Global Next-generation Sequencing (NGS) Market Forecasts to 2024

- June, 2018

- Domain: Healthcare - Biotechnology

- Get Free 10% Customization in this Report

Overview: Next-generation sequencing (NGS) is the massively parallel sequencing technology that has revolutionized the biological sciences. With its ultra-high throughput, scalability, and speed, NGS enables researchers to perform a wide variety of applications and study biological systems at a level never before possible. Illumina, Pacific Biosciences of California, Thermo Fisher scientific and Oxford Nanopore technology offers next-generation sequencing instruments based on different technologies such as Reversible terminator sequencing, Sequencing by ligation, Single-molecule, real-time sequencing (SMRT), ion semiconductor sequencing technology and Nanopore sequencing technology respectively. Wide range of diagnostic applications, continuous technology advancements are making it more efficient and user-friendly, but the complications associated with data storage and lack of skilled professional are some of the factors which may hamper growth to an extent.

Market Analysis: The “Global Next-Generation Sequencing market” is estimated to witness a CAGR of 18.6% during the forecast period 2018–2024. The global market is analyzed based on five segments – Technology, Products, Application, End-users and regions.

Regional Analysis: The regions covered in the report are the North America, Europe, Asia Pacific, and Rest of the World (ROW). North America is the major shareholder in the global next-generation sequencing market, followed by Europe. Asia-Pacific region is expected to grow at high CAGR during the forecasted period due to increasing funding for healthcare research, growing patient pool, and increasing healthcare expenditure. The markets in emerging counties such as, India, China and Brazil are expected to grow at a rapid pace for next five years.

Technology Analysis: The next-generation sequencing market by technology is segmented into reversible terminator sequencing, ion semiconductor sequencing, sequencing by ligation, single molecule real-time sequencing, nanopore sequencing and others. Reversible terminator sequencing occupied a major market share in 2017 and is expected to remain same during the forecasted period.

Product Analysis: The market by product type is segmented into instruments, consumables and reagents and services. The services segment of the NGS market includes data analysis services and sequencing services. Among various application, consumables and reagents occupied the largest share in 2017, due to increased usage and need of consumables throughout the sample preparation, library construction, and various other pre-requisite steps of next-generation sequencing.

Application Analysis: The market by application is segmented into diagnostics, biomarker discovery, drug discovery, agriculture and animal research and others. Diagnostics includes prenatal testing, cancer diagnostics, genetic screening, pre-implantation, HLA typing and various other clinical diagnostics applications. The diagnostics application occupied a major share in 2017, due to increasing usage of next-generation sequencing for disease diagnosis.

End-Users Analysis: The market by end-users is segmented into academic and research institutes, hospitals and clinics, biotech and pharma companies and others. Among various end-users of the NGS market, academic and research institutes occupied a major share in 2017.

Key Players: Illumina, Inc., Thermo Fisher Scientific, Inc., Pacific Biosciences of California, Oxford Nanopore Technologies Limited, Beijing Genomics Institute, Agilent Technologies, Inc., Qiagen N.V., Eurofins Scientific, F. Hoffmann-La Roche, DNASTAR, Inc., Biomatters Limited and other predominate and niche players.

Competitive Analysis: Currently the next-generation sequencing market is consolidated with few key companies due to the involvement of complicated technologies and the requirement of high capital investment. Sequencing-based test may soon be regarded as the gold standard in the field of molecular diagnostics. The increase in the applications of NGS has made many biotechnological firms and diagnostic laboratories to invest heavily in this field by launching new products or acquiring other smaller firms or by collaboration. For instance, in August 2017, US based Illumina and Telegraph Hill Partners launched Verogen, Inc. to drive adoption of NGS in the global forensic genomics Market. In February 2018, Twist Bioscience entered the NGS sample prep market with the launch of its first target enrichment products. In March 2017, MedGenome launched NGS based liquid biopsy blood test “Oncotrack” for the diagnosis of cancer in India.

Benefits: The report provides complete details about the usage and adoption rate of Next-generation Sequencing in various therapeutic verticals and regions. With that, key stakeholders can know about the major trends, drivers, investments, and vertical player’s initiatives. Moreover, the report provides details about the major challenges that are going to impact on the market growth. Additionally, the report gives the complete details about the key business opportunities to key stakeholders to expand their business and capture the revenue in the specific verticals to analyze before investing or expanding the business in this market.

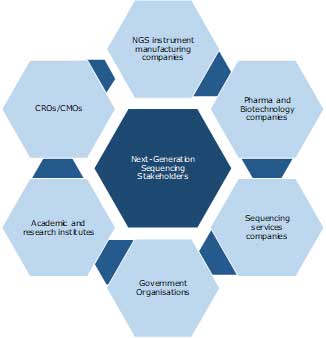

Key Stakeholders:

Report Scope:

- Technology:

- Reversible terminator sequencing

- Ion Semiconductor sequencing

- Sequencing by ligation

- Single molecule real-time sequencing

- Nanopore sequencing

- Others

- Product:

- Instruments

- Consumables and reagents

- Services

- Application Areas:

- Diagnostics

- Biomarker discovery

- Drug discovery

- Agriculture and animal research

- Others

- End-Users:

- Academic and research institutes

- Hospitals and clinics

- Biotech and pharma companies

- Others

- Region:

- North America

- Europe

- Asia Pacific

- Rest of the world

1 Industry Outlook

1.1 Market Overview

1.2 Total Addressable Market

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Advantages of Next-generation Sequencing

3.3 Segmented Addressable Market

3.4 Trends in the Next-generation Sequencing Market

3.5 Related Markets

3.5.1 Polymerase Chain Reaction

3.5.2 In-situ Hybridization

3.5.3 Microarray

4 Market Outlook

4.1 Market Segmentation

4.2 PEST Analysis

4.3 Porter 5(Five) Forces

5 Market Characteristics

5.1 DRO Analysis – Market Dynamics

5.1.1 Drivers

5.1.1.1 Usage of sequencing in a wide range of diagnostic applications

5.1.1.2 High speed, accuracy, and reduced sequencing cost

5.1.2 Opportunities

5.1.2.1 Emerging applications of next-generation sequencing

5.1.2.2 Evolution of personalized medicine

5.1.3 Restraints

5.1.3.1 Complications associated with NGS data storage

5.1.3.2 Lack of skilled professional

5.2 DRO – Impact Analysis

5.3 Key Stakeholders

6 Technology: Market Size and Analysis

6.1 Overview

6.2 Reversible Terminator Sequencing

6.3 Ion Semiconductor Sequencing

6.4 Sequencing by Ligation

6.5 Single-molecule Real-time (SMRT) Sequencing

6.6 Nanopore Sequencing

6.7 Others

7 Products: Market Size and Analysis

7.1 Overview

7.2 Instruments

7.3 Consumables and Reagents

7.4 Services

8 Applications: Market Size and Analysis

8.1 Overview

8.2 Diagnostics

8.3 Biomarker Discovery

8.4 Drug Discovery

8.5 Agriculture and Animal Research

8.6 Other Applications

9 End-users: Market Size and Analysis

9.1 Overview

9.2 Hospitals and Reference Laboratories

9.3 Academic and Research Institutions

9.4 Biotech and Pharma Companies

9.5 Others

10 Regions: Market Size and Analysis

10.1 Overview

10.2 North America

10.3 Europe

10.4 Asia Pacific

10.5 Rest of the World

11 Competitive Landscape

12 Vendor Profiles

12.1 Illumina Inc.

12.1.1 Overview

12.1.2 Business Units

12.1.3 Geographic Revenue

12.1.4 Business Focus

12.1.5 SWOT Analysis

12.1.6 Business Strategies

12.2 Thermo Fisher Scientific Inc.

12.2.1 Overview

12.2.2 Business Units

12.2.3 Geographic Revenue

12.2.4 Business Focus

12.2.5 SWOT Analysis

12.2.6 Business Strategies

12.3 Pacific Biosciences of California Inc.

12.3.1 Overview

12.3.2 Geographic Revenue

12.3.3 Business Focus

12.3.4 SWOT Analysis

12.3.5 Business Strategies

12.4 Oxford Nanopore Technologies Ltd.

12.4.1 Overview

12.4.2 Business Focus

12.4.3 SWOT Analysis

12.4.4 Business Strategies

12.5 Beijing Genomics Institute

12.5.1 Overview

12.5.2 Business Focus

12.5.3 SWOT Analysis

12.5.4 Business Strategies

13 Companies to Watch for

13.1 DNASTAR Inc.

13.1.1 Overview

13.2 Agilent Technologies Inc.

13.2.1 Overview

13.3 Qiagen N.V.

13.3.1 Overview

13.4 Eurofins Scientific

13.4.1 Overview

13.5 Biomatters Limited

13.5.1 Overview

13.6 F. Hoffmann-La Roche

13.6.1 Overview

Annexure

Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.