Healthcare Data Storage Market by Deployment (On-premise, Remote, and Hybrid), Type (Magnetic and Flash & Solid-state), Architect (File Storage, Block Storage, Object Storage), Storage System (SAN, DAS, and NAS) and Geography – Global Drivers, Restraints, Opportunities, Trends, and Forecast up to 2026

- September, 2020

- Domain: Healthcare - Healthcare IT

- Get Free 10% Customization in this Report

Healthcare data storage is a software solution used by clinics, diagnostic centers, hospitals to record patient data for future use. These software solutions are used by healthcare companies to store data about manufacturing products and their processes.

Research Methodology:

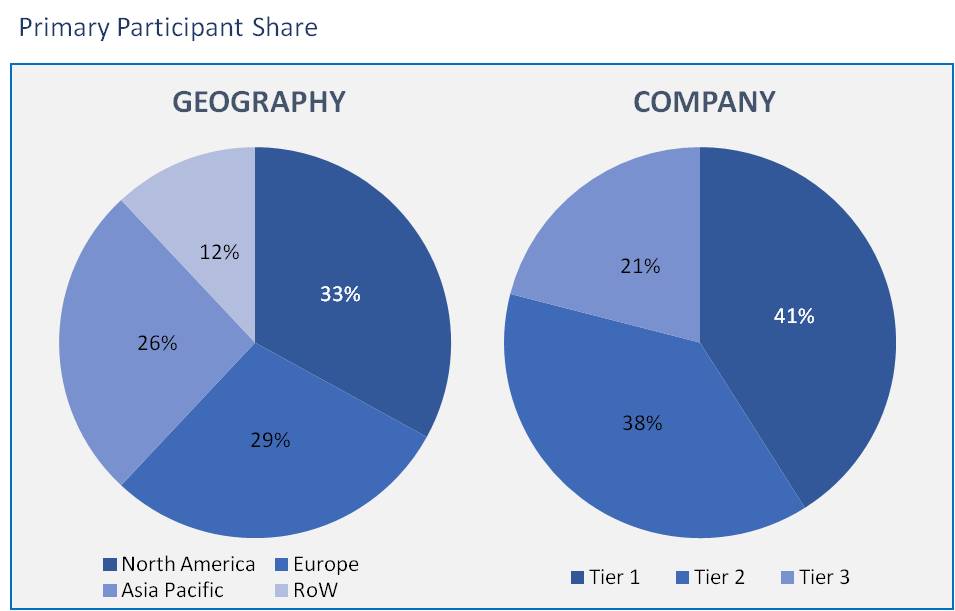

The healthcare data storage market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

The factors responsible for the global healthcare data storage market growth can be termed as increasing clinical trials, increasing information of patients due to the increasing number of surgeries, and research activities to develop innovative products. Also, decreasing paper use to maintain patient information has increased the demand for healthcare data storage solutions. Somehow, the key aspects such as cyber-attacks, data violation, and expensive costs incurred in healthcare data storage solutions which are restricting the market growth.

The Healthcare Data Storage Market is expected to reach $7.44 billion by 2026 from an estimated value of $3.27 billion in 2020, growing at a CAGR of ~14.7% during the forecast period.

The segmentation of the Healthcare Data Storage Market is given in detail below:

By Deployment

- On-premise

- Remote

- Hybrid

By Type

- Magnetic Storage

- Magnetic Disks

- Magnetic Tapes

- Flash & Solid-state Storage

By Architect

- Object Storage

- File Storage

- Block Storage

By End-User

- Pharmaceutical & Biotechnology Companies, CROs, and CMOS

- Academic & Government Institutes, Research Centers and Clinical Research Labs

- Hospitals, Clinics, and ASCs

- Diagnostic & Clinical Laboratories

- Other

By Storage System

- Direct-attached Storage

- Network-attached Storage

- Storage Area Network

By Region

- North America

- Europe

- APAC

- RoW

Based on storage type, the market is categorized into magnetic storage and flash & solid-state storage. The flash & solid-state storage segment covered the largest share of the market in 2019 and is expected to record the highest CAGR within the healthcare data storage market during the forecast period. Compared to magnetic disks and their decreasing costs, the high capabilities of flash & solid-state drives happened to increase the demand for them by end-users.

Based on the deployment model, the market is subdivided into remote, on-premise, and hybrid solutions. The on-premise model is expected to cover the largest share of the market. On-premise solutions are the most-widely accepted storage solutions in the market. The localized storage deployment model can make use of multi-vendor architecture and minimize risks associated with external attacks and data breaches. Moreover, users can have their on-premise storage and can control their deployment, backup, and data recovery systems. These benefits are propelling the growth of the on-premise solutions market.

Based on the end-user, the medical market is subdivided into pharmaceutical & biotechnology companies, CROs, and CMOs; research centers, academic & government institutes, and clinical research labs; hospitals, clinics, and ASCs; diagnostic & clinical laboratories; and other end users. The segment comprising pharmaceutical & biotechnology companies, CROs, and CMOs, earned the largest share of the market in 2018. This high revenue share can be attributed to the fact that extensive research on drug discovery is done in pharmaceutical & biotechnology companies, which creates a massive amount of data.

Based on the architect, the medical market is segmented into Object Storage, File Storage, and Block Storage. Object storage obtained the largest share. Object storage can serve as unstructured data with relative ease. Therefore, it is aptly suitable for the big data needs of organizations in finance, healthcare, and beyond. File Storage is an old method to store data using a simple approach. Many companies demand centralized, easy to use, and accessible ways to store files. It is commonly demanded by small businesses as it is low-cost contrast to other data storage approaches. Block Storage or block-level storage is a facility that stores data in singular blocks. Block storage is largely favored where efficient and fast transportation of information is needed.

Based on the storage system, there are three types; the Direct-attached Storage, Network-attached Storage, and Storage Area Network. Storage Area Network is the largest segment. As the name implies, a storage area network is a network of disks that are connected to a number of servers through fiber optics, whereas network-attached storage is a single server that shares its storage over the network.

In 2019, North America covered the largest share of the market. Rapid technological advancements, coupled with an unsynchronized approach, led to an increasing volume of unstructured healthcare data. This disarray of information in the wake of consumer awareness and growing cyber threats increased demand for secure, reliable, and cost-efficient storage infrastructure in North America. The RoW is growing fast with increasing IT penetration and is estimated to rise at the highest CAGR during the forecast period.

The major vendors analyzed in the Healthcare Data Storage market report are Fujitsu, Samsung, Drobo, Tintri, Cloudian, Dell, IBM Corporation, NetApp, Hewlett Packard Enterprise (HPE), Pure Storage, Hitachi, Toshiba, Western Digital, Scality, and Huawei.

The data storage is playing a vital role not only in one domain but in all sectors. This report explains how the data storage market is penetrating in the healthcare sector and also gives the analysis based on market segments.

- The report represents the current trends, challenges, opportunities and the factors which are accelerating the growth of the market.

- Further, it also gives the SWOT analysis, strategies and portfolio analysis and potential analysis of the key market players.

- The competitive analysis of the major vendors provides the perspective of the dynamic strategies such as innovative technology, upgrades in the software which enhances the users' experience.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- PEST Analysis

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Evolution

- Market Trends and Impact

- Advantages/Disadvantages of Market

- Regulatory Impact

- Market Offerings

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

5. Deployment: Market Size & Analysis

5.1. Overview

5.2. On-premise

5.3. Remote

5.4. Hybrid

6. Type: Market Size & Analysis

6.1. Overview

6.2. Magnetic Storage

6.2.1. Magnetic Disks

6.2.2. Magnetic Tapes

6.3. Flash & Solid-state Storage

7. Architect: Market Size & Analysis

7.1. Overview

7.2. Object Storage

7.3. File Storage

7.4. Block Storage

8. End User: Market Size & Analysis

8.1. Overview

8.2. Pharmaceutical & Biotechnology Companies, CROs, and CMOS

8.3. Academic & Government Institutes, Research Centers and Clinical Research Labs

8.4. Hospitals, Clinics, and ASCs

8.5. Diagnostic & Clinical Laboratories

8.6. Other

9. Storage System: Market Size & Analysis

9.1. Overview

9.2. Direct-attached Storage

9.3. Network-attached Storage

9.4. Storage Area Network

10. Geography: Market Size & Analysis

10.1. Overview

10.2. North America

10.3. Europe

10.4. Asia Pacific

10.5. Rest of the World

11. Competitive Landscape

11.1. Competitor Comparison Analysis

11.2. Market Developments

11.2.1. Mergers and Acquisitions, Legal, Awards, Partnerships

11.2.2. Product Launches and execution

12. Vendor Profiles

12.1. Dell.

12.1.1. Overview

12.1.2. Product Architects

12.1.3. Geographic Revenue

12.1.4. Business Units

12.1.5. Developments

12.1.6. Business Strategy

12.2. IBM Corporation

12.2.1. Overview

12.2.2. Product Architects

12.2.3. Geographic Revenue

12.2.4. Business Units

12.2.5. Developments

12.2.6. Business Strategy

12.3. NetApp

12.3.1. Overview

12.3.2. Product Architects

12.3.3. Geographic Revenue

12.3.4. Business Units

12.3.5. Developments

12.3.6. Business Strategy

12.4. Hewlett Packard Enterprise

12.4.1. Overview

12.4.2. Product Architects

12.4.3. Geographic Revenue

12.4.4. Business Units

12.4.5. Developments

12.4.6. Business Strategy

12.5. Pure Storage

12.5.1. Overview

12.5.2. Product Architects

12.5.3. Geographic Revenue

12.5.4. Business Units

12.5.5. Developments

12.5.6. Business Strategy

12.6. Hitachi

12.6.1. Overview

12.6.2. Product Architects

12.6.3. Geographic Revenue

12.6.4. Business Units

12.6.5. Developments

12.6.6. Business Strategy

12.7. Cloud Pharmaceuticals, Inc

12.7.1. Overview

12.7.2. Product Architects

12.7.3. Geographic Revenue

12.7.4. Business Units

12.7.5. Developments

12.7.6. Business Strategy

12.8. Toshiba

12.8.1. Overview

12.8.2. Product Architects

12.8.3. Geographic Revenue

12.8.4. Business Units

12.8.5. Developments

12.8.6. Business Strategy

12.9. Western Digital

12.9.1. Overview

12.9.2. Product Architects

12.9.3. Geographic Revenue

12.9.4. Business Units

12.9.5. Developments

12.9.6. Business Strategy

12.10. Scality

12.10.1. Overview

12.10.2. Product Architects

12.10.3. Geographic Revenue

12.10.4. Business Units

12.10.5. Developments

12.10.6. Business Strategy

13. Companies to Watch

13.1. Huawei

13.1.1. Overview

13.1.2. Market

13.1.3. Business Strategy

13.2. Fujitsu.

13.2.1. Overview

13.2.2. Market

13.2.3. Business Strategy

13.3. Samsung

13.3.1. Overview

13.3.2. Market

13.3.3. Business Strategy

13.4. Drobo

13.4.1. Overview

13.4.2. Market

13.4.3. Business Strategy

13.5. Tintri

13.5.1. Overview

13.5.2. Market

13.5.3. Business Strategy

13.6. Cloudian.

13.6.1. Overview

13.6.2. Market

13.6.3. Business Strategy

14 Analyst Opinion

15. Annexure

15.1 Report Scope

15.2.Market Definitions

15.3. Research Methodology

15.3.1 Data Collation and In-house Estimation

15.3.2 Market Triangulation

15.3.3 Forecasting

16. Report Assumptions

17. Declarations

18. Stakeholders

19. Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.