Global Foot and Ankle Devices Market Forecast up to 2025

- February, 2019

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

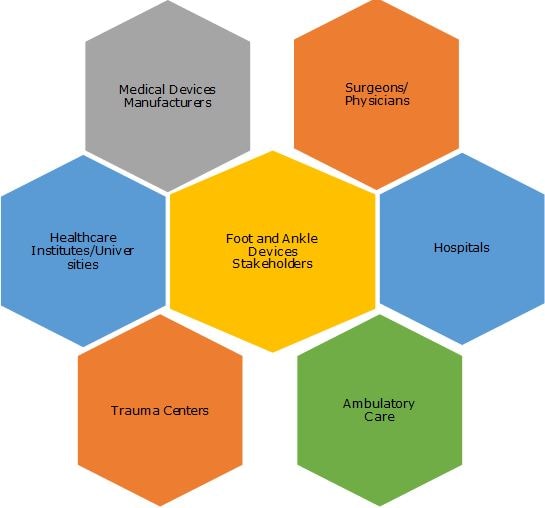

[119 pages report] This market research report identifies Johnson & Johnson, Stryker, Zimmer Biomet Holdings Inc., Smith and Nephew, Inc., Arthrex, Inc., and Wright Medical Group N.V., as the major vendors operating in the Global Foot and Ankle Devices Market. This report also provides a detailed analysis of the market by product type (joint implants, support and braces, prosthetics, fixations, and consumables), by applications (osteoporosis, rheumatoid arthritis, hammertoe, bunions, and others), by end-users (hospitals, ambulatory care, and trauma centers), and by regions (North America, Europe, APAC, and Rest of the World).

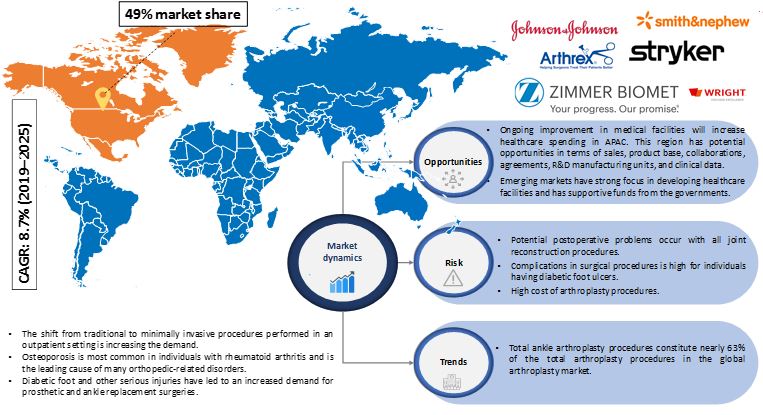

Foot and Ankle Devices Market Research Overview

Infoholic Research predicts that the Global Foot and Ankle Devices Market will grow at a CAGR of 8.7% during the forecast period. The market is expected to see a significant growth with factors driving the market such as increase in incidence of arthritis, low limb disorders causing acute injury and overuse injuries, sports activities, accidents, and diabetic foot. Also, the increase in popularity of minimally invasive surgical procedures (especially total ankle replacement i.e., arthroplasty procedures) has increased the usage of Foot and Ankle Devices across the globe. Lower extremities are one of the common injury regions in the body primarily caused due to accidents and fall. Other orthopedic disorders also require surgical and replacement procedures. The foot and ankle devices market have advanced joint reconstruction, ankle fusion, internal fixation, and prosthetics. An increase in the demand for minimally invasive orthopedic surgeries is on the rise in developed and developing countries.

The shift from traditional to minimally invasive procedures performed in an outpatient setting is increasing in demand. The growing popularity of minimally invasive surgical procedures has increased the demand of foot and ankle devices as they have fewer complications associated with it. Joint reconstruction is one of the most successful orthopedic surgeries and is expected be one of the most effective and accurate procedures. Arthroscopy is one of the alternatives for the open surgical technique and is the most commonly performed total ankle replacement surgical procedure.

Most of the joint replacement implants are surgically performed when the joint is worn out or becomes dysfunctional due to injuries. Surgeries are primarily carried out to restore mobility and relieve pain. In minimally invasive surgery, a small surgical incision is made and fewer muscles around the joint are detached or cut. Despite this difference, both traditional and minimally invasive joint replacement are technically demanding due to the outcomes and are dependent on the operating team with considerable experience.

According to Infoholic Research analysis, North America accounted for the largest share of the global foot and ankle devices market in 2018. The primary reasons behind the market’s growth in the Americas are rise in the aging population, increasing incidence of osteoporosis, advanced healthcare infrastructure, and rising demand for minimally invasive surgeries. The Asia Pacific region is expected to witness the fastest growth rate due to large patient pool, increasing awareness, and rising healthcare expenditure.

Foot and Ankle Devices Market by Product Types

- Joint Implants

- Support and Braces

- Prosthetics

- Fixations

- Consumables

The prosthetics segment is the fastest growing segment and the advancements in technology has gained immense popularity in treating externally powered foot and ankle, which can normalize daily activity of a prosthetic leg or individual who has undergone amputation. Further, the total ankle systems have also gained high adoption in the foot and ankle market, which will lead it to gain the highest volume sales during the forecast period.

Foot and Ankle Devices Market by Applications

- Osteoporosis

- Rheumatoid arthritis

- Hammertoe

- Bunions

- Others

In 2018, the osteoporosis segment accounted for the maximum share with increased use of ortho-related procedures, especially for total ankle replacement.

Foot and Ankle Devices Market by End-users

- Hospitals

- Ambulatory Care

- Trauma Centers

In 2018, hospitals gained the highest share in the foot and ankle devices market with the large volumes of diagnostics and treatments globally.

Foot and Ankle Devices Market by Regions

- North America

- Europe

- APAC

- RoW

The foot and ankle devices market in APAC region is growing at a significant pace. The rise in aging population, road accidents, increase prevalence of osteoporosis, increase in demand of minimally invasive surgeries, swiftly growing medical tourism industry, and investments in mid-tier hospitals from the government are driving the market growth.

Competitive Analysis

The competition in the global foot and ankle devices industry is intense and is primarily characterized by widespread research efforts and fast technological progress. Manufacturers including major and mid-sized companies in the foot and ankle devices and biologics industries are competing with newer products, advanced features, quality, safety, and efficacy. They have partnered with academic institutions and other public and private research organizations that continue to conduct research and development activities. The partnership and collaboration help to develop the product with high productivity, seek patent protection, and establish arrangements for commercializing products that will compete with our products. The market in the developed countries is almost reaching maturity.

The competitive advantage is primarily due to the increase in mergers & acquisitions that have increased the product launch and product portfolio expansion in leading companies. Factors such as price, quality, innovative design and technical capability, scale of operations, clinical results, distribution capabilities, breadth of product line, brand reputation, and strong customer service remains the primary objectives of all the vendors. Most of the vendors are trying to compete by having core competencies and develop strong competitive advantage in the market.

Key Vendors

- Johnson & Johnson (DePuy Synthes Inc.)

- Stryker

- Zimmer Biomet Holdings, Inc.

- Smith & Nephew, Inc.

- Arthrex, Inc.

- Wright Medical Group N.V.

Key Competitive Facts

- The market is highly competitive with all the players competing to gain the market share. Intense competition, rapid advancements in technology, frequent changes in government policies, and the prices are key factors that confront the market.

- The requirement of high initial investment, implementation, and maintenance cost in the market are also limiting the entry of new players.

- Responding to competitive pricing pressures specific to each of our geographic markets

- Protection of proprietary technology for products and manufacturing processes

Benefits

The report provides complete details about the usage and adoption rate of foot and ankle devices. Thus, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives towards the medical devices segment in the upcoming years along with details of the pureplay companies entering the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to key stakeholders in order to expand their business and capture the revenue in specific verticals, and to analyze before investing or expanding the business in this market.

Key Takeaways

- Understanding the potential market opportunity with precise market size and forecast data.

- Detailed market analysis focusing on the growth of the foot and ankle devices industry.

- Factors influencing the growth of the foot and ankle devices market.

- In-depth competitive analysis of dominant and pureplay vendors.

- Prediction analysis of the foot and ankle devices industry in both developed and developing regions.

- Key insights related to major segments of the foot and ankle devices market.

- The latest market trend analysis impacting the buying behavior of the consumers.

Key Stakeholders

1 Industry Outlook

1.1 Orthopedic Devices

1.1.1 Overview

1.1.2 Geography

1.1.3 Medical Technologies

1.1.4 Increase in Mergers & Acquisitions

1.1.5 Industry Trends

1.2 Healthcare Spending in the US

1.3 Regulatory Bodies & Standards

1.4 Reimbursement Scenario

1.5 Third-party Reimbursement

1.6 Emerging Global Markets

1.7 Patient Demographics

1.8 Definition: Foot and Ankle

1.8.1 Overview

1.8.2 Statistics

1.9 PESTLE Analysis

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Total Addressable Market (TAM)

3.1.1 Importance of Orthopedic Devices

3.2 Segmented Addressable Market (SAM)

3.3 Related Markets

3.3.1 Surgical Devices Market

3.3.2 Biomaterial Market

3.3.3 Arthroscopy Devices Market

3.3.4 Hip Replacement Market

3.3.5 Dental Implant Market

3.3.6 Energy-based Aesthetic Devices Market

3.3.7 Spine Orthopedic Devices Market

3.4 Porter 5 (Five) Forces

4 Market Characteristics

4.1 Market Segmentation, By Product Type

4.1.1 Joint Implants

4.1.2 Support and Braces

4.1.3 Prosthetics

4.1.4 Fixations

4.1.5 Consumables

4.2 Foot and Ankle Devices Market, By Application Type

4.2.1 Osteoporosis

4.2.2 Rheumatoid arthritis

4.2.3 Hammertoe

4.2.4 Bunions

4.2.5 Others

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Increase in the prevalence of osteoporosis

4.3.1.1 Increasing in number of road accidents

4.3.1.2 Increase in number of diabetic foot reconstruction

4.3.1.3 Rise in elderly population

4.3.1.4 Rise in the number of outpatient procedures

4.3.2 Restraints

4.3.2.1 Huge cost of foot and ankle devices

4.3.2.2 Complications and risks associated with foot and ankle procedures

4.3.2.3 Inadequate reimbursement policies

4.3.2.1 Product recall

4.3.2.1 Dearth of skilled professionals

4.3.2.1 Stringent regulatory framework and labeling requirement

4.3.3 Opportunities

4.3.3.1 Technological advancement in foot and ankle devices

4.3.3.2 In-depth transformation in prosthetic care

4.3.3.3 Growing popularity of minimally invasive surgeries

4.3.3.4 Rise in use of biomaterial in ortho-related surgeries

4.3.3.5 Increase in healthcare spending in improvising healthcare facilities

4.3.3.6 Market expansion opportunities in emerging nations

4.3.4 DRO – Impact Analysis

4.4 Key Stakeholders

5 End-Users

5.1 Overview

5.2 Hospitals

5.3 Ambulatory Care

5.4 Trauma Centers

6 Regions

6.1 Overview

6.1.1 North America

6.1.1.1 Market overview

6.1.2 Europe

6.1.2.1 Market overview

6.1.3 APAC

6.1.3.1 Market overview

6.1.4 Rest of the World

6.1.4.1 Market overview

7 Competitive Landscape

7.1 Competitor Comparison Analysis

7.1.1 M&A Analysis

8 Vendor Profiles

8.1 Johnson & Johnson (DePuy Synthes, Inc)

8.1.1 Business Units

8.1.2 Geographic Revenue

8.1.3 Business Focus

8.1.4 SWOT Analysis

8.1.5 Business Strategies

8.2 Zimmer Biomet Holdings, Inc

8.2.1 Overview

8.2.2 Business Units

8.2.3 Geographic Revenue

8.2.4 Business Focus

8.2.5 SWOT Analysis

8.2.6 Business Strategies

8.3 Stryker

8.3.1 Overview

8.3.2 Business Units

8.3.3 Geographic Revenue

8.3.4 Business Focus

8.3.5 SWOT Analysis

8.3.6 Business Strategies

8.4 Smith & Nephew, Inc

8.4.1 Overview

8.4.2 Business Units

8.4.3 Geographic Revenue

8.4.4 Business Focus

8.4.5 SWOT Analysis

8.4.6 Business Strategies

8.5 Arthrex, Inc.

8.5.1 Overview

8.5.2 Business Focus

8.5.3 SWOT Analysis

8.5.4 Business Strategies

8.6 Wright Medical Group N.V.

8.6.1 Overview

8.6.2 Business Units

8.6.3 Geographic Revenue

8.6.4 Business Focus

8.6.5 SWOT Analysis

9 Companies to Watch for

9.1 Orthofix International N.V.

9.1.1 Overview

9.1.2 Key Highlights

9.1.3 Business Strategies

9.2 B. Braun

9.2.1 Overview

9.2.2 Key Highlights

9.2.3 Business Strategies

9.3 OMNIlife Science

9.3.1 Overview

10 Other Vendors

Annexure

Ø Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.