Food Safety Testing Market by Testing Technologies (DNA-based, Immunoassay-based, and Chromatography- & spectroscopy-based), Targets Tested (Pathogen, GMO, Mycotoxin, and Allergen), and Geography – Global Forecast up to 2026

- March, 2021

- Domain: Healthcare - Health and Hygiene

- Get Free 10% Customization in this Report

The realistic impact of COVID-19 on the global food safety testing market has been projected to be valued at $10.5 billion in 2020, which is expected to reach USD 13.03 billion by 2021, recording a CAGR of 17.59%. Rising concerns among consumers for processed food due to the outbreak of COVID-19 across the world will upsurge food products' security and safety, therefore driving the food safety testing industry development. The DNA-based segment accounted for a biggest share in the food safety testing market. DNA-based technology is used to manufacture multiple duplicates of genetic materials of microorganisms. This supports in testing the contamination of food products in less duration of time. Owing to its capacity to test multiple targets simultaneously, it is an effective technology resulting in the segment accounting for an important share in the food safety testing business.

Intertek, a Total Quality Assurance provider to industries worldwide, is contented to announce its partnership with Penlon to deliver rapid electromagnetic compatibility (EMC) testing to support their ESO 2 Emergency Ventilator project in response to the COVID-19 pandemic.

Research Methodology:

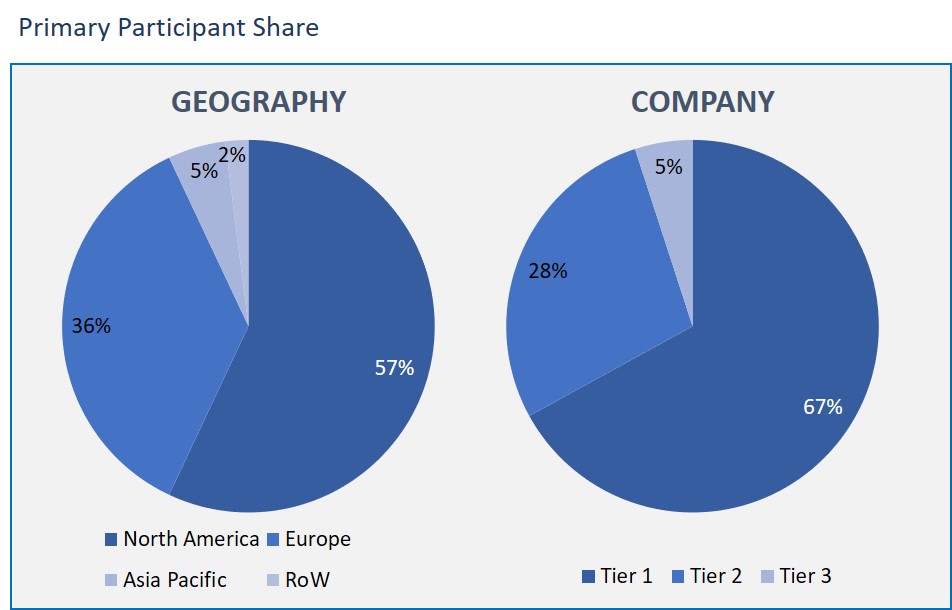

The COVID-19 impact on food safety testing market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

COVID-19 Impact on Food Safety Testing Market based on Testing Technologies

- DNA-based

- Immunoassay-based

- Chromatography- & spectroscopy-based

COVID-19 Impact on Food Safety Testing Market based on Targets Tested

- Pathogen

- GMO

- Mycotoxin

- Allergen

COVID-19 Impact on Food Safety Testing Market based on Geography

- North America

- Europe

- Asia Pacific

- Rest of the World

As per the testing technologies, the market is sub-segmented into DNA-based, Immunoassay-based, Chromatography- & spectroscopy-based. The DNA-based segment registered a maximum share in the market of food safety testing. DNA-based technology is generally used to produce numerous copies of genetic materials of microorganisms. This assists in testing the impurities in the food products in less period. Owing to its capability to test numerous targets at the same time, it is an efficient technology supporting the segment for a significant share in the food safety testing industry.

In terms of targets tested segmentation, the market is segmented into a pathogen, GMO, mycotoxin, and allergen. The pathogen segment is anticipated to acquire the largest share of the food safety testing market due to increasing consumer concerns regarding pathogen occurrences. The ailments raised by the incidence of microorganisms in food can be reached from mild to serious. Therefore, the demand for pathogen testing is projected to increase owing to the COVID-19 pandemic.

In this market, North America has the largest share in the market due to the strict rules and regulations to minimize foodborne diseases. The coronavirus pandemic has brought an upward trend in consumer consciousness regarding food products' safety, which has further accelerated the food safety testing market in the North American region. This region is also among the highest consumers of packed and processed food. Huge investment in research and development and advanced technology for labs and test kits are projected to positively impact the food safety testing market in North America.

The growth in the global food security testing market is driving the market requirement for the adoption of different types of testing technologies. These technologies allow testing the virus on food and augment the food industry’s supply chain's function and operations. Owing to the COVID-19, there has been a surge in demand for testing technologies. These technologies are used for testing the virus and other microorganisms on the food.

Food Safety Net Services, Ugene Laboratory Services Pte Ltd., Symbio Laboratories, Intertek Group plc, SGS SA, Bureau Veritas, Eurofins Scientific, TÜV SÜD, ALS Limited, TÜV NORD GROUP, QIMA, Pacific Lab, Kedah Bioresources Corporation Sdn. Bhd., Mérieux Nutrisciences, NEOGEN CORPORATION, Adpen Laboratories, Inc., and Cotecna Inspection SA are the companies that are leading the market.

As a result, there is an immense influence of COVID-19 on the food safety testing market. From the past few days, food testing plays an important role in safety and assures to provide safe food to the consumers. Food safety testing during this time of pandemic also helps the food industry by certifying the food which is manufactured.

- This report gives the overall analysis of the driving factors, restricting factor of the food safety testing market.

- This report gives information on the food safety testing market, which has majorly impacted by the COVID-19.

- This further describes how the COVID-19 virus has positively affected the manufacturing of food safety testing products.

- Also gives insights into the market penetration in the developed and underdeveloped countries keeping the virus impact as a focal point.

- Executive Summary

- Industry Outlook

- Industry Overview

- Industry Trends

- Market Snapshot

- Market Definition

- Market Outlook

- Porter Five Forces

- Related Markets

- Market characteristics

- Market Overview

- Market Segmentation

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- DRO - Impact Analysis

- Testing Technologies: Market Size & Analysis

- Overview

- DNA-based

- Immunoassay-based

- Chromatography- & spectroscopy-based

- Targets Tested: Market Size & Analysis

- Overview

- Pathogen

- GMO

- Mycotoxin

- Allergen

- Geography: Market Size & Analysis

- Overview

- North America

- Europe

- Asia Pacific

- Rest of the World

- Competitive Landscape

- Competitor Comparison Analysis

- Market Developments

- Mergers and Acquisitions, Legal, Awards, Partnerships

- Product Launches and execution

- Vendor Profiles

- FOOD SAFETY NET SERVICES

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Ugene Laboratory Services Pte Ltd

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Symbio Laboratories

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Intertek Group plc

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- SGS SA

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Bureau Veritas

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- Eurofins Scientific

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- TÜV SÜD

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- ALS Limited

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- TÜV NORD GROUP

- Overview

- Financial Overview

- Product Offerings

- Developments

- Business Strategy

- FOOD SAFETY NET SERVICES

- Companies to Watch

- QIMA

- Overview

- Products & Services

- Business Strategy

- Pacific Lab

- Overview

- Products & Services

- Business Strategy

- Kedah Bioresources Corporation Sdn. Bhd.

- Overview

- Products & Services

- Business Strategy

- Mérieux Nutrisciences

- Overview

- Products & Services

- Business Strategy

- NEOGEN CORPORATION

- Overview

- Products & Services

- Business Strategy

- Adpen Laboratories, Inc

- Overview

- Products & Services

- Business Strategy

- Cotecna Inspection SA

- Overview

- Products & Services

- Business Strategy

- QIMA

- Analyst Opinion

- Annexure

- Report Scope

- Market Definitions

- Research Methodology

- Data Collation and In-house Estimation

- Market Triangulation

- Forecasting

- Report Assumptions

- Declarations

- Stakeholders

- Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.