Coronary Stents Market - Global Forecasts to 2023

- August, 2017

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

Cardiovascular diseases (CVDs) are one of the most common causes of death globally. According to the World Health Organization (WHO) statistics, around 17.5 million deaths are reported due to CVDs every year, which represent a total of 31% of the global death statistics. Out of this, 7.4 million deaths are due to coronary heart diseases and 6.7 million deaths are due to stroke. Coronary artery disease (CAD) is one of the common heart diseases accounting for around 45.1% of the deaths in the US. This condition arises when the coronary arteries narrow due to the formation of plaque, thereby, hardening and reducing their flexibility. Lifestyle variations, such as healthy food, workout regimen, and quitting smoking, help to recover from CAD risk.

Improvements in coronary stents have enhanced the probability of patients undergoing cardiovascular surgery. The objective of the latest advancement in the industry is to decrease the sensitivity of drugs in the drug-eluting stents and lessen the risk associated with the surgery. For instance, in 2017, Medtronic Japan Co. Ltd., a subsidiary of Medtronic PLC, launched Resolute Onyx Stent System. The design of the stent allows better penetration of the arterial walls with ease.

Factors, such as the increasing prevalence of cardiovascular diseases, the increasing aging population, and the growing acceptance of minimally invasive endovascular surgeries, are driving the market growth. However, stringent government regulations, high cost associated with stent implants, and the availability of alternative treatment procedures are hampering the growth of the market. The markets in India, Brazil, China, and Russia are also expected to grow at a rapid pace during the forecast period due to the high prevalence cardiovascular diseases.

Market Analysis:

The Global Coronary Stents Market is estimated to witness a CAGR of 15.03% during the forecast period 2017–2023. The Coronary Stents Market is analyzed based on two segments – Stent types and regions.

Regional Analysis:

The regions covered in the report are North America, Europe, Asia Pacific, and Rest of the World (ROW). The availability of technologically advanced products has made North America the leader of the market followed by Europe. More than 75% of CVD deaths are recorded in low-income and middle-income countries. Thus, the market growth in APAC and ROW is expected to grow at a high rate. Currently, many manufacturers are concentrating in launching advanced products in these regions to tap the opportunity.

Stents Types Analysis:

The coronary stents market is segmented into bare metal stents, drug-eluting stents, and bio-absorbable stents. Approximately 90% of all percutaneous coronary intervention (PCI) surgeries use a coronary stent. Thus, drug-eluting stents hold the major share in the market. The highest growth rate is expected in the bioresorbable stents due to the advantages of the polylactic acid material. Companies, such as Abbott and Boston, are concentrating on developing biodegradable stents to offer effective products and maintain their leadership in the market. The market is also witnessing various mergers, acquisitions, and collaborations among the top players, which is defining the future of the Global Coronary Stents Market.

Key Players:

Abbott Laboratories, Boston Scientific Corporation, Medtronic PLC, B. Braun Melsungen AG, Terumo Corporation, Biotronik SE & Co. KG, Stentys SA, MicroPort Scientific Corporation, and Meril Life Science, and other predominant and niche players.

Competitive Analysis:

The exit of Johnson and Johnson from the coronary stents market has provided opportunities for many players to strengthen their market share. Abbott Laboratories, Medtronic, and Boston Scientific Corporation were the market leaders in the global coronary stents market as of 2016. The top three market players are estimated to hold more than 60% share of the market in 2016. Abbott Laboratories emerged to be the global leader, while Boston Scientific Corporation dominated the market in Brazil and other emerging Latin American countries.

Benefits:

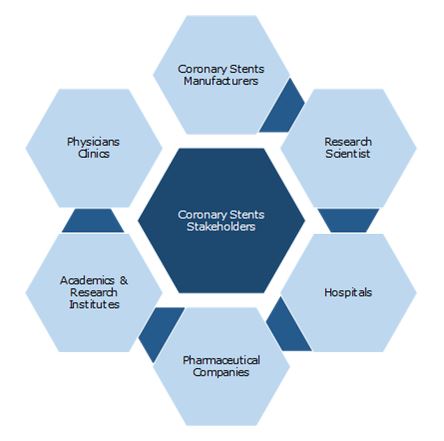

The report provides complete details about the usage and adoption rate of coronary stents in various therapeutic verticals and regions. Thus, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the business opportunities to key stakeholders and help them to expand their business and capture the revenue in the specific verticals and analyze before investing or expanding the business in this market.

Key Stakeholders:

1.1 Industry Overview

1.2 Industry Trends

1.3 PEST Analysis

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Total Addressable Market

3.2 Segmented Addressable Market

3.3 Related Markets

3.3.1 Interventional Cardiology

3.3.2 Peripheral Vascular Stents

3.3.3 Atherectomy

4 Market Outlook

4.1 Market Definition – Infoholic Research

4.2 Causes for Coronary Heart Disease

4.3 Market Segmentation

4.4 Porter 5(Five) Forces

5 Market Characteristics

5.1 Evolution

5.2 Stents Platforms

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing prevalence of cardiovascular diseases

5.3.1.2 Increasing aging population

5.3.1.3 Growing acceptance for minimally invasive endovascular surgeries

5.3.2 Opportunities

5.3.2.1 Market expansion opportunities in emerging nations

5.3.2.2 Increasing clinical trials

5.3.3 Restraints

5.3.3.1 Stringent regulations for approval

5.3.3.2 High cost of treatment associated with stent implants

5.3.3.3 Availability of alternative treatment procedure

5.4 DRO – Impact Analysis

5.5 Key Stakeholders

6 Coronary Stents Pipeline

6.1 Overview

7 Types: Market Size and Analysis

7.1 Overview

7.2 Bare Metal Stents (BMS)

7.3 Drug Eluting Stents

7.4 Bio-absorbable Stents

8 End-users: Market Size and Analysis

8.1 Overview

8.2 Hospitals

8.3 Ambulatory Surgical Centers (ASCs)

8.4 Cardiac Centers

9 Regions: Market Size and Analysis

9.1 Overview

9.2 North America

9.2.1 US

9.2.2 Canada

9.3 Europe

9.3.1 UK

9.3.2 Germany

9.3.3 France

9.4 Asia Pacific

9.4.1 Japan

9.4.2 China

9.4.3 India

9.5 Rest of the World

9.5.1 Africa

9.5.2 Brazil

10 Competitive Landscape

10.1 Overview

11 Vendors Profile

11.1 Abbott Laboratories (Abbott)

11.1.1 Overview

11.1.2 Business Unit

11.1.3 Geographic Presence

11.1.4 Business Focus

11.1.5 SWOT Analysis

11.1.6 Business Strategy

11.2 Boston Scientific Corp. (Boston)

11.2.1 Overview

11.2.2 Business Units

11.2.3 Geographic Presence

11.2.4 Business Focus

11.2.5 SWOT Analysis

11.2.6 Business Strategies

11.3 B. Braun Melsungen AG

11.3.1 Overview

11.3.2 Business Units

11.3.3 Geographic Presence

11.3.4 Business Focus

11.3.5 SWOT Analysis

11.3.6 Business Strategies

11.4 Medtronic Plc

11.4.1 Overview

11.4.2 Business Units

11.4.3 Geographic Presence

11.4.4 Business Focus

11.4.5 SWOT Analysis

11.4.6 Business Strategies

11.5 MicroPort Scientific Corporation

11.5.1 Overview

11.5.2 Business Units

11.5.3 Geographic Presence

11.5.4 Business Focus

11.5.5 SWOT Analysis

11.5.6 Business Strategies

12 Companies to Watch For

12.1 Terumo Corp.

12.1.1 Overview

12.2 Biosensors International Group

12.2.1 Overview

12.3 BIOTRONIK

12.3.1 Overview

12.4 Meril Life Science

12.4.1 Overview

12.5 STENTYS S.A.

12.5.1 Overview

12.5.2 Overview

Annexure

Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.