Molecular Diagnostics Market by Application (Infectious Disease, Genetic Testing, Oncology), Technology (PCR, INAAT & NGS), End User (Hospital/Reference Laboratories) - Global Forecast to 2023

- July, 2017

- Domain: Healthcare - Diagnostics

- Get Free 10% Customization in this Report

[101 Pages Report] This market research report includes a detailed segmentation of the global molecular diagnostics market by application (oncology, blood testing, infectious disease, genetic testing, and tissue typing), by technology type (PCR, INAAT, Microarray, Hybridization, DNA Sequencing and other MDX technology), by end-users (hospitals, reference laboratories and others), and by regions (Americas, APAC, EMEA, and RoW). The market research report identifies F.Hoffmann-La Roche, Abbott Diagnostics, Siemens Healthineers, Danaher, and Hologic as the major vendors operating in the global molecular diagnostics market.

Overview of the Global Molecular Diagnostics Market Research

Infoholic’s market research report predicts that the global molecular diagnostics market will grow at a CAGR of 8.7% during the forecast period. The market for molecular diagnostics is driven by increasing prevalence of infectious and other lifestyle diseases, increasing demand for non-invasive biomarker-based tests, growing adoption of point-of-care testing, and high growth of the market in emerging countries. Increasing number of mergers & acquisitions and growing significance of companion diagnostics are providing opportunities for the market growth. Low awareness about standardization, stringent regulatory approval process, and lack of skilled labors are hampering the market growth.

According to the molecular diagnostics industry analysis, North America accounted for the largest share of the global molecular diagnostics market in 2017. The reason for the market’s growth in the Americas is the increasing incidences of disease and organ transplantation in the US along with increasing funding by government and private players and increased adoption of personalized medicine in clinical practices are some of the factors driving the molecular diagnostics market growth. The Asia Pacific region is expected to witness the fastest growth rate due to the large patient pool, increasing awareness, and rising healthcare expenditure.

Molecular Diagnostics Market Research competitive analysis and key vendors

Molecular diagnostics are performed mainly to examine the existence of the disease in blood, tissue, or even in bones. The importance of nucleic acids and other cellular biomarkers in defining the vital cellular process has facilitated medical advancements in the diagnosis of various diseases. Early diagnosis of the disease is one of the key advantages of this technology. The capacity of molecular diagnostics to systematize molecular reactions for the enhancement of the clinical diagnosis has put healthcare in the front line. The increasing importance of molecular diagnostic tests has resulted in the launch of new tests and also increased acquisition, strategic partnership, and funding to develop new tests and technologies. For instance, in April 2018, NanoString Technologies, Inc. launched a Breast Cancer 360 (BC 360) research panel. In July 2017, MDxHealth SA announced the commercial launch of its AssureMDx for bladder cancer test in the US as a laboratory developed test. Illumina recently started a new company, named GRAIL, for liquid biopsy. It invested $100 million and raised another $900 million through public funding to develop new non-invasive tests for cancer diagnosis.

Some of the Key Vendors in the Molecular Diagnostics Market Research are:

- Hoffmann-La Roche

- Abbott Diagnostics

- Siemens Healthineers

- Danaher

- Hologic

Molecular Diagnostics Market Research by Application type

- Oncology

- Blood Testing

- Infectious Disease

- Genetic Testing

- Tissue Typing

In 2017, the infectious disease application occupied the largest share due to large number of patients suffering from hospital-associated infection, sexually transmitted infection (STI), hepatitis, respiratory infection, pathogen ID detection, and others is fostering the market growth, but oncology is expected to grow at the highest growth rate during the forecast period due to increasing incidence of cancer globally.

Molecular Diagnostics Market Research By Technology

- PCR

- INAAT

- Microarray

- Hybridization

- DNA Sequencing

- Other MDX Technology

In 2017, the PCR segment occupied the largest share. PCR is a gold standard technique for DNA amplification and is the primary technique conducted prior to any molecular diagnostic examination Next-generation sequencing and microarray are expected to grow at the fastest rate during the forecast period.

Molecular Diagnostics Market Research By End-Users

- Hospitals

- Reference Laboratories

- Others

In 2017, the hospitals occupied the largest share and is expected to continue the same trend during the forecast period.

Molecular Diagnostics Market Research Benefits

The report provides detailed information about the usage and adoption of molecular diagnostics market in various applications and regions. With that, key stakeholders can find out the major trends, drivers, investments, vertical player’s initiatives, government initiatives toward the product adoption in the upcoming years, along with the details of commercial products available in the market. Moreover, the report provides details about the major challenges that are going to have an impact on market growth. Additionally, the report gives complete details about the business opportunities to key stakeholders to expand their business and capture revenues in the specific verticals. The report will help companies interested or established in this market to analyze the various aspects of this domain before investing or expanding their business in the molecular diagnostics market.

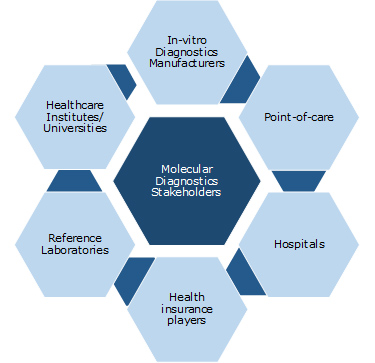

Key Stakeholders:

1 Industry Outlook

1.1 Industry Overview

1.2 Industry Trends

1.3 PEST Analysis

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Total Addressable Market

3.2 Segmented Addressable Market

3.3 Related Markets

3.3.1 Immunoassays

3.3.2 Clinical Chemistry

4 Market Outlook

4.1 Market Definition – Infoholic Research

4.2 Market Segmentation

4.3 Porter 5(Five) Forces

5 Market Characteristics

5.1 Milestones in Molecular Diagnostics

5.2 Basic steps of molecular diagnostics

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing prevalence of Infectious diseases

5.3.1.2 Growing adoption of POC testing

5.3.1.3 Increasing demand for biomarker-based tests

5.3.1.4 High growth of market in emerging countries

5.3.2 Opportunities

5.3.2.1 Growing significance of companion diagnostics

5.3.2.2 Increased number of Merger and Acquisition

5.3.2.3 Increased adoption of DNA probe-based diagnostics

5.3.3 Restraints

5.3.3.1 Stringent regulatory approvals

5.3.3.2 Lack of skilled labor

5.3.4 DRO – Impact Analysis

5.3.5 Key Stakeholders

6 Market Segmentation by Technology: Market Size and Analysis

6.1 Overview

6.2 Polymerase Chain Reaction (PCR)

6.3 Isothermal Nucleic Acid Amplification Technology (INAAT)

6.4 Microarray

6.5 Hybridization

6.6 DNA Sequencing

6.7 Other MDX technology

7 Market Segmentation by Application: Market Size and Analysis

7.1 Overview

7.2 Oncology

7.3 Blood Testing

7.4 Infectious Diseases

7.5 Genetic Testing

7.6 Tissue Typing

7.7 Others

8 End-user: Market Size and Analysis

8.1 Overview

8.2 Hospitals

8.3 Reference Laboratories

8.4 Others

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.2.1 US 40

9.3 Europe

9.3.1 UK 41

9.3.2 Germany

9.4 APAC

9.4.1 India

9.4.2 China

9.4.3 Japan

9.5 Rest of the World

9.5.1 Brazil

9.5.2 Mexico

9.5.3 Africa

10 Competitive Landscape

10.1 Overview

11 Vendor Profiles

11.1 F.Hoffmann-La Roche Ltd

11.1.1 Overview

11.1.2 Business Unit

11.1.3 Geographic Presence

11.1.4 Business Focus

11.1.5 SWOT Analysis

11.1.6 Business Strategy

11.2 Abbott Laboratories

11.2.1 Overview

11.2.2 Business Unit

11.2.3 Geographic Presence

11.2.4 Business Focus

11.2.5 SWOT Analysis

11.2.6 Business Strategy

11.3 Siemens Healthineers Inc.

11.3.1 Overview

11.3.2 Geographic Presence

11.3.3 Business Focus

11.3.4 SWOT Analysis

11.3.5 Business Strategy

11.4 Danaher Corporation.

11.4.1 Overview

11.4.2 Business Unit

11.4.3 Geographic Presence

11.4.4 Business Focus

11.4.5 SWOT Analysis

11.4.6 Business Strategy

11.5 Hologic Inc.

11.5.1 Overview

11.5.2 Business Unit

11.5.3 Geographic Presence

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategy

12 Companies to Watch For

12.1 Becton Dickinson and Company

12.1.1 Overview

12.2 Bio-Rad Laboratories, Inc.

12.2.1 Overview

12.3 QIAGEN NV

12.3.1 Overview

12.4 bioMerieux S.A.

12.4.1 Overview

12.5 ThermoFisher Scientific.

12.5.1 Overview

Annexure

12.6 Abbreviations

TABLE 1 GLOBAL MOLECULAR DIAGNOSTICS MARKET BY APPLICATION, 2016–2023 ($MILLION) 28

TABLE 2 GLOBAL MOLECULAR DIAGNOSTICS MARKET REVENUE BY GEOGRAPHY, 2016–2023 ($MILLION) 38

TABLE 3 OTHER PROMINENT VENDORS IN THE MARKET 47

TABLE 4 F. HOFFMANN-LA ROCHE: OFFERINGS 49

TABLE 5 F. HOFFMANN-LA ROCHE.: RECENT DEVELOPMENTS 52

TABLE 6 ABBOTT LABORATORIES: RECENT DEVELOPMENTS 60

TABLE 7 ABBOTT LABORATORIES: RECENT DEVELOPMENTS 61

TABLE 8 SIEMENS HEALTHINEERS INC.: RECENT DEVELOPMENTS 67

TABLE 9 SIEMENS HEALTHINEERS INC.: RECENT DEVELOPMENTS 67

TABLE 10 DANAHER CORPORATION: OFFERINGS 73

TABLE 11 DANAHER CORPORATION: RECENT DEVELOPMENTS 74

TABLE 12 HOLOGIC INC: OFFERINGS 80

TABLE 13 HOLOGIC INC.: RECENT DEVELOPMENTS 82

TABLE 14 BECTON DICKENSON AND COMPANY: RECENT DEVELOPMENTS 88

TABLE 15 BIO-RAD LABORATORIES: RECENT DEVELOPMENTS 90

TABLE 16 QIAGEN NV: RECENT DEVELOPMENTS 91

TABLE 17 BIOMERIEUX: RECENT DEVELOPMENTS 93

TABLE 18 THERMOFISHER SCIENTIFIC: RECENT DEVELOPMENTS 94

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.