Healthcare Fraud Analytics Market by Delivery (On-premise and On-demand), Application (Insurance Claims Review, Pharmacy Billing Misuse, Payment Integrity, and Other applications), End-User (Public & Government Agencies, Private Insurance Payers, Third-party service providers, and Employers), Geography – Global Drivers, Restraints, Opportunities, Trends, and Forecast up to 2026

- September, 2020

- Domain: Healthcare - Healthcare IT

- Get Free 10% Customization in this Report

“Health is wealth” is an old adage that we all have heard since time immemorial. The importance of health need not be told or explained to anyone. In the wake of the pandemic, which has hit us hard, we cannot emphasize more on the importance of the healthcare sector. Still, the rising number of fraudulent cases in the healthcare area all around the globe and the insurance industry, which seems to be leveraging the opportunity lurking in this area, are the factors that are quite worrisome. There are hovering concerns regarding the healthcare fraud analytics industry; the most common among them is the lack of privacy and an acute shortage of data scientists, which seem to affect the market in a negative manner. For sure, the hospital industry is growing, and with it, the expenditure concerning technological advancements has also shot up. Though there has been a slight reduction in the number of days of the average hospital stay per person (from 7 days to 5-6 days), there has been an increase in the total number of hospital admissions in 2017 (36.5 million). One of the major reasons which are responsible for fuelling up the hospital market in the US is an increase in the elderly population. The multi-specialty, as well as super-specialty hospitals, has in store a plethora of opportunities for the forecast period of 2020-2026. Since the micro-hospitals are providing personalized care all around the clock with a waiting period of fewer than 5 minutes, they are gaining huge popularity among people. Because of the ongoing advancements, the hospital industry is growing and is likely to hold many such opportunities for the market of Healthcare Fraud Analytics in the near future.

Research Methodology:

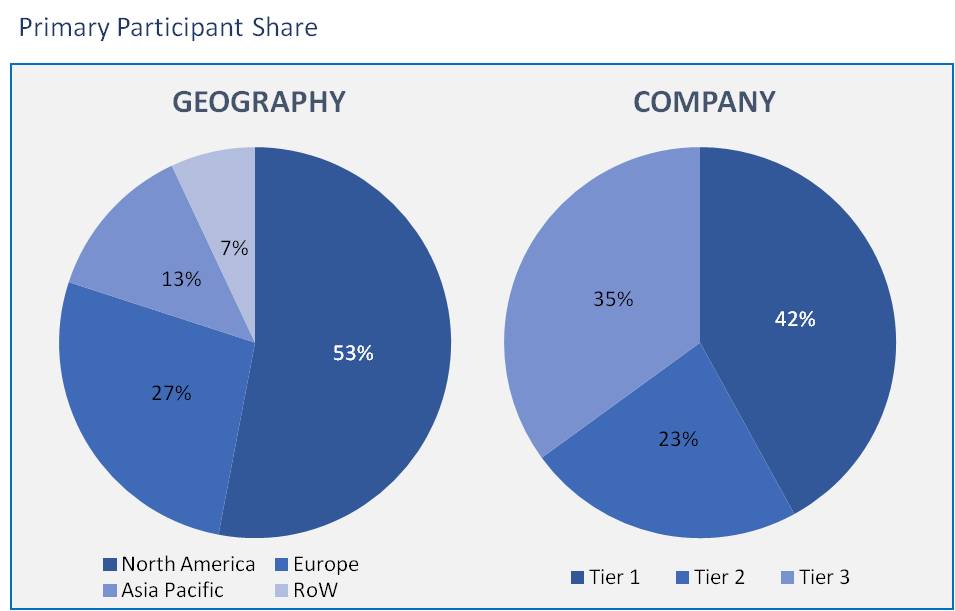

The healthcare fraud analytics market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

The market of healthcare fraud analytics is expected to reach $5.87 billion by 2026 at a CAGR of ~32.18% during the forecast period of 2020-2026

The segmentation of the Market is enumerated below:

By Delivery model

- On-premise

- On-demand

By Application

- Insurance Claims Review

- Pharmacy Billing Misuse

- Payment Integrity

- Other applications

By End-User

- Public & Government Agencies

- Private Insurance Payers

- Third-party service providers

- Employers

By Region

- North America

- Europe

- APAC

- RoW

By Solution Type

- Descriptive Analytics

- Predictive Analytics

- Prescriptive Analytics

On the basis of kind of solution, the market of Healthcare Fraud Analytics witnesses the descriptive Analytics segment holding the largest share as of 2019. The Descriptive Analytics segment forms the base for the effective application of prescriptive or predictive analytics. Therefore, these analytics use the basics of descriptive analytics and then integrate them with those of the additional sources of data, which in turn leads to the generation of meaningful insights.

As per the analysis based on application, the market is furcated into insurance claims review, pharmacy billing misuse, payment integrity, and other applications. The insurance claims review segment as of 2019 dominated the healthcare fraud analytics market. The major drivers of the growth of this segment are the rising number of fraudulent claims, the growing patients’ count seeking health insurance, and the growing adoption of the prepayment review model.

The end-users segment in this market can be segregated into hospitals, home care settings, ambulatory care settings, academic and research institutes. The segment holding the major share in this market is the hospital segment owing to the specialized Healthcare Fraud Analytics adopted by the hospitals and the presence of trained professionals for operating them efficiently.

Geographically, the global healthcare fraud analytics market is segmented into North America, Europe, the Asia Pacific, and the Rest of the World. North America witnessed the largest share of the market in 2019. The largest share of the North American market is ascribed to a drastic increase in healthcare frauds, the large volume of people taking health insurance, the burden of reducing healthcare costs, beneficial government anti-fraud initiatives, technological advancements, and greater product and service availability in this region. Also, a majority of dominant players in the market of healthcare fraud detection have their headquarters situated in North America.

The major vendors of the Healthcare Fraud Analytics Market are WhiteHatAI, Healthcare Fraud Shield, FraudLens, Inc, HMS, FraudScope, Inc, IBM, Optum (A Part of UnitedHealth Group), Cotiviti Holdings, Inc, Fair Isaac Corporation, SAS Institute, Change Healthcare, EXL Service Holdings, Inc, Wipro, Conduent, Inc, CL Technologies, CGI Group, DXC Technology Company, and Northrop Grumman Corporation

This report analysis helps the vendors in the market to know the current trends, dynamics, and opportunities of the market and the needs of the end-users. The value of the market on non-quantifiable bases and the analysis of revenues and market share enhances the user experience of the report.

- The competitive analysis of the major players enables users to understand the dynamic strategies such as technology innovation, partnerships, merger & acquisitions and joint ventures of the key players

- This report also provides the SWOT analysis, portfolio analysis, capability analysis of the leading players

- Quantitative analysis of the market enables users to understand the actual facts of the market across four major regions

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- PEST Analysis

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Evolution

- Market Trends and Impact

- Advantages/Disadvantages of Market

- Regulatory Impact

- Market Offerings

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

5. Delivery Model: Market Size & Analysis

5.1. Overview

5.2. On-premise

5.3. On-demand

6. Application: Market Size & Analysis

6.1. Overview

6.2. Insurance Claims Review

6.2.1. Post payment Review

6.2.2. Prepayment Review

6.3. Pharmacy Billing Misuse

6.4. Other applications

7. End-user: Market Size & Analysis

7.1. Overview

7.2. Public & Government Agencies

7.3. Private Insurance Payers

7.4. Third-party service providers

7.5. Employers

8. Solution Type: Market Size & Analysis

8.1. Overview

8.2. Descriptive Analytics

8.3. Predictive Analytics

8.4. Prescriptive Analytics

9. Geography: Market Size & Analysis

9.1. Overview

9.2. North America

9.3. Europe

9.4. Asia Pacific

9.5. Rest of the World

10. Competitive Landscape

10.1. Competitor Comparison Analysis

10.2. Market Developments

10.2.1. Mergers and Acquisitions, Legal, Awards, Partnerships

10.2.2. Product Launches and execution

11. Vendor Profiles

11.1. IBM.

11.1.1. Overview

11.1.2. Product Offerings

11.1.3. Geographic Revenue

11.1.4. Business Units

11.1.5. Developments

11.1.6. Business Strategy

11.2. Optum

11.2.1. Overview

11.2.2. Product Offerings

11.2.3. Geographic Revenue

11.2.4. Business Units

11.2.5. Developments

11.2.6. Business Strategy

11.3. Cotiviti Holdings, Inc

11.3.1. Overview

11.3.2. Product Offerings

11.3.3. Geographic Revenue

11.3.4. Business Units

11.3.5. Developments

11.3.6. Business Strategy

11.4. Fair Isaac Corporation.

11.4.1. Overview

11.4.2. Product Offerings

11.4.3. Geographic Revenue

11.4.4. Business Units

11.4.5. Developments

11.4.6. Business Strategy

11.5. SAS Institute

11.5.1. Overview

11.5.2. Product Offerings

11.5.3. Geographic Revenue

11.5.4. Business Units

11.5.5. Developments

11.5.6. Business Strategy

11.6. Change Healthcare

11.6.1. Overview

11.6.2. Product Offerings

11.6.3. Geographic Revenue

11.6.4. Business Units

11.6.5. Developments

11.6.6. Business Strategy

11.7. EXL Service Holdings, Inc.

11.7.1. Overview

11.7.2. Product Offerings

11.7.3. Geographic Revenue

11.7.4. Business Units

11.7.5. Developments

11.7.6. Business Strategy

11.8. Wipro

11.8.1. Overview

11.8.2. Product Offerings

11.8.3. Geographic Revenue

11.8.4. Business Units

11.8.5. Developments

11.8.6. Business Strategy

11.9. Conduent, Inc

11.9.1. Overview

11.9.2. Product Offerings

11.9.3. Geographic Revenue

11.9.4. Business Units

11.9.5. Developments

11.9.6. Business Strategy

11.10. HCL Technologies.

11.10.1. Overview

11.10.2. Product Offerings

11.10.3. Geographic Revenue

11.10.4. Business Units

11.10.5. Developments

11.10.6. Business Strategy

12. Companies to Watch

12.1. CGI Group.

12.1.1. Overview

12.1.2. Market

12.1.3. Business Strategy

12.2. DXC Technology Company.

12.2.1. Overview

12.2.2. Market

12.2.3. Business Strategy

12.3. Northrop Grumman Corporation

12.3.1. Overview

12.3.2. Market

12.3.3. Business Strategy

12.4. LexisNexis

12.4.1. Overview

12.4.2. Market

12.4.3. Business Strategy

12.5. Pondera Solutions

12.5.1. Overview

12.5.2. Market

12.5.3. Business Strategy

12.6. WhiteHatAI.

12.6.1. Overview

12.6.2. Market

12.6.3. Business Strategy

12.7. Healthcare Fraud Shield.

12.7.1. Overview

12.7.2. Market

12.7.3. Business Strategy

12.8. FraudLens, Inc

12.8.1. Overview

12.8.2. Market

12.8.3. Business Strategy

12.9. HMS

12.9.1. Overview

12.9.2. Market

12.9.3. Business Strategy

12.10. FraudScope, Inc

12.10.1. Overview

12.10.2. Market

13. Analyst Opinion

14. Annexure

14.1. Report Scope

14.2. Market Definitions

14.3. Research Methodology

14.3.1 Data Collation and In-house Estimation

14.3.2. Market Triangulation

14.3.2. Forecasting

15. Report Assumptions

16. Declarations

17. Stakeholders

18. Abbreviations

TABLE 1. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 2. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR ON-PREMISE, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 3. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR ON-DEMAND, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 4. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY APPLICATION, 2020-2026 (USD MILLION)

TABLE 5. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR INSURANCE CLAIMS REVIEW, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 6. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR POSTPAYMENT REVIEW, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 7. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR PREPAYMENT REVIEW, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 8. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR PHARMACY BILLING MISUSE, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 9. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR PAYMENT INTEGRITY, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 10. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR OTHER APPLICATIONS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 11. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY END USER, 2020-2026 (USD MILLION)

TABLE 12. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR PUBLIC & GOVERNMENT AGENCIES, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 13. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR PRIVATE INSURANCE PAYERS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 14. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR THIRD-PARTY SERVICE PROVIDERS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 15. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR EMPLOYERS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 16. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY SOLUTION TYPE, 2020-2026 (USD MILLION)

TABLE 17. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR DESCRIPTIVE ANALYTICS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 18. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR PREDICTIVE ANALYTICS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 19. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR PRESCRIPTIVE ANALYTICS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 20. GLOBAL HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY REGION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 21. NORTH AMERICA HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 22. NORTH AMERICA HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 23. NORTH AMERICA HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 24. NORTH AMERICA HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 25. NORTH AMERICA HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 26. U.S. HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 27. U.S. HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 28. U.S. HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 29. U.S. HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 30. CANADA HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 31. CANADA HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 32. CANADA HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 33. CANADA HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 34. EUROPE AMERICA HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 35. EUROPE HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 36. EUROPE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 37. EUROPE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 38. EUROPE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 39. GERMANY HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 40. GERMANY HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 41. GERMANY HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 42. GERMANY HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 43. UK HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 44. UK HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 45. UK HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 46. UK HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 47. FRANCE HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 48. FRANCE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 49. FRANCE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 50. FRANCE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 51. ROE HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 52. ROE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 53. ROE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 54. ROE HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 55. ASIA PACIFIC HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 56. ASIA PACIFIC HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 57. ASIA PACIFIC HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 58. ASIA PACIFIC HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 59. ROW HEALTHCARE FRAUD ANALYTICS MARKET VALUE, BY DELIVERY MODEL, 2020-2026 (USD MILLION)

TABLE 60. ROW HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR APPLICATION, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 61. ROW HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR END USER, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 62. ROW HEALTHCARE FRAUD ANALYTICS MARKET VALUE FOR SOLUTION TYPE, BY GEOGRAPHY 2020-2026 (USD MILLION)

TABLE 63. IBM.: OVERVIEW

TABLE 64. IBM.: STRATEGIC SNAPSHOT

TABLE 65. IBM.: BUSINESS FOCUS

TABLE 66. IBM.: END USER/SERVICE PORTFOLIO

TABLE 67. OPTUM: OVERVIEW

TABLE 68. OPTUM: STRATEGIC SNAPSHOT

TABLE 69. OPTUM: BUSINESS FOCUS

TABLE 70. OPTUM: END USER/SERVICE PORTFOLIO

TABLE 71. COTIVITI HOLDINGS, INC: OVERVIEW

TABLE 72. COTIVITI HOLDINGS, INC: STRATEGIC SNAPSHOT

TABLE 73. COTIVITI HOLDINGS, INC: BUSINESS FOCUS

TABLE 74. COTIVITI HOLDINGS, INC: END USER/SERVICE PORTFOLIO

TABLE 75. FAIR ISAAC CORPORATION. : OVERVIEW

TABLE 76. FAIR ISAAC CORPORATION.: STRATEGIC SNAPSHOT

TABLE 77. FAIR ISAAC CORPORATION.: BUSINESS FOCUS

TABLE 78. FAIR ISAAC CORPORATION.: END USER/SERVICE PORTFOLIO

TABLE 79. SAS INSTITUTE: OVERVIEW

TABLE 80. SAS INSTITUTE: STRATEGIC SNAPSHOT

TABLE 81. SAS INSTITUTE: BUSINESS FOCUS

TABLE 82. SAS INSTITUTE: END USER/SERVICE PORTFOLIO

TABLE 83. CHOICESPINE: OVERVIEW

TABLE 84. CHOICESPINE: STRATEGIC SNAPSHOT

TABLE 85. CHOICESPINE: BUSINESS FOCUS

TABLE 86. CHOICESPINE: END USER/SERVICE PORTFOLIO

TABLE 87. EXL SERVICE HOLDINGS, INC.: OVERVIEW

TABLE 88. EXL SERVICE HOLDINGS, INC.: STRATEGIC SNAPSHOT

TABLE 89. EXL SERVICE HOLDINGS, INC.: BUSINESS FOCUS

TABLE 90. EXL SERVICE HOLDINGS, INC.: END USER/SERVICE PORTFOLIO

TABLE 91. WIPRO: OVERVIEW

TABLE 92. WIPRO: STRATEGIC SNAPSHOT

TABLE 93. WIPRO: BUSINESS FOCUS

TABLE 94. WIPRO: END USER/SERVICE PORTFOLIO

TABLE 95. CONDUENT, INC: OVERVIEW

TABLE 96. CONDUENT, INC: STRATEGIC SNAPSHOT

TABLE 97. CONDUENT, INC: BUSINESS FOCUS

TABLE 98. CONDUENT, INC: END USER/SERVICE PORTFOLIO

TABLE 99. HCL TECHNOLOGIES.: OVERVIEW

TABLE 100. HCL TECHNOLOGIES.: STRATEGIC SNAPSHOT

TABLE 101. HCL TECHNOLOGIES.: BUSINESS FOCUS

TABLE 102. HCL TECHNOLOGIES.: END USER/SERVICE PORTFOLIO

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.