Dimethylformamide Market based on Product Type (First grade, Qualified grade, Others), Applications (Catalyst, Reactant, Feedstock), End-Users (Agrochemical, Electronics, Chemical & Petrochemical, Pharmaceutical, Others) and Geography – Global Forecast up to 2027

- July, 2021

- Domain: Chemicals, Materials & Food - Agro, Pharma, Food & Personal Care

- Get Free 10% Customization in this Report

Dimethylformamide is a colorless organic compound with a formula (CH3)2NC(O)H and CAS number 68-12-2. Dimethylformamide is mainly used as an industrial solvent for several applications, including polymer fibers, films, and surface coatings. Dimethylformamide is a combination of methyl formate and dimethylamine or the combination of carbon monoxide with dimethylamine. Dimethylformamide is also utilized as a catalyst in several chemical reactions and used in raw material in various chemical reactions due to its miscibility with water and multiple compounds. The vigorous growth of the chemical and pharmaceutical industry worldwide is projected to drive the demand for dimethylformamide in various applications substantially. Owing to the great solubility of organic and inorganic remains, dimethylformamide is vastly used as a cleaner for hot-dip tinned parts in the chemical industry. Besides the driving factors, the factors such as government restrictions about the extent of usage of dimethylformamide in industries coupled with the global economic slowdown have impeded the market growth. The Dimethylformamide Market is likely to grow at the rate of 4.72% CAGR by 2027.

Research Methodology:

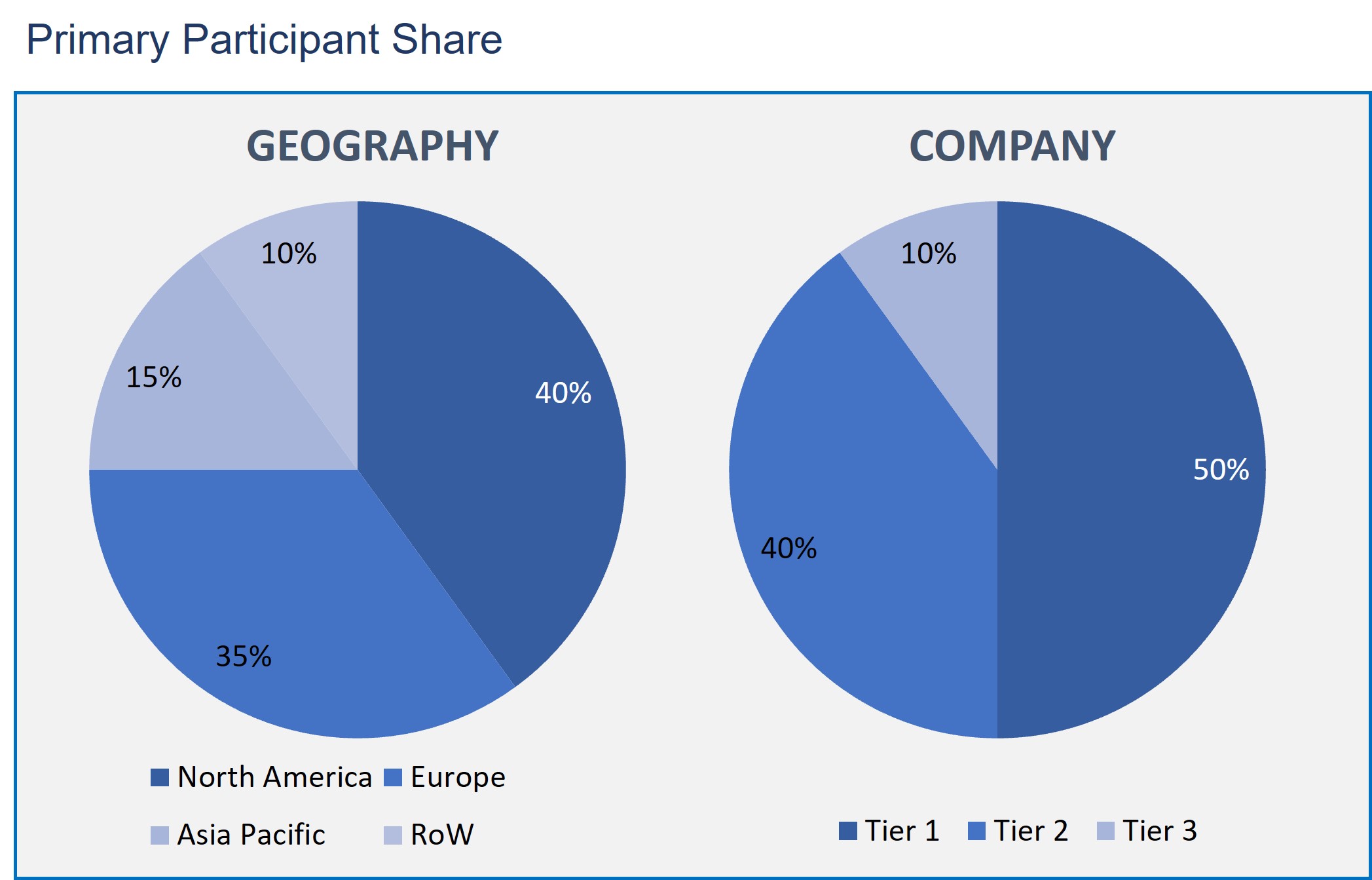

The Dimethylformamide Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Dimethylformamide Market based on Product Type

- First grade

- Qualified grade

- Others

Dimethylformamide Market based on Applications

- Catalyst

- Reactant

- Feedstock

Dimethylformamide Market based on End-Users

- Agrochemical

- Electronics

- Chemical & Petrochemical

- Pharmaceutical

- Others

Dimethylformamide Market based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

The dimethylformamide (DMF) market is bifurcated into first grade, qualified grade, and others based on product type. The first grade segment accounts for the major share of the market; On the other hand, the qualifier grade segment is projected to increase rapidly during the forecast period. The growth of the segment can be ascribed to the increasing use of these products in several industries.

As per the market by application, the market is classified into catalyst, reactant, and feedstock. The product is most widely used as a catalyst in various reactions performed in chemical and other industries. For instance, it is utilized as a catalyst in synthesizing acyl chloride from a carboxylic acid by utilizing oxalyl or thionyl chloride. Additionally, it is widely applied as an affordable commercially available solvent in the chemical industry due to its aprotic and hydrophilic properties. Thus, the catalyst segment is projected to witness the highest growth in the coming years.

Further based on end-user, the market is divided into, Agrochemical, Electronics, Chemical & Petrochemical, Pharmaceutical, and Others. Among these segments, the agrochemical segment had held a significant share in the market. DMF in the agrochemical industry is used as a solvent in the manufacturing of pesticides. Increasing pesticide demand worldwide to improve the agriculture industry output is projected to make a major constructive impact on the dimethylformamide market size in the next few years.

As in the geography market, the Asia Pacific region has acquired a substantial share in the market. India, followed by China and Japan, is considered the largest producer of pesticides. The market is projected to witness robust growth in the region due to the continuously increasing demand for pesticides in the coming years.

Globally, dimethylformamide is substantially applicable in the electronics industry due to its high solvency. For instance, the high solubility of inorganic substances in DMF leads to the generation of high voltage capacitors in the electronic industry. This is a substantial factor that is anticipated to bolster the global market growth in the coming years.

Key players operational in the market are Samsung Fine Chemicals Co., Ltd., Shandong Hualu-Hengsheng Chemical Co., Ltd., Shandong IRO Amine Industry Co., Ltd., The Chemours Company, Zhejiang Jiangshan Chemical Co., Ltd., Johnson Matthey Davy Technologies, Luxi Chemical Group Co., Ltd., Mitsubishi Gas Chemical Co., Inc., Anyang Chemical Industry Limited Liability Company and Balaji Amines Ltd.

Henceforth, the dimethylformamide market is witnessing healthy gains over the forecasted period. The product is most widely used in various applications due to its benefits. Most prominently, dimethylformamide has a wide scope in the agrochemical and automotive industries.

- Complete details on factors that will foster the market growth during the next five years are mentioned in the report.

- An accurate estimation of the dimethylformamide market size and its contribution to the whole market is mentioned in the report.

- This report describes and defines the dimethylformamide market facts and figures and accurate estimations on future trends and changes in consumer preferences.

- This report includes the estimation of possible opportunities for the market by all segments and sub-segments.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Product Type: Market Size & Analysis

- Overview

- First grade

- Qualified grade

- Others

- Applications: Market Size & Analysis

- Overview

- Catalyst

- Reactant

- Feedstock

- End-Users: Market Size & Analysis

- Overview

- Agrochemical

- Electronics

- Chemical & Petrochemical

- Pharmaceutical

- Others

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Samsung Fine Chemicals Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Shandong Hualu-Hengsheng Chemical Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Shandong IRO Amine Industry Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- The Chemours Company

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Zhejiang Jiangshan Chemical Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Johnson Matthey Davy Technologies

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Luxi Chemical Group Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Mitsubishi Gas Chemical Co., Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Anyang Chemical Industry Limited Liability Company

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Balaji Amines Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Samsung Fine Chemicals Co., Ltd.

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 2. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR FIRST GRADE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 3. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR QUALIFIED GRADE, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 4. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 5. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 6. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR CATALYST, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 7. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR REACTANT, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 8. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR FEEDSTOCK, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 9. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 10. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR AGROCHEMICAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 11. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR ELECTRONICS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 12. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR CHEMICAL & PETROCHEMICAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 13. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR PHARMACEUTICAL, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 14. GLOBAL DIMETHYLFORMAMIDE MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2021-2027 (USD BILLION)

TABLE 15. NORTH AMERICA DIMETHYLFORMAMIDE MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 16. NORTH AMERICA DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 17. NORTH AMERICA DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 18. NORTH AMERICA DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 19. U.S DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 20. U.S DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 21. U.S DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 22. CANADA DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 23. CANADA DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 24. CANADA DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 25. EUROPE DIMETHYLFORMAMIDE MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 26. EUROPE DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 27. EUROPE DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 28. EUROPE DIMETHYLFORMAMIDE MARKET VALUE, END-USERS, 2021-2027 (USD BILLION)

TABLE 29. GERMANY DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 30. GERMANY DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 31. GERMANY DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 32. U.K DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 33. U.K DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 34. U.K DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 35. FRANCE DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 36. FRANCE DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 37. FRANCE DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 38. ITALY DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 39. ITALY DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 40. ITALY DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 41. SPAIN DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 42. SPAIN DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 43. SPAIN DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 44. ROE DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 45. ROE DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 46. ROE DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 47. ASIA PACIFIC DIMETHYLFORMAMIDE MARKET VALUE, BY COUNTRY, 2021-2027 (USD BILLION)

TABLE 48. ASIA PACIFIC DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 49. ASIA PACIFIC DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 50. ASIA PACIFIC DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 51. CHINA DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 52. CHINA DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 53. CHINA DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 54. INDIA DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 55. INDIA DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 56. INDIA DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 57. JAPAN DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 58. JAPAN DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 59. JAPAN DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 60. REST OF APAC DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 61. REST OF APAC DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 62. REST OF APAC DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 63. REST OF WORLD DIMETHYLFORMAMIDE MARKET VALUE, BY PRODUCT TYPE, 2021-2027 (USD BILLION)

TABLE 64. REST OF WORLD DIMETHYLFORMAMIDE MARKET VALUE, BY APPLICATIONS, 2021-2027 (USD BILLION)

TABLE 65. REST OF WORLD DIMETHYLFORMAMIDE MARKET VALUE, BY END-USERS, 2021-2027 (USD BILLION)

TABLE 66. SAMSUNG FINE CHEMICALS CO., LTD.: FINANCIALS

TABLE 67. SAMSUNG FINE CHEMICALS CO., LTD.: PRODUCTS & SERVICES

TABLE 68. SAMSUNG FINE CHEMICALS CO., LTD.: RECENT DEVELOPMENTS

TABLE 69. SHANDONG HUALU-HENGSHENG CHEMICAL CO., LTD: FINANCIALS

TABLE 70. SHANDONG HUALU-HENGSHENG CHEMICAL CO., LTD: PRODUCTS & SERVICES

TABLE 71. SHANDONG HUALU-HENGSHENG CHEMICAL CO., LTD: RECENT DEVELOPMENTS

TABLE 72. SHANDONG IRO AMINE INDUSTRY CO., LTD: FINANCIALS

TABLE 73. SHANDONG IRO AMINE INDUSTRY CO., LTD: PRODUCTS & SERVICES

TABLE 74. SHANDONG IRO AMINE INDUSTRY CO., LTD: RECENT DEVELOPMENTS

TABLE 75. THE CHEMOURS COMPANY: FINANCIALS

TABLE 76. THE CHEMOURS COMPANY: PRODUCTS & SERVICES

TABLE 77. THE CHEMOURS COMPANY: RECENT DEVELOPMENTS

TABLE 78. ZHEJIANG JIANGSHAN CHEMICAL CO., LTD: FINANCIALS

TABLE 79. ZHEJIANG JIANGSHAN CHEMICAL CO., LTD: PRODUCTS & SERVICES

TABLE 80. ZHEJIANG JIANGSHAN CHEMICAL CO., LTD: RECENT DEVELOPMENTS

TABLE 81. JOHNSON MATTHEY DAVY TECHNOLOGIES: FINANCIALS

TABLE 82. JOHNSON MATTHEY DAVY TECHNOLOGIES: PRODUCTS & SERVICES

TABLE 83. JOHNSON MATTHEY DAVY TECHNOLOGIES: RECENT DEVELOPMENTS

TABLE 84. LUXI CHEMICAL GROUP CO., LTD: FINANCIALS

TABLE 85. LUXI CHEMICAL GROUP CO., LTD: PRODUCTS & SERVICES

TABLE 86. LUXI CHEMICAL GROUP CO., LTD: RECENT DEVELOPMENTS

TABLE 87. MITSUBISHI GAS CHEMICAL CO., INC: FINANCIALS

TABLE 88. MITSUBISHI GAS CHEMICAL CO., INC: PRODUCTS & SERVICES

TABLE 89. MITSUBISHI GAS CHEMICAL CO., INC: RECENT DEVELOPMENTS

TABLE 90. ANYANG CHEMICAL INDUSTRY LIMITED LIABILITY COMPANY: FINANCIALS

TABLE 91. ANYANG CHEMICAL INDUSTRY LIMITED LIABILITY COMPANY: PRODUCTS & SERVICES

TABLE 92. ANYANG CHEMICAL INDUSTRY LIMITED LIABILITY COMPANY: RECENT DEVELOPMENTS

TABLE 93. BALAJI AMINES LTD: FINANCIALS

TABLE 94. BALAJI AMINES LTD: PRODUCTS & SERVICES

TABLE 95. BALAJI AMINES LTD: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.