Commercial Vehicles Market based on the Product (Light Commercial Vehicles (LCVs), Heavy Trucks, and Buses & Coaches), End-use (Industrial, Mining & Construction, Logistics, Passenger Transportation, and Others) and Geography – Global Forecast up to 2026

- April, 2021

- Domain: ICT - Verticals - Automobile

- Get Free 10% Customization in this Report

Over the projected period, demand for commercial vehicles is expected to rise due to digitization and increased infrastructure spending. Initially, business development was closely linked to global economic growth; however, this connection rapidly broke down. Consumer demand for unique transportation solutions, telematics integration, and the growing popularity of shared mobility are major trends shaping the commercial vehicle market's growth. Also, policymakers in several countries have adopted policies and legislation to efficiently manage the size of goods transported in a commercial vehicle. For example, in the United States, the Federal Motor Carrier Safety Administration (FMCSA) was created to prevent deaths and injuries caused by commercial vehicles. As a result, the body has set a limit on the size of goods transported in these vehicles. As a result, the selling of commercial vehicles is projected to boom in the near future.

Research Methodology:

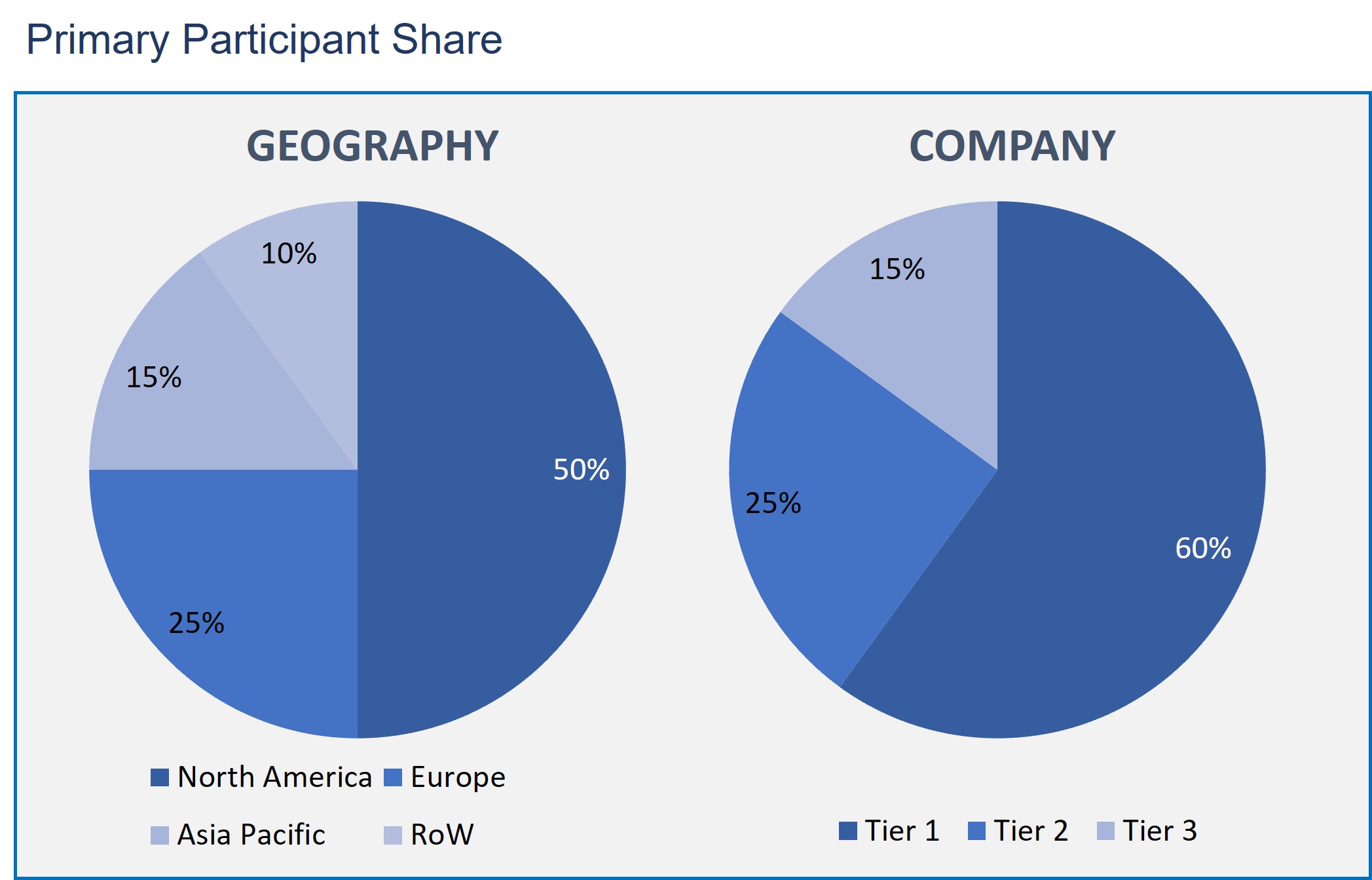

The Commercial Vehicles Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Commercial Vehicles Market by End-use

- Industrial

- Mining & Construction

- Logistics

- Passenger Transportation

- Others

Commercial Vehicles Market by Product

- Light Commercial Vehicles

- Heavy Trucks

- Buses & Coaches

Commercial Vehicles Market by Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

On the basis of Product, the commercial vehicles market is categorized into light-heavy trucks, commercial vehicles, and buses and coaches. This development can be attributed to these vehicles' dynamic nature, which enables them to be improved and utilized for the transportation of passengers and goods. These vehicles are cost-effective and aid in reducing emissions, which also improvements segment development.

The commercial vehicles market's end-use includes industrial, mining & construction, logistics, passenger transportation, and others. The passenger transportation segment has been leading the market because of the increasing transportation investments to enhance accessibility and affordability. Further, the rising trend of shared transportation coupled with norms associated with vehicles' traffic on the road is the other significant factor that stimulates the growth of passenger transportation in the forthcoming years.

North America's intensification in financing options, continuous investment in infrastructure development, and governments' growing concentration on in-house automotive production are key factors that positively affect regional development. Further, the government’s push for electrifying the commercial fleet with the electric vehicle will also bolden the market growth.

Furthermore, the rising number of construction activities and e-commerce activities worldwide is resulting in increasing demand for commercial vehicles for the transportation of commercial materials is majorly stimulating the global market growth. Also, the significant inclination towards commercial electric vehicles in developed countries to curb the cities' pollution level is anticipated to augment the global market revenue.

This report gives the profiles of companies leading the Commercial Vehicles market: Piaggio Vehicles Private Limited, Ashok Leyland Limited, Tata Motors Limited, SML Isuzu Limited, Force Motors Limited, Mahindra & Mahindra Limited, Daimler India Commercial Vehicles Private Limited, VE Commercial Vehicles Limited, and Scania Commercial Vehicles India Private Limited.

- This report offers an overall analysis of the Commercial Vehicles market growth drivers, restraints, opportunities, and other related challenges.

- This report depicts the market developments such as new product launches, mergers and acquisitions, diversification, and joint ventures of the market players.

- This report also describes all potential segments and sub-segments present in the market to help the companies in strategic business planning.

- This report also gives a regional analysis of the Commercial Vehicles market in terms of market penetration across the world.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Product: Market Size & Analysis

- Overview

- Light Commercial Vehicles (LCVs)

- Heavy Trucks

- Buses & Coaches

- End-use: Market Size & Analysis

- Overview

- Industrial

- Mining & Construction

- Logistics

- Passenger Transportation

- Others

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Piaggio Vehicles Private Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Ashok Leyland Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Tata Motors Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- SML Isuzu Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Force Motors Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Mahindra & Mahindra Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Daimler India Commercial Vehicles Private Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- VE Commercial Vehicles Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Scania Commercial Vehicles India Private Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Piaggio Vehicles Private Limited

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 2. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR LIGHT COMMERCIAL VEHICLES (LCVS), BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 3. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR HEAVY TRUCKS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 4. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR BUSES & COACHES, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 5. GLOBAL COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 6. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR INDUSTRIAL, 2020-2026 (USD BILLION)

TABLE 7. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR MINING & CONSTRUCTION, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 8. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR LOGISTICS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 9. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR PASSENGER TRANSPORTATION, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 10. GLOBAL COMMERCIAL VEHICLES MARKET VALUE FOR OTHERS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 11. NORTH AMERICA COMMERCIAL VEHICLES MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 12. NORTH AMERICA COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 13. NORTH AMERICA COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 14. U.S COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 15. U.S COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 16. CANADA COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 17. CANADA COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 18. EUROPE COMMERCIAL VEHICLES MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 19. EUROPE COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 20. EUROPE COMMERCIAL VEHICLES MARKET VALUE, END-USE, 2020-2026 (USD BILLION)

TABLE 21. GERMANY COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 22. GERMANY COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 23. U.K COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 24. U.K COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 25. FRANCE COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 26. FRANCE COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 27. ITALY COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 28. ITALY COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 29. SPAIN COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 30. SPAIN COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 31. ROE COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 32. ROE COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 33. ASIA PACIFIC COMMERCIAL VEHICLES MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 34. ASIA PACIFIC COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 35. ASIA PACIFIC COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 36. CHINA COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 37. CHINA COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 38. INDIA COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 39. INDIA COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 40. JAPAN COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 41. JAPAN COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 42. REST OF APAC COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 43. REST OF APAC COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 44. REST OF WORLD COMMERCIAL VEHICLES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 45. REST OF WORLD COMMERCIAL VEHICLES MARKET VALUE, BY END-USE, 2020-2026 (USD BILLION)

TABLE 46. PIAGGIO VEHICLES PRIVATE LIMITED: FINANCIALS

TABLE 47. PIAGGIO VEHICLES PRIVATE LIMITED: PRODUCTS & SERVICES

TABLE 48. PIAGGIO VEHICLES PRIVATE LIMITED: RECENT DEVELOPMENTS

TABLE 49. ASHOK LEYLAND LIMITED: FINANCIALS

TABLE 50. ASHOK LEYLAND LIMITED: PRODUCTS & SERVICES

TABLE 51. ASHOK LEYLAND LIMITED: RECENT DEVELOPMENTS

TABLE 52. TATA MOTORS LIMITED: FINANCIALS

TABLE 53. TATA MOTORS LIMITED: PRODUCTS & SERVICES

TABLE 54. TATA MOTORS LIMITED: RECENT DEVELOPMENTS

TABLE 55. SML ISUZU LIMITED: FINANCIALS

TABLE 56. SML ISUZU LIMITED: PRODUCTS & SERVICES

TABLE 57. SML ISUZU LIMITED: RECENT DEVELOPMENTS

TABLE 58. FORCE MOTORS LIMITED: FINANCIALS

TABLE 59. FORCE MOTORS LIMITED: PRODUCTS & SERVICES

TABLE 60. FORCE MOTORS LIMITED: RECENT DEVELOPMENTS

TABLE 61. MAHINDRA & MAHINDRA LIMITED: FINANCIALS

TABLE 62. MAHINDRA & MAHINDRA LIMITED: PRODUCTS & SERVICES

TABLE 63. MAHINDRA & MAHINDRA LIMITED: RECENT DEVELOPMENTS

TABLE 64. DAIMLER INDIA COMMERCIAL VEHICLES PRIVATE LIMITED: FINANCIALS

TABLE 65. DAIMLER INDIA COMMERCIAL VEHICLES PRIVATE LIMITED: PRODUCTS & SERVICES

TABLE 66. DAIMLER INDIA COMMERCIAL VEHICLES PRIVATE LIMITED: RECENT DEVELOPMENTS

TABLE 67. VE COMMERCIAL VEHICLES LIMITED: FINANCIALS

TABLE 68. VE COMMERCIAL VEHICLES LIMITED: PRODUCTS & SERVICES

TABLE 69. VE COMMERCIAL VEHICLES LIMITED: RECENT DEVELOPMENTS

TABLE 70. SCANIA COMMERCIAL VEHICLES INDIA PRIVATE LIMITED: FINANCIALS

TABLE 71. SCANIA COMMERCIAL VEHICLES INDIA PRIVATE LIMITED: PRODUCTS & SERVICE

TABLE 72. SCANIA COMMERCIAL VEHICLES INDIA PRIVATE LIMITED: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.