Industrial Cleaning Market based on Ingredient (Surfactants, Solvents, Chelating Agents, pH Regulators, Solubilizers/Hydrotropes and Others), Product (General Cleaners, Metal Cleaners, Oven & Grill Cleaners, Dish Washing, Commercial Laundry, Dairy Cleaners, Food Cleaners, and Disinfectants), Application, and Geography – Global Forecast up to 2027

- July, 2021

- Domain: Chemicals, Materials & Food - Specialty Chemicals

- Get Free 10% Customization in this Report

Industrial cleaning is defined as cleaning harmful areas located in industries such as warehouses, factories, and power plants, among others. Industrial cleaning consists of cleaning and removing dirt, grease, stains, rust, and other hazardous particles from components, metals, substances, and various other industrial components. The cleaning process generally includes a chemical solution or a solvent, which is made up of a chemical compound in the form of liquid that can be used on industrial products for cleaning purposes. Escalating demand for energy driven by renewable sources is the prominent factor escalating the market growth and rising workplace hygiene initiatives. Further, an increasing number of infectious and communicable diseases has set forward a requirement for disinfection and other industrial cleaners in industries, which in turn elevate the demand for cleaning and are the key factors among others driving the industrial cleaning market. On the other hand, government and environmental regulations might limit the market growth. The Industrial Cleaning Market is expected to grow at the rate of 5.09% CAGR by 2027.

Research Methodology:

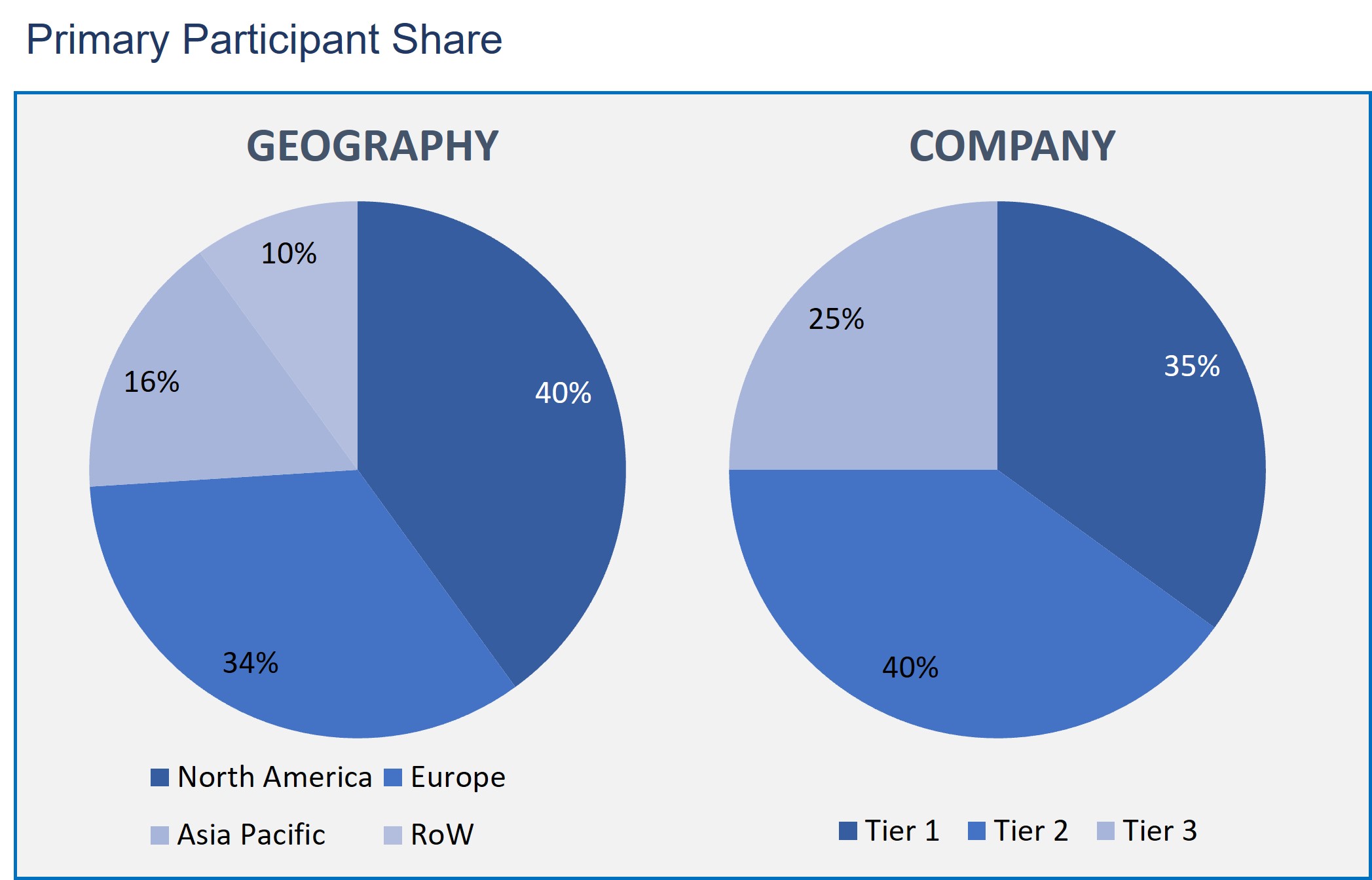

The industrial cleaning market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Industrial Cleaning Market based on Ingredient

- Surfactants

- Solvents

- Chelating Agents

- pH Regulators

- Solubilizers/Hydrotropes

- Others

Industrial Cleaning Market based on Product

- General Cleaners

- Metal Cleaners

- Oven & Grill Cleaners

- Dish Washing

- Commercial Laundry

- Dairy Cleaners

- Food Cleaners

- Disinfectants

Industrial Cleaning Market based on Application

- Manufacturing & Commercial Offices

- Healthcare

- Retail & Foodservice

- Hospitality

- Automotive & Aerospace

- Food Processing

- Others

Industrial Cleaning Market based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

The surfactants segment has a substantial share in the industrial cleaning market growth based on ingredient type. This is due to the factors such as lower prices & easy availability of surfactants, and a wide area of applications. The proliferating awareness about the hygiene and demand for germ-free, dirt-free, and clean working space is propelling the use of surfactants in industrial cleaning.

As per the market by product type, the general cleaners segment is anticipated to exhibit a major share in the market. Since the consumption of general cleaners is very more in the market majorly owing to its consumption in nearly every industry. General cleaners consist of sub-types such as floor care and carpet care. Cleaning of floor and carpet is very general in every industry, which increases the consumption of general cleaners in the industrial cleaning market.

By application, the healthcare segment is exhibiting considerable growth in the market. The increasing healthcare expenditure is a key factor driving the growth of the industrial cleaning market in the healthcare segment. Moreover, the prevalence of cleaning is very high in healthcare facilities, which propels its high consumption. The utilization of superior and high-performance cleaning is estimated to boost the growth of industrial cleaning in healthcare application.

According to the geography, the Asia Pacific industrial cleaning market is expected to be the largest during the forecast period. This is primarily owing to the well-developed manufacturing industry. The key industrial cleaning markets in the Asia Pacific are China, Japan, India, Australia, and South Korea, which is also contributing to the market growth.

Increasing hygiene and health awareness among consumers around the world is majorly projected to accelerate the market growth of industrial cleaning. In addition, the increasing awareness about the infections caused by several types of viruses and bacteria owing to the growing incidence of the outbreak of viral infections around the world is further anticipated to augment the market growth of industrial cleaning over the forecast period.

The key vendors operating in the industrial cleaning market are Arcot Manufacturing Corporation, Dupont De Nemours Inc., Pilot Chemical Corp, Spartan Chemical Company, Inc., Nyco Products Company, Croda International PLC, Emulso Corporation, Evonik Industries AG, Huntsman Corporation, and Prime Industries Ltd.

As a result, the effectual cleaning solutions help industries maintain a high level of safety and efficiency in their premises, preventing environmental and health hazards and providing flawless products to the market. Hence, industrial cleaning plays a vital role in achieving a high level of safety and prevents health hazards.

- This report for the industrial cleaning market consists of a complete quantitative analysis of the market, which helps the shareholders to maximize profits by the present market trends.

- Further, the report will help in perceiving the market players’ capabilities and strategies such as innovations, mergers and acquisitions, and expansions.

- This report on the industrial cleaning market also includes exclusive insights about the technical innovations in the products.

- Additionally, this research will illustrate the geographical analysis of the industrial cleaning market to understand the market penetration across the globe.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Ingredient: Market Size & Analysis

- Overview

- Surfactants

- Solvents

- Chelating Agents

- pH Regulators

- Solubilizers/Hydrotropes

- Others

- Product: Market Size & Analysis

- Overview

- General Cleaners

- Metal Cleaners

- Oven & Grill Cleaners

- Dish Washing

- Commercial Laundry

- Dairy Cleaners

- Food Cleaners

- Disinfectants

- Application: Market Size & Analysis

- Overview

- Manufacturing & Commercial Offices

- Healthcare

- Retail & Foodservice

- Hospitality

- Automotive & Aerospace

- Food Processing

- Others

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Arcot Manufacturing Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Dupont De Nemours Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Pilot Chemical Corp

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Spartan Chemical Company, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Nyco Products Company

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Croda International PLC

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Emulso Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Evonik Industries AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Huntsman Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Prime Industries Ltd

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Arcot Manufacturing Corporation

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 2. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR SURFACTANTS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 3. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR SOLVENTS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 4. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR CHELATING AGENTS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 5. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR PH REGULATORS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 6. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR SOLUBILIZERS/HYDROTROPES, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 7. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 8. GLOBAL INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 9. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR GENERAL CLEANERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 10. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR METAL CLEANERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 11. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR OVEN & GRILL CLEANERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 12. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR DISH WASHING, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 13. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR COMMERCIAL LAUNDRY, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 14. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR DAIRY CLEANERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 15. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR FOOD CLEANERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 16. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR DISINFECTANTS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 17. GLOBAL INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 18. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR MANUFACTURING & COMMERCIAL OFFICES, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 19. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR HEALTHCARE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 20. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR RETAIL & FOODSERVICE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 21. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR HOSPITALITY, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 22. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR AUTOMOTIVE & AEROSPACE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 23. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR FOOD PROCESSING, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 24. GLOBAL INDUSTRIAL CLEANING MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 25. NORTH AMERICA INDUSTRIAL CLEANING MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 26. NORTH AMERICA INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 27. NORTH AMERICA INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 28. NORTH AMERICA INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 29. U.S INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 30. U.S INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 31. U.S INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 32. CANADA INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 33. CANADA INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 34. CANADA INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 35. EUROPE INDUSTRIAL CLEANING MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 36. EUROPE INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 37. EUROPE INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 38. EUROPE INDUSTRIAL CLEANING MARKET VALUE, APPLICATION, 2021-2027 (USD BILLION)

TABLE 39. GERMANY INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 40. GERMANY INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 41. GERMANY INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 42. U.K INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 43. U.K INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 44. U.K INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 45. FRANCE INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 46. FRANCE INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 47. FRANCE INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 48. ITALY INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 49. ITALY INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 50. ITALY INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 51. SPAIN INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 52. SPAIN INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 53. SPAIN INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 54. ROE INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 55. ROE INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 56. ROE INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 57. ASIA PACIFIC INDUSTRIAL CLEANING MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 58. ASIA PACIFIC INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 59. ASIA PACIFIC INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 60. ASIA PACIFIC INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 61. CHINA INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 62. CHINA INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 63. CHINA INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 64. INDIA INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 65. INDIA INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 66. INDIA INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 67. JAPAN INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 68. JAPAN INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 69. JAPAN INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 70. REST OF APAC INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 71. REST OF APAC INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 72. REST OF APAC INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 73. REST OF WORLD INDUSTRIAL CLEANING MARKET VALUE, BY INGREDIENT, 2021-2027 (USD BILLION)

TABLE 74. REST OF WORLD INDUSTRIAL CLEANING MARKET VALUE, BY PRODUCT, 2021-2027 (USD BILLION)

TABLE 75. REST OF WORLD INDUSTRIAL CLEANING MARKET VALUE, BY APPLICATION, 2021-2027 (USD BILLION)

TABLE 76. ARCOT MANUFACTURING CORPORATION: FINANCIALS

TABLE 77. ARCOT MANUFACTURING CORPORATION: PRODUCTS & SERVICES

TABLE 78. ARCOT MANUFACTURING CORPORATION: RECENT DEVELOPMENTS

TABLE 79. DUPONT DE NEMOURS INC: FINANCIALS

TABLE 80. DUPONT DE NEMOURS INC: PRODUCTS & SERVICES

TABLE 81. DUPONT DE NEMOURS INC: RECENT DEVELOPMENTS

TABLE 82. PILOT CHEMICAL CORP: FINANCIALS

TABLE 83. PILOT CHEMICAL CORP: PRODUCTS & SERVICES

TABLE 84. PILOT CHEMICAL CORP: RECENT DEVELOPMENTS

TABLE 85. SPARTAN CHEMICAL COMPANY, INC: FINANCIALS

TABLE 86. SPARTAN CHEMICAL COMPANY, INC: PRODUCTS & SERVICES

TABLE 87. SPARTAN CHEMICAL COMPANY, INC: RECENT DEVELOPMENTS

TABLE 88. NYCO PRODUCTS COMPANY: FINANCIALS

TABLE 89. NYCO PRODUCTS COMPANY: PRODUCTS & SERVICES

TABLE 90. NYCO PRODUCTS COMPANY: RECENT DEVELOPMENTS

TABLE 91. CRODA INTERNATIONAL PLC: FINANCIALS

TABLE 92. CRODA INTERNATIONAL PLC: PRODUCTS & SERVICES

TABLE 93. CRODA INTERNATIONAL PLC: RECENT DEVELOPMENTS

TABLE 94. EMULSO CORPORATION: FINANCIALS

TABLE 95. EMULSO CORPORATION: PRODUCTS & SERVICES

TABLE 96. EMULSO CORPORATION: RECENT DEVELOPMENTS

TABLE 97. EVONIK INDUSTRIES AG: FINANCIALS

TABLE 98. EVONIK INDUSTRIES AG: PRODUCTS & SERVICES

TABLE 99. EVONIK INDUSTRIES AG: RECENT DEVELOPMENTS

TABLE 100. HUNTSMAN CORPORATION: FINANCIALS

TABLE 101. HUNTSMAN CORPORATION: PRODUCTS & SERVICES

TABLE 102. HUNTSMAN CORPORATION: RECENT DEVELOPMENTS

TABLE 103. PRIME INDUSTRIES LTD: FINANCIALS

TABLE 104. PRIME INDUSTRIES LTD: PRODUCTS & SERVICES

TABLE 105. PRIME INDUSTRIES LTD: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.