Fetal and Neonatal Equipment - Global Market Forecast to 2025

- April, 2019

- Domain: Healthcare - Medical Devices

- Get Free 10% Customization in this Report

[128 pages report] This market research report includes a detailed segmentation of the global fetal and neonatal equipment market by product types (fetal care equipment, neonatal care equipment, and others), by end-users (hospitals, pediatric hospitals, and NICU centers), and by regions (North America, Europe, APAC, and RoW).

Research Overview

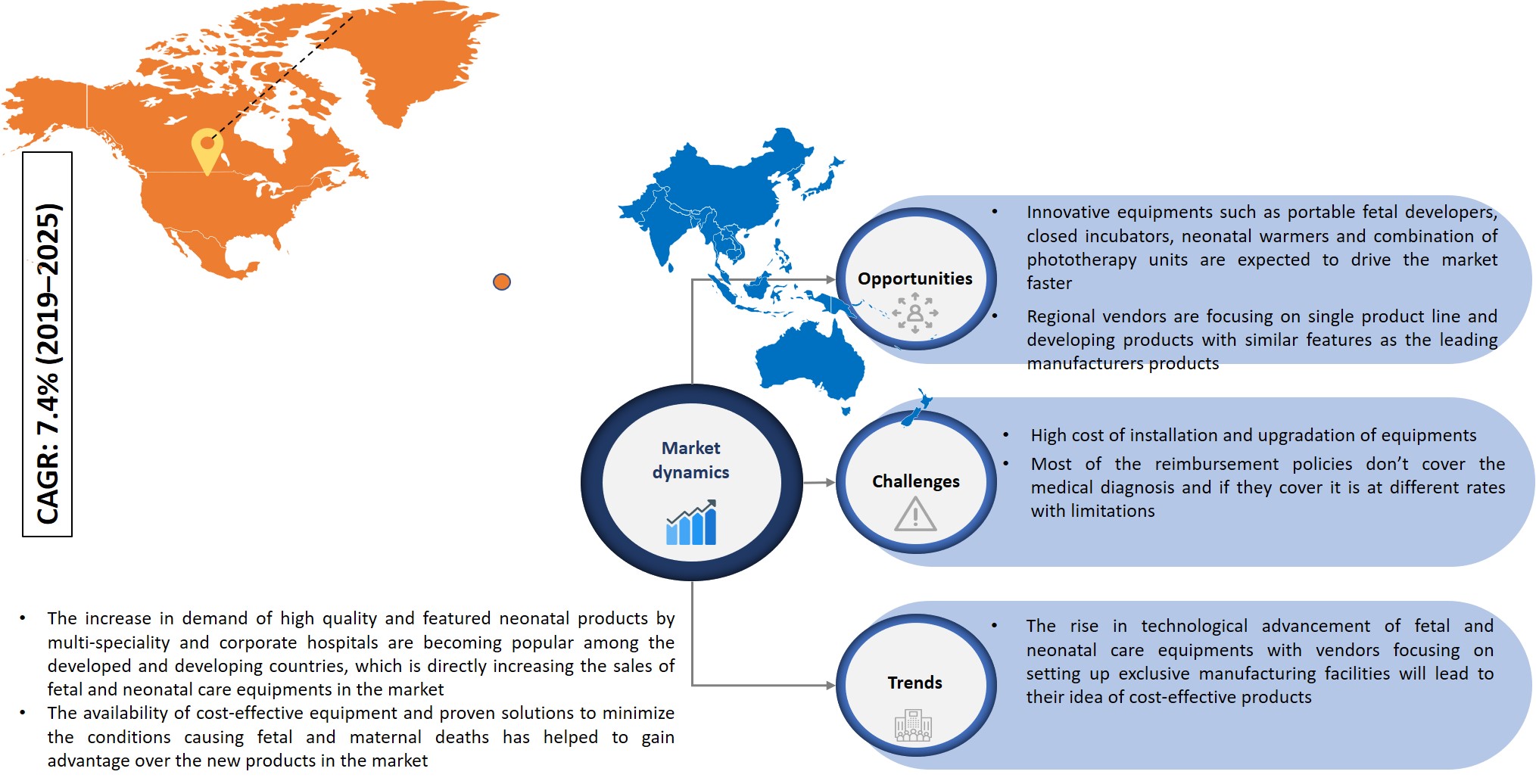

Infoholic Research predicts that the global fetal and neonatal equipment market will grow at a CAGR of 7.4% during the forecast period. The market is classified into different product categories: patient monitoring, diagnostic devices, warmers, incubators, and phototherapy equipment’s. The rise in patient monitoring especially fetal and neonatal care equipment’s have seen an increased adoption in basic to advanced equipment’s across globe. The rise in adoption of such devices in developing countries with various agreements and policies have helped the market to grow faster. Fetal and neonatal care equipment’s are mostly used in emergency and life-threatening complication. Factors driving the market include congenital diseases, premature health, lifestyle, and chronic conditions such as anemia, bronchopulmonary dysplasia, hyperbilirubinemia, and intraventricular hemorrhage.

The market is growing significantly due to technological advancement of patient monitoring, respiratory, and phototherapy devices. According to WHO, every year there are about 15 million infants born preterm, which is the primary reason for higher mortality. Most of the emerging economies like India, China, Indonesia, Malaysia, Philippines, and Bangladesh have the highest preterm due to poor infrastructure and lack of trained professionals.

Proper prenatal care and appropriate medical care is important for a healthy pregnancy. Further, features such as light weight, compact, advanced featured, and remote-based monitoring has enabled end-users to rely towards effective patient monitoring devices. The fetal and neonatal care equipment’s are expected to see a steady growth in the future. The market is not much explored in developing markets and is going to create huge market opportunity for the global market.

The market is fueled by innovation and new technological techniques & procedures. The increase in demand for more advanced & customized diagnosis and treatment with availability of vast healthcare services globally have pushed the market to produce safe, efficient, and cost-effective products in the market. The advancement in technology has shifted most of the developed economies towards high quality care. Also, connectivity via wireless technologies has eliminated the need for bedside transmitters as mobile app integration has become more seamless in individual’s daily routine. Few devices are proactive in anticipating the health information and deliver it timely with supportive communication and coordination among the providers involved in the healthcare delivery services.

The market is fueled by innovation and new technological techniques & procedures. The increase in demand for more advanced & customized diagnosis and treatment with availability of vast healthcare services globally have pushed the market to produce safe, efficient, and cost-effective products in the market. The advancement in technology has shifted most of the developed economies towards high quality care. Also, connectivity via wireless technologies has eliminated the need for bedside transmitters as mobile app integration has become more seamless in individual’s daily routine. Few devices are proactive in anticipating the health information and deliver it timely with supportive communication and coordination among the providers involved in the healthcare delivery services.

Segmentation by Product Types:

- Fetal Care Equipment

- Neonatal Care Equipment

- Others

The neonatal care units have a complex setup with different types of machines and monitoring devices for intensive care of neonates or new-born. This segment is contributing the maximum share due to various factors: preterm births, deformities with new infants, increase initiatives by government to support and upgrade the existing equipment, and rise in demand in lieu with collaborations and agreements for high-quality neonatal systems. Phototherapy units and warming equipment’s share the maximum revenue holder in the global fetal and neonatal market and is expected to grow steadily in the market.

Segmentation by End-users:

- Hospitals

- Pediatric Hospitals

- NICU Centers

In 2018, hospitals gained the highest share in the fetal and neonatal equipment market with the large volumes of diagnostics and treatments globally.

Segmentation by Regions:

- North America

- Europe

- APAC

- RoW

According to Infoholic Research analysis, North America accounted for the largest share of the global fetal and neonatal equipment market in 2018. In North America, the US and Canada are the leading countries with newest advances and wide options in choosing diagnosis for early prevention and treatment. Europe is the second leading region. The market in Europe was largely driven due to advances in and replacement of devices in fetal and neonatal care systems. Factors such as increase in the incidence of preterm birth, continuous adoption of advanced technologies, and increasing awareness are driving the market. The leading countries are Germany, France, UK, and Italy to the market.

The APAC region is expected to grow faster due to increase in sales of new fetal and neonatal equipment’s in the coming years. According to UNICEF, it was estimated that in 2017 the neonatal mortality rate in India (24%), China (4.7%), Thailand (5.3%), Vietnam (10.6%) deaths per 1,000 live birth. The availability of cost-effective or low-cost patient monitoring devices is helping many hospitals, NICU centers, and many other healthcare facilities to adopt such diagnostics and monitoring for safe and efficient fetal and neonatal care.

Competitive Analysis – The competition among leading vendors is due to the availability of a wide range of fetal and neonatal care equipment’s with different brand names in the market. This provides an opportunity for healthcare consumers (fetal and neonatal care facilities) to choose products based on brand, price, features, model, and discount. Most of the vendors are focusing on providing bundling product models for increasing their sales and having a larger market share in terms of revenue. Many vendors have established their market presence globally and focus strongly on marketing and selling their products by competing with small and regional vendors. Therefore, the competition among the vendors is expected to hinder the market growth, yet the market will have more products developed and launched in the market. Most of the vendors are primarily focusing on research and development to offer fast technological progress. Manufacturers including major and mid-sized companies in the fetal and neonatal equipment market are competing with newer products, advanced features, quality, safety, and efficacy.

The competition is growing among the healthcare service providers – hospitals, NICU centers, and pediatric hospitals where the customer groups are being consolidated for purchasing products. Diversified product portfolio companies, large volume product buyers (hospitals), and primary competitors (single product manufacturers) have strong market positions in certain segments and regions due to their wide range of products and services they offer. New competitors especially from Asia are also taking the competition to a new high with quality, safety, and efficacy of the product over the past few years.

Key Vendors:

- Drägerwerk AG & Co. KGaA

- Medtronic plc

- GE Healthcare

- Masimo Corp

- Philips Healthcare

- Natus Medical Incorporated

Key Competitive Facts:

- The market is highly competitive with all the players competing to gain the market share. Intense competition, rapid advancements in technology, frequent changes in government policies, and the prices are key factors that confront the market.

- The requirement of high initial investment, implementation, and maintenance cost in the market are also limiting the entry of new players.

- Responding to competitive pricing pressures specific to each of our geographic markets.

- Protection of proprietary technology for products and manufacturing processes.

Benefits – The report provides complete details about the usage and adoption rate of fetal and neonatal equipment’s. Thus, the key stakeholders can know about the major trends, drivers, investments, vertical player’s initiatives, and government initiatives towards the medical devices segment in the upcoming years along with details of the pureplay companies entering the market. Moreover, the report provides details about the major challenges that are going to impact the market growth. Additionally, the report gives complete details about the key business opportunities to key stakeholders in order to expand their business and capture the revenue in specific verticals and to analyze before investing or expanding the business in this market.

Key Takeaways:

- Understanding the potential market opportunity with precise market size and forecast data.

- Detailed market analysis focusing on the growth of the fetal and neonatal equipment

- Factors influencing the growth of the fetal and neonatal equipment

- In-depth competitive analysis of dominant and pureplay vendors.

- Prediction analysis of the fetal and neonatal equipment industry in both developed and developing regions.

- Key insights related to major segments of the fetal and neonatal equipment

- The latest market trend analysis impacting the buying behavior of the consumers.

Key Stakeholders:

1 Industry Outlook

1.1 Medical Devices Industry

1.1.1 Overview

1.1.2 Patient monitoring systems

1.1.3 Medical technologies

1.1.4 Industry Trends

1.2 Healthcare Spending

1.2.1 The US

1.2.2 Europe

1.3 Reimbursement Scenario

1.4 Regulatory Bodies & Standards

1.5 Emerging Global Markets

1.6 Future of Remote Monitoring Devices

1.7 Introduction - Fetal and Neonatal Equipment

1.7.1 Overview

1.7.2 Definition: Fetal and Neonatal Care Equipment

1.7.3 Why Fetal and Neonatal Equipment?

1.7.4 PESTLE Analysis

2 Report Outline

2.1 Report Scope

2.2 Report Summary

2.3 Research Methodology

2.4 Report Assumptions

3 Market Snapshot

3.1 Total Addressable Market (TAM)

3.2 Segmented Addressable Market (SAM)

3.3 Opportunity Analysis

3.4 Strategic Initiatives

3.5 Related Markets

3.5.1 Patient Monitoring Devices

3.5.2 Ultrasound Devices

3.5.3 Medical Imaging

3.5.4 Intracranial Pressure Monitor Market

3.6 Porter 5 (Five) Forces

4 Market Characteristics

4.1 Market Segmentation

4.1.1 Neonatal Care Equipment

4.1.2 Fetal Care Equipment

4.1.3 Others

4.2 Market Dynamics

4.2.1 Drivers

4.2.1.1 Increase in incidence of preterm birth

4.2.1.2 Increase adoption of portable fetal and neonatal equipment

4.2.1.3 High adoption of LED phototherapy units

4.2.1.1 Increase awareness and expansion in emerging nations

4.2.2 Restraints

4.2.2.1 High cost of technology and intensive care monitoring devices

4.2.2.2 Product recall

4.2.2.3 Paucity of skilled professionals

4.2.2.4 Low reimbursement/Unfavorable reimbursement plans

4.2.3 Opportunities

4.2.3.1 Technological advancement

4.2.3.2 Rising demand for remote monitoring devices

4.2.3.3 eHealth for improved outcome

4.2.3.4 Affordable and quality care

4.2.4 DRO – Impact Analysis

4.3 Key Stakeholders

5 End-users

5.1 Overview

5.2 Hospitals

5.3 Pediatric Hospitals

5.4 NICU Centers

6 Regions

6.1 Overview

6.2 North America

6.2.1 Overview

6.3 Europe

6.3.1 Overview

6.4 APAC

6.4.1 Overview

6.5 Rest of the World

6.5.1 Overview

7 Competitive Landscape

7.1 Competitor Comparison Analysis

7.1.1 Competitiveness

7.1.2 Key Competitive Facts

8 Vendors Profile

8.1 Drägerwerk AG & Co. KGaA

8.1.1 Overview

8.1.2 Business Units

8.1.3 Geographic Revenue

8.1.4 Business Focus

8.1.5 SWOT Analysis

8.1.6 Business Strategies

8.2 Medtronic plc

8.2.1 Overview

8.2.2 Business Units

8.2.3 Geographic Revenue

8.2.4 Business Focus

8.2.5 SWOT Analysis

8.2.6 Business Strategies

8.3 GE Healthcare

8.3.1 Overview

8.3.2 Business Units

8.3.3 Geographic Revenue

8.3.4 Business Focus

8.3.5 SWOT Analysis

8.3.6 Business Strategies

8.4 Philips Healthcare

8.4.1 Overview

8.4.2 Business Units

8.4.3 Geographic Revenue

8.4.4 Business Focus

8.4.5 SWOT Analysis

8.4.6 Business Strategies

8.5 Masimo Corp.

8.5.1 Overview

8.5.2 Geographic Revenue

8.5.3 Business Focus

8.5.4 SWOT Analysis

8.5.5 Business Strategies

8.6 Natus Medical Incorporated

8.6.1 Overview

8.6.2 Business Segments

8.6.3 Geographic Revenue

8.6.4 Business Focus

8.6.5 SWOT Analysis

8.6.6 Business Strategies

9 Companies to Watch for

9.1 Becton Dickinson and Company

9.1.1 Overview

9.1.2 Key Highlights

9.1.3 Key Focus

9.2 NIHON KOHDEN CORPORATION

9.2.1 Overview

9.2.2 Business focus

9.3 Smiths Group plc

9.3.1 Overview

9.3.2 Business Focus

9.4 Aspect Imaging

9.4.1 Overview

9.4.2 Key Highlights

9.4.3 Key News

9.5 Nonin Medical, Inc.

9.5.1 Overview

9.6 OMRON

9.6.1 Overview

10 Other Prominent Vendors

11 Annexure

Research Framework

Infoholic research works on a holistic 360° approach in order to deliver high quality, validated and reliable information in our market reports. The Market estimation and forecasting involves following steps:

- Data Collation (Primary & Secondary)

- In-house Estimation (Based on proprietary data bases and Models)

- Market Triangulation

- Forecasting

Market related information is congregated from both primary and secondary sources.

Primary sources

involved participants from all global stakeholders such as Solution providers, service providers, Industry associations, thought leaders etc. across levels such as CXOs, VPs and managers. Plus, our in-house industry experts having decades of industry experience contribute their consulting and advisory services.

Secondary sources

include public sources such as regulatory frameworks, government IT spending, government demographic indicators, industry association statistics, and company publications along with paid sources such as Factiva, OneSource, Bloomberg among others.