Industrial Automation Market By Product (Relays & Switches, Sensors, Motors & Drives, Machine Vision, Robotics, DCS, PLC, MES , SCADA, PLM, ERP, and Others), End-Use Industry (Chemicals & Mining, Oil & Gas, Pharma & Biotech, Energy & Power, Automotive, Food and Beverages, and Others), and Region (Americas, EMEA, Asia Pacific, and Middle East & Africa) - Global Forecast to 2025

- July, 2019

- Domain: Electronics & Semiconductors - Electronics & Semiconductors

- Get Free 10% Customization in this Report

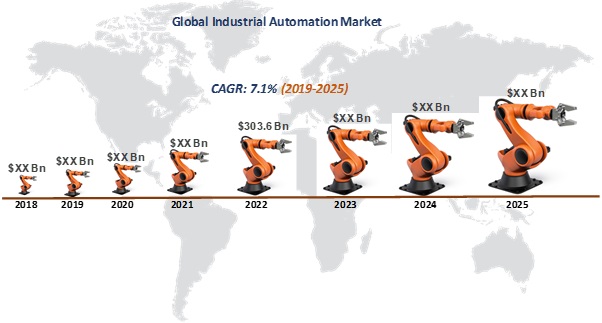

The global industrial automation market is expected to witness a steady growth during the forecast period. In the era of Industry 4.0 which entails the convergence of digital technologies and manufacturing industries, economies dependent on manufacturing sector are strategically adopting automaton solutions to strengthen their market position.

Industrial automation solutions enable companies to improve operational performance by minimizing wastage and offers data driven operations which helps to minimize unscheduled downtime. Advancement in artificial intelligence robotics systems are now matching/outperforming human performance in production line, which enable companies to raise productivity growth and support the offset impact of working-age population in many countries. Globally, robotics, industrial internet of things (IIoT), and other digitalized automation services are extending the capabilities and value proposition of manufacturing sector. In order to stay ahead of global competition, manufacturers are focusing on aligning their business strategies with the global technological trend i.e. automation, which is transforming the productivity of manufacturing sector.

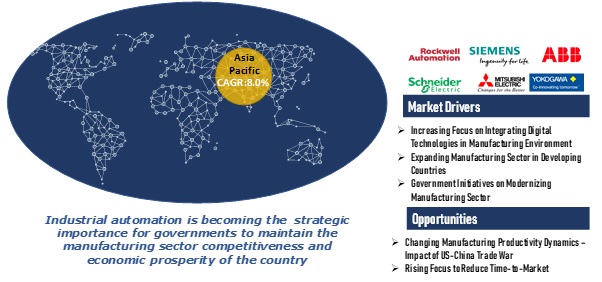

Rising focus on integrating digital technologies in manufacturing environment, increasing government initiatives on modernizing manufacturing sector, and expanding manufacturing sector in developing countries are the key factors contributing to the growth of global industrial automation market. Additionally, changing manufacturing productivity dynamics – impact of US–China trade war, and rising focus to reduce time-to-market is anticipated to offer new opportunities for the vendors present in the global industrial automation market. However, high capital investment, concerns over return on investment, and lack of unified engagement is identified as restraints likely to deter the progression of global industrial automation market during the forecast period.

The global industrial automation market is segmented based on product, end-use industry, and region. In terms of product, the industrial automation market is segmented into relays & switches, sensors, motors & drives, machine vision, robotics, DCS, PLC, MES, SCADA, PLM, ERP, and others. Among all the segments the robotics segment is projected to be the fastest growing segment growing at 10.9% CAGR during the forecast period 2019–2025. This is mainly due to the cost of the robots designed for performing defined task is getting more economical compared with labor cost.

Regional Analysis:

Regionally, the global industrial automation market is segmented into Americas, Asia Pacific, and EMEA. Asia Pacific industrial automation market contributes more than 35% market share and is expected to remain dominant throughout the forecast period. This is mainly due to expanding manufacturing sector and increasing interest on automation solutions to enhance competitiveness. In terms of value, Asia Pacific is identified as the fastest growing industrial automation market, growing at a CAGR of 8.0% during the forecast period 2019–2025.

Benefits and Vendors

The report on industrial automation market contains an in-depth analysis of vendors profile, which includes financial health, business units, key business priorities, SWOT, strategies, and views, and competitive landscape. Few of the key players profiled in this study include Rockwell Automation, Inc., Siemens AG, ABB, Schneider Electric, Omron Corporation, Yokogawa Electric Corporation, Mitsubishi Electric Corporation, Yaskawa Electric Corporation, Keyence Corporation, and Fanuc Corporation.

The study on industrial automation market offers a comprehensive analysis of the “global industrial automation market”. Bringing out the complete key insights of the industry, the report aims to provide an insight into the latest trends, current market scenario, and technologies related to the market. In addition, it helps the venture capitalists to understand revenue opportunities across different segments to take better decisions.

Key segments of the report include:

Industrial Automation Market Size & Analysis - By Product

- Relays & Switches

- Sensors

- Motors & Drives

- Machine Vision

- Robotics

- DCS

- PLC

- MES

- SCADA

- PLM

- ERP

- Others

Industrial Automation Market Size & Analysis - By End-Use Industry

- Chemicals & Mining

- Oil & Gas

- Pharma & Biotech

- Energy & Power

- Automotive

- Food and Beverage

- Others

Industrial Automation Market Size & Analysis - By Regions

- Americas

- Europe, Middle East and Africa (EMEA)

- Asia Pacific

2 Industry Outlook

2.1 Industry Overview

2.1.1 Industry Trend

2.1.1.1 Emergence of 5G in Industrial Automation/ Transformative automation using 5G

3 Market Snapshot

3.1 Overview

3.1.1 PEST Analysis

3.2 Related Markets

4 Market Characteristics

4.1 Market Developments

4.2 Market Segmentation

4.3 Market Dynamics

4.3.1 Drivers

4.3.1.1 Increasing focus on integrating digital technologies in manufacturing environment

4.3.1.2 Expanding Manufacturing Sector in Developing Countries

4.3.1.3 Government initiatives on digital manufacturing

4.3.2 Restraints

4.3.2.1 High capital investment and concerns over return on investment

4.3.2.2 Lack of unified engagement

4.3.3 Opportunities

4.3.3.1 Changing manufacturing productivity dynamics – Impact of US-China trade war

4.3.3.2 Rising Focus to Reduce Time-To-Market

4.3.4 DRO – Impact Analysis

5 Global Industrial Automation Market, By Product Type

5.1 Overview

5.2 Relays & Switches

5.3 Sensors

5.4 Motors & Drives

5.5 Machine Vision

5.6 Robotics

5.7 Distributed Control System (DCS)

5.8 Programmable Logic Controller (PLC)

5.9 Manufacturing Execution System (MES)

5.10 Supervisory Control and Data Acquisition (SCADA)

5.11 Product Lifecycle Management (PLM)

5.12 Product Lifecycle Management (PLM)

5.13 Enterprise resource planning (ERP)

5.14 Others

6 Global Industrial Automation Market, By End-use Industry

6.1 Overview

7 Global Industrial Automation Market, By Region

7.1 Overview

7.2 Americas

7.2.1 Overview

7.2.2 Americas Industrial Automation Market, By Country – Market Size and Analysis

7.2.3 By Product– Market Size and Analysis

7.2.4 By Component – Market Size and Analysis

7.3 Europe, Middle East, & Africa (EMEA)

7.3.1 Overview

7.3.2 By Country – Market Size and Analysis

7.3.3 By Product– Market Size and Analysis

7.3.4 By End-Use Industry – Market Size and Analysis

7.4 Asia Pacific

7.4.1 Overview

7.4.2 By Country – Market Size and Analysis

7.4.3 By Product– Market Size and Analysis

7.4.4 By End-Use Industry – Market Size and Analysis

8 Vendor Profiles

8.1 Rockwell Automation, Inc.

8.1.1 Analyst Opinion

8.1.2 Business Analysis

8.1.2.1 Strategic Snapshot

8.1.2.2 Business Impact Analysis

8.1.2.3 Operational Snapshot

8.1.2.4 Product/Service Portfolio

8.2 ABB

8.2.1 Analyst Opinion

8.2.2 Business Analysis

8.2.2.1 Strategic Snapshot

8.2.2.2 Business Impact Analysis

8.2.2.3 Operational Snapshot

8.2.2.4 Product/Service Portfolio

8.3 SIEMENS AG

8.3.1 Analyst Opinion

8.3.2 Business Analysis

8.3.2.1 Strategic Snapshot

8.3.2.2 Business Impact Analysis

8.3.2.3 Operational Snapshot

8.3.2.4 Product/Service Portfolio

8.4 Schneider Electric

8.4.1 Analyst Opinion

8.4.2 Business Analysis

8.4.2.1 Strategic Snapshot

8.4.2.2 Business Impact Analysis

8.4.2.3 Operational Snapshot

8.4.2.4 Product/Service Portfolio

8.5 Mitsubishi Electric Corporation

8.5.1 Company Description

8.5.2 Business Analysis

8.5.2.1 Strategic Snapshot

8.5.2.2 Business Impact Analysis

8.5.2.3 Operational Snapshot

8.5.2.4 Product/Service Portfolio

9 Companies to Watch for

9.1 OMRON Corporation

9.1.1 Analyst Opinion

9.1.1.1 Strategic Snapshot

9.1.1.2 Business Impact Analysis

9.1.1.3 Operational Snapshot

9.1.1.4 Product/Service Portfolio

9.2 Yokogawa Electric Corporation

9.2.1 Analyst Opinion

9.2.2 Business Analysis

9.2.2.1 Strategic Snapshot

9.2.2.2 Business Impact Analysis

9.2.2.3 Operational Snapshot

9.2.2.4 Product/Service Portfolio

9.3 YASKAWA ELECTRIC CORPORATION

9.3.1 Analyst Opinion

9.3.2 Business Analysis

9.3.2.1 Strategic Snapshot

9.3.2.2 Business Impact Analysis

9.3.2.3 Operational Snapshot

9.3.2.4 Product/Service Portfolio

9.4 FANUC CORPORATION

9.4.1 Analyst Opinion

9.4.2 Business Analysis

9.4.2.1 Strategic Snapshot

9.4.2.2 Business Impact Analysis

9.4.2.3 Product/Service Portfolio

9.5 KEYENCE CORPORATION

9.5.1 Analyst Opinion

9.5.2 Business Analysis

9.5.2.1 Strategic Snapshot

9.5.2.2 Product/Service Portfolio

10 Annexure

10.1 Report Scope

10.2 Research Methodology

10.2.1 Data Collation & In-house Estimation

10.2.2 Market Triangulation

10.2.3 Forecasting

10.3 Study Declarations

10.4 Report Assumptions

10.5 Abbreviations

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.