Pacemaker Market – Global Forecast upto 2024

- May, 2018

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

[111 Report Pages] This market research report identifies Abbott Laboratories, Biotronik Inc., Boston Scientific Corporation, Medtronic plc, and MicroPort Scientific Corporation as the major vendors operating in the global pacemakers market. This report also provides a detailed analysis of the market by product type (Internal pacemakers and External pacemakers), technology (Single-chambered, Dual-chambered, and Biventricular pacemakers), end-users (Hospitals, ASC, and Cardiac clinics), and region (North America, Europe, Asia Pacific, and Rest of the World).

Overview of the Pacemakers Market

Infoholic’s market research report predicts that the global pacemakers market will grow at a CAGR of 7.8% during the forecast period 2018–2024. The major drivers of the market are the growing aging population, increasing prevalence of cardiovascular diseases, and good reimbursement facilities are few of the factors driving the pacemaker market growth. Increase in healthcare spending, use of electronic health records for monitoring outcomes of pacemakers, and increase in the number of outpatient procedures are providing an opportunity for the growth of the market. However, side effects of pacemakers, alternatives for pacemakers, lack of skilled healthcare professionals, and stringent regulatory approval process will hamper the growth of the market.

According to the pacemaker market analysis, in 2017, North America accounts for the largest share of the pacemaker market, followed by Europe, Asia Pacific, and Rest of the World. More than 60% of the market is occupied by North America, with the US being the major contributor to the market growth.

Competitive Analysis and Key Vendors

New product development, geographical expansion, collaboration, mergers & acquisitions, and pricing strategies are vital for players in this space. For instance, in May 2018, MicroPort, a Chinese company acquired the cardiac rhythm management segment of the LivaNova company, which has made MicroPort a prominent player in the market. In January 2017, one of the major players in the market, St. Jude Medical was acquired by Abbott Laboratories for a total of $25 billion. This acquisition has strengthened the Abbott’s position in the cardiovascular segment and increased its market share. The convenience of reimbursement for the pacemaker implantation treatment has lessened the monetary load on patients, thus prompting the procedure rate of such devices. For example, a single chamber pacemaker device costs nearly $10,000, and almost $7,500 is compensated under the US Medicare plan. Reimbursement settlement plans are available in most of the regions, particularly in developed nations such as the UK, the US, and Canada.

Some of the Pacemaker Market key vendors are:

- Abbott Laboratories

- Boston Scientific Corporation

- Medtronic plc

- MicroPort Scientific Corporation

- Biotronik Inc.

Other vendors in the global pacemakers market are Lepu Medical Technology Co. Ltd., Medico, S.p.A, Osypka Medical GmbH, Sree Pacetronix Ltd., and SORIN Group are the other predominate players in the pacemakers market.

Pacemaker Market by product type

- Internal pacemakers

- External pacemakers

The usage of internal pacemakers is extensive when compared to the external pacemakers, which makes it the largest segment in the global pacemaker market.

Pacemaker Market by technology type

- Single-chambered

- Dual-chambered

- Biventricular pacemakers

Cardiologists generally recommend the use of single chamber or dual chamber pacemakers bestowing to the medicinal requirement of the patient.

Pacemaker Market by end-users

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Cardiac Clinics

The hospitals dominated the market in 2017 due to the good reimbursement facilities and availability of skilled professionals and is expected to continue the same during the forecast period.

Benefits

The report provides detailed information about the usage and adoption of pacemakers in various regions. With that, key stakeholders can find out the major trends, drivers, investments, and vertical player’s initiatives toward the product adoption in the upcoming years, along with the details of commercial products available in the market. Moreover, the report provides details about the major challenges that are going to have an impact on market growth. Additionally, the report gives complete details about the business opportunities to key stakeholders to expand their business and capture the revenue in the specific verticals. The report will help companies interested or established in this market to analyze the various aspects of this domain before investing or expanding their business in the pacemakers market.

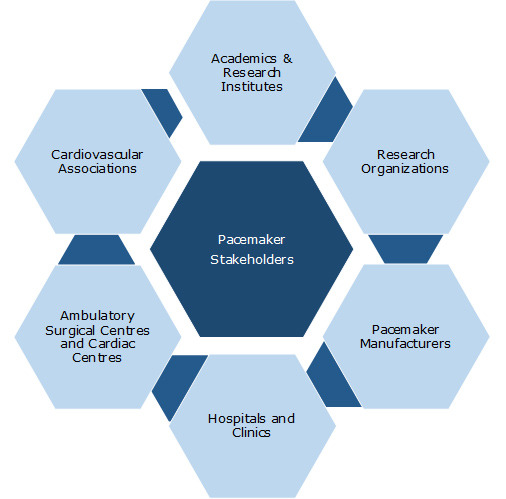

Key Stakeholders:

1 Industry Outlook

1.1 Industry Overview

1.2 Patient Demography

1.3 Healthcare Spending in the US

1.4 Total Addressable Market

1.4.1 Cardiac Rhythm Management (CRM)

1.5 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Segmented Addressable Market

3.3 Industry Trends

3.4 Related Markets

3.4.1 Cardiovascular Drugs

3.4.1.1 Trends of cardiovascular drugs market

3.4.2 Aortic Aneurysm

3.4.2.1 Trends of Aortic Aneurysm Market

3.4.3 Coronary Stents Market

3.4.3.1 Trends of Coronary Stents Market

3.4.4 Cardiovascular Diagnostics

4 Market Outlook

4.1 Reimbursement Scenario

4.2 Market Segmentation

4.3 Porter 5(Five) Forces

4.4 PEST Analysis

5 Market Characteristics

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing prevalence of cardiovascular diseases

5.1.1.2 Increasing Aging Population

5.1.1.3 Good Reimbursement Facilities

5.1.2 Opportunities

5.1.2.1 Increase in healthcare spending

5.1.2.2 Use of Electronic Health Records for Monitoring Outcomes of The Pacemake

5.1.2.3 Increase in the number of outpatient procedures

5.1.3 Restraints

5.1.3.1 Side Effects of Pacemakers

5.1.3.2 Alternative for Pacemakers

5.1.3.3 Lack of skilled healthcare professionals

5.1.3.4 Stringent Regulatory Approval Process

5.2 DRO – Impact Analysis

5.3 Key Stakeholders

6 Product: Market Size and Analysis

6.1 Overview

6.2 External Pacemakers

6.3 Internal Pacemaker

7 Technology: Market Size and Analysis

7.1 Overview

7.2 Single Chamber Pacemaker

7.3 Dual Chamber Pacemaker

7.4 Biventral Pacemaker

8 End-users: Market Size and Analysis

8.1 Overview

8.2 Hospitals and clinics

8.3 Ambulatory Surgical Center

8.3.1.1 US

8.4 Cardiac Centers

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.2.1 Overview

9.2.2 United States

9.2.3 Canada

9.3 Europe

9.3.1 Overview

9.3.2 UK 60

9.3.3 Germany

9.3.4 France

9.4 Asia Pacific

9.4.1 Overview

9.4.2 India

9.4.3 Japan

9.4.4 China

9.5 Rest of the World

9.5.1 Overview

9.5.2 Brazil

9.5.3 Africa

10 Competitive Landscape

11 Vendors Profile

11.1 Medtronic Plc

11.1.1 Overview

11.1.2 Business Units

11.1.3 Geographic Presence

11.1.4 Business Focus

11.1.1 SWOT Analysis

11.1.2 Business Strategies

11.2 Abbott Laboratories

11.2.1 Overview

11.2.2 Business Unit

11.2.3 Geographic Presence

11.2.4 Business Focus

11.2.5 SWOT Analysis

11.2.6 Business Strategy

11.3 Boston Scientific Corp

11.3.1 Overview

11.3.2 Business Units

11.3.3 Geographic Presence

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategies

11.4 Biotronik Inc.

11.4.1 Overview

11.4.2 Business Focus

11.4.3 SWOT Analysis

11.4.4 Business Strategy

11.5 MicroPort Scientific Corporation

11.5.1 Overview

11.5.2 Business Units

11.5.3 Geographic Presence

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategies

12 Vendors Profile

12.1 Shree Pacetronix Ltd.

12.1.1 Overview

12.2 OSYPKA AG

12.2.1 Overview

12.3 Medico S.p.A..

12.3.1 Overview

12.4 Oscor Inc.

12.4.1 Overview

12.5 Lepu Medical Technology Co. Ltd.

12.5.1 Overview

13 Annexure

Abbreviations

TABLE 1 TOP ACQUISITIONS IN CARDIOVASCULAR INDUSTRY 16

TABLE 1 GLOBAL PACEMAKER MARKET REVENUE BY REGIONS, 2017–2024 ($MILLION) 44

TABLE 2 GLOBAL PACEMAKER MARKET REVENUE BY REGIONS, 2017–2024 ($MILLION) 55

TABLE 3 PERMANENT CARDIAC PACEMAKER IMPLANT NO COMPLICATIONS COST 57

TABLE 4 ANNUAL NEW PACEMAKER IMPLANT RATE PER MILLION POPULATION 60

TABLE 5 MEDTRONIC PLC: OFFERINGS 68

TABLE 6 MEDTRONIC PLC: RECENT DEVELOPMENTS 69

TABLE 2 ABBOTT LABORATORIES: PRODUCT OFFERINGS 80

TABLE 3 ABBOTT LABORATORIES: RECENT DEVELOPMENTS 80

TABLE 7 BOSTON SCIENTIFIC CORP: OFFERINGS 86

TABLE 8 BOSTON SCIENTIFIC CORP: RECENT DEVELOPMENTS 86

TABLE 4 BIOTRONIK INC.: PRODUCT OFFERINGS 94

TABLE 5 BIOTRONIK INC.: RECENT DEVELOPMENTS 94

TABLE 9 MICROPORT SCIENTIFIC: OFFERINGS 97

TABLE 10 MICROPORT SCIENTIFIC CORPORATION: RECENT DEVELOPMENTS 97

TABLE 11 SHREE PACETRONIX LTD.: OVERVIEW 105

TABLE 12 OSYPKA AG: OVERVIEW 106

TABLE 13 OSYPKA AG.: RECENT DEVELOPMENTS 106

TABLE 14 MEDICO S.P.A.: OVERVIEW 107

TABLE 15 MEDICO S.P.A.: RECENT DEVELOPMENTS 107

TABLE 16 OSCOR INC: OVERVIEW 108

TABLE 17 OSCOR INC.: RECENT DEVELOPMENTS 108

TABLE 18 LEPU MEDICAL TECHNOLOGY CO. LTD.: OVERVIEW 109

TABLE 19 LEPU MEDICAL TECHNOLOGY CO. LTD.: RECENT DEVELOPMENTS 109

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.