Cataract Surgery Devices Market based on Product (Intraocular Lens (IOL), Ophthalmic Viscoelastic Device (OVD), Femtosecond Laser Equipment and Phacoemulsification Equipment), End Users (Hospitals & Clinics and Ophthalmology Centers), and Geography – Global Forecast up to 2026

- May, 2021

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

A cataract is a disorder related to the eye in which clouding of the eye lens is observed, which results in permanent vision loss. Cataract surgery is the removal of the clouded natural lens and includes insertion of the intraocular lens. Generally, the treatment includes replacing the natural lens with an artificial lens that helps restore a vision of the eye. Eradicating the cataract by surgery is the only option to restore vision and see the world again. The growing geriatric population and technological advancements are the principal factors that will propel the growth of the cataract surgery devices market in the coming future. The rising awareness among people regarding eye disease will also increase the market demand in the coming years. The rise in the population aged 60 and above will increase the prevalence of the disease, therefore enhancing the treatment rate, which would fuel the market growth. On the contrary, the shortage of skilled professionals and limited awareness regarding cataract disorders, majorly in developing countries, limit the growth of the cataract surgery devices market. The Cataract Surgery Devices Market is estimated to grow at the rate of 4.9% CAGR by 2026.

Research Methodology:

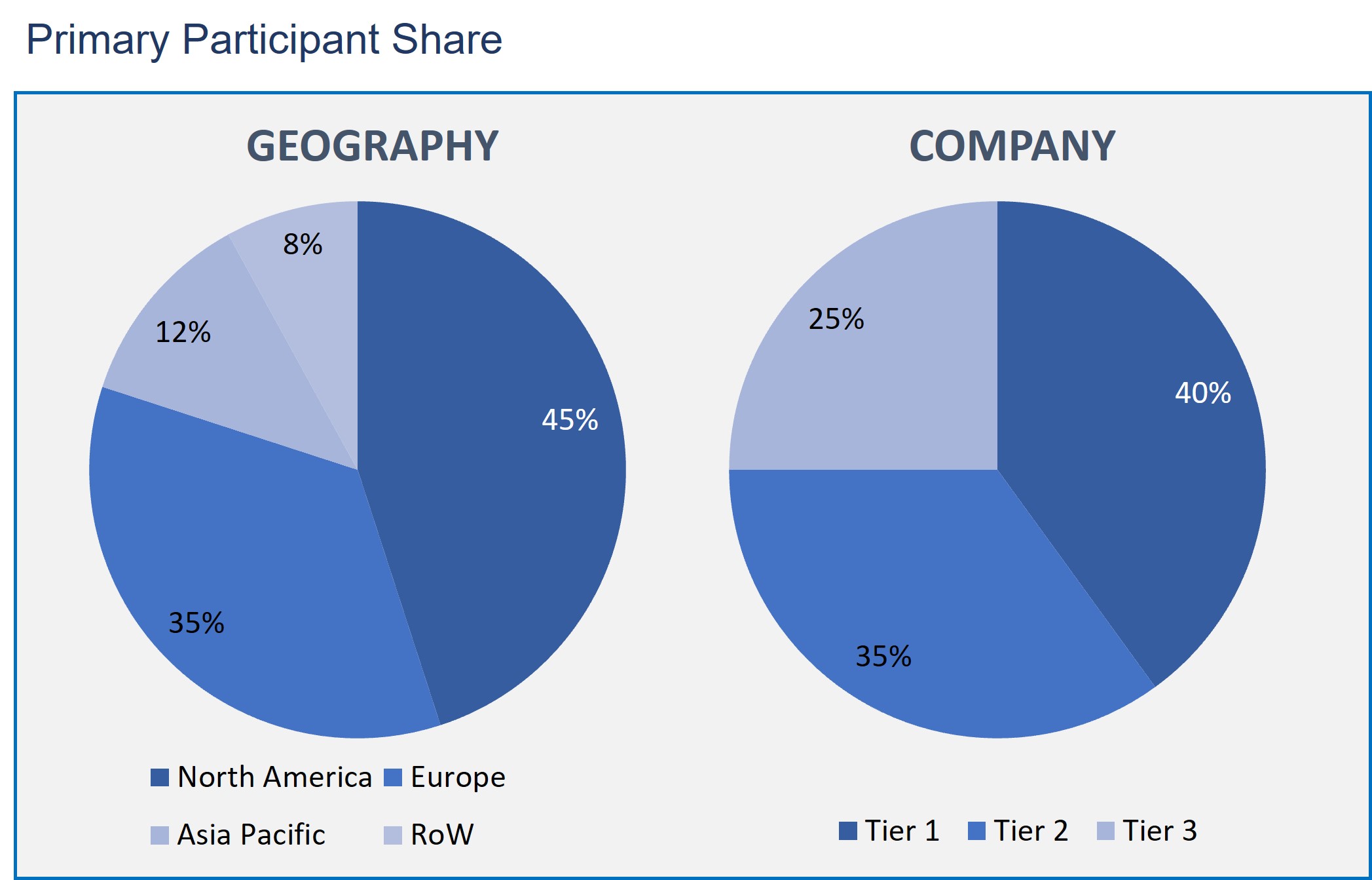

The cataract surgery devices market has been assessed and analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Cataract Surgery Devices Market based on Product

- Intraocular Lens (IOL)

- Ophthalmic Viscoelastic Device (OVD)

- Femtosecond Laser Equipment

- Phacoemulsification Equipment

Cataract Surgery Devices Market based on End-Users

- Hospitals & Clinics

- Ophthalmology Centers

Cataract Surgery Devices Market based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

As in the cataract surgery devices market based on product, the market products include Intraocular Lens (IOL), Ophthalmic Viscoelastic Device (OVD), Femtosecond Laser Equipment, and Phacoemulsification Equipment. Among them, the intraocular lens segment is expected to have the largest share in the market. This is due to the several products providing different cost ranges offered by local and global manufacturers. Moreover, the increasing demand for the intraocular lens from the various developed countries is also augmenting the segment growth.

As per the market by end-users, the market is furcated into hospitals & clinics and ophthalmology centers. The hospitals & clinics segment holds the largest share of the cataract surgery devices market. The maximum share is majorly ascribed to the rising number of cataract eye disorders worldwide, which will increase the number of surgeries in hospitals and clinics. Few factors such as improving healthcare infrastructure in emerging countries and the growth in the number of advanced healthcare facilities are estimated to fuel the adoption of cataract surgery devices in hospitals and clinics, propelling the growth of this segment over the forecast period.

North America is projected to lead the overall market share throughout the forecast period. The market growth is owing to the factors such as the high incidence of cataracts in the region, improved healthcare infrastructure, increased disposable income, beneficial reimbursement policies.

The cataract surgery devices market is significantly compelled by the increasing number of people suffering from cataract problems worldwide. Since according to a study, the major reason for blindness among a substantial population is cataract. Also, the rising accessibility of cataract surgeries due to the increasing awareness about the disorder and improving healthcare infrastructure is projected to escalate the demand for cataract surgery devices, enhancing market growth.

This report includes the profiles of the major competitors of the cataract surgery devices market: Valeant Pharmaceuticals International, Inc., Johnson & Johnson Services, Inc., Carl Zeiss Meditec AG, Ziemer Ophthalmic Systems AG, HumanOptics AG, Essilor International S.A., Nidek Co., Ltd., HAAG-Streit Holding AG, Topcon Corporation, and Novartis AG.

As a result, the cataract surgery treatment for an eye has emerged to be an effective treatment that has restored vision for most people since the cataract was responsible for world blindness due to various reasons, majorly increasing demand for cataract surgery devices.

- A complete analysis of all vital geographical regions is included in the report, determining the potential opportunities in these regions.

- Detailed information about the attributes generating growth in the cataract surgery devices market in the forecast period.

- An exact estimation of the cataract surgery devices' market share and their contribution to the parent market is provided.

- Further profiles of key competitors and their dynamic strategies are also covered in the study.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Product: Market Size & Analysis

- Overview

- Intraocular Lens (IOL)

- Ophthalmic Viscoelastic Device (OVD)

- Femtosecond Laser Equipment

- Phacoemulsification Equipment

- End Users: Market Size & Analysis

- Overview

- Hospitals & Clinics

- Ophthalmology Centers

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Valeant Pharmaceuticals International, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Johnson & Johnson Services, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Carl Zeiss Meditec AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Ziemer Ophthalmic Systems AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- HumanOptics AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Essilor International S.A.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Nidek Co., Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- HAAG-Streit Holding AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Topcon Corporation

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Novartis AG

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Valeant Pharmaceuticals International, Inc.

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

TABLE 1. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 2. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE FOR INTRAOCULAR LENS (IOL), BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 3. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE FOR OPHTHALMIC VISCOELASTIC DEVICE (OVD), BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 4. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE FOR FEMTOSECOND LASER EQUIPMENT, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 5. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE FOR PHACOEMULSIFICATION EQUIPMENT, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 6. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 7. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE FOR HOSPITALS & CLINICS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 8. GLOBAL CATARACT SURGERY DEVICES MARKET VALUE FOR OPHTHALMOLOGY CENTERS, BY GEOGRAPHY, 2020-2026 (USD BILLION)

TABLE 9. NORTH AMERICA CATARACT SURGERY DEVICES MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 10. NORTH AMERICA CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 11. NORTH AMERICA CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 12. U.S CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 13. U.S CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 14. CANADA CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 15. CANADA CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 16. EUROPE CATARACT SURGERY DEVICES MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 17. EUROPE CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 18. EUROPE CATARACT SURGERY DEVICES MARKET VALUE, END USERS, 2020-2026 (USD BILLION)

TABLE 19. GERMANY CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 20. GERMANY CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 21. U.K CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 22. U.K CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 23. FRANCE CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 24. FRANCE CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 25. ITALY CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 26. ITALY CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 27. SPAIN CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 28. SPAIN CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 29. ROE CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 30. ROE CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 31. ASIA PACIFIC CATARACT SURGERY DEVICES MARKET VALUE, BY COUNTRY, 2020-2026 (USD BILLION)

TABLE 32. ASIA PACIFIC CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 33. ASIA PACIFIC CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 34. CHINA CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 35. CHINA CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 36. INDIA CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 37. INDIA CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 38. JAPAN CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 39. JAPAN CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 40. REST OF APAC CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 41. REST OF APAC CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 42. REST OF WORLD CATARACT SURGERY DEVICES MARKET VALUE, BY PRODUCT, 2020-2026 (USD BILLION)

TABLE 43. REST OF WORLD CATARACT SURGERY DEVICES MARKET VALUE, BY END USERS, 2020-2026 (USD BILLION)

TABLE 44. VALEANT PHARMACEUTICALS INTERNATIONAL, INC: FINANCIALS

TABLE 45. VALEANT PHARMACEUTICALS INTERNATIONAL, INC: PRODUCT AND SERVICE

TABLE 46. VALEANT PHARMACEUTICALS INTERNATIONAL, INC: RECENT DEVELOPMENTS

TABLE 47. JOHNSON & JOHNSON SERVICES, INC: FINANCIALS

TABLE 48. JOHNSON & JOHNSON SERVICES, INC: PRODUCT AND SERVICE

TABLE 49. JOHNSON & JOHNSON SERVICES, INC: RECENT DEVELOPMENTS

TABLE 50. CARL ZEISS MEDITEC AG: FINANCIALS

TABLE 51. CARL ZEISS MEDITEC AG: PRODUCT AND SERVICE

TABLE 52. CARL ZEISS MEDITEC AG: RECENT DEVELOPMENTS

TABLE 53. ZIEMER OPHTHALMIC SYSTEMS AG: FINANCIALS

TABLE 54. ZIEMER OPHTHALMIC SYSTEMS AG: PRODUCT AND SERVICE

TABLE 55. ZIEMER OPHTHALMIC SYSTEMS AG: RECENT DEVELOPMENTS

TABLE 56. HUMANOPTICS AG: FINANCIALS

TABLE 57. HUMANOPTICS AG: PRODUCT AND SERVICE

TABLE 58. HUMANOPTICS AG: RECENT DEVELOPMENTS

TABLE 59. ESSILOR INTERNATIONAL S.A.: FINANCIALS

TABLE 60. ESSILOR INTERNATIONAL S.A.: PRODUCT AND SERVICE

TABLE 61. ESSILOR INTERNATIONAL S.A.: RECENT DEVELOPMENTS

TABLE 62. NIDEK CO., LTD.: FINANCIALS

TABLE 63. NIDEK CO., LTD.: PRODUCT AND SERVICE

TABLE 64. NIDEK CO., LTD.: RECENT DEVELOPMENTS

TABLE 65. HAAG-STREIT HOLDING AG: FINANCIALS

TABLE 66. HAAG-STREIT HOLDING AG: PRODUCT AND SERVICE

TABLE 67. HAAG-STREIT HOLDING AG: RECENT DEVELOPMENTS

TABLE 68. TOPCON CORPORATION: FINANCIALS

TABLE 69. TOPCON CORPORATION: PRODUCT AND SERVICE

TABLE 70. TOPCON CORPORATION: RECENT DEVELOPMENTS

TABLE 71. NOVARTIS AG: FINANCIALS

TABLE 72. NOVARTIS AG: PRODUCT AND SERVICE

TABLE 73. NOVARTIS AG: RECENT DEVELOPMENTS

Research Framework

Infoholic Research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

Involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

Include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.