North America AI in Financial Asset Management Market Forecast 2019–2025

- March, 2020

- Domain: ICT - Verticals - BFSI,digital technologies

- Get Free 10% Customization in this Report

Artificial intelligence (AI) enables financial institutions to identify trends and patterns to make efficient investment decisions. While the traditional business analytics tools are generally built on present and historical data in a structured system, currently investment management firms are increasingly inclined toward AI-embedded solutions to discover the hidden patterns in unstructured as well as structured data to create actionable insights. AI-based cognitive systems analyze raw data from multiple sources using NLP, image recognition, and machine language to identify patterns and provides actionable insights. A few of the use cases where financial assets are being managed using AI include event monitoring, sentiment analysis, customer interaction analysis, and portfolio management.

Market Dynamics – North America AI in Financial Asset Management Market

Increasing focus on developing investment and risk strategies with the help of digital technologies such as AI and machine learning is the key factor contributing to the growth of the North America AI in financial asset management market. Increasing dependency of social media analytics to understand the current market sentiment along with the increasing preference for AI-based solutions to predict market sentiment is accelerating the growth of North America AI in financial asset management market.

Increasing reliance on AI and machine learning technologies for portfolio management & optimization and fraud detection & compliance is further propelling the growth of North America AI in financial asset management market. However, high capital investment and concerns related to the accuracy of cognitive machine capabilities in managing financial assets are identified as restraints likely to deter the progression of North America AI in financial asset management market.

Market Segmentation – North America AI in Financial Asset Management Market

The North America AI in financial asset management market is segmented based on technology, application, and country. Based on technology, the North America AI in financial asset management market is segmented into predictive analytics, machine learning, NLP, and others. Based on application, the North America AI in financial asset management market is segmented into conversational platforms, data analysis, risk & compliance, portfolio optimization, process automation, and others.

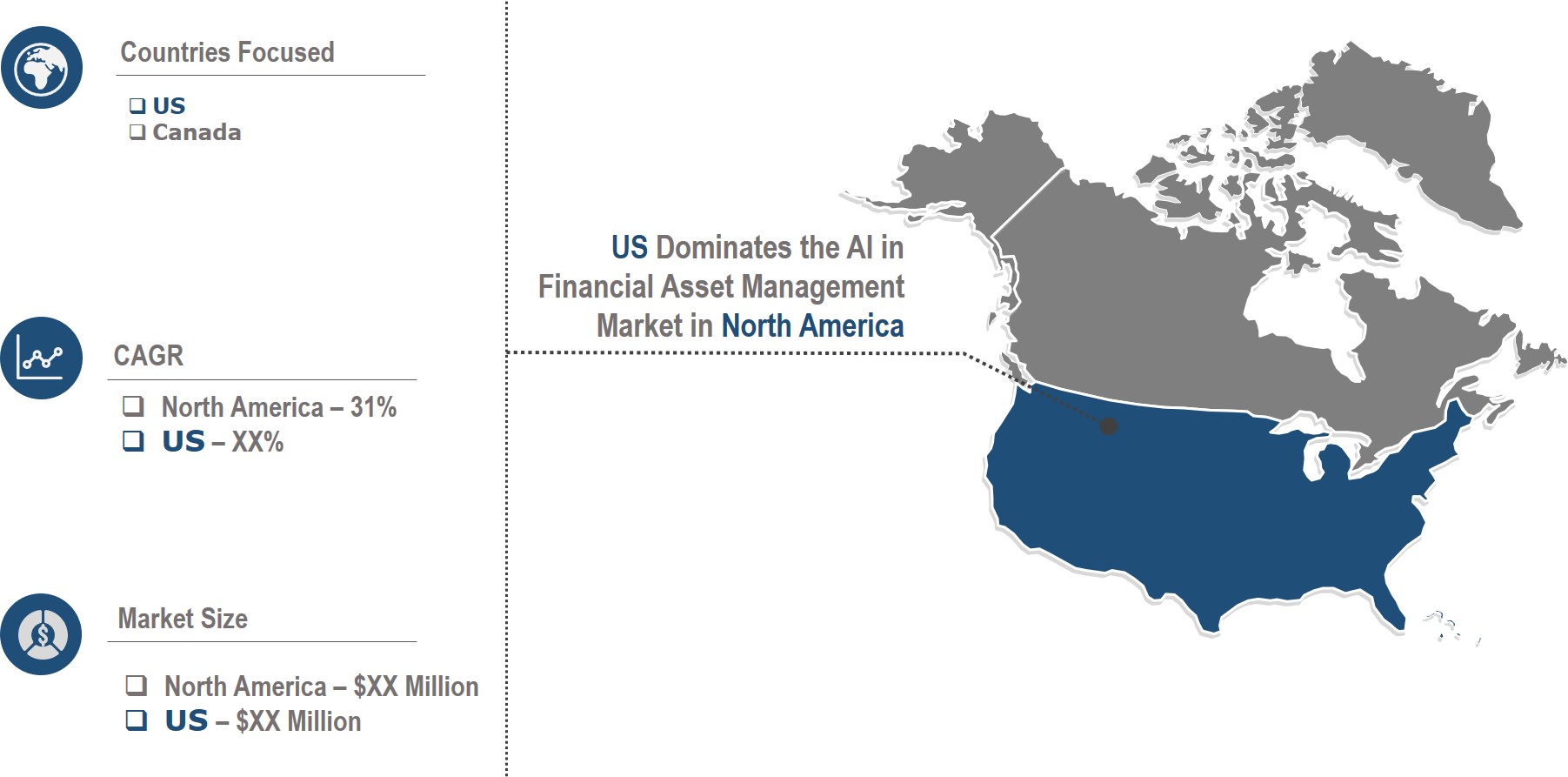

Country-level Outlook – North America AI in Financial Asset Management Market

In terms of country-wise analysis, the North America AI in financial asset management market is segmented into US and Canada. Among these countries, the US dominates the North America AI in financial asset management market and is expected to remain dominant throughout the forecast period. This is mainly due to increasing interest in artificial intelligence for investment recommendations and portfolio management decisions.

Benefits and Vendors – North America AI in Financial Asset Management Market

The study on the North America AI in financial asset management market contains an in-depth analysis of vendors, which includes financial health, business units, key business priorities, SWOT, strategies, and views, and competitive landscape. Few of the key players highlighted in this study include Genpact, IBM, Infosys, Synechron, Cognizant Next IT, IPsoft, Lexalytics, Narrative Science, and Oliver Wyman.

The study offers a comprehensive analysis of the “North America AI in financial asset management market”. Bringing out the complete key insights of the industry, the report aims to provide an insight into the latest trends, current market scenario, and technologies related to the market. In addition, it helps the venture capitalists to understand the revenue opportunities across different segments to take better decisions.

- Executive Summary

- Industry Outlook

- Industry Snapshot

- Industry Overview

- Industry Trends

- Industry Snapshot

- Market Snapshot

- Total Addressable Market

- Segmented Addressable Market

- PEST Analysis

- Porter’s Five Force Analysis

- Related Market

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO – Impact Analysis

- AI in Financial Asset Management Market, By Technology

- Overview

- Predictive Analytics

- Machine Learning

- 4.4 NLP 26

- Others

- AI in Financial Asset Management Market, By Application

- Overview

- Conversational Platform

- Data Analysis

- Risk & Compliance

- Portfolio Optimization

- Process Automation

- Others

- AI in Financial Asset Management Market, By Country

- Overview

- US

- Canada

- Competitive Landscape

- Competitor Analysis

- Product/Offerings Portfolio Analysis

- SWOT Analysis

- Market Developments

- Mergers & Acquisitions (M&A)

- Expansions

- Product Launches & Exhibitions

- Vendor Profile

- Genpact

- IBM

- Infosys

- Synechron

- Cognizant

- Next IT

- IPsoft

- Lexalytics

- Narrative Science

- Oliver Wyman

- Annexure

- Report Scope

- Research Methodology

- Study Declarations

- Report Assumptions

- Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.