Global Human Insulin Market 2017-2023

- January, 2018

- Domain: Healthcare - Pharmaceuticals

- Get Free 10% Customization in this Report

Overview: Insulin is a peptide hormone that helps in controlling the absorption of fat and carbohydrate in the body. The human insulin market is anticipated to grow at a robust CAGR during the forecast period due to a high incidence rate of diabetes, globally.

The growth in the prevalence rate of diabetes, changes in lifestyles, rising number of obese patients, and increasing geriatric population are the major factors driving the market growth. However, the high cost for the development and production of insulin, manufacturing complexities, and stringent regulatory scenario for the approval of derived products are hampering the growth of the market. The development of pipeline insulin products and expiry of key patents are providing an opportunity for the manufacturers of human insulin.

Market Analysis: The “Global Human Insulin” market is estimated to witness a CAGR of 10.2% during the forecast period 2017–2023. The human insulin market is analyzed based on three segments – top insulin brands, product types, and regions.

Regional Analysis: The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (ROW). North America accounts for the largest share of the global human insulin market, followed by Europe, Asia Pacific, and Rest of the World. Nearly half of the market is occupied by North America, with the US being the major contributor to the market growth.

Product Analysis: Based on types, the market is segmented into modern human insulin and traditional human insulin. Modern human insulin includes rapid-acting insulin analogs, premixed analogue insulins, and long-acting insulin. Traditional human insulin includes regular human insulin, NPH human insulin, and pre-mixed insulin. Novo Nordisk holds 45.0% share of the total modern insulin market.

Top Insulin Brands: Lantus is the major insulin drug in the market. Due to the loss of patents, the drug has got competition in the form of biosimilar by name Basaglar from Eli Lilly. After the loss of share for its biosimilar counterpart, the drug lost its value for its follow-up drug Toujeo. Since the launch of Toujeo in April 2015, the company has been switching over as many patients as possible to the newer drug to fill the sales gap caused by the reduced revenue of Lantus.

Key Players: Novo Nordisk, Sanofi A/S, Eli Lilly & Company, and Astra Zeneca PLC are the key players in the market. The other prominent players in the market include Biocon, Julphar, Wockhardt, GSK, Oramed, and SemBioSys Genetics.

Competitive Analysis: Regardless of the size of the total market, it is chiefly dominated by Novo Nordisk, Sanofi, and Eli Lilly. These firms function globally either independently or through subsidiaries and distributors. The insulin products of Novo Nordisk are sold in 111 countries along with 101 countries for Sanofi’s insulin products and 94 countries for Eli Lilly’s insulin products. Especially in higher income countries of Western Europe, nearly 55% of insulin products are sold by these major manufacturers. Moreover, in 2012, they occupied 88.7% of share in the global insulin market. However, there are many small companies involved in the production and sales of insulin products. Other major companies in the market are Wockhardt, Biocon, Julphar, Oramed, GSK, and SemBioSys Genetics Inc.

Benefits: The report provides complete details about the usage and adoption rate of human insulin in various regions. With that, key stakeholders can know about the major trends, drivers, investments, and vertical player’s initiatives. Moreover, the report provides details about the major challenges that are going to impact on the market growth. Additionally, the report gives the complete details about the key business opportunities to key stakeholders to expand their business and capture the revenue in the specific verticals to analyze before investing or expanding the business in this market.

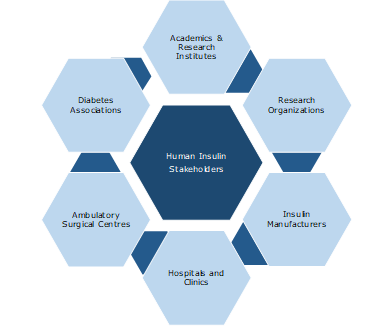

Key Stakeholders:

1 Industry Outlook

1.1 Industry Overview

1.2 Total Addressable Market

1.3 Industry Trends

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Market Definition – Infoholic Research

3.2 Segmented Addressable Market (SAM)

3.2.1 Trends of Human Insulin market

3.3 Related Markets

3.3.1 Oncology (Cancer) Drugs

3.3.2 Active pharmaceutical ingredients (APIs)

3.3.3 Over the counter drugs (OTC)

3.3.4 Diabetes Drugs

4 Market Outline

4.1 Pipeline products

4.2 Market Segmentation

4.3 Porter 5(Five) Forces

4.4 PEST Analysis

5 Market Characteristics

5.1 Market Dynamics

5.1.1 Drivers

5.1.1.1 Increasing Aging Population

5.1.1.2 Increasing People Suffering with Diabetes

5.1.2 Opportunities

5.1.2.1 Increase healthcare spending

5.1.2.2 Patent Expiry for Blockbuster Drugs

5.1.3 Restraints

5.1.3.1 Complex regulatory process

5.1.3.2 High cost of insulin

5.1.4 DRO – Impact Analysis

5.1.5 Key Stakeholders

6 Insulin Types: Market Size and Analysis

6.1 Overview

6.2 Lantus

6.3 Humulin

6.4 Levemir

6.5 Humalog

6.6 NovoLog/NovoRapid

6.7 Tresiba

6.8 Basaglar/ Abasaglar

6.9 Toujeo

6.10 Apidra

Company: Sanofi

7 Types: Market Size and Analysis

7.1 Overview

7.2 Modern Insulin

7.2.1 Rapid Acting Insulin Analogs

7.2.2 Premixed analogue insulins

7.2.3 Long-acting insulin

7.3 Traditional Human Insulin

7.3.1 Regular Human Insulin

7.3.2 NPH Human Insulin

7.3.3 Pre-Mixed Insulin

8 Regions: Market Size and Analysis

8.1 Overview

8.2 North America

8.2.1 Overview

8.2.2 United States

8.2.3 Canada

8.3 Europe

8.3.1 Overview

8.3.2 United Kingdom

8.3.3 Germany

8.4 APAC

8.4.1 Overview

8.4.2 India

8.4.3 China

8.4.4 Japan

8.5 Rest of the World

8.5.1 Overview

8.5.2 Middle East and Africa

8.5.3 Brazil

9 Competitive Landscape

10 Vendor Profiles

10.1 Novo Nordisk A/S

10.1.1 Overview

10.1.2 Geographic Revenue

10.1.3 Business Focus

10.1.4 SWOT Analysis

10.1.5 Business Strategy

10.2 Sanofi

10.2.1 Overview

10.2.2 Geographic Revenue

10.2.3 Business Focus

10.2.4 SWOT Analysis

10.2.5 Business Strategy

10.3 Eli Lilly & Company Ltd

10.3.1 Overview

10.3.2 Business Focus

10.3.3 SWOT Analysis

10.3.4 Business Strategies

10.4 Astra Zenca PLC.

10.4.1 Overview

10.4.2 Geographic Presence

10.4.3 Business Focus

10.4.4 SWOT Analysis

10.4.5 Business Strategy

11 Companies to Watch For

11.1 GlaxoSmithKline plc

11.1.1 Overview

11.2 Julphar Gulf Pharmaceutical Industries.

11.2.1 Overview

11.2.2 Highlights

11.3 Biocon Ltd

11.3.1 Overview

11.4 Wockhardt

11.4.1 Overview

11.4.2 Highlights

11.5 Oramed

11.5.1 Overview

11.5.2 Highlights

11.6 SemBioSys Genetics Inc.

11.6.1 Overview

Annexure

Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.