Fleet Management Market segmented by Solutions (Operations Management, Performance Management, Vehicle Maintenance & Diagnostics, Fleet Analytics & Reporting and Others), Services (Professional Services & Managed Services), Fleet Type (Commercial Fleets & Passenger Cars), and Geography – Global Drivers, Restraints, Opportunities, Trends, and Forecast up to 2026

- September, 2020

- Domain: ICT - Social, Mobile, Analytics & Cloud (SMAC)

- Get Free 10% Customization in this Report

Fleet management is the systematic management of the vehicle profile, which are used for business purpose. Fleet management involves various functions such as vehicle maintenance, vehicle financing, fuel management, licensing, and other functions. This management helps transport based firms to control the risks related to vehicle investment and minimizing the costs of transportation and staff. The fleet management market growth is stimulated by factors such as increasing the operational efficiency of the business and rising deployment of cloud computing and large data analytics solution for efficient fleet management functions. Additionally, emerging initiatives concerned about environmental safety by controlling pollution is creating opportunities for fleet management. The market for fleet management is predicted to grow at a CAGR of 15.3% during the forecasting period.

Research Methodology

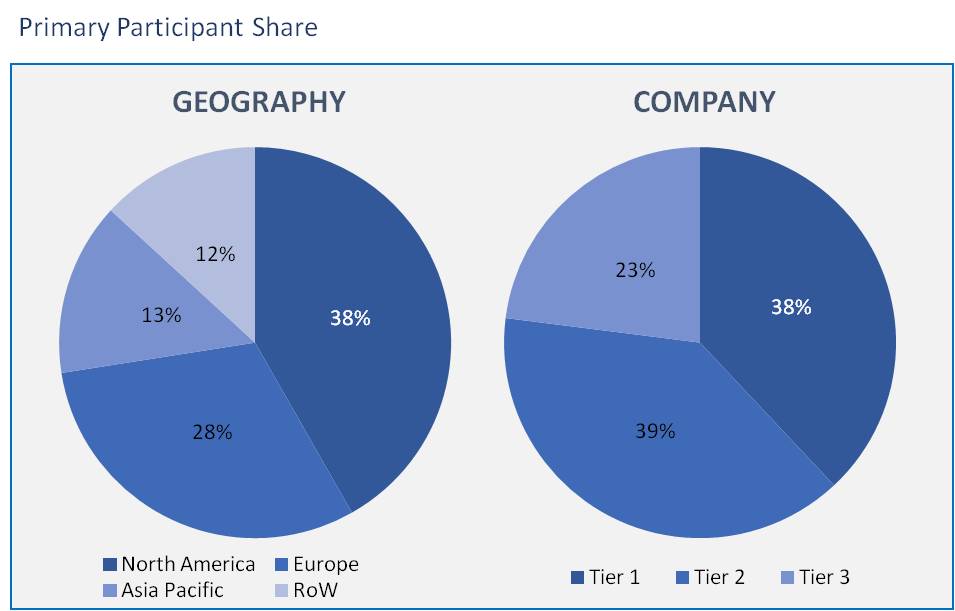

The fleet management market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

Fleet Management Market is segmented on the bases of solutions, services, components, fleet type, and geography.

Solutions: Market Size & Analysis

- Operations Management

- Performance Management

- Vehicle Maintenance and Diagnostics

- Fleet Analytics and Reporting

- Others

Services: Market Size & Analysis

- Professional Services

- Managed Services

Fleet Type: Market Size & Analysis

- Commercial Fleets

- Passenger Cars

Geography: Market Size & Analysis

- North America

- Europe

- Asia Pacific

- Rest of the World

The market of fleet management based on the solution has been segmented into operations management, performance management, vehicle maintenance and diagnostics, fleet analytics and reporting, and others. The performance management solution has a rapidly increasing demand in the fleet management as it is widely opted by industries to manage the performance of the fleet to make sure the proper supply chain. A performance management solution provides the maintenance information of the fleet to reduce the engine downtime.

In the market by service, the professional service provider is anticipated to have a large market position. Professional service providers examine the fleet operations of logistics companies, that means understanding business restrictions, gives the key insights that assist the company in optimum usage of available resources and making the most of their technological investments.

In terms of division by fleet type, the market has been bifurcated among commercial fleets and passenger cars. The commercial fleet type is attributed to have the major share due to the high dependence on commercial fleets in manufacturing industries for on-time supply of the goods, to maintain the proper management of exchange, and also to track the fleet with fleet management solutions.

According to the regional market analysis, the fleet management market is segregated into North America, Europe, Asia Pacific, and the Rest of the world. North America is considered to have the highest growing market due to the growing deployment of software, which resulted in growth in the supply of raw materials. Europe is happening to reap the maximum market revenue next to North America due to the rapidly adopting corporate cars for the employees in the firms.

Globally, increasing dependence on advanced technology in terms of artificial intelligence in this domain is enhancing market growth. The other aspects accountable for the global market growth are the rising awareness of the safety of the fleet, mandatory implementation of the electronic logging devices in the commercial fleets to record the restricted driving hours which are scheduled by the government, and growing deployment of wireless technology due to the low costs. Moreover, the abruptly increasing data volumes in the world and rising cyber threats are likely to hamper the market growth

ARI Fleet Management, Azuga, Chevin Fleet Solutions, Donlen Corporation, GPS Insight, Masternaut, Nextraq, Keeptruckin, Avrios, ThingTech, Automile Inc, Fleetonomy, Fleetroot, Autofleet, and ClearPathGPS. These are a few companies which are playing a major role in market growth.

The large industries have widely adopted the fleet management process and are largely investing in frequently developing technologies. The mandatory initiative to protect the environment is an opportunity to raise the growth of the market. The fleet management market gives insights into market dynamics.

- The study presents a comprehensive fleet management market analysis in addition to present trends and future evaluations to explain the impending investment pockets.

- The fleet management market report offers insights into key drivers, constraints, and opportunities also their impact analysis.

- This study also provides a geographical analysis of the market in terms of market share and future prospective.

- This report also provides the strategic depiction of key companies, which helps players to understand the market competency.

1. Executive Summary

2. Industry Outlook

2.1. Industry Overview

2.2. Industry Trends

3. Market Snapshot

3.1. Total Addressable Market

3.2. Segment Addressable Market

3.2.1. PEST Analysis

3.2.2. Porter Five Forces

3.3. Related Markets

3.4. Ecosystem

4. Market Outlook

4.1. Overview

4.1.1. Market Evolution

4.2. Market Trends and Impact

4.3. Pricing Analysis

4.4. Market Segmentation

4.5. Market Dynamics

4.5.1. Drivers

4.5.2. Restraints

4.5.3. Opportunities

4.6. DRO - Impact Analysis

5. Solutions: Market Size & Analysis

5.1. Overview

5.2. Operations Management

5.3. Performance Management

5.4. Vehicle Maintenance and Diagnostics

5.5. Fleet Analytics and Reporting

5.6. Others

6. Services: Market Size & Analysis

6.1. Overview

6.2. Professional Services

6.3. Managed Services

7. Fleet Type: Market Size & Analysis

7.1. Overview

7.2. Commercial Fleets

7.3. Passenger Cars

8. Geography: Market Size & Analysis

8.1. Overview

8.2. North America

8.3. Europe

8.4. Asia Pacific

8.5. Rest of the World

9. Competitive Landscape

9.1. Competitor Comparison Analysis

9.2. Market Developments

9.2.1. Mergers and Acquisitions, Legal, Awards, Partnerships

9.2.2. Product Launches and execution

10. Vendor Profiles

10.1. ARI FLEET MANAGEMENT

10.1.1. Overview

10.1.2. Business Units

10.1.3. Geographic Revenue

10.1.4. Product Offerings

10.1.5. Developments

10.1.6. Business Strategy

10.2. AZUGA

10.2.1. Overview

10.2.2. Business Units

10.2.3. Geographic Revenue

10.2.4. Product Offerings

10.2.5. Developments

10.2.6. Business Strategy

10.3. CHEVIN FLEET SOLUTIONS

10.3.1. Overview

10.3.2. Business Units

10.3.3. Geographic Revenue

10.3.4. Product Offerings

10.3.5. Developments

10.3.6. Business Strategy

10.4. DONLEN CORPORATION

10.4.1. Overview

10.4.2. Business Units

10.4.3. Geographic Revenue

10.4.4. Product Offerings

10.4.5. Developments

10.4.6. Business Strategy

10.5. GPS INSIGHT

10.5.1. Overview

10.5.2. Business Units

10.5.3. Geographic Revenue

10.5.4. Product Offerings

10.5.5. Developments

10.5.6. Business Strategy

10.6. MASTERNAUT

10.6.1. Overview

10.6.2. Business Units

10.6.3. Geographic Revenue

10.6.4. Product Offerings

10.6.5. Developments

10.6.6. Business Strategy

10.7. NEXTRAQ

10.7.1. Overview

10.7.2. Business Units

10.7.3. Geographic Revenue

10.7.4. Product Offerings

10.7.5. Developments

10.7.6. Business Strategy

10.8. KEEPTRUCKIN

10.8.1. Overview

10.8.2. Business Units

10.8.3. Geographic Revenue

10.8.4. Product Offerings

10.8.5. Developments

10.8.6. Business Strategy

10.9. AVRIOS

10.9.1. Overview

10.9.2. Business Units

10.9.3. Geographic Revenue

10.9.4. Product Offerings

10.9.5. Developments

10.9.6. Business Strategy

10.10. ThingTech

10.10.1. Overview

10.10.2. Business Units

10.10.3. Geographic Revenue

10.10.4. Product Offerings

10.10.5. Developments

10.10.6. Business Strategy

11. Companies to Watch

11.1. Automile Inc

11.1.1. Overview

11.1.2. Market

11.1.3. Business Strategy

11.2. Fleetonomy

11.2.1. Overview

11.2.2. Market

11.2.3. Business Strategy

11.3. Fleetroot

11.3.1. Overview

11.3.2. Market

11.3.3. Business Strategy

11.4. Autofleet

11.4.1. Overview

11.4.2. Market

11.4.3. Business Strategy

11.5. ClearPathGPS

11.5.1. Overview

11.5.2. Market

11.5.3. Business Strategy

12. Analyst Opinion

13. Annexure

13.1. Report Scope

13.2. Market Definitions

13.3. Research Methodology

13.3.1. Data Collation and In-house Estimation

13.3.2. Market Triangulation

13.3.3. Forecasting

13.4. Report Assumptions

13.5. Declarations

13.6. Stakeholders

13.7. Abbreviation

TABLE 1. GLOBAL FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 2. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR OPERATIONS MANAGEMENT, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 3. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR PERFORMANCE MANAGEMENT, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 4. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR VEHICLE MAINTENANCE AND DIAGNOSTICS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 5. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR FLEET ANALYTICS AND REPORTING, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 6. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 7. GLOBAL FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 8. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR COMMERCIAL FLEETS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 9. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR PASSENGER CARS, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 10. GLOBAL FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 11. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR PROFESSIONAL SERVICES, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 12. GLOBAL FLEET MANAGEMENT MARKET VALUE FOR MANAGED SERVICES, BY GEOGRAPHY, 2020-2026 (USD MILLION)

TABLE 13. NORTH AMERICA FLEET MANAGEMENT MARKET VALUE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 14. NORTH AMERICA FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 15. NORTH AMERICA FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 16. NORTH AMERICA FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 17. NORTH AMERICA FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 18. U.S FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 19. U.S FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 20. U.S FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 21. U.S FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 22. CANADA FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 23. CANADA FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 24. CANADA FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 25. CANADA FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 26. EUROPE FLEET MANAGEMENT MARKET VALUE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 27. EUROPE FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 28. EUROPE FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 29. EUROPE FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 30. EUROPE FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 31. GERMANY FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 32. GERMANY FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 33. GERMANY FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 34. GERMANY FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 35. U.K FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 36. U.K FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 37. U.K FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 38. U.K FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 39. FRANCE FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 40. FRANCE FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 41. FRANCE FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 42. FRANCE FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 43. ROE FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 44. ROE FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 45. ROE FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 46. ROE FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 47. ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY COUNTRY, 2020-2026 (USD MILLION)

TABLE 48. ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 49. ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 50. ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 51. ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 52. CHINA FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 53. CHINA FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 54. CHINA FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 55. CHINA FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 56. JAPAN FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 57. JAPAN FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 58. JAPAN FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 59. JAPAN FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 60. INDIA FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 61. INDIA FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 62. INDIA FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 63. INDIA FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 64. REST OF ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 65. REST OF ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 66. REST OF ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 67. REST OF ASIA PACIFIC FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 68. REST OF WORLD FLEET MANAGEMENT MARKET VALUE, BY SOLUTIONS, 2020-2026 (USD MILLION)

TABLE 69. REST OF WORLD FLEET MANAGEMENT MARKET VALUE, BY COMPONENT, 2020-2026 (USD MILLION)

TABLE 70. REST OF WORLD FLEET MANAGEMENT MARKET VALUE, BY SERVICES, 2020-2026 (USD MILLION)

TABLE 71. REST OF WORLD FLEET MANAGEMENT MARKET VALUE, BY FLEET TYPE, 2020-2026 (USD MILLION)

TABLE 72. ARI FLEET MANAGEMENT.: OVERVIEW

TABLE 73. ARI FLEET MANAGEMENT.: STRATEGIC SNAPSHOT

TABLE 74. ARI FLEET MANAGEMENT.: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 75. ARI FLEET MANAGEMENT.: PRODUCT/SERVICE PORTFOLIO

TABLE 76. AZUGA: OVERVIEW

TABLE 77. AZUGA: STRATEGIC SNAPSHOT

TABLE 78. AZUGA: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 79. AZUGA: PRODUCT/SERVICE PORTFOLIO

TABLE 80. AVRIOS: OVERVIEW

TABLE 81. AVRIOS: STRATEGIC SNAPSHOT

TABLE 82. AVRIOS: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 83. AVRIOS: PRODUCT/SERVICE PORTFOLIO

TABLE 84. AUTOFLEET: OVERVIEW

TABLE 85. AUTOFLEET: STRATEGIC SNAPSHOT

TABLE 86. AUTOFLEET: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 87. AUTOFLEET: PRODUCT/SERVICE PORTFOLIO

TABLE 88. GPS INSIGHT: OVERVIEW

TABLE 89. GPS INSIGHT: STRATEGIC SNAPSHOT

TABLE 90. GPS INSIGHT: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 91. GPS INSIGHT: PRODUCT/SERVICE PORTFOLIO

TABLE 92. MASTERNAUT: OVERVIEW

TABLE 93. MASTERNAUT: STRATEGIC SNAPSHOT

TABLE 94. MASTERNAUT: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 95. MASTERNAUT: PRODUCT/SERVICE PORTFOLIO

TABLE 96. NEXTRAQ: OVERVIEW

TABLE 97. NEXTRAQ: STRATEGIC SNAPSHOT

TABLE 98. NEXTRAQ: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 99. NEXTRAQ: PRODUCT/SERVICE PORTFOLIO

TABLE 100. KEEPTRUCKIN.: OVERVIEW

TABLE 101. KEEPTRUCKIN.: STRATEGIC SNAPSHOT

TABLE 102. KEEPTRUCKIN.: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 103. KEEPTRUCKIN.: PRODUCT/SERVICE PORTFOLIO

TABLE 104. AVRIOS: OVERVIEW

TABLE 105. AVRIOS: STRATEGIC SNAPSHOT

TABLE 106. AVRIOS: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 107. AVRIOS: PRODUCT/SERVICE PORTFOLIO

TABLE 108. THINGTECH.: OVERVIEW

TABLE 109. THINGTECH.: STRATEGIC SNAPSHOT

TABLE 110. THINGTECH.: BUSINESS OPPORTUNITIES AND OUTLOOK

TABLE 111. THINGTECH.: PRODUCT/SERVICE PORTFOLIO

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.