HLA Typing Market By Product (Reagents & Consumables, Instruments, Software & Services), By Technology (Molecular Assay Technologies and Non-Molecular Assay Technologies), By Application (Diagnostic Applications and Research Applications), By End-Users (Independent Reference Laboratories, Hospitals & Transplant Centers, Research Laboratories & Academic Institutes), Geography (North America, Europe, APAC, RoW) - Global Forecast up to 2026

- July, 2020

- Domain: Healthcare - Biotechnology

- Get Free 10% Customization in this Report

HLA (Human Leukocyte Antigen) Typing is a kind of genetic test conducted to check individual differences in an immune system of the person. This test is important to identify whether a person is capable to safely donate bone marrow, cord blood, or any other organ to any person who is in need of a transplant. There is a rapid growth in the demand for transplant diagnostic products due to factors such as public and private increased funding in target research activities. Majorly the increase in certain diseases such as blood cancers, genetic blood disorders where stem cell transplantation is required, this situation is expected to drive the HLA Typing market. However, the limited reimbursements for target procedures are a restrain for this market. The HLA typing market is expected to reach USD 990.12 million by 2026 from USD 659.75 million in 2020, at a CAGR of ~7.0%.

Research Methodology:

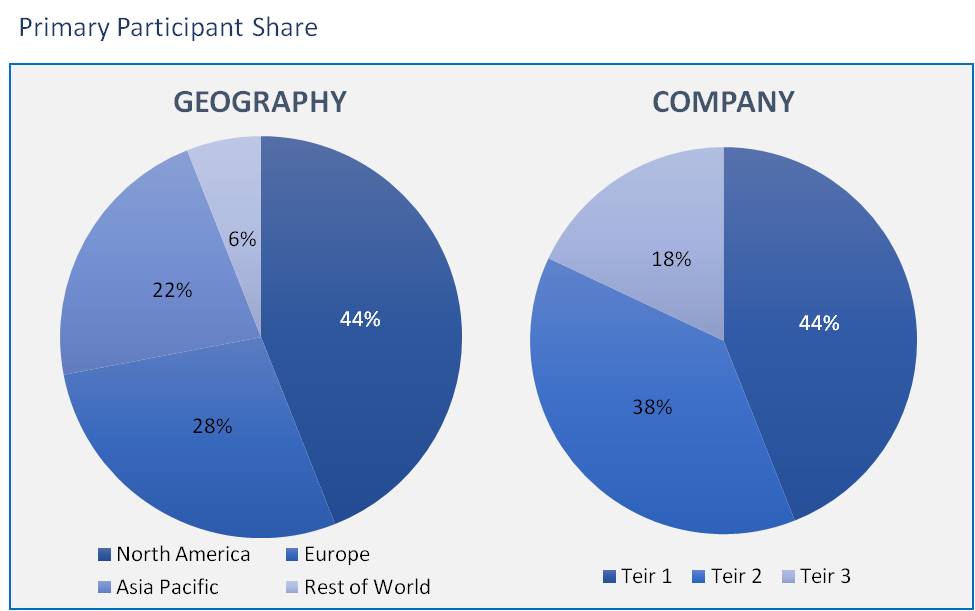

The HLA typing market has been analyzed by utilizing the optimum combination of secondary sources and in-house methodology, along with an irreplaceable blend of primary insights. The real-time assessment of the market is an integral part of our market sizing and forecasting methodology. Our industry experts and panel of primary participants have helped in compiling relevant aspects with realistic parametric estimations for a comprehensive study. The participation share of different categories of primary participants is given below:

The scope of the HLA Typing market is defined in the segmentation includes:

By Product and Service:

- Reagents & Consumables

- Instruments

- Software & Services

By Technology:

- Molecular Assay Technologies

- PCR-Based Molecular Assays

- Sequence-specific oligonucleotide-PCR

- Sequence-specific primer-PCR

- Real-time PCR

- Other PCR-based molecular assays

- Sequencing-Based Molecular Assays

- Sanger sequencing

- Next-generation sequencing

- Other sequencing-based molecular assays

- Sequencing-Based Molecular Assay

- Non-Molecular Assay Technologies

By Application:

- Diagnostic Applications

- Antibody Screening

- Chimerism Monitoring

- Other Applications

- Research Applications

By End User:

- Independent Reference Laboratories

- Hospitals & Transplant Centers

- Research Laboratories & Academic Institutes

By Region:

- North America

- Europe

- APAC

- Rest of World

The global HLA (Human Leukocyte Antigen) Typing market is segmented based on end-user. The segment of independent reference laboratories accounted for the largest share in the market due to the increased demand for organ transplant procedures, improved and automated diagnostic laboratories, increasing research and development activities outsourced by pharmaceutical and biotechnology companies to independent reference laboratories.

The global HLA Typing market is segmented based on end-user. The independent reference laboratories segment, which accounted for the largest share in the market with increased demand for organ transplant procedures, improved and automated diagnostic laboratories, increasing research and development activities outsourced by pharmaceutical and biotechnology companies to independent reference laboratories.

Further, HLA Typing market segmentation based on product and service includes Reagents & Consumables, Instruments, software & services. In this market segment, reagent and consumables play a major role in the market growth because of the early patient profiling during organ transplantation.

Based on technology, the market is divided into molecular assay technologies and non- molecular technologies. By analysis, the molecular assay technology has the majority of the demand in the HLA typing. The molecular assay technology consumes less time as compared to other technology and gives effective results that support market growth.

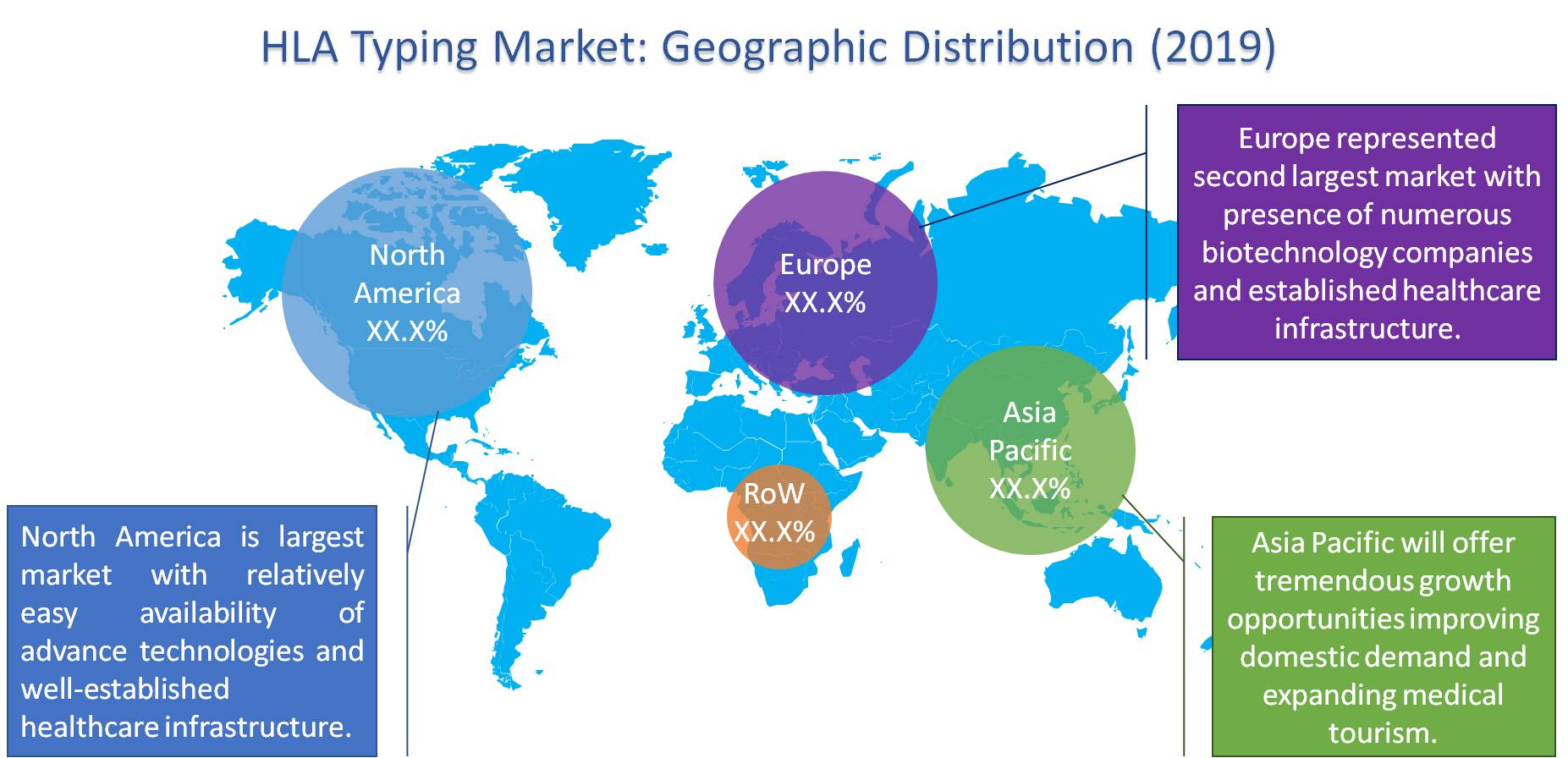

Moreover, the HLA Typing market based on region is segmented into four regions, including North America, Europe, Asia Pacific, and RoW. Further, the North America region is accounted for the largest share of the transplant market due to the well-developed market for medical devices, highly improvised healthcare system, a rapid increase in the adoption of the innovative transplant diagnostic technologies.

Globally, the HLA Typing market is growing at a CAGR of ~7.0% during the forecast period of 2020-2026. The factors which are majorly driving this market are innovative technologies in the transplant procedures and increasing transplant procedures, a large number of research and development activities in this field of HLA Typing. Molecular tests include high expenses for the HLA typing test, which is standing as a constraint in this market.

Globally HLA Typing market is playing a major role in the transplant diagnostic field, giving an accurate analysis of the person’s immune system for further transplantation process. An increase in the adoption of cross-matching and chimerism testing during post and pre-transplantation gives the opportunity in the market. However, due to the number of donors compared to donor accepters are very less, the market is facing a major challenge in the growth of the market.

Some of the prominent players in the HLA Typing Market are Thermo Fisher Scientific, Inc., Omixon, CareDx, Inc, QIAGEN N.V., Luminex, Biofortuna, Illumina, Bio-Rad Laboratories, Inc., Takara Bio, TBG Diagnostics Ltd., and F. Hoffman-La Roche Ltd.

Moreover, the awareness about organ donation and transplantation across the developing countries and emerging technologies are supporting the HLA Typing Market growth globally. This report will enable the market players to understand the key market trends, market dynamics, and critical needs of the end-users. The qualitative and quantitative analysis covered in the study would enhance the user utility of the report.

- The competitive analysis of the major players enables users to understand the dynamic strategies such as product innovation, partnerships, merger & acquisitions and joint ventures of the key players

- This report also provides the portfolio analysis, capability analysis of the leading players

- The report will also help the research organization of HLA Typing market to support their development activities

- Quantitative analysis of the market enables users to understand the actual facts of the market across four major regions

1. Executive Summary

2. Industry Outlook

2.1. Industry Overview

2.2. Industry Trends

3. Market Snapshot

3.1. Market Definition

3.2. Market Outlook

3.3. PEST Analysis

3.4. Porter Five Forces

3.5. Related Markets

4. Market characteristics

4.1. Market Evolution

4.2. Market Trends and Impact

4.3. Advantages/Disadvantages of Market

4.4. Regulatory Impact

4.5. Market Offerings

4.6. Market Segmentation

4.7. Market Dynamics

4.7.1. Drivers

4.7.2. Restraints

4.7.3. Opportunities

4.8. DRO - Impact Analysis

5. Technology: Market Size & Analysis

5.1. Overview

5.2. Molecular Assay Technologies

5.3. Non-molecular Assay Technologies

6. Application: Market Size & Analysis

6.1. Overview

6.2. Diagnostic Applications

6.2.1. Antibody Screening

6.2.2. Chimerism Monitoring

6.2.3. Others

6.3. Research Applications

7. Product: Market Size & Analysis

7.1. Overview

7.2. Reagents & Consumables

7.3. Instruments

7.4. Software & Services

8. End User: Market Size & Analysis

8.1. Overview

8.2. Independent Reference Laboratories

8.3. Hospitals & Transplant Centers

8.4. Research Laboratories & Academic Institutes

9. Geography: Market Size & Analysis

9.1. Overview

9.2. North America

9.3. Europe

9.4. Asia Pacific

9.5. Rest of the World

10. Competitive Landscape

10.1. Competitor Comparison Analysis

10.2. Market Developments

10.3. Mergers and Acquisitions, Legal, Awards, Partnerships

10.4. Product Launches and execution

11. Vendor Profiles

11.1. Thermo Fisher Scientific Inc.

11.1.1. Overview

11.1.2. Product Offerings

11.1.3. Geographic Revenue

11.1.4. Business Units

11.1.5. Developments

11.1.6. SWOT Analysis

11.1.7. Business Strategy

11.2. F. Hoffman-La Roche Limited

11.2.1. Overview

11.2.2. Product Offerings

11.2.3. Geographic Revenue

11.2.4. Business Units

11.2.5. Developments

11.2.6. SWOT Analysis

11.2.7. Business Strategy

11.3. Qiagen

11.3.1. Overview

11.3.2. Product Offerings

11.3.3. Geographic Revenue

11.3.4. Business Units

11.3.5. Developments

11.3.6. SWOT Analysis

11.3.7. Business Strategy

11.4. Immucor

11.4.1. Overview

11.4.2. Product Offerings

11.4.3. Geographic Revenue

11.4.4. Business Units

11.4.5. Developments

11.4.6. SWOT Analysis

11.4.7. Business Strategy

11.5. Abbott Laboratories Inc

11.5.1. Overview

11.5.2. Product Offerings

11.5.3. Geographic Revenue

11.5.4. Business Units

11.5.5. Developments

11.5.6. SWOT Analysis

11.5.7. Business Strategy

11.6. Luminex

11.6.1. Overview

11.6.2. Product Offerings

11.6.3. Geographic Revenue

11.6.4. Business Units

11.6.5. Developments

11.6.6. SWOT Analysis

11.6.7. Business Strategy

11.7. Biofortuna

11.7.1. Overview

11.7.2. Product Offerings

11.7.3. Geographic Revenue

11.7.4. Business Units

11.7.5. Developments

11.7.6. SWOT Analysis

11.7.7. Business Strategy

11.8. Omixon

11.8.1. Overview

11.8.2. Product Offerings

11.8.3. Geographic Revenue

11.8.4. Business Units

11.8.5. Developments

11.8.6. SWOT Analysis

11.8.7. Business Strategy

11.9. Creative Biolabs

11.9.1. Overview

11.9.2. Product Offerings

11.9.3. Geographic Revenue

11.9.4. Business Units

11.9.5. Developments

11.9.6. SWOT Analysis

11.9.7. Business Strategy

11.10. Tbg Diagnostics Limited

11.10.1. Overview

11.10.2. Product Offerings

11.10.3. Geographic Revenue

11.10.4. Business Units

11.10.5. Developments

11.10.6. SWOT Analysis

11.10.7. Business Strategy

12. Companies to Watch

12.1. Caredx, Inc.

12.1.1. Overview

12.1.2. Market

12.1.3. Business Strategy

12.2. Illumina

12.2.1. Overview

12.2.2. Market

12.2.3. Business Strategy

12.3. Bio-Rad Laboratories

12.3.1. Overview

12.3.2. Market

12.3.3. Business Strategy

12.4. Alpha Biotech, Ltd.

12.4.1. Overview

12.4.2. Market

12.4.3. Business Strategy

12.5. Gendx

12.5.1. Overview

12.5.2. Market

12.5.3. Business Strategy

12.6. Histogenetics Llc

12.6.1. Overview

12.6.2. Market

12.6.3. Business Strategy

12.7. Pacific Biosciences of California, Inc.

12.7.1. Overview

12.7.2. Market

12.7.3. Business Strategy

12.8. Hansa Biopharma Ab

12.8.1. Overview

12.8.2. Market

12.8.3. Business Strategy

12.9. Bag Healthcare

12.9.1. Overview

12.9.2. Market

12.9.3. Business Strategy

12.10. Takara Bio

12.10.1. Overview

12.10.2. Market

12.10.3. Business Strategy

13. Analyst Opinion

14. Annexure

14.1. Report Scope

14.2. Market Definitions

14.3. Research Methodology

14.3.1. Data Collation and In-house Estimation

14.3.2. Market Triangulation

14.3.3. Forecasting

14.4. Report Assumptions

14.5. Declarations

14.6. Stakeholders

14.7. Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.