Global Immunotherapy Drugs Market Forecast to 2025

- March, 2019

- Domain: Healthcare - Biotechnology

- Get Free 10% Customization in this Report

[104 pages report] This market research report includes a detailed segmentation of the global immunotherapy drugs market by drug type (monoclonal antibodies, vaccine, non-specific immunotherapies, adaptive cell therapy, and others), by treatment area (cancer, inflammatory and autoimmune disease, infectious disease, and others), by regions (North America, Europe, Asia Pacific, and Rest of the World).

Overview of the Global Immunotherapy Drugs Market

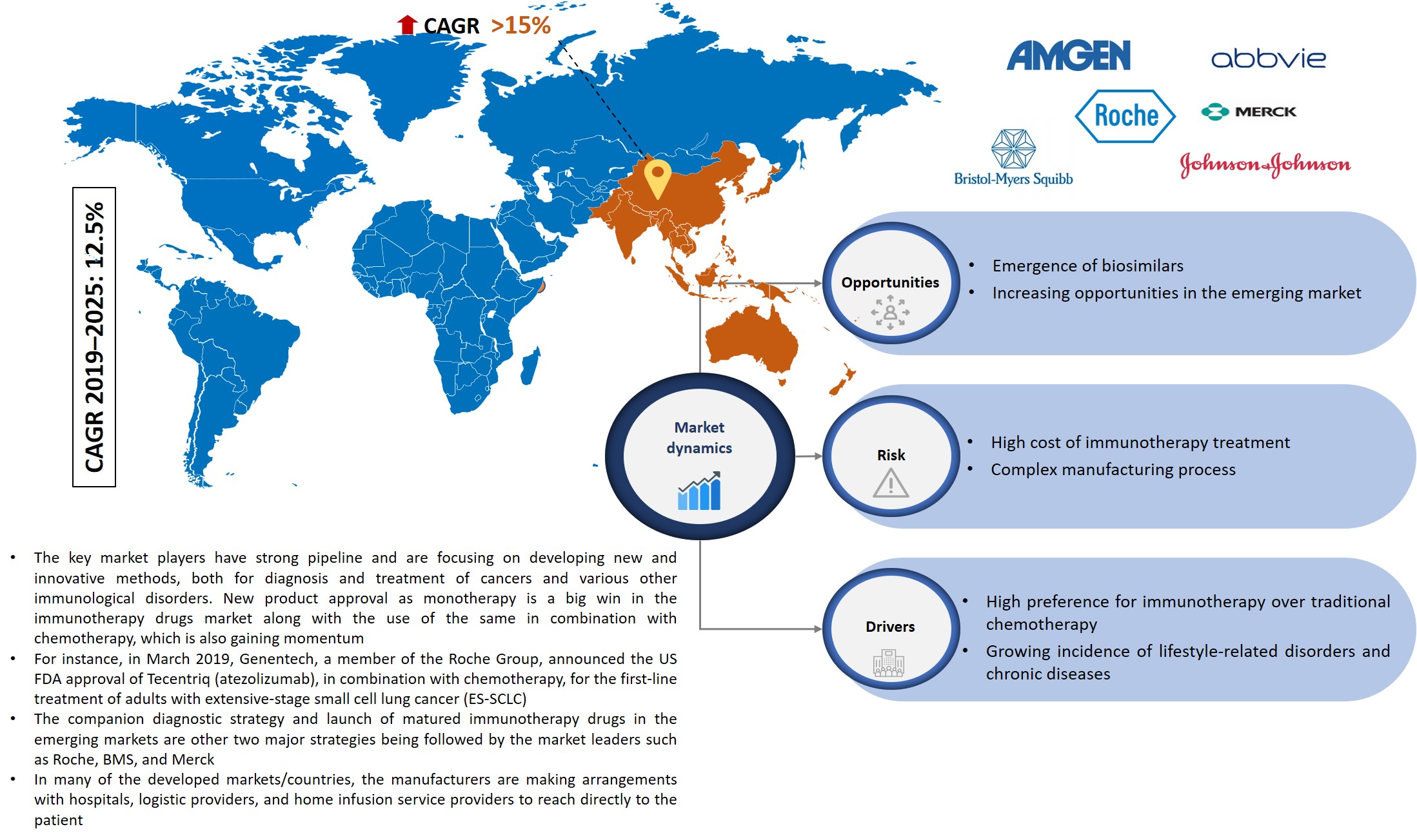

Infoholic’s market research report predicts that the “Global Immunotherapy Drugs Market” will grow at a CAGR of 12.5% during the forecast period. The market has witnessed steady growth in the past few years, and the introduction of novel products has increased the acceptance of immunotherapy drugs in the market. The market is fueled by an upsurge in the incidence of lifestyle and chronic disease globally, reduction in disease recurrence, increasing product approval, and high preference for immunotherapy over traditional chemotherapy.

The growing market trend continues and is becoming one of the increasingly accepted treatments across many countries worldwide. The manufacturers are focusing on new approvals, collaboration, and development of new products due to the increase in demand for immunotherapy drugs for the treatment of cancer and other diseases. Most of the revenue is generated from the leading players in the market with dominant sales such as AbbVie, Inc., Amgen, Inc., F. Hoffmann-La Roche Ltd., Bristol–Myers Squibb, Johnson and Johnson, and Merck & Co., Inc.

According to Infoholic Research analysis, North America accounted for the largest share of the global immunotherapy drugs market in 2018. The US dominates the market owing to the presence of most of the immunotherapy drugs manufacturers in the region. Asia Pacific is expected to grow at the fastest rate during the forecast period, owing to factors such as growing incidence of lifestyle diseases, increasing adoption of novel treatment, and low manufacturing cost.

By Drug Type:

- Monoclonal Antibodies (mAbs)

- Vaccines

- Non-specific Immunotherapies

- Adaptive Cell Therapy

- Others

The monoclonal antibodies segment occupied the largest share in 2018 and is expected to grow at low-double-digit CAGR during the forecast period. The adaptive cell therapy segment is expected to grow at a high CAGR during the forecast period 2019–2025.

By Treatment Area:

- Cancer

- Inflammation and Autoimmune Disease

- Infectious Disease

- Others

In 2018, the cancer segment occupied the largest share and is expected to grow at a high CAGR during the forecast period due to the rising incidence of cancer globally and increasing preference for immunotherapy as a first line of treatment.

By Regions:

- North America

- Europe

- APAC

- RoW

North America is dominant in the global immunotherapy drugs market, followed by Europe and Asia Pacific. The significant share of the North America market comes from the US due to the availability of favorable reimbursement policies.

Immunotherapy Drugs Market Research Competitive Analysis – The global immunotherapy drugs market has massive growth opportunities in both developed and developing regions. The introduction of a novel product with affordable drug cost is expected to increase the competition among the market players.

Many companies are currently focused on approvals, collaboration, and development of new products related to immunotherapy drugs due to increased demand for this therapy to treat various disease types.

For instance, in January 2019, BioNTech AG inked a deal with MAB Discovery GmbH to acquire MAB’s operational antibody generation unit. The acquisition helps to expand BioNTech, which is a top privately-held developer of RNA-based therapeutics, further into monoclonal antibody (mAb) development to develop new treatments that combine technologies of both the companies. In June 2018, Novartis received European approval for Aimovig, for the prevention of migraine in adults, and it works by blocking the activity of calcitonin gene-related peptide (CGRP) that is involved in migraine attacks. It is the only treatment specifically designed for migraine prevention to be approved in the European Union. In addition, other leading vendors are focusing on hugely investing in R&D activities to develop new products to obtain a high share in the market.

Key Vendors:

- AbbVie, Inc.

- Amgen, Inc.

- Hoffmann-La Roche Ltd.

- Bristol–Myers Squibb

- Johnson and Johnson

- Merck & Co., Inc.

Key Competitive Facts

- Increasing disease incidence, aging population, promising repayment or reimbursement plans in few nations, and enormous R&D activities for the immunotherapy drug development are the major factors driving the market growth.

- With more than 8,000 ongoing trials for cancer immunotherapy, a huge amount of study concentrated on checkpoint inhibitors (CPi) and combinations with chemotherapies, targeted therapies, and other immune-oncology (IO) agents.

Benefits – The report provides complete details about the related sub-segments of the immunotherapy drugs market. Through this report, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives toward the disease management in the upcoming years along with details of the existing pure-play companies and new players entering the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to key stakeholders in order to expand their business and capture the revenue in specific verticals, and to analyze before investing or expanding the business in this market.

Key Takeaways:

- Understanding the potential market opportunity with precise market size and forecast data.

- A detailed market analysis focusing on the growth of the immunotherapy drugs

- Factors influencing the growth of the immunotherapy drugs

- In-depth competitive analysis of dominant and pure-play vendors.

- Prediction analysis of the immunotherapy drugs market in both developed and developing regions.

- Key insights related to major segments of the immunotherapy drugs

- Latest market trend analysis impacting the buying behavior of the consumers.

Key Stakeholders

1 Industry Outlook

1.1 Industry Overview

1.1.1 Global Drivers for Pharmaceutical Demand

1.1.2 R&D Pipeline in Pharmaceutical Industry

1.1.3 Top Pharma Drugs by Sales

1.2 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Benefits of Immunotherapy

3.3 Segmented Addressable Market

3.4 Trends in the Immunotherapy Drugs Market

3.5 Related Markets

3.5.1 Human Insulin

3.5.2 Oncology Drugs

4 Market Outlook

4.1 List of Cancer Immunotherapy Drugs Approved

4.2 Market Segmentation

4.3 PEST Analysis

4.4 Porter 5(Five) Forces

5 Market Characteristics

5.1 DRO – Market Dynamics

5.1.1 Drivers

5.1.1.1 High preference for immunotherapy over traditional chemotherapy

5.1.1.2 Growing incidence of lifestyle-related disorders and chronic diseases

5.1.2 Opportunities

5.1.2.1 Emergence of biosimilars

5.1.2.2 Increasing opportunities in the emerging market

5.1.3 Restraints

5.1.3.1 High cost of immunotherapy treatment

5.1.3.2 Complex manufacturing processes

5.2 DRO – Impact Analysis

5.3 Key Stakeholders

6 Drug Types: Market Size and Analysis

6.1 Overview

6.2 Monoclonal Antibodies

6.3 Vaccine

6.4 Non-specific Immunotherapy

6.5 Adaptive Cell Therapy

6.6 Others

7 Treatment Area: Market Size and Analysis

7.1 Overview

7.2 Cancer

7.3 Inflammatory and Autoimmune Disease

7.4 Infectious Disease

7.5 Others

8 Regions: Market Size and Analysis

8.1 Overview

8.2 North America

8.3 Europe

8.4 Asia Pacific

8.5 Rest of the World

9 Competitive Landscape

9.1 Overview

10 Vendors Profile

10.1 AbbVie, Inc.

10.1.1 Overview

10.1.2 Geographic Revenue

10.1.3 Business Focus

10.1.4 SWOT Analysis

10.1.5 Business Strategies

10.2 Amgen, Inc.

10.2.1 Overview

10.2.2 Geographic Revenue

10.2.3 Business Focus

10.2.4 SWOT Analysis

10.2.5 Business Strategies

10.3 F. Hoffmann-La Roche Ltd

10.3.1 Overview

10.3.2 Business Units

10.3.3 Geographic Revenue

10.3.4 Business Focus

10.3.5 SWOT Analysis

10.3.6 Business Strategies

10.4 Bristol–Myers Squibb

10.4.1 Overview

10.4.2 Geographic Revenue

10.4.3 Business Focus

10.4.4 SWOT Analysis

10.4.5 Business Strategies

10.5 Johnson & Johnson

10.5.1 Overview

10.5.2 Business Units

10.5.3 Geographic Revenue

10.5.4 Business Focus

10.5.5 SWOT Analysis

10.5.6 Business Strategies

10.6 Merck & Co., Inc.

10.6.1 Overview

10.6.2 Business Units

10.6.3 Geographic Revenue

10.6.4 Business Focus

10.6.5 SWOT Analysis

10.6.6 Business Strategies

11 Companies to Watch for

11.1 Novartis AG

11.1.1 Overview

11.2 GlaxoSmithKline plc

11.2.1 Overview

11.3 AstraZeneca PLC

11.3.1 Overview

11.4 Eli Lilly and Company Ltd.

11.4.1 Overview

Annexure

Abbreviations

TABLE 1 LIST OF CANCER IMMUNOTHERAPY DRUGS APPROVED (2016-APRIL 2019) 24

TABLE 2 GLOBAL IMMUNOTHERAPY DRUGS MARKET REVENUE BY DRUG TYPE, 2018–2025 ($BILLION) 35

TABLE 3 GLOBAL IMMUNOTHERAPY DRUGS MARKET REVENUE BY TREATMENT AREA, 2018–2025 ($BILLION) 44

TABLE 4 GLOBAL IMMUNOTHERAPY DRUGS MARKET REVENUE BY REGIONS, 2018–2025 ($BILLION) 51

TABLE 5 GLOBAL IMMUNOTHERAPY DRUGS MARKET BY VENDOR RANKING, 2018 60

TABLE 6 OTHER PROMINENT VENDORS OF IMMUNOTHERAPY DRUGS MARKET 60

TABLE 7 ABBVIE INC.: OFFERINGS 61

TABLE 8 ABBVIE INC.: RECENT DEVELOPMENTS 61

TABLE 9 AMGEN INC.: OFFERINGS 66

TABLE 10 AMGEN INC.: RECENT DEVELOPMENTS 66

TABLE 11 F. HOFFMANN-LA ROCHE LTD.: PRODUCT OFFERINGS 71

TABLE 12 F. HOFFMANN-LA ROCHE LTD.: RECENT DEVELOPMENTS 71

TABLE 13 BRISTOL-MYERS SQUIBB: OFFERINGS 75

TABLE 14 BRISTOL-MYERS SQUIBB: RECENT DEVELOPMENT 75

TABLE 15 JOHNSON & JOHNSON: PRODUCT OFFERINGS 81

TABLE 16 JOHNSON & JOHNSON: RECENT DEVELOPMENTS 81

TABLE 17 MERCK & CO., INC.: PRODUCT OFFERINGS 88

TABLE 18 MERCK & CO., INC.: RECENT DEVELOPMENTS 89

TABLE 19 NOVARTIS AG: SNAPSHOT 95

TABLE 20 NOVARTIS AG: RECENT DEVELOPMENTS 95

TABLE 21 GLAXOSMITHKLINE PLC: SNAPSHOT 98

TABLE 22 GLAXOSMITHKLINE PLC: RECENT DEVELOPMENTS 98

TABLE 23 ASTRAZENECA PLC: SNAPSHOT 100

TABLE 24 ASTRAZENECA PLC: RECENT DEVELOPMENTS 100

TABLE 25 ELI LILLY AND COMPANY LTD: SNAPSHOT 101

TABLE 26 ELI LILLY AND COMPANY LTD: RECENT DEVELOPMENTS 101

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.