Anti-Drone Market by Mitigation Type (Destructive System and Non-destructive System), Defense Type (Drone Detection & Disruption Systems and Drone Detection Systems), End-Use (Military & Defense, Commercial, Government, and Others), and Geography – Global Forecast to 2026

- May, 2021

- Domain: ICT - Security

- Get Free 10% Customization in this Report

Anti-Drone is a system used to spot the enemy or unwanted drones and intercept them, and unmanned aerial vehicles are also included in them. Anti-drone systems are deployed to safeguard areas such as airports and other critical areas, including military bases and battlefields. The military generally adopts these devices to counter the enemy's unwanted drones to secure the area. The increasing significance of detecting the activities of terrorists, border trespassing, smuggling, and spying is a majorly supporting for the requirement of having a smart system in the area for risk management. Implementation of drones and unmanned aerial systems for the reasons mentioned above has become quite general. Therefore, the demand for the anti-drone market is projected to rise substantially during the forecast period. The Anti-Drone Market is anticipated to grow at the rate of 33.3% CAGR by 2026.

Research Methodology:

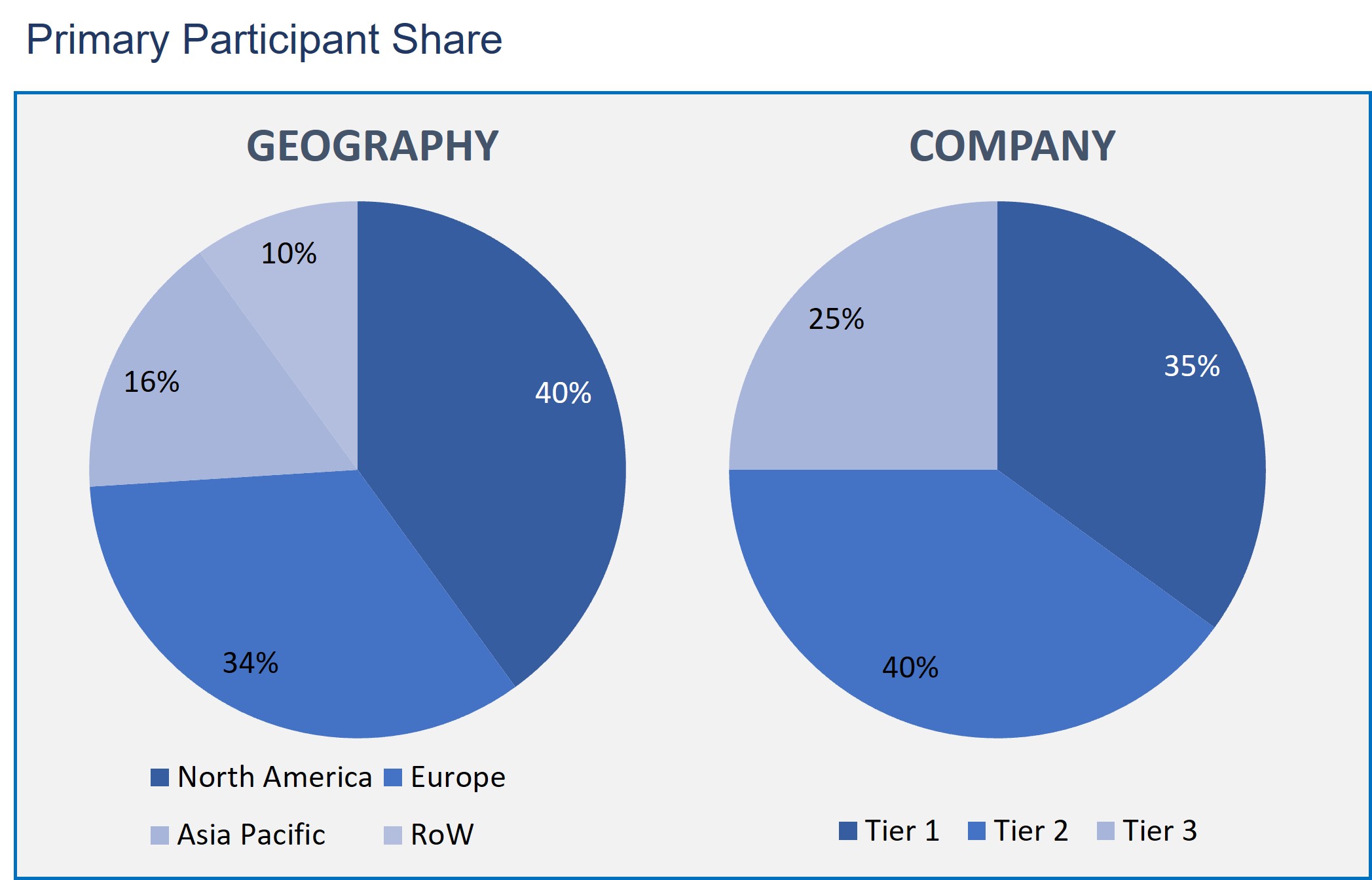

The Anti-Drone Market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology and a unique balance of primary insights. The real-time valuation of the market is an integral part of our forecasting and market sizing methodology. Industry experts and our primary participants have helped to compile related aspects with accurate parametric estimations for a complete study. The primary participants share is given below:

Mitigation Type Outlook in Anti-Drone Market

- Destructive System

- Laser System

- Missile Effector

- Electronic Countermeasure

- Non-destructive System

Defense Type Outlook in Anti-Drone Market

- Drone Detection & Disruption Systems

- Drone Detection Systems

End-Use Outlook in Anti-Drone Market

- Military & Defense

- Commercial

- Government

- Others

Geography Outlook in Anti-Drone Market

- North America

- Europe

- Asia Pacific

- Rest of the World

As taken into account the market based on mitigation type, the market is divided into the destructive system and non-destructive system. The destructive system segment has a substantial share, and this segment is further subdivided into laser systems, missile effectors, and electronic countermeasure. The laser system has a high demand in the market due to its ability to destroy several critical portions of the drone’s airframe with the help of directed energy, which eventually causes it to crash to the ground.

In the market segmentation of defense type, the drone detection and disruption systems are anticipated to hold the maximum share in the anti-drone market. The maximum share of this segment is attributed to the capability of this type of defense measure, such as the ability to detect, identify, and disruption of drones and UAVs, which are interrupting and are unwanted.

The primary end uses of the anti-drone system include military and defense, commercial, government, and other uses. But among them, the military and defense end-user plays the primary role in the anti-drone market share. The abrupt rise in illicit and terrorist activities worldwide and increasing spending on research and developments by prime defense contractors support the high demand for the anti-drone in military and defense. Moreover, several military forces increasingly use anti-drone systems to safeguard from intruders.

North America is witnessing a substantial share in the anti-drone market due to the increasing cases of security breaches by unknown drones and an increasing number of attacks from terrorists. Additionally, the aerospace and defense sector is increasingly deploying these anti-drone devices in the US.

The rising deployment of drones results in various security breaches by unknown drones or UAVs at critical infrastructure, and public areas have increased. This has stimulated the demand for countermeasures. In the present scenario, drones have become more popular and readily available due to their affordability. Commercial organizations utilize drones for the fastest parcel delivery; on the other hand, military groups utilize them for countering suspected terrorist groups. From the past few years, there has been an abrupt growth in the usage of all types of unmanned aerial systems.

This report provides the profiles of the major competitors of the anti-drone market: Raytheon Technologies Corp., DroneShield Ltd., SRC, Inc., Thales Group, Blighter Surveillance Systems Ltd, DeTect, Inc., Leonardo S.P.A, Rafael Advanced Defense Systems Ltd., Liteye Systems, Inc., Lockheed Martin Corp., Israel Aerospace Industries Ltd., Dedrone, Northrop Grumman Corp., MBDA and Battelle Memorial Institute.

The increasing number of security issues related to drones and prominent federal authorities worldwide encourage the expansion and commercialization of advanced drone detection and other technologies to generate opportunities for market growth.

- This research segments the anti-drone market exclusively and offers the nearest estimation of the overall market size and the subsegments across major regions.

- This study assists shareholders in understanding the market and gives information on prominent market drivers, restraints, challenges, and opportunities.

- This research would also assist shareholders in recognizing their competitors better and obtaining more information to stimulate their position in the business.

- The competitive landscape is also included in this report, such as product launches, acquisitions, mergers, and partnerships of the players.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Total Addressable Market

- Segment Addressable Market

- PEST Analysis

- Porter Five Forces

- Related Markets

- Ecosystem

- Market Overview

- Overview

- Market Evolution

- Market Trends and Impact

- Pricing Analysis

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Overview

- Mitigation Type: Market Size & Analysis

- Overview

- Destructive System

- Laser System

- Missile Effector

- Electronic Countermeasure

- Non-destructive System

- Defense Type: Market Size & Analysis

- Overview

- Drone Detection & Disruption Systems

- Drone Detection Systems

- End-Use: Market Size & Analysis

- Overview

- Military & Defense

- Commercial

- Government

- Others

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- Raytheon Technologies Corp.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- DroneShield Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- SRC, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Thales Group

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Blighter Surveillance Systems Ltd

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- DeTect, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Leonardo S.p.A

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Rafael Advanced Defense Systems Ltd.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Liteye Systems, Inc.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Lockheed Martin Corp.

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Raytheon Technologies Corp.

- Companies to Watch

- Israel Aerospace Industries Ltd.

- Overview

- Products & Services

- Business Strategy

- Dedrone

- Overview

- Products & Services

- Business Strategy

- Northrop Grumman Corp.

- Overview

- Products & Services

- Business Strategy

- MBDA

- Overview

- Products & Services

- Business Strategy

- Battelle Memorial Institute

- Overview

- Products & Services

- Business Strategy

- Israel Aerospace Industries Ltd.

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.