Dental Market By Product Type (Prosthetics – Dental Implants, Crown & Bridges, Dentures, Veneers, and Others) and (Orthodontics – Braces Types and Invisalign), By End-user (Hospitals and Dental Clinics), and By Regions (North America, EMEA, APAC, and RoW) – Global Forecast up to 2025

- September, 2019

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

This market research report includes a detailed segmentation of the Dental Market By Product Type (Prosthetics – Dental Implants, Crown & Bridges, Dentures, Veneers, and Others) and (Orthodontics – Braces Types and Invisalign), By End-user (Hospitals and Dental Clinics), and By Regions (North America, EMEA, APAC, and RoW) – Global Forecast up to 2025.

Research Overview

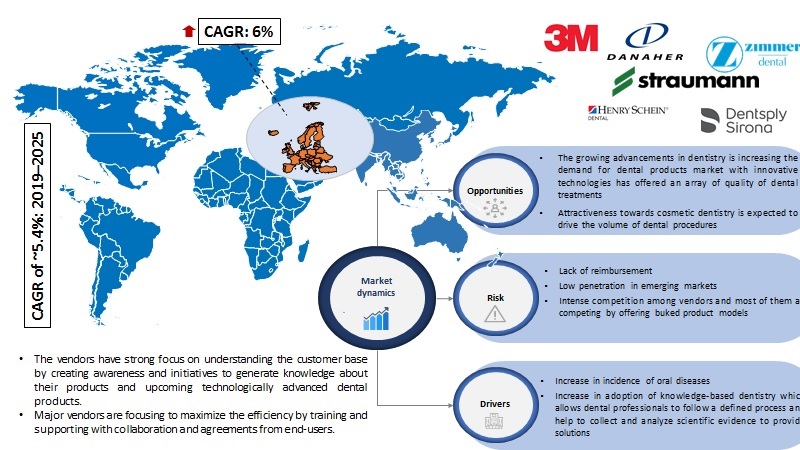

Infoholic Research predicts that the global dental market will grow at a CAGR of ~5.4% during the forecast period 2019–2025. Dental market has witnessed a substantial growth in past years due to an increase in oral health awareness and increasing aging population. In the past decade there has been significant nutritional and lifestyle changes, increased risk of chronic diseases, especially diabetes and coronary artery diseases, and high probability of cancers. The dental market is categorized into four major segments: general dentistry, dental specialties (implants, endodontics, and orthodontics), equipment, and prosthetics.

There is an increase in the incidence of the periodontal diseases amongst all ages. According to research studies, the highest prevalence (>22%) of periodontal diseases is observed in countries such as India, China, Bangladesh, Canada, Germany, and Chile. Also, the lowest prevalence (<4%) is marked in the countries such as Madagascar and Hungary. The improvement in dental products with up roaring technological advancements is set to offer an array of good quality dental treatments. Many companies are entering into the market with innovative technologies and support systems for dental treatments like softwares, scans, imaging tools, and other handheld devices that are a must for many dental procedures. The potential of new entrants and growing opportunity in dental market has given other pure play vendors to focus on single product line and target the developing countries for better market share. The attractiveness of the industry has continued and the leading vendors will take this as an advantage and create strategic analysis to gain a stronghold in the market.

Government initiatives towards improvising standard healthcare infrastructure and increased focus on healthcare expenditure is helping these countries to focus on offering high quality healthcare. Apart from this, Eastern European governments and dental organizations are working hard to promote the advanced dental treatments available in the market. Also, there has been a significant increase in the number of practicing dentists in across the globe in the past few years. In terms of the vendor scenario, leading players such as Straumann, Zimmer Biomet, Dentsply Sirona, and Danaher Corporation have large customer bases in both developed and developing countries. The market is expected to witness significant growth during the forecast period because of the presence of several market vendors that manufacture dental implants. Further, the presence of a strong dental healthcare provision framework inspires individuals to visit the dental clinics for regular check-ups, which will drive the growth of this market.

Acquisitions and mergers are helping in geographical expansion. Growing demand for dental products with innovative features is also creating awareness among the population. The market is steadily penetrating in untapped market focusing in capturing the market. These strategic moves are generally implemented in the emerging markets especially in the untapped region. Further, the vendors will have a strong hold towards the market and can generate huge revenue by developing better strategies.

Segmentation by Product Type:

- Prosthetics – dental implants, crown & bridges, dentures, veneers, and others

- Orthodontics – braces types and Invisalign

Prosthetics market is the leading market with vast business opportunity in dental implants, crowns and bridges, dentures veneers etc. has the largest market share in 2018. The increase movement towards digitization and adoption of CAD/CAM technology has supported many dental treatments and many companies are focusing in integrating technology with teeth by a technician in lab. Pureplay vendors like Biotech Dental, Osstem Implants, CAMLOG Biotechnologies AG, and DENTCA are focusing in developing innovative products.

Orthodontic market is followed by the prosthetic market and having one of the fastest growing segment in the market. The market has high potential across the globe and most of the dentists are focusing in providing high quality and cost-effective dental products.

Segmentation by End-users:

- Hospitals

- Dental clinics

In 2018, hospitals led the maximum revenue in the dental implant market with large volumes of dental restoration and cosmetic dentistry procedures.

Segmentation by Region:

- North America

- EMEA

- APAC

- ROW

The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (ROW). Europe is set to be the leading region for the dental market growth followed by the Americas. Asia Pacific and ROW are set to be the emerging regions. The emerging markets have a high potential to grow owing to an increase in the number of patient population and focus toward healthcare infrastructure. The dental market has lowest penetration in the emerging market and most of the vendors are targeting to penetrate in countries such as India, China, Thailand, Vietnam etc., Further, medical tourism has become a new trend in the emerging markets as most of the people from developed countries are travelling to APAC, especially India, for dental implant procedures. However, the high cost of implants and the other expensive procedural cost, lack of skilled surgeons, lack of proper reimbursement policies, lack of awareness about advanced implants in the developing countries have a significant impact on the overall market growth.

Competitive Analysis – The competition among leading vendors is due to the availability of a wide range of dental market products with different brand names in the market. The market is highly competitive with all the players competing to gain market stronghold. Intense competition, rapid advances in technology, frequent changes in government policies, and fluctuating prices are key factors that confront the market. The vendors have strong focus on understanding the customer base by creating awareness and initiatives to generate knowledge about their products and upcoming technologically advanced dental implants. The vendors have a strong focus on acquiring smaller companies and expanding their business operations by leveraging their products portfolio across the globe. The competition is growing among the healthcare service providers – hospitals and dental clinics where the customer groups are being consolidated for adopting different dental restoration. Most of the company’s focus on developing products in less time and fasten the regulation process with effective means to commercialize the product early into the market to stay dominant.

Key Vendors:

- Straumann Group

- Danaher Corporation

- Dentsply Sirona

- Zimmer Biomet

- Henry Schein

- 3M, Inc.

- Astra Tech AB

- Sweden & Martina S.p.A

- OsteoCare Implant System Limited

- Leone S.p.A.

- Tekka SA

- Timplant Ltd.

- ZL-Microdent Attachment GmbH & Co. KG

Key Competitive Facts:

- The market is highly competitive with all the players competing to gain the market share. Intense competition, rapid advancements in technology, frequent changes in government policies, and the prices are key factors that confront the market.

- The requirement of high initial investment, implementation, and maintenance cost in the market are also limiting the entry of new players.

- Responding to competitive pricing pressures specific to each of our geographic markets.

- Protection of proprietary technology for products and manufacturing processes.

Benefits – The report provides complete details about the usage and adoption rate of dental products. Thus, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives towards the medical devices segment in the upcoming years along with details of the pureplay companies entering the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to stakeholders in order to expand their business and capture the revenue in specific verticals and to analyze before investing or expanding the business in this market.

Key Takeaways:

- Understanding the potential market opportunity with precise market size and forecast data.

- Detailed market analysis focusing on the growth of the dental products globally.

- Factors influencing the growth of the dental products market.

- In-depth competitive analysis of dominant and pureplay vendors.

- Prediction analysis of the dental products industry across the globe.

- Key insights related to major segments of the dental products market globally.

- The latest market trend analysis impacting the buying behavior of the consumers.

Key Stakeholders:

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.