Video Surveillance Market By Component (Hardware [Network Security Cameras, Network Video Recorders (NVRs), HD CCTV Cameras, HD CCTV Recorders, Analogue Security Cameras & DVRs, Monitors, and Others], Software [Video Management Software and Video Analytics Software], and Services), By End-user (Commercial, Government, Residential, Education, and Industrial), and By Region (Asia Pacific, Americas, Europe, and Middle East & Africa) – Global Forecast up to 2025

- October, 2019

- Domain: Electronics & Semiconductors - Electronics & Semiconductors

- Get Free 10% Customization in this Report

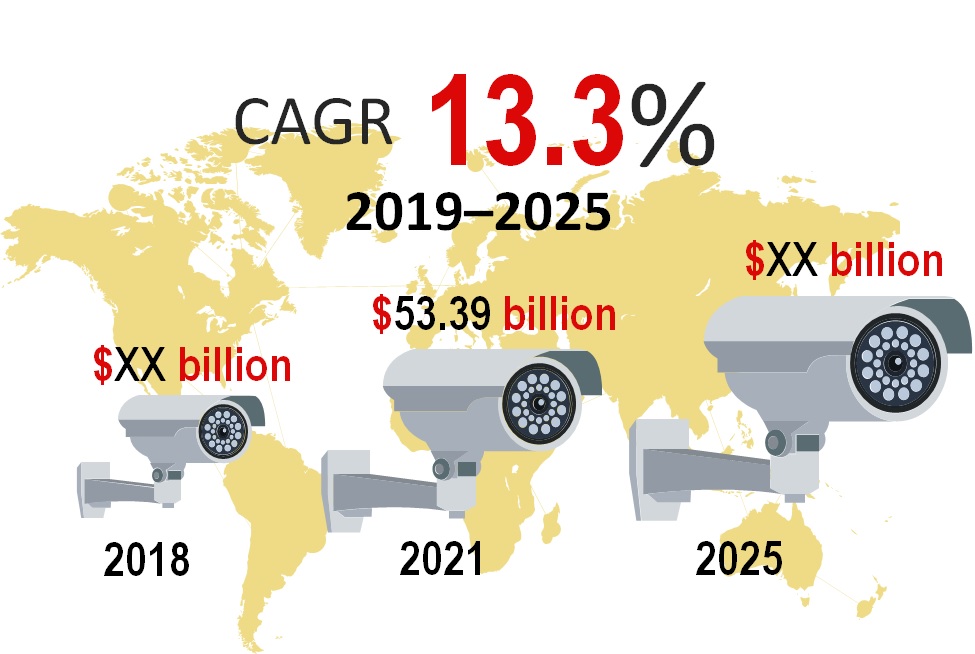

This market research report by Infoholic Research includes a detailed segmentation of the global video surveillance market by component (hardware – network security cameras, network video recorders (NVRs), HD CCTV cameras, HD CCTV recorders, analogue security cameras & DVRs, Monitors, software – video management software, video analytics, and services), end-user – commercial, government, residential, education, industrial), and region (Asia Pacific, Americas, Europe, MEA).

Overview: Global Video Surveillance Market

Video surveillance is an integral part of the security industry that assists in the protection of assets, facilities, and individuals. The video surveillance industry is around 30 years old and has witnessed a series of technological changes in terms of camera technology, content delivery, and transmission modes. Currently, the market for video surveillance is driven by increasing private & public security concerns along with the technology shift and changing business models. Earlier, only large entities were able to afford IP video surveillance; but due to the declining price of IP cameras and the proliferation of IP networks, the video surveillance industry is rapidly moving out from analog to IP network surveillance infrastructure as IP surveillance enhances the traditional monitoring and post-event investigation practices.

In recent years, video surveillance is expanding beyond the traditional practice of monitoring only the critical infrastructure. The growing focus on integrating next-generation technologies, i.e., deep learning, analytics, AI, and cloud computing, is considerably increasing the scope of video surveillance applications – traffic monitoring, people-count, facial recognition, posture detection, heat map, post-forensic analytics, and lot more.

Few of the key factors driving the growth of the global video surveillance market include:

- Increasing investment to improve city surveillance

- Rising interest in intelligent video surveillance solutions

- Increasing penetration of IP cameras

Artificial intelligence (AI) technology is rapidly proliferating across industries. Advancements in AI technology and growing interest in integrating AI with video surveillance systems are certainly hybridizing the landscape of the video surveillance market. Integrating AI in surveillance applications in combination with the power of deep learning techniques helps to identify individuals, patterns, and trends across thousands of geolocation. Moving forward, AI and deep learning technology will become the foundations of modern surveillance systems. These systems are equipped to capture the unique features of the human face in real-time, make a comparison with the central database, and trigger an alarm when it detects the specific face of concern. These systems enable monitoring real-time data against specific parameters, i.e., real-time watchlist detection, which will automate and enhance city surveillance practices.

Currently, China dominates the global video surveillance market with the incorporation of advanced facial recognition powered by AI in surveillance applications, and the adoption is expected to spread across other countries. The increasing penetration of AI in surveillance applications is anticipated to increase the demand for front- and back-end surveillance devices with advanced functionalities in the coming years. Few of the prominent companies offering AI technologies for surveillance applications include Huawei, Hikvision, Dahua, ZTE, NEC Corporation, IBM, Palantir, and Cisco.

Market Segmentation: Global Video Surveillance Market

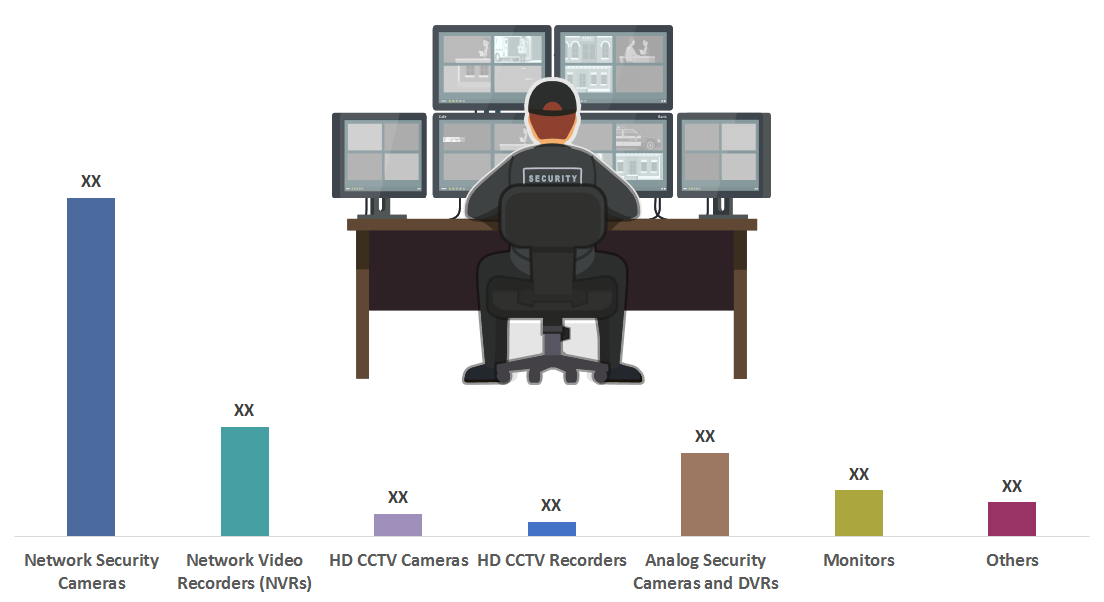

The global video surveillance market is segmented based on components, end-users, and regions. In terms of hardware components analysis, network security cameras dominated in 2018, contributing to XX% of the total hardware market share and is anticipated to remain dominant throughout the forecast period. This is mainly due to the increasing preference for video surveillance solutions with remote monitoring capabilities. Also, the penetration of network cameras is expected to increase significantly during the forecast period.

In terms of end-user analysis, the commercial segment dominated with more than XX% of the market share in 2018 and the trend is likely to continue during the forecast period. The residential segment is identified as the fastest-growing segment, i.e., CAGR of 18.0%, during the forecast period 2019–2025.

Regional Outlook: Global Video Surveillance Market

The global video surveillance market is segmented in the regions of Asia Pacific, Americas, Europe, and Middle East & Africa. Asia Pacific dominates the global video surveillance market, contributing to XX% share in 2018, and is expected to remain dominant throughout the forecast period. This is mainly due to China’s dominance in video surveillance penetration, increasing investment in enhancing public security, and building security surveillance in other developing countries in the Asia Pacific region.

Competitive Analysis and Key Vendors: Global Video Surveillance Market

The report covers and analyzes the global video surveillance market. Vendors are increasingly focusing on expanding their IP-based video surveillance solutions that offer lower installation cost, efficient scalability, and have a wider scope of automation, which embraces other security technology solutions, including access control, anti-intrusion, and others.

Few of the Key Vendors in the Global Video Surveillance Market

- HANGZHOU HIKROBOT TECHNOLOGY CO., LTD.

- Axis Communications

- Robert Bosch GmbH

- Dahua Technology Co., Ltd.

- Motorola Solutions, Inc. (Avigilon)

- IDIS Ltd.

- Panasonic Corporation

- IndigoVision

- VIVOTEK Inc.

- Dynacolor, Inc.

Benefits:

The report on the video surveillance market by Infoholic Research contains an in-depth analysis of vendors, which includes financial health, business units, key business priorities, SWOT, strategies, and views; and competitive landscape. The study offers a comprehensive analysis of the “global video surveillance market”. Bringing out the complete key insights of the industry, the report aims to provide an insight into the latest trends, current market scenario, and technologies related to the market. Besides, it helps the venture capitalists, video surveillance component manufacturers, video surveillance device manufacturers, software vendors, system integrators, and service providers to understand revenue opportunities across different segments to make better decisions.

Global Video Surveillance Market: Segmentation

- Global Video Surveillance Market, By Component

- Hardware

- Network Security Cameras

- Network Video Recorders (NVRs)

- HD CCTV Cameras

- HD CCTV Recorders

- Analogue Security Cameras & DVRs

- Monitors

- Others

- Software

- Video Management Software

- Video Analytics Software

- Services

- Hardware

- Global Video Surveillance Market, By End-user

- Commercial

- Government

- Residential

- Education

- Industrial

- Global Video Surveillance Market: By Geography

- Asia Pacific

- Americas

- Europe

- MEA (Middle East & Africa)

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.