Global Hospital Information System Market By Component (Hardware, Software, and Services), Mode of Delivery (Cloud-based Technology, Web-based Technology, and On-premises Installation), Applications Type (Clinical, Administrative, Electronic Medical Records, Laboratory, Radiology, and Pharmacy), End-users (Healthcare Providers, Healthcare Facilities, and Patients), and By Regions (North America, Europe, APAC, and RoW) – Forecast up to 2025

- January, 2020

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

This market research report includes a detailed segmentation of the global hospital information system market by component (hardware, software, and services), by mode of delivery (cloud-based technology and on-premises installation), by applications type (clinical, administrative, electronic medical records, laboratory, radiology, and pharmacy), by end-users (healthcare providers, healthcare facilities, and patients), and by regions (North America, Europe, APAC, and RoW).

Research Overview

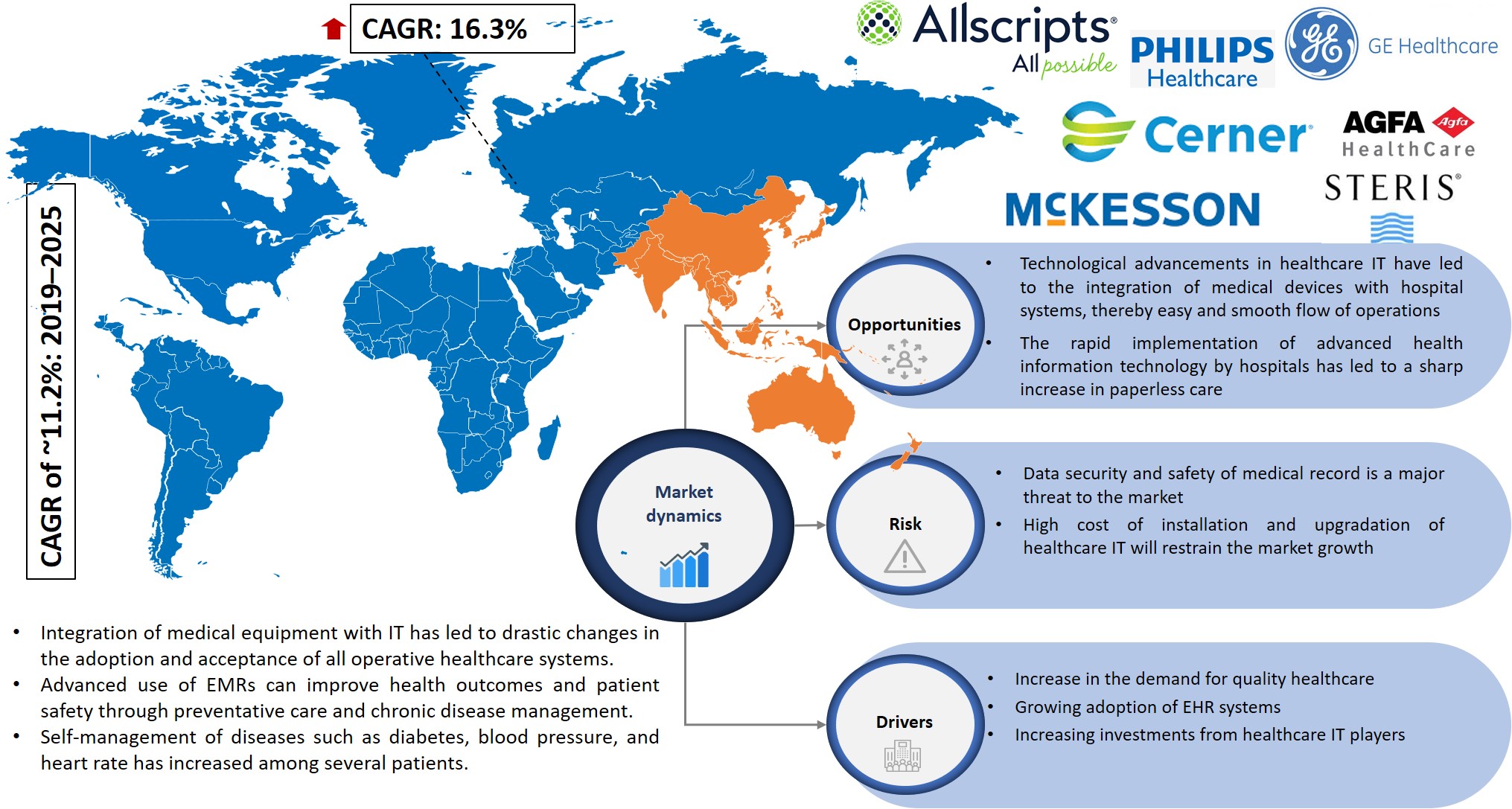

Infoholic Research predicts that the global hospital information system market will grow at a CAGR of 11.2% during the forecast period 2019–2025. Hospital information systems are designed specifically to manage essential activities of the hospital, i.e., administration, financial, and support in storing data. The healthcare industry is dependent on a massive amount of data to make decisions about patient care and facilitate the delivery of care. Health information systems are useful tools that aid clinicians and administrative personnel in ensuring better patient experience. The increase in the adoption of healthcare IT has enabled many healthcare providers and facilities to deliver rapid, safe, and effective treatment procedures. It has digitized systems with health data and processed for final output to boost the market growth.

Digital technologies are supporting the health system's efforts to switching to new models of patient-centered care and helping them in developing “smart health” to increase access and affordability, improve quality, and lower the costs. Technologies, i.e., cloud, artificial intelligence, robotics, internet of medical things, and digital & virtual reality, are helping to expand the healthcare industry with speed, quality, and accuracy, and thereby improving the patient experience.

With the advent of new technologies-enabled care services, manufacturers have focused on developing tools and devices that help to achieve productivity gain for quick and reliable results. Technology-enabled care (TEC) is consistently seeking to improve the patient's wellbeing ability to self-manage their health. It helps healthcare professionals (HPs) to add, change, support patient conditions efficiently with cost-effective care. The healthcare IT includes the following applications: Laboratory Information Systems (LIS), Picture Archiving and Communication System (PACS) and Vendor Neutral Archive (VNA), Radiology Information Systems (RIS), Cardiovascular Information Systems (CIS), Electronic Health Record (EHR), Claims Management Solutions, Telemedicine, Clinical Decision Support System (CDSS), Fraud Analytics, Provider Management Solutions, Services, Billing and Accounts Management Services.

The broader economic and social costs of poor-quality care, including long-term disability, impairment, and lost productivity, are estimated to increase HIS amount to trillions of dollars each year. According to WHO, people can attain health services whenever required, irrespective of time and location. The economic and social benefits are clear and need to focus on investing and improving quality to create trust in health services and by providing access to high-quality healthcare facilities. Low-quality care unfairly impacts the poor, which is not only morally deplorable but also economically unsustainable for families and the entire country. Quality health is the platform of a nation, and no country can afford low-quality or unsafe healthcare.

Hospital information systems are essential for managing processes in hospital departments. To access information across and between hospitals, the integration of systems is necessary. In America’s Essential Hospitals, integrated hospital service is a significant priority. Essential Hospitals and Health Systems provide a range of inpatient and outpatient services for millions of patients across the country. Out of all IT professionals working with cloud apps, 56% said the apps are improving patient satisfaction, and 55% said they led to better treatment. Cloud-based health information management systems can benefit rural practices and healthcare organizations with lower budgets.

North America is considered as the largest region in the global hospital information systems market due to extensive technological advancements, sophisticated healthcare infrastructures, and various government initiatives in the region. Europe was observed to be the second-largest region in the hospital information system market owing to enhanced digitization of the healthcare processes in the region. The major factor that drives the market in Asia Pacific includes the acceptance and demand for high-end medical infrastructure in the region. China, Japan, and India are expected to grow at a faster rate when compared to other countries in the Asia Pacific region.

Segmentation by Product Type:

- Hardware

- Software

- Services

Segmentation by Delivery Mode:

- Cloud-based Technology

- On-premises Installation

The software component is the leading segment in the global hospital information system market with maximum revenue generation. Its updates and frequent maintenance led to the largest chunk of the HIS market in 2018.

The service component is the second leading and the essential aspect of the market as it involves an array of technologies that are supported by both hardware and software. The increasing incidence & prevalence of chronic diseases is driving the service component of the hospital information system market. This is followed by the hardware component, which requires set up with installation sharing nearly ~25% of the market.

Segmentation by End-users:

- Healthcare Providers

- Healthcare Facilities

- Patients

In 2018, the healthcare facilities segment was leading with maximum revenue in the global hospital information system market with a large number of users and patients globally.

Segmentation by Region:

- North America

- Europe

- APAC

- RoW

The regions covered in the report include North America, Europe, Asia Pacific, and Rest of the World. North America is set to be the leading region in the global hospital information system market, followed by Europe. Asia Pacific and RoW are set to be the emerging regions. The emerging markets have a high potential to grow owing to an increase in the patient population and focus on various chronic disorders. The global hospital information system market is likely to seek a steady penetration rate in the emerging market, and most of the vendors are targeting to penetrate India, China, Thailand, and Vietnam markets. Further, driving factors such as large patient population and government initiatives have become a new trend in the emerging markets.

Competitive Analysis – The competition among leading vendors is due to the availability of a wide range of hospital information systems with different brand names in the market. The market is highly competitive, with all the players competing to gain a market stronghold. Intense competition, rapid advancements in technology, frequent changes in government policies, and fluctuating prices are the key factors that confront the market. The vendors have a strong focus on understanding the customer base by creating awareness and initiatives to generate knowledge about their products and upcoming technologically advanced hardware and software of healthcare IT. The vendors have a strong focus on acquiring smaller companies and expanding their business operations by leveraging their product portfolio globally. The competition is growing among the healthcare service providers – hospitals, physicians’ clinics, and home care where the customer groups are being consolidated for adopting different healthcare IT products. Most of the companies focus on developing products in less time and fasten the regulation process with effective means to commercialize the product early into the market to stay dominant.

Key Vendors:

- Agfa-Gevaert Group

- Allscripts Healthcare Solutions

- Cerner Corporation

- GE Healthcare

- Integrated Medical Systems

- Philips Healthcare

- McKesson Corporation Healthcare

Key Competitive Facts:

- The market is highly competitive, with all the players competing to gain the market share. Intense competition, rapid advancements in technology, frequent changes in government policies, and price are key factors that confront the market.

- The requirement of high initial investment, implementation, and maintenance cost in the market are also limiting the entry of new players.

- Responding to competitive pricing pressures specific to each of our geographic markets.

- Protection of proprietary technology for products and manufacturing processes.

Benefits – The report provides complete details about the usage and adoption rate of hospital information system products. Thus, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives toward the medical devices segment in the upcoming years along with details of the pureplay companies entering the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to stakeholders in order to expand their business and capture the revenue in specific verticals and to analyze before investing or expanding the business in this market.

Key Takeaways:

- Understanding the potential market opportunity with precise market size and forecast data.

- Detailed market analysis focusing on the growth of the hospital information system globally.

- Factors influencing the growth of the hospital information system market.

- In-depth competitive analysis of dominant and pureplay vendors.

- Prediction analysis of the hospital information system products industry across the globe.

- Key insights related to major segments of the hospital information system products market globally.

- The latest market trend analysis impacting the buying behavior of the consumers.

Key Stakeholders:

- Industry Outlook

- Industry Overview

- Patient Demographics

- Healthcare Spending in the US

- Definition: Hospital Information System

- Why Hospital Information System?

- Industry Trends

- Reimbursement Scenario

- Emerging Global Markets

- Report Outline

- Report Scope

- Report Summary

- Research Methodology

- Report Assumptions

- Market Snapshot

- Total Addressable Market

- Segmented Addressable Market

- Porter 5 (Five) Forces

- Market Dynamics

- Drivers

- Increased demand for quality healthcare

- Growing adoption of EHR systems

- Increasing investments from healthcare IT players

- Government initiatives

- Restraints

- Data security and implementation issues

- High cost of installation and upgradation of healthcare IT (software and solutions

- Lack of proper IT infrastructure in developing nations

- Lack of trained staff

- Opportunities

- Healthcare IT emerging technology

- Advanced integrated healthcare systems

- Growing popularity of cloud-based systems

- Technological advancement (RFID, support services, automation, real time)

- DRO – Impact Analysis

- Key Stakeholders

- Drivers

- Product Segmentation by Component: Market Size & Analysis

- Hardware

- Overview

- Market Size and Analysis

- Highlights

- Market Size and Analysis

- Software

- Overview

- Market Size and Analysis

- Highlights

- Market Size and Analysis

- Services

- Overview

- Market Size and Analysis

- Highlights

- Market Size and Analysis

- Product Segmentation by Mode of Delivery: Market Size & Analysis

- Cloud-based Technology

- Overview

- Market Size and Analysis

- Highlights

- Market Size and Analysis

- On-premises Installation

- Overview

- Market Size and Analysis

- Highlights

- Market Size and Analysis

- Product Segmentation by Application Type

- Clinical Information Systems

- Administrative Information Systems

- Electronic Medical Record

- Laboratory Information Systems

- Radiology Information Systems

- Pharmacy Information Systems

- End-user: Analysis

- Overview

- Healthcare Providers

- Healthcare Facilities

- Patients

- Regions: Market Size & Analysis

- Overview

- North America

- Market Overview

- Europe

- Market Overview

- APAC

- Market Overview

- Rest of the World

- Market Overview

- Competitive Landscape

- Competitor Comparison Analysis

- Vendor Profile

- Agfa-Gevaert Group

- Business Unit

- Geographic Presence

- Business Focus

- SWOT Analysis

- Business Strategy

- Allscripts Healthcare Solutions Inc.

- Overview

- Business Unit

- Geographic Revenue

- Business Focus

- SWOT Analysis

- Business Strategy

- Cerner Corporation

- Overview

- Business Unit

- Geographic Revenue

- Business Focus

- SWOT Analysis

- Business Strategy

- GE Healthcare

- Overview

- Business Unit

- Geographic Revenue

- Business Focus

- SWOT Analysis

- Business Strategy

- Integrated Medical Systems

- Overview

- Geographical revenue

- Business focus

- SWOT analysis

- Business strategies

- Philips Healthcare

- Overview

- Geographical revenue

- Business focus

- SWOT analysis

- Business strategies

- McKesson Corporation

- Overview

- Geographical revenue

- Business focus

- SWOT analysis

- Agfa-Gevaert Group

- Companies to Watch for

- Akhil Systems Pvt. Ltd.

- Overview

- Key Highlights

- Business Strategies

- Carestream

- Overview

- Key Highlights

- Business Strategies

- QuadraMed Corporation

- Overview

- Key Highlights

- Business Strategies

- Siemens Medical Solutions

- Overview

- Key Highlights

- Business Strategies

- Sysmex

- Overview

- Key Highlights

- Business Strategies

- Integrated Medical Systems Pty Ltd

- Overview

- Key Highlights

- Business Strategies

- Akhil Systems Pvt. Ltd.

- Other Vendors

Annexure

Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.