Pea and Wheat), Type (Slices, Flakes, Chunks, and Granules), Application (Meat alternatives, Cereals & snacks and Other Applications), and Geography – Global Forecast to 2026

- March, 2021

- Domain: Chemicals, Materials & Food - Agro, Pharma, Food & Personal Care

- Get Free 10% Customization in this Report

Textured vegetable protein is the by-product derived from various types of vegetable ingredients processing and is leveraged as a substitute for meat due to its same protein content. This protein is a defatted form of vegetable proteins that are very simple in their cooking procedure. These proteins are rich in fiber and contain no fat, and are highly nutritious. The growing demand in the functional drinks industry is projected to boost the market growth over the forecast period. Rapidly growing demand for Ready-to-Eat (RTE) food products due to a hectic lifestyle and busy schedules are projected to drive the market growth. But somehow, the allergies related to the vegetable protein sources, including soy and wheat, restrict the textured vegetable protein market growth. The textured vegetable protein market is expected to reach at a CAGR of 6.1% by 2026.

Research Methodology:

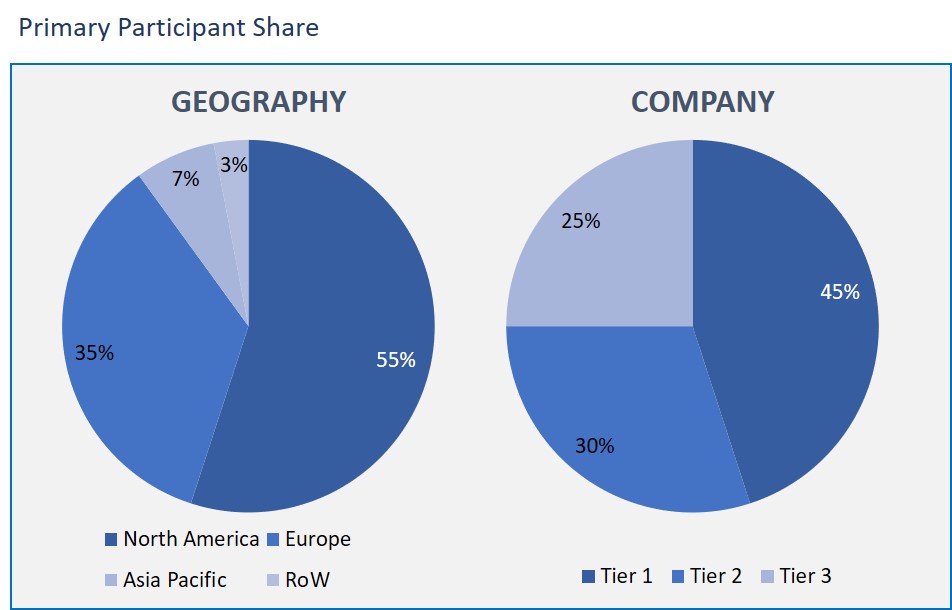

The textured vegetable protein market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an important part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Textured Vegetable Protein Market by Source

- Soy

- Pea

- Wheat

Textured Vegetable Protein Market by Type

- Slices

- Flakes

- Chunks

- Granules

Textured Vegetable Protein Market by Application

- Meat alternatives

- Cereals & snacks

- Other applications

Textured Vegetable Protein Market by Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

In the market based on source, the soy segment has a significant share in the textured vegetable protein market. This is because it is a low-fat protein vegetable source, and it is often taken as a substitute for meat owing to the low cost compared to animal-based protein. Since textured soy is a perfect meat substitute, it is gaining more demand among vegan consumers. Thus, these soy features are majorly responsible for increasing soy demand as an essential source for textured vegetable protein.

In terms of the type of textured vegetable protein, the slice type has more demand. This is because the slices are derived by processing different kinds of beans high in protein. These slices contain very important amino acids, minerals, and vitamins that significantly impact metabolism. The textured vegetable protein slices are generally used as meat alternatives as burger patties.

The textured vegetable protein application is primarily used as the meat alternatives where meat alternatives are having the highest share in the market growth. This is attributed to the increasing awareness among the public about the benefits of protein, increasing the vegan population's rate where they prefer only vegetarian food. Additionally, the soy source protein helps chronic diseases and helps in better body function compared to meat.

As observed in the regional market, North America has a substantial share in the textured vegetable protein market. The increasing population of vegans is driving the market growth in the region. Also, the growing preference for plant-based food in hospitals since the healthcare facilities are offering vegan meals over the processed meat food boosts the demand for textured vegetable protein in this region.

Globally, consumers have reduced the intake of meat in their diet, ascribed to rising health concerns. This has resulted in increasing preference for plant-based proteins, which serve as a perfect alternative to meat products. This factor is anticipated to significantly fuel the demand for textured vegetable protein, which will eventually drive the global textured soy protein market's growth in the prevailing years.

This report offers the various leading profiles of market players such as Shandong Wonderful Industrial Group, FoodChem International, Shandong Yuxin Bio-Tech, Crown Soya Protein Group, AGT Food & Ingredients, ADM, Cargill, Beneo GmbH, CHS, Roquette Freres, DuPont, Wilmar International, Axiom Foods, The Scoular Company, Puris Foods, VestKorn, MGP Ingredients, Sun NutraFoods, La Troja, and Hung Yang Foods.

Hence, owing to the health benefits of textured vegetable protein and increasing awareness about plant-based protein compared to meat protein, the textured vegetable protein market is gaining momentum. Besides that, the importance of protein in the daily diet is the primary factor driving the product demand.

- This report offers a complete analysis of the market growth factors, hampering factors, and opportunities and challenges in the market.

- This report depicts the central regions of the textured vegetable protein market and the significant share.

- This report also describes the competitive market outlook in terms of significant market player's profiles.

- The report also gives market players information about their productive strategies, products portfolio, and new developments in the products.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Source: Market Size & Analysis

- Overview

- Soy

- Pea

- Wheat

- Type: Market Size & Analysis

- Overview

- Slices

- Flakes

- Chunks

- Granules

- Application: Market Size & Analysis

- Overview

- Meat alternatives

- Cereals & snacks

- Other applications

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Shandong Wonderful Industrial Group

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- FoodChem International

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Shandong Yuxin Bio-Tech

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Crown Soya Protein Group

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- AGT Food & Ingredients

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- ADM

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Cargill

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Beneo GmbH

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- CHS

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Roquette Freres

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Shandong Wonderful Industrial Group

- Companies to Watch

- DuPont

- Overview

- Products & Services

- Business Strategy

- Wilmar International

- Overview

- Products & Services

- Business Strategy

- Axiom Foods

- Overview

- Products & Services

- Business Strategy

- The Scoular Company

- Overview

- Products & Services

- Business Strategy

- Puris Foods

- Overview

- Products & Services

- Business Strategy

- VestKorn

- Overview

- Products & Services

- Business Strategy

- MGP Ingredients

- Overview

- Products & Services

- Business Strategy

- Sun NutraFoods

- Overview

- Products & Services

- Business Strategy

- La Troja

- Overview

- Products & Services

- Business Strategy

- Hung Yang Foods

- Overview

- Products & Services

- Business Strategy

- DuPont

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 2. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR SOY, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 3. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR PEA, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 4. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR WHEAT, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 5. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 6. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR SLICES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 7. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR FLAKES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 8. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR CHUNKS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 9. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR GRANULES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 10. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 11. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR MEAT ALTERNATIVES, 2020-2026 (USD BILLION)

TABLE 12. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR CEREALS & SNACKS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 13. GLOBAL TEXTURED VEGETABLE PROTEIN MARKET VALUE FOR OTHER APPLICATIONS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 14. NORTH AMERICA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 15. NORTH AMERICA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 16. NORTH AMERICA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 17. NORTH AMERICA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 18. U.S TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 19. U.S TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 20. U.S TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 21. CANADA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 22. CANADA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 23. CANADA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 24. EUROPE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 25. EUROPE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 26. EUROPE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 27. EUROPE TEXTURED VEGETABLE PROTEIN MARKET VALUE, APPLICATION, 2020-2026 (USD BILLION)

TABLE 28. GERMANY TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 29. GERMANY TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 30. GERMANY TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 31. U.K TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 32. U.K TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 33. U.K TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 34. FRANCE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 35. FRANCE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 36. FRANCE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 37. ITALY TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 38. ITALY TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 39. ITALY TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 40. SPAIN TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 41. SPAIN TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 42. SPAIN TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 43. ROE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 44. ROE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 45. ROE TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 46. ASIA PACIFIC TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 47. ASIA PACIFIC TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 48. ASIA PACIFIC TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 49. ASIA PACIFIC TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 50. CHINA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 51. CHINA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 52. CHINA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 53. INDIA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 54. INDIA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 55. INDIA TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 56. JAPAN TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 57. JAPAN TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 58. JAPAN TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 59. REST OF APAC TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 60. REST OF APAC TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 61. REST OF APAC TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY APPLICATION, 2020-2026 (USD BILLION)

TABLE 62. REST OF WORLD TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY SOURCE, 2020-2026 (USD BILLION)

TABLE 63. REST OF WORLD TEXTURED VEGETABLE PROTEIN MARKET VALUE, BY TYPE, 2020-2026 (USD BILLION)

TABLE 64. SHANDONG WONDERFUL INDUSTRIAL GROUP: FINANCIALS

TABLE 65. SHANDONG WONDERFUL INDUSTRIAL GROUP: PRODUCTS & SERVICES

TABLE 66. SHANDONG WONDERFUL INDUSTRIAL GROUP: RECENT DEVELOPMENTS

TABLE 67. FOODCHEM INTERNATIONAL: FINANCIALS

TABLE 68. FOODCHEM INTERNATIONAL: PRODUCTS & SERVICES

TABLE 69. FOODCHEM INTERNATIONAL: RECENT DEVELOPMENTS

TABLE 70. SHANDONG YUXIN BIO-TECH: FINANCIALS

TABLE 71. SHANDONG YUXIN BIO-TECH: PRODUCTS & SERVICES

TABLE 72. SHANDONG YUXIN BIO-TECH: RECENT DEVELOPMENTS

TABLE 73. CROWN SOYA PROTEIN GROUP: FINANCIALS

TABLE 74. CROWN SOYA PROTEIN GROUP: PRODUCTS & SERVICES

TABLE 75. CROWN SOYA PROTEIN GROUP: RECENT DEVELOPMENTS

TABLE 76. AGT FOOD & INGREDIENTS: FINANCIALS

TABLE 77. AGT FOOD & INGREDIENTS: PRODUCTS & SERVICES

TABLE 78. AGT FOOD & INGREDIENTS: RECENT DEVELOPMENTS

TABLE 79. ADM: FINANCIALS

TABLE 80. ADM: PRODUCTS & SERVICES

TABLE 81. ADM: RECENT DEVELOPMENTS

TABLE 82. CARGILL: FINANCIALS

TABLE 83. CARGILL: PRODUCTS & SERVICES

TABLE 84. CARGILL: RECENT DEVELOPMENTS

TABLE 85. BENEO GMBH: FINANCIALS

TABLE 86. BENEO GMBH: PRODUCTS & SERVICES

TABLE 87. BENEO GMBH: RECENT DEVELOPMENTS

TABLE 88. CHS: FINANCIALS

TABLE 89. CHS: PRODUCTS & SERVICES

TABLE 90. CHS: RECENT DEVELOPMENTS

TABLE 91. ROQUETTE FRERES: FINANCIALS

TABLE 92. ROQUETTE FRERES: PRODUCTS & SERVICES

TABLE 93. ROQUETTE FRERES: RECENT DEVELOPMENTS

TABLE 94. DUPONT: PRODUCTS & SERVICES

TABLE 95. WILMAR INTERNATIONAL: PRODUCTS & SERVICES

TABLE 96. AXIOM FOODS: PRODUCTS & SERVICES

TABLE 97. THE SCOULAR COMPANY: PRODUCTS & SERVICES

TABLE 98. PURIS FOODS: PRODUCTS & SERVICES

TABLE 99. VESTKORN: PRODUCTS & SERVICES

TABLE 100. MGP INGREDIENTS: PRODUCTS & SERVICES

TABLE 101. SUN NUTRAFOODS: PRODUCTS & SERVICES

TABLE 102. LA TROJA: PRODUCTS & SERVICES

TABLE 103. HUNG YANG FOODS: PRODUCTS & SERVICES

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.